Hey fellow traders! As someone who’s spent years navigating the thrilling world of online trading, I know firsthand that getting your profits out easily is just as crucial as making them. There’s nothing worse than hitting a great trade, only to face hurdles when it’s time to enjoy your earnings. That’s why I’m here to demystify the Olymp Trade withdrawal process for you.

Olymp Trade has always aimed for user-friendliness, and that extends to their payout system. Your hard-earned money should reach you without unnecessary stress or delay. Let’s dive into how you can ensure a smooth, hassle-free withdrawal every single time.

- Understanding Your Payout Options

- Common Withdrawal Methods:

- Step-by-Step: Your Olymp Trade Withdrawal Process

- What Influences Olymp Trade Withdrawal Time?

- Factors Affecting Payout Speed:

- Tips for a Smoother Withdrawal Experience

- Common Issues and How to Resolve Them

- Understanding Olymptrade Withdrawal Policies

- Key Aspects of Your Olymp Trade Withdrawal Experience

- How Fast is the Olymp Trade Withdrawal Time?

- Tips for a Seamless Withdrawal

- Typical Withdrawal Processing Times (After Olymp Trade Approval)

- Available Olymptrade Withdrawal Methods

- Your Options for Cashing Out

- Understanding Your Olymp Trade Withdrawal Time

- Tips for a Smooth Withdrawal Experience

- E-Wallets and Digital Payment Systems

- Why E-Wallets Are Your Best Trading Ally

- Popular E-Wallet Choices for Traders

- The Critical Edge: Speedy Withdrawals

- Optimizing Your E-Wallet Experience

- Bank Transfer and Card Options

- Bank Transfers: The Reliable Giant

- Card Options: Speed and Simplicity

- Choosing Your Best Fit

- Cryptocurrency Withdrawals

- Why Choose Crypto for Your Withdrawals?

- The Process: Simple & Secure

- Step-by-Step Guide to Olymptrade Withdrawal

- Accessing Your Funds: The Withdrawal Process

- Understanding Olymp Trade Withdrawal Time

- Pro Tips for Faster Withdrawals

- Why Quick Withdrawals Matter to Traders

- What if There’s a Delay?

- Olymp Trade Withdrawal Processing Times

- What Influences Your Olymp Trade Withdrawal Time?

- Typical Processing Periods: What to Expect

- Tips for a Quicker Olymp Trade Withdrawal Experience

- Encountering Delays? Here’s What to Do

- Fees, Limits, and Important Considerations

- Deconstructing Common Trading Fees

- Navigating Platform Limits

- Crucial Considerations for Smooth Operations

- Withdrawal Fees Explained

- What Are Withdrawal Fees?

- Why Do Brokers Charge Withdrawal Fees?

- Smart Withdrawal Tips to Optimize Your Earnings

- Minimum and Maximum Limits

- Minimum Withdrawal Limits: What You Need to Know

- Navigating Maximum Withdrawal Limits

- Planning Your Withdrawals: A Pro Tip

- Account Verification (KYC) for Olymptrade Withdrawal

- Why KYC? Your Security, Your Money.

- What Documents Will You Need?

- KYC and Your Olymp Trade Withdrawal Time

- KYC: Initial Effort, Long-Term Gain

- Pro Tips for a Seamless Verification

- Troubleshooting Common Olymptrade Withdrawal Issues

- Common Withdrawal Hurdles and How to Clear Them

- 1. Verification Woes

- 2. Payment Method Mismatch

- 3. Exceeding Withdrawal Limits or Minimums

- 4. Bonus Withdrawal Conditions

- 5. Technical Glitches & Bank Delays

- Quick Troubleshooting Checklist

- Why Your Withdrawal Might Be Declined

- Common Reasons for Withdrawal Declines:

- Dealing with Delays

- Tips for a Successful Olymp Trade Withdrawal

- 1. Verify Your Account Promptly

- 2. Choose Consistent Payment Methods

- 3. Understand Withdrawal Limits and Fees

- 4. Be Mindful of Olymp Trade Withdrawal Time

- 5. Double-Check All Details

- 6. What to Do If Delays Occur

- Comparing Olymptrade Withdrawal with Other Platforms

- Olymp Trade Withdrawal: A Closer Look

- How Does Olymp Trade Stack Up Against Competitors?

- Tips for Faster Withdrawals, No Matter the Platform

- Final Thoughts on Withdrawals

- Enhancing Security During Olymptrade Withdrawals

- Best Practices for Secure Withdrawals

- The Role of Account Verification

- Common Withdrawal Security Checks

- A Trader’s Perspective on Security

- When to Contact Olymptrade Customer Support

- Trader’s Tip: Be Prepared

- Olymp Trade Withdrawal FAQs

- How long does Olymp Trade withdrawal take?

- What withdrawal methods can I use?

- Are there any withdrawal fees on Olymp Trade?

- What are the minimum and maximum withdrawal limits?

- Why is my withdrawal delayed or rejected?

- Pro Tips for Smooth Withdrawals

- Conclusion: Maximizing Your Olymptrade Withdrawal Efficiency

- Key Takeaways for Faster Withdrawals

- Your Profit, Your Control

- Frequently Asked Questions

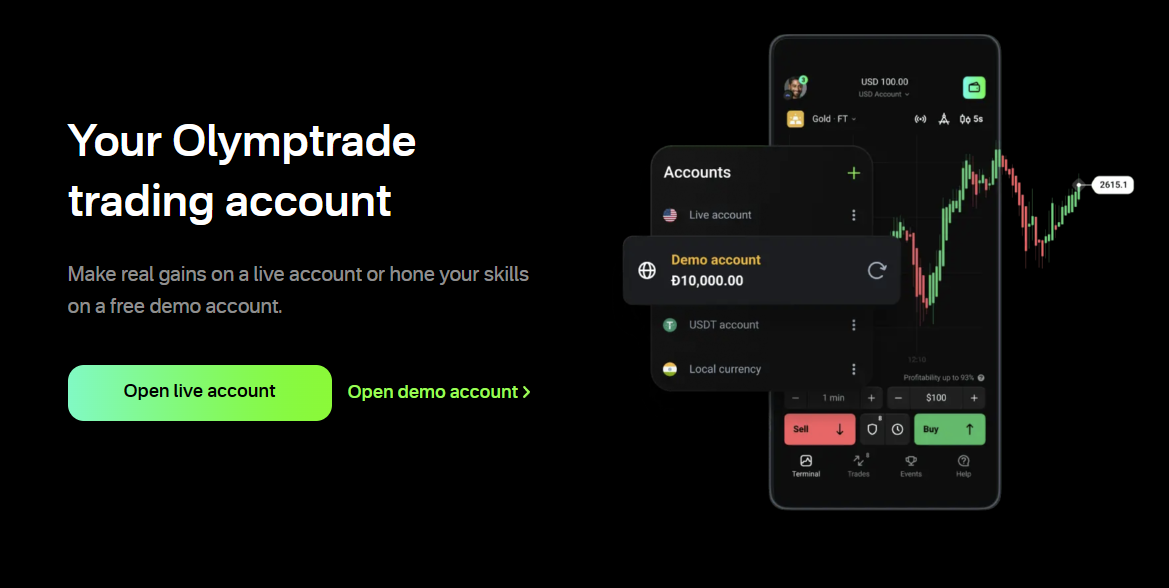

Understanding Your Payout Options

Olymp Trade offers a variety of withdrawal methods to suit traders worldwide. Choosing the right one can significantly impact your Olymp Trade withdrawal time. Always try to withdraw using the same method you used for your deposit; this often speeds up the process due to platform policies and regulatory compliance.

Common Withdrawal Methods:

- E-wallets: Skrill, Neteller, WebMoney, FasaPay, AstroPay Card, and others. These are often the fastest options.

- Bank Cards: Visa, MasterCard. Withdrawals to cards can sometimes take a bit longer.

- Bank Transfers: Direct transfers to your bank account. These usually have the longest processing times but are highly secure.

- Cryptocurrency: Bitcoin, Ethereum, Litecoin, and others. Fast and secure for crypto enthusiasts.

Step-by-Step: Your Olymp Trade Withdrawal Process

Getting your money out is straightforward. Follow these simple steps:

- Log In to Your Account: Access your Olymp Trade dashboard.

- Navigate to ‘Withdraw’: Look for the ‘Payments’ or ‘Withdraw’ section in your account menu.

- Select Your Withdrawal Method: Choose the method you prefer. Remember, using your deposit method is often recommended.

- Enter the Amount: Specify how much you want to withdraw. Always check the minimum and maximum withdrawal limits for your chosen method.

- Confirm Details: Double-check all the information you’ve entered. Ensure your account details are correct.

- Submit Request: Click the ‘Withdraw’ or ‘Confirm’ button.

After submission, your request enters the processing queue. You’ll usually receive an email confirmation of your withdrawal request.

What Influences Olymp Trade Withdrawal Time?

Everyone wants their money quickly. Several factors play a role in how fast your funds hit your account.

The primary one is the Olymp Trade withdrawal time, which officially ranges from a few hours to a few business days.

Factors Affecting Payout Speed:

- Your Account Status: Verified accounts typically experience faster withdrawals. If your account isn’t fully verified, Olymp Trade might request additional documents, causing delays.

- Chosen Method: As mentioned, e-wallets often clear within hours, while bank transfers can take 3-5 business days or even more, depending on your bank and country.

- Amount Requested: Larger withdrawals might undergo additional security checks, slightly extending the processing time.

- Processing Time by Olymp Trade:

Olymp Trade aims to process requests quickly, often within 24 hours. VIP traders may even get priority processing.

- Bank/Payment Provider Processing: Once Olymp Trade processes your request, your bank or e-wallet provider still needs to credit the funds. This external processing time is beyond Olymp Trade’s control.

“In my experience, sticking to e-wallets like Skrill or Neteller has consistently provided the quickest Olymp Trade withdrawal time. I often see funds land in my account within a few hours, sometimes even less. It’s truly seamless.” – A Professional Trader’s Insight

Tips for a Smoother Withdrawal Experience

You can take proactive steps to ensure your funds reach you as quickly as possible:

- Verify Your Account Fully: Complete all necessary KYC (Know Your Customer) procedures early on. This involves submitting ID and proof of address. It’s a one-time process but saves a lot of hassle later.

- Use Consistent Methods: Always try to withdraw to the same payment method you used for deposits. This simplifies anti-money laundering checks.

- Check Limits: Be aware of minimum and maximum withdrawal limits for your chosen method to avoid rejections.

- Monitor Your Email: Olymp Trade might send updates or requests for additional information. Respond promptly.

- Withdraw During Business Hours: While not always necessary, initiating withdrawals during standard business hours (e.g., Monday to Friday) can sometimes lead to faster processing.

Common Issues and How to Resolve Them

Sometimes, minor hiccups occur. Here’s a quick look at common issues and their solutions:

| Issue | Potential Reason | Solution |

|---|---|---|

| Withdrawal Pending for Long | Unverified account, bank holidays, large amount, first-time withdrawal. | Check account verification status. Contact support if exceeding typical Olymp Trade withdrawal time. |

| Withdrawal Rejected | Incorrect details, trying to withdraw to an unverified method, insufficient funds. | Double-check all details. Ensure you meet minimum withdrawal requirements. Contact support for clarification. |

| Funds Not Reflecting | Bank/provider delay, incorrect account number. | Wait for your bank’s processing time. Verify bank details with Olymp Trade support. |

Withdrawing your profits from Olymp Trade should be as straightforward as making them. By understanding the process, choosing the right method, and ensuring your account is in order, you can enjoy swift and stress-free payouts. Keep trading smart, and always keep an eye on your financial flow!

Understanding Olymptrade Withdrawal Policies

As a seasoned Forex trader, I know one thing for sure: making profits is great, but getting them into your bank account is even better. That’s why understanding a platform’s withdrawal policies isn’t just a detail; it’s a critical part of your trading strategy. You want your funds accessible, quickly and without hassle.

Olymp Trade understands this need for efficiency. Their withdrawal process aims to be straightforward, but like any reputable financial platform, they have protocols in place to ensure security and compliance. Let’s break down what you need to know to make your withdrawals smooth and swift.

Key Aspects of Your Olymp Trade Withdrawal Experience

- Diverse Payment Methods: Olymp Trade supports a wide range of withdrawal options. You can typically use e-wallets like Skrill or Neteller, credit/debit cards (Visa, MasterCard), and even direct bank transfers. Often, it’s best to withdraw using the same method you used for your deposit, which can speed up the process.

- The Verification Process: Before your first withdrawal, Olymp Trade will ask you to verify your account. This is a standard Know Your Customer (KYC) procedure, required by financial regulations to prevent fraud and money laundering. Provide accurate documents promptly – it’s a one-time step that ensures all future withdrawals go without a hitch.

- Minimum and Maximum Limits: Be aware of the set minimum and maximum withdrawal amounts. These limits are usually quite flexible, accommodating both small gains and significant profits. You can find the specific figures in your account’s withdrawal section or the platform’s FAQ.

How Fast is the Olymp Trade Withdrawal Time?

This is often the million-dollar question for traders, right? What is the typical Olymp Trade withdrawal time? Here’s the good news: once your account is fully verified, Olymp Trade processes most withdrawal requests remarkably fast. Many e-wallet withdrawals can even appear in your account within a few hours, or even minutes, after processing.

For bank transfers or card withdrawals, it might take a bit longer due to banking system processing times, usually ranging from 1 to 5 business days. But the platform itself aims to approve requests within 24 hours for most users, especially those with verified accounts and a clean trading history.

“A verified account is your fast pass to quick withdrawals. Do it once, enjoy seamless payouts forever!” – A Fellow Trader’s Tip

Tips for a Seamless Withdrawal

Want to ensure your funds reach you as quickly as possible? Follow these simple tips:

- Verify Early: Complete your account verification as soon as you open your Olymp Trade account, not when you’re ready to withdraw. This proactive step saves you time later.

- Match Methods: Whenever possible, use the same payment method for both deposits and withdrawals. This streamlines the internal processing.

- Check Details: Double-check all your withdrawal details – account numbers, card numbers, email addresses – before confirming your request. A small typo can cause significant delays.

Typical Withdrawal Processing Times (After Olymp Trade Approval)

| Withdrawal Method | Typical Time to Reach Your Account |

|---|---|

| E-wallets (Skrill, Neteller, etc.) | Instant to 24 hours |

| Credit/Debit Cards | 1-3 business days |

| Bank Transfers | 3-5 business days |

Understanding these policies and taking a few proactive steps empowers you to manage your funds effectively. Olymp Trade’s commitment to swift and secure withdrawals means you can focus less on logistics and more on honing your trading strategies. Happy trading, and even happier withdrawing!

Available Olymptrade Withdrawal Methods

As a seasoned trader, you know the thrill of a successful trade. But the real satisfaction comes when you can easily access your hard-earned profits. At Olymp Trade, getting your money out is designed to be as straightforward and secure as your trading journey. They offer a diverse range of withdrawal methods, ensuring you can choose the option that best fits your needs and regional banking preferences.

Your Options for Cashing Out

Olymp Trade understands that traders come from all corners of the globe, each with unique financial setups. That’s why they provide a robust selection of popular and secure withdrawal options. Whether you prefer traditional banking or modern digital solutions, Olymp Trade has you covered.

- Bank Cards: Visa and MasterCard are widely accepted. This is often the go-to for many traders due to its familiarity and ease of use.

- E-Wallets: Digital wallets like Skrill, Neteller, FasaPay, Perfect Money, and WebMoney offer speed and convenience. If you use these for deposits, withdrawing to them is typically seamless.

- Bank Transfers: For larger sums or if you prefer direct bank integration, bank wire transfers are available. This method provides a direct link to your personal bank account.

Understanding Your Olymp Trade Withdrawal Time

One of the most common questions traders ask is about the Olymp Trade withdrawal time. While Olymp Trade aims to process all requests quickly – often within a few hours for e-wallets and up to 24 hours for most methods – the actual time it takes for funds to reflect in your account can vary. This largely depends on your chosen withdrawal method and your bank’s processing procedures.

Here’s a general overview of typical processing times:

| Withdrawal Method | Typical Olymp Trade Processing Time | Funds Arrival Time (Approx.) |

|---|---|---|

| E-Wallets (Skrill, Neteller, etc.) | A few hours, often under 24 hours | Instant to 1 business day |

| Bank Cards (Visa, MasterCard) | Within 24 hours | 2-5 business days |

| Bank Transfer | Within 24 hours | 3-7 business days |

Tips for a Smooth Withdrawal Experience

To ensure your funds arrive quickly and without hassle, consider these expert tips:

- Verify Your Account: Always complete your account verification ahead of time. This speeds up all future transactions.

- Withdraw to Deposit Method: For security reasons, Olymp Trade often requires you to withdraw funds using the same method you used to deposit. Stick to this to avoid delays.

- Check Limits: Be aware of minimum and maximum withdrawal limits for your chosen method.

- Weekend/Holiday Impact: Remember that banks and payment systems may have slower processing times during weekends and public holidays.

Getting your profits out should never be a source of stress. Olymp Trade’s variety of methods and transparent policies make it a reliable choice for traders who value both security and efficiency. Focus on your trades; Olymp Trade handles the rest!

E-Wallets and Digital Payment Systems

As a seasoned trader, you know speed and efficiency are paramount. In the fast-paced world of Forex and binary options, every second counts, not just in executing trades but also in managing your capital. This is where e-wallets and digital payment systems become absolute game-changers for any serious trader.

Forget the days of waiting around for bank transfers to clear. E-wallets offer a streamlined, secure, and incredibly fast way to deposit funds into your trading account and, crucially, to withdraw your hard-earned profits. They bridge the gap between your trading platform and your personal finances, making the entire process seamless.

Why E-Wallets Are Your Best Trading Ally

E-wallets aren’t just a convenience; they’re a strategic tool. Here’s why they dominate the payment landscape for traders:

- Lightning Speed: Deposits are instant, getting you into the market without delay. Withdrawals, while not always instantaneous due to platform processing, are significantly faster than traditional banking methods.

- Enhanced Security: Your sensitive banking information stays private, never directly shared with the broker. E-wallets act as a secure intermediary.

- Global Accessibility: Many e-wallets support multiple currencies and are accepted by brokers worldwide, simplifying international transactions.

- Cost-Effective: Often, e-wallet transaction fees are lower or even non-existent compared to wire transfers, saving you money in the long run.

- Convenience: Manage your funds from anywhere with an internet connection, often through dedicated mobile apps.

Popular E-Wallet Choices for Traders

You have a range of reliable options, each with its own nuances. Some of the most widely accepted and trusted e-wallets in the trading community include:

- Skrill: A veteran in the online payment space, widely embraced by brokers. Known for its global reach and ease of use.

- Neteller: Another powerhouse, very similar to Skrill, and often used interchangeably by traders for its robust security and quick transactions.

- WebMoney: Popular in Eastern Europe and Asia, offering various payment units and strong security protocols.

- Perfect Money: Provides versatile payment solutions with attractive fee structures for frequent transactions.

- AstroPay Card: A popular virtual prepaid card solution, offering a quick way to deposit without directly linking bank accounts.

The Critical Edge: Speedy Withdrawals

Let’s talk about what really matters once you’ve made those profitable trades: getting your money out. The speed of withdrawal can vary wildly depending on your chosen method. While bank transfers can take days, e-wallets drastically cut down this waiting period. For example, considering the Olymp Trade withdrawal time, using an e-wallet often ensures your funds reflect in your e-wallet account within hours, or at most, a day or two, once the broker processes the request. This rapid access to your funds means you can re-invest quicker, or simply enjoy your earnings without unnecessary delays.

Think about it: turning your trading success into spendable cash is much more satisfying when it happens swiftly. E-wallets eliminate the friction, transforming a potentially anxious wait into a smooth, efficient transfer.

Optimizing Your E-Wallet Experience

To get the most out of your e-wallets as a trader, keep these tips in mind:

- Verify Your Account: Complete all necessary verification steps with your e-wallet provider as soon as you open an account. This prevents future delays, especially with larger withdrawals.

- Check Fees: Be aware of any fees for deposits, withdrawals, or currency conversions. While generally low, they can add up over time.

- Match Deposit/Withdrawal Method: Most brokers require you to withdraw funds using the same method you used for deposits. Plan accordingly.

- Keep Your Login Secure: Use strong, unique passwords and enable two-factor authentication (2FA) for an extra layer of security.

In conclusion, if you’re serious about trading, integrating e-wallets into your financial strategy is not just smart; it’s essential. They empower you with speed, security, and convenience, letting you focus on what you do best: making profitable trades.

Bank Transfer and Card Options

As traders, we know the thrill of a successful trade. But the real satisfaction comes when you can easily access your hard-earned profits. When it’s time to withdraw, you want options that are both secure and convenient. That’s where traditional methods like bank transfers and card options truly shine.

Let’s dive into why these methods remain popular choices for traders worldwide, and what you should consider when using them.

Bank Transfers: The Reliable Giant

Bank transfers are often seen as the gold standard for moving larger sums of money. They offer unparalleled security and are widely accepted by almost all trading platforms. You directly transfer funds from your trading account to your personal bank account. It’s straightforward, and you have a clear record of the transaction.

However, it’s worth noting that while secure, bank transfers can sometimes take a bit longer. For example, when considering the Olymp Trade withdrawal time, bank transfers typically fall within the 2-5 business day range, depending on your bank and the platform’s processing queue.

Card Options: Speed and Simplicity

Debit and credit cards offer a fantastic balance of speed and simplicity. If you’ve ever made an online purchase, you already know how simple it is to withdraw to your card. Most major cards like Visa and MasterCard are widely supported. This method is often preferred for smaller to medium-sized withdrawals due to its quick processing.

Here’s a quick look at the advantages:

- Convenience: Quick and familiar process.

- Speed: Often faster than bank transfers, with funds appearing in your account within hours to a couple of days.

- Accessibility: Funds land directly on your card, ready for use or transfer to your bank.

Choosing Your Best Fit

Ultimately, the best withdrawal method depends on your priorities. Are you moving a substantial profit? A bank transfer provides the peace of mind. Need your funds quickly for a new opportunity? Your card might be the better bet.

Remember to always check your platform’s specific terms and conditions regarding withdrawal limits, fees, and processing times for each method. Understanding these details ensures a smooth and hassle-free experience every time you decide to cash out your trading gains!

Cryptocurrency Withdrawals

As a seasoned Forex trader, I know the thrill of a successful trade and the anticipation of accessing your profits. In today’s fast-paced financial world, traditional withdrawal methods can sometimes feel like a step back in time. That’s why I’m a huge proponent of cryptocurrency withdrawals – they truly revolutionize how we manage our funds.

Crypto withdrawals offer a blend of speed, security, and global accessibility that traditional banking simply can’t match. When you’re ready to take your profits, you want them in your hands, or rather, your digital wallet, as quickly as possible. This is where digital assets shine.

Why Choose Crypto for Your Withdrawals?

There are several compelling reasons why I always recommend cryptocurrency for withdrawals, especially for platforms like Olymp Trade:

- Unmatched Speed: Forget waiting days for bank transfers. Crypto transactions, once processed by the platform, often reflect in your wallet within hours, sometimes even minutes, depending on network congestion. This significantly impacts your overall Olymp Trade withdrawal time, making it much more efficient.

- Enhanced Security: Blockchain technology provides a robust and transparent ledger, making transactions incredibly secure and virtually impossible to alter once confirmed. Your funds are protected by cutting-edge cryptography.

- Lower Fees: While there are network fees, they are often much lower than traditional wire transfer fees, especially for international transactions. You keep more of your hard-earned profits.

- Global Accessibility: Crypto knows no borders. You can withdraw your funds from almost anywhere in the world, without worrying about currency conversions or international banking regulations slowing things down.

- Privacy: While transactions are public on the blockchain, your personal identity remains private, adding an extra layer of discretion to your financial movements.

The Process: Simple & Secure

Withdrawing your funds via cryptocurrency is usually straightforward. Most reputable trading platforms, including Olymp Trade, have streamlined the process:

- Navigate to the withdrawal section of your trading account.

- Select your preferred cryptocurrency (e.g., Bitcoin, Ethereum, USDT).

- Enter your wallet address carefully (double-check it!).

- Confirm the withdrawal amount.

- Complete any security verification steps (2FA, email confirmation, etc.).

Once confirmed, the platform initiates the transfer. The actual time it takes for the funds to appear in your personal wallet largely depends on the blockchain network’s activity and the platform’s internal processing, but it’s typically much faster than traditional banking. It truly minimizes your wait time and optimizes your Olymp Trade withdrawal time experience.

“In the world of trading, time is money. Cryptocurrency withdrawals ensure you don’t waste either waiting for your hard-earned profits.”

— A Pro Trader’s Perspective

Embracing cryptocurrency for your withdrawals is not just about adopting new technology; it’s about optimizing your trading workflow, enhancing your financial freedom, and gaining faster access to your capital. It’s a strategic move for any serious trader.

Step-by-Step Guide to Olymptrade Withdrawal

Hey, fellow traders! You’ve put in the work, honed your strategies, and now your Olymp Trade account balance is looking healthy. That’s fantastic! The next exciting step is getting your hard-earned profits into your pocket. While Olymp Trade makes the withdrawal process remarkably simple, knowing the exact steps ensures a smooth, stress-free experience. Let’s dive in and make sure your cash-out is as seamless as your best trades!

Accessing Your Funds: The Withdrawal Process

Getting your money out is straightforward. Here’s a quick run-through:

- Log In and Navigate: First things first, log into your Olymp Trade account. Once you’re in, look for the “Payments” or “Withdrawal” section. It’s usually clearly visible in your dashboard or profile menu.

- Choose Your Withdrawal Method: Olymp Trade offers various options to suit your needs. You can choose from e-wallets (like Skrill, Neteller, or Perfect Money), bank cards (Visa, MasterCard), bank transfers, or even cryptocurrencies. Pick the method that works best for you, ideally the same one you used for your deposit, as this often speeds things up.

- Enter the Amount: Decide how much you want to withdraw. Always double-check your balance and any minimum or maximum withdrawal limits that might apply to your chosen method.

- Provide Necessary Details: Depending on your selected method, you might need to re-enter your e-wallet ID, bank account details, or card information. Always ensure accuracy here – a small typo can cause delays.

- Confirm and Submit: Review all the details one last time. Happy? Hit that “Submit Request” button! You’ll typically receive a confirmation message that your request is being processed.

Understanding Olymp Trade Withdrawal Time

One of the most common questions I hear from traders is about the Olymp Trade withdrawal time. I completely get it – when your money is on the line, you want it fast! Here’s what you should generally expect:

- E-wallets (Skrill, Neteller, etc.): These are usually the quickest. You can often see your funds in your e-wallet account within a few hours, sometimes even minutes, after Olymp Trade processes the request.

- Bank Cards/Bank Transfers: These methods typically take a bit longer due to banking system processing times. Expect funds to reach your bank account within 1 to 3 business days. Public holidays or weekends can extend this.

- Cryptocurrencies: Once Olymp Trade releases the funds, crypto withdrawals are usually very fast, depending on blockchain confirmations.

Olymp Trade strives to process all withdrawal requests promptly, often within a few hours. The actual time it takes for funds to appear in your account then depends on your chosen payment provider.

Pro Tips for Faster Withdrawals

As a seasoned trader, I’ve learned a few tricks to make the withdrawal process even smoother:

“Always verify your account fully! Completing KYC (Know Your Customer) procedures before your first withdrawal is a game-changer. Unverified accounts are a common reason for delays.”

- Use Consistent Methods: Try to use the same payment method for both deposits and withdrawals. This simplifies the process for Olymp Trade and can reduce verification steps.

- Check Your Account Status: Ensure your account is fully verified. If not, complete all necessary documentation beforehand.

- Withdraw During Business Hours: While Olymp Trade processes requests quickly, initiating withdrawals during standard business hours might lead to faster processing by your bank or e-wallet.

- Stay Updated: Keep an eye on your Olymp Trade notifications. They will inform you about the status of your withdrawal request.

Why Quick Withdrawals Matter to Traders

For us traders, quick access to our capital isn’t just about convenience; it’s about control and opportunity:

- Immediate Capital Access

- You can reinvest profits, secure your gains, or use your funds for personal needs without long waits.

- Enhanced Trust

- A platform that consistently processes withdrawals quickly builds immense confidence and trust with its users.

- Financial Flexibility

- Knowing you can access your funds swiftly allows for better financial planning and responsiveness to market changes.

What if There’s a Delay?

Occasionally, a withdrawal might take longer than expected. Don’t panic! Here’s what to do:

- Check Your Email: Sometimes Olymp Trade sends emails requesting additional information or explaining a delay.

- Review Your Account: Double-check if your account is fully verified or if there are any outstanding issues.

- Contact Support: If the delay persists beyond the typical timeframe, reach out to Olymp Trade’s customer support. Their team is responsive and can provide specific updates on your request.

Withdrawing your profits from Olymp Trade is generally a hassle-free experience. By following these simple steps and understanding the process, you can ensure your hard-earned money lands safely and swiftly in your hands. Happy trading, and even happier withdrawing!

Olymp Trade Withdrawal Processing Times

As a professional Forex trader, I know few things matter more than getting your funds out quickly and efficiently when you’re riding a wave of profit. Once you’ve made those smart moves on Olymp Trade, the natural next thought turns to how fast your money hits your account. We all want a smooth, reliable process, and understanding the typical Olymp Trade withdrawal time is key. Let’s explore what you can truly expect.

What Influences Your Olymp Trade Withdrawal Time?

The speed of your withdrawal isn’t just a single fixed number; several factors come into play. Being aware of these elements helps you manage your expectations and even speed things up yourself. Think of it like navigating the market – preparation is everything!

- Account Verification Status: A fully verified account (KYC) is crucial. Olymp Trade, like any regulated broker, needs to confirm your identity. Delays often occur when verification documents are pending or incomplete. Get this done early!

- Chosen Payment Method: Different payment methods have wildly different processing speeds. E-wallets are typically lightning-fast, while traditional bank transfers take more time.

- Withdrawal Amount: Larger withdrawals might sometimes trigger additional security checks, which can add a little extra time to the Olymp Trade withdrawal time.

- Your Bank’s Processing Times: If you’re withdrawing to a bank card or account, your bank itself plays a significant role. They have their own internal processing schedules, which Olymp Trade cannot control.

- Weekends and Public Holidays: Like most financial institutions, Olymp Trade’s finance department and banks operate on business days. Requests made on weekends or holidays will typically begin processing on the next business day.

Typical Processing Periods: What to Expect

While external factors can influence the final delivery, Olymp Trade generally processes withdrawals efficiently. Here’s a quick overview of the expected Olymp Trade withdrawal time based on common payment methods. Keep in mind these are estimates, but they give you a strong idea.

| Payment Method | Expected Olymp Trade Processing Time |

|---|---|

| E-wallets (Skrill, Neteller, WebMoney, AstroPay, FasaPay, etc.) | Usually within 24 hours (often just a few hours) |

| Credit/Debit Cards (Visa, MasterCard) | 2-5 business days |

| Bank Transfers | 3-7 business days (can vary significantly by your bank and country) |

As one seasoned trader aptly put it, “For a quick Olymp Trade withdrawal time, e-wallets are almost always your best bet. It’s like magic – money appears before you even finish your coffee!”

Tips for a Quicker Olymp Trade Withdrawal Experience

Want to optimize your withdrawal process and ensure you get your funds without unnecessary delays? Follow these simple, yet effective, strategies that seasoned traders swear by:

- Complete Account Verification ASAP: This cannot be stressed enough. Verify your account fully before you even think about making your first withdrawal. It removes the biggest potential hurdle.

- Use Consistent Payment Methods: Whenever possible, withdraw using the same method you used for your deposit. This streamlines the process for Olymp Trade’s security protocols and often speeds things up.

- Opt for E-wallets: If speed is your priority, e-wallets consistently offer the fastest Olymp Trade withdrawal time. Set one up if you haven’t already.

- Time Your Withdrawal: Submit your withdrawal requests during business hours on weekdays. Avoid making requests late on Friday or over the weekend, as processing will only begin on Monday.

- Double-Check Your Details: A tiny typo in your account number or e-wallet ID can cause significant delays. Always review your withdrawal request details carefully before confirming.

Encountering Delays? Here’s What to Do

Even with the best preparation, sometimes a withdrawal might take a little longer than expected. Don’t panic! Here are the steps you should take if your Olymp Trade withdrawal time seems to be stretching:

- Check Your Email: Olymp Trade might have sent you an email requesting additional information or clarification regarding your withdrawal. Sometimes, these requests go to spam, so check there too.

- Contact Support: Their customer support team is available 24/7. Reach out to them via live chat, email, or phone. Provide them with your transaction ID and explain your concern. They can often provide specific updates on your withdrawal status.

- Be Patient (Within Reason): If you’ve requested a withdrawal to a bank card or account, remember that bank processing times are outside Olymp Trade’s control. Allow for the full estimated period before getting too concerned.

In conclusion, Olymp Trade generally offers a reliable and efficient withdrawal process. By understanding the influencing factors and following these straightforward tips, you can ensure your funds reach you as quickly as possible, allowing you to focus on what you do best: trading!

Fees, Limits, and Important Considerations

As a seasoned trader, I’ve learned that truly successful trading isn’t just about nailing market predictions. It’s also about understanding the often-overlooked nuances that directly impact your bottom line: fees, limits, and the operational considerations of your chosen platform. Many traders get caught off guard here, but with a bit of foresight, you can avoid costly surprises and optimize your profitability.

Deconstructing Common Trading Fees

Every trade comes with a cost, and knowing these charges helps you make smarter decisions. Here are the common fees you’ll encounter:

- Spreads: This is the difference between the buy (ask) and sell (bid) price of an asset. It’s essentially the broker’s profit. Wider spreads mean higher costs per trade.

- Commissions: Some platforms charge a flat fee or a percentage of the trade value. While less common in retail forex, it’s worth checking.

- Overnight (Swap) Fees: If you hold a position open past a certain time (usually platform-specific, like midnight server time), you’ll pay or earn a small fee called a swap. This reflects the interest rate difference between the currencies involved.

- Inactivity Fees: Watch out for these! Some platforms charge you if your account remains dormant for an extended period. Keep your account active or close it if you take a break.

Always review your platform’s specific fee schedule. It’s critical to factor these into your trading strategy.

Navigating Platform Limits

Trading platforms impose various limits to manage risk and operations. Understanding these is crucial for effective capital management.

- Deposit Limits: Brokers set minimum and maximum amounts you can deposit at once or over a period. This affects how much capital you can start with or add to your account.

- Withdrawal Limits: Just like deposits, there are often minimum and maximum amounts you can withdraw per transaction or within a given timeframe.

- Trade Size Limits: Platforms usually have minimum and maximum trade sizes (e.g., minimum lot size or maximum volume per trade). This impacts your ability to scale positions.

- Leverage Limits: Regulatory bodies often cap the maximum leverage available to retail traders. High leverage amplifies both profits and losses, so manage it carefully.

Crucial Considerations for Smooth Operations

Beyond fees and hard limits, several other factors significantly impact your trading experience, especially when it comes to managing your funds.

One of the most frequent questions traders ask revolves around accessing their funds. For example, understanding the Olymp Trade withdrawal time is incredibly important. This isn’t just a random number; several factors influence how quickly you receive your money:

- Account Verification (KYC): New traders or those who haven’t completed their Know Your Customer (KYC) verification will experience delays. Platforms require this for security and regulatory compliance. Make sure your documents are in order before you even think about withdrawing.

- Payment Method: Your chosen withdrawal method plays a huge role. E-wallets like Skrill or Neteller often process faster than bank transfers, which can take several business days due to bank processing times.

- Platform Processing: Even after your request is submitted, the platform needs to review and approve it. This internal processing time varies between brokers.

- Weekends & Public Holidays: Bank and platform operations typically slow down or halt during non-business days. Plan your withdrawals accordingly.

Always check the platform’s FAQ or support section for detailed information on their withdrawal policies. Delays can be frustrating, but knowing the process helps you manage expectations.

Trader’s Insight: Always read the fine print! The terms and conditions document holds all the vital information about fees, limits, and processing times. A few minutes of research before you deposit can save you hours of headaches later.

For traders with significant capital, or those who hit substantial profits, understanding these maximums is paramount. If you plan to withdraw a large sum, splitting it into multiple transactions over several days or weeks might be necessary.

Withdrawal Fees Explained

As a seasoned trader, I’ve seen countless strategies succeed and fail, but one common pitfall often overlooked by newcomers and even some experienced market participants is the cost associated with getting your profits out of the broker. Understanding withdrawal fees isn’t just about saving a few dollars; it’s about maximizing your net gains and managing your trading capital efficiently. Let’s break down what these fees are all about.

What Are Withdrawal Fees?

Simply put, a withdrawal fee is a charge applied by your broker or payment provider when you transfer funds from your trading account back to your personal bank account or e-wallet. Not all brokers impose these fees, and when they do, the charges can vary significantly based on several factors:

- Payment Method: Different methods (bank wire, credit/debit card, e-wallets like Skrill or Neteller) often have different fee structures.

- Currency Conversion: If you withdraw in a currency different from your trading account’s base currency, you might incur conversion fees.

- Broker Policy: Some brokers offer a certain number of free withdrawals per month, while others charge for every transaction.

- Amount: Occasionally, fees might be a percentage of the withdrawn amount, or a flat fee for specific tiers.

Why Do Brokers Charge Withdrawal Fees?

You might wonder why, after all the trading you’ve done, you still have to pay to get your money. Here are the primary reasons:

- Processing Costs: Banks and payment processors charge the broker for facilitating transactions. These costs are often passed on to the client.

- Maintenance: Maintaining secure and efficient payment gateways requires resources.

- Deterrent for Frequent Small Withdrawals: Some brokers might implement fees to discourage numerous small withdrawals, which can be administratively burdensome.

Smart Withdrawal Tips to Optimize Your Earnings

Nobody wants to lose hard-earned profits to fees. Here are some actionable tips to ensure you keep more of your money:

- Read the Fine Print: Before you even deposit, thoroughly check your broker’s terms and conditions regarding withdrawals. Look for specific details on fees, minimum withdrawal amounts, and processing times.

- Choose Your Method Wisely: Compare the fees for different withdrawal methods offered by your broker. E-wallets often have lower fees than bank wires, but this isn’t always the case.

- Consolidate Withdrawals: If your broker charges a flat fee per transaction, try to make fewer, larger withdrawals rather than many small ones. This helps reduce the cumulative cost.

- Understand Timelines: Factor in how long it takes for funds to reach you. For example, knowing the typical Olymp Trade withdrawal time is just as important as knowing the fee. Some methods are quicker, but might come with a higher cost. Plan your withdrawals strategically around your financial needs.

- Check for Promotional Offers: Occasionally, brokers run promotions with reduced or waived withdrawal fees. Keep an eye out for these.

Ultimately, understanding and factoring in withdrawal fees is a crucial part of your overall trading strategy. It’s not just about what you make, but what you keep. Always stay informed and make smart choices with your funds!

Minimum and Maximum Limits

Understanding the minimum and maximum limits for deposits and withdrawals is crucial for any serious trader. These thresholds aren’t arbitrary; brokers implement them for various reasons, including regulatory compliance, security protocols, and effective liquidity management. Knowing these boundaries ensures your trading operations, from funding your account to cashing out profits, run smoothly and without unexpected hitches. Let’s break down what these limits mean for you.

Minimum Withdrawal Limits: What You Need to Know

Most platforms, including top-tier brokers, set a minimum amount you can withdraw. This usually isn’t a huge sum, often around $10 to $20. Why do they do this? Processing even a small transaction incurs costs for the broker, including payment gateway fees and administrative overhead. Setting a minimum limit ensures that the cost of processing a withdrawal is justified, preventing a flood of micro-transactions that would burden the system and administrative teams. Always check your broker’s specific terms; it’s a vital detail that impacts your financial planning and ensures you don’t find yourself unable to withdraw a small profit.

Navigating Maximum Withdrawal Limits

On the flip side, brokers also establish maximum withdrawal limits. These limits can vary significantly. You might encounter daily, weekly, or monthly caps on how much you can take out of your trading account. For instance, a platform might allow a maximum of $5,000 per day, $20,000 per week, and $50,000 per month. These limits serve several purposes:

- Risk Management: It helps brokers manage their financial exposure and ensures adequate liquidity across the platform.

- Security: Large withdrawals might trigger additional security checks, acting as a safeguard against unauthorized access and potential fraud.

- Regulatory Compliance: Anti-Money Laundering (AML) regulations often mandate limits and require enhanced due diligence for larger transactions to prevent illicit financial activities.

For traders with significant capital, or those who hit substantial profits, understanding these maximums is paramount. If you plan to withdraw a large sum, splitting it into multiple transactions over several days or weeks might be necessary. Keep in mind that for many platforms, including Olymp Trade, withdrawal time is often a point of pride, with many transactions processed quickly. However, larger withdrawals, especially those nearing or exceeding maximum daily limits, might undergo additional scrutiny, potentially impacting the overall Olymp Trade withdrawal time. Always verify your account’s specific limits and any tiers you might fall into, as VIP or higher-tier accounts often enjoy more generous maximums.

Planning Your Withdrawals: A Pro Tip

Before you even place your first trade, familiarize yourself with your chosen broker’s deposit and withdrawal policies. Don’t wait until you’ve made a profit to discover these limits. Proactive knowledge saves you time, frustration, and helps you manage your trading capital more effectively. A clear understanding of minimums, maximums, and the typical Olymp Trade withdrawal time for your chosen method empowers you to make smarter financial decisions and ensures your trading journey is as smooth as possible.

Account Verification (KYC) for Olymptrade Withdrawal

You’ve crushed your trades, now you’re ready to cash out. But before your profits hit your bank, there’s one vital step: Account Verification, or KYC. It’s not a roadblock; it’s your express lane to secure withdrawals.

Why KYC? Your Security, Your Money.

KYC stands for “Know Your Customer.” It’s a standard regulatory requirement for financial institutions worldwide, and that includes brokers like Olymp Trade. Their goal? To prevent fraud, combat money laundering, and ensure your hard-earned money always reaches your account. Think of it as a digital handshake that confirms your identity. It’s all about protecting you and your funds.

What Documents Will You Need?

Getting verified is straightforward, but you need the right paperwork. Here’s what Olymp Trade typically asks for:

- Proof of Identity: A clear, color scan or photo of your valid government-issued ID. This could be your passport, national ID card, or driver’s license. Make sure all four corners are visible, and the document isn’t expired.

- Proof of Address: A utility bill (electricity, water, gas, internet) or a bank statement issued within the last three months. It must clearly show your name and address, matching the details on your Olymp Trade account. Mobile phone bills are usually not accepted.

- Payment Method Verification (if applicable): If you use a bank card, they might ask for photos of the front (showing the first 6 and last 4 digits, and your name) and back (covering the CVV). For e-wallets, a screenshot of your account showing your name and email might be required.

KYC and Your Olymp Trade Withdrawal Time

Many traders wonder if verification delays their payouts. Here’s the truth: KYC is typically a one-time process. Completing it promptly can significantly improve your overall experience regarding Olymp Trade withdrawal time. While your first withdrawal might take a bit longer as your documents get reviewed, every subsequent withdrawal becomes faster and smoother because your identity is already confirmed. It’s an investment in future speed!

KYC: Initial Effort, Long-Term Gain

| Advantages of Prompt KYC | Potential Disadvantages (If Delayed) |

|---|---|

| Faster future withdrawals | Delayed first withdrawal |

| Enhanced account security | Potential account restrictions |

| Full access to platform features | Limited access until verified |

Pro Tips for a Seamless Verification

Don’t let verification stress you out. Follow these simple tips for a quick approval:

- High-Quality Scans: Use clear, well-lit photos or scans. Blurry documents get rejected.

- Match Information: Ensure the name and address on your documents exactly match what you registered with Olymp Trade.

- Be Patient: Verification usually takes a few hours to a few days. Don’t submit the same documents repeatedly.

- Check Your Email: Olymp Trade will communicate through email if they need more information or if your verification is complete.

“A verified account isn’t just a requirement; it’s a testament to a broker’s commitment to security and a trader’s path to hassle-free profits. Get it done, trade confidently, and enjoy your payouts!”

– A Seasoned Forex & Options Trader

By taking a few moments to complete your account verification, you set yourself up for smooth, secure, and swift withdrawals. Get it done, and keep your focus where it belongs: on mastering the markets and growing your portfolio!

Troubleshooting Common Olymptrade Withdrawal Issues

As experienced traders, we know the thrill of a successful trade. But that excitement can quickly turn to frustration when your funds seem stuck. It’s a common scenario, and navigating Olymp Trade withdrawal issues can feel like another challenge in itself. Don’t worry, you’re not alone. Many traders encounter hurdles, and understanding them is the first step to a smooth payout.

The good news is most withdrawal problems have straightforward solutions. We’ll walk through the most frequent issues and provide clear steps to get your funds into your account without unnecessary delays. Your focus should be on the markets, not on struggling to access your profits.

Common Withdrawal Hurdles and How to Clear Them

You’ve initiated a withdrawal, but it’s taking longer than expected, or perhaps it’s even been rejected. Let’s tackle the usual suspects one by one:

1. Verification Woes

- The Problem: Your account isn’t fully verified, or your documents have expired. Olymp Trade, like all regulated brokers, requires identity verification (KYC) to prevent fraud and ensure compliance.

- The Solution:

Before initiating any withdrawal, ensure your profile is 100% verified. Head to your personal profile section on the Olymp Trade platform. Check the status of your:

- Identity document (passport, ID card, driver’s license)

- Proof of address (utility bill, bank statement)

- Payment method verification (e.g., a photo of your bank card with specific digits masked)

If any document needs updating or re-uploading, do it promptly. Clear, high-quality images are crucial. A common reason for a delayed Olymp Trade withdrawal time is incomplete verification.

2. Payment Method Mismatch

- The Problem: You’re trying to withdraw to a different payment method than the one you used for deposits, or you’ve attempted to use a method that isn’t fully supported for withdrawals.

- The Solution:

Olymp Trade has a strict policy: you must withdraw funds to the same method you used for deposits, and proportionally to the amount deposited. If you deposited with a bank card and then with an e-wallet, your withdrawal might need to be split between these methods. Always use the same card or e-wallet for both deposits and withdrawals. This minimizes security risks and streamlines the process.

If you’ve closed an account or lost a card, contact Olymp Trade support immediately. They can guide you through the alternative verification steps required to use a new withdrawal method.

3. Exceeding Withdrawal Limits or Minimums

- The Problem: You’re trying to withdraw an amount below the minimum threshold or above your daily/weekly limit.

- The Solution:

Every broker has withdrawal limits. Check Olymp Trade’s official terms for their current minimum withdrawal amount. Typically, it’s quite low, making it accessible for most traders. Also, be aware of any daily or weekly withdrawal caps, especially if you’re pulling out substantial profits. If your requested amount falls outside these parameters, adjust it accordingly and try again.

4. Bonus Withdrawal Conditions

- The Problem: You received a bonus and are trying to withdraw funds before fulfilling its trading volume requirements.

- The Solution:

Bonuses are fantastic for boosting your trading capital, but they often come with specific turnover conditions. If you accept a bonus, you usually need to trade a certain volume before you can withdraw the bonus funds or any profits derived directly from them. Check your “Bonuses” section on the platform to see the progress of your bonus turnover. If you withdraw before meeting the conditions, you might forfeit the bonus and any profits earned from it.

5. Technical Glitches & Bank Delays

- The Problem: Sometimes, the issue isn’t on your end or Olymp Trade’s, but rather a temporary technical glitch or a delay from your bank/payment provider.

- The Solution:

While Olymp Trade strives for fast processing, the actual Olymp Trade withdrawal time can sometimes extend due to external factors. After Olymp Trade processes your request, your bank or e-wallet provider still needs to process the incoming transaction. This can take anywhere from a few hours to several business days. If your withdrawal status shows “Processed” on Olymp Trade but hasn’t arrived in your account, contact your bank or payment provider first. Also, ensure your internet connection is stable when initiating withdrawals.

Quick Troubleshooting Checklist

Before you contact support, run through this mental checklist:

| Check Item | Action |

|---|---|

| Account Verification | Are all documents uploaded and approved? |

| Payment Method | Is it the same method used for deposit? Is it active? |

| Withdrawal Amount | Is it within minimum/maximum limits? |

| Bonus Conditions | Have I met the trading volume requirements? |

| Transaction Status | What does the Olymp Trade withdrawal history show? |

Patience is key, especially with financial transactions. The Olymp Trade withdrawal time typically ranges from a few hours to 3-5 business days depending on your chosen method and bank processing. If you’ve gone through all these steps and your issue persists, then it’s time to reach out to Olymp Trade’s support team. Provide them with all relevant details: transaction ID, date, amount, and screenshots if possible. A well-informed support request leads to a faster resolution.

Remember, a successful trade isn’t just about making money; it’s about getting that money into your hands. Master these troubleshooting steps, and you’ll navigate Olymp Trade withdrawals like a pro.

Why Your Withdrawal Might Be Declined

There’s nothing more frustrating than seeing your hard-earned profits stuck in limbo. You’ve had a great trading session, made your withdrawal request, and then… it’s declined. Before panic sets in, understand that this is often due to common, solvable issues. As a fellow trader, I know the feeling. Let’s break down the most frequent culprits so you can get your funds flowing smoothly.

Common Reasons for Withdrawal Declines:

- Unverified Account (KYC): This is perhaps the biggest reason. Regulatory bodies require brokers to verify your identity. If your account isn’t fully verified with the necessary documents (ID, proof of address), the platform will likely block your withdrawal. Ensure all your details are accurate and uploaded as per the platform’s requirements.

- Mismatched Payment Details: Did you try to withdraw to a bank account or e-wallet not registered in your name? Or perhaps a different account than the one you used for depositing? Brokers have strict anti-money laundering policies. Your withdrawal method usually needs to match your deposit method and be in your name.

- Unfulfilled Bonus Conditions: If you accepted a bonus, it likely came with specific trading volume requirements. Trying to withdraw before meeting these conditions will result in a declined request. Always read the fine print on any bonus offer.

- Insufficient Funds or Active Trades: Check your balance. Are there enough available funds, or are some tied up in active trades? Some platforms also require a minimum withdrawal amount. Make sure you meet this threshold.

- Technical Glitches or Platform Issues: While less common, technical issues can occur. If you’ve ruled out all other possibilities, the problem might be on the platform’s end. This is where patience and contacting support become key.

Pro Tip: Always double-check your withdrawal details before hitting submit. Even a small typo in an account number or email can cause a significant delay. Remember, platforms like Olymp Trade set clear expectations for their withdrawal processes, and understanding the typical Olymp Trade withdrawal time frames for your chosen method can save you a lot of worry.

When your withdrawal is declined, don’t fret. First, review your account for any pending verification steps or unfulfilled bonus terms. Next, ensure your withdrawal method details are absolutely correct and match your deposit method. If you’re still unsure, gather all relevant screenshots and details, then reach out to the platform’s customer support. They are there to help you navigate these issues and get your profits to you as quickly as possible. Happy trading!

Dealing with Delays

Every seasoned trader knows the feeling: you’ve placed a great trade, profits are locked in, and now you’re waiting for your hard-earned cash to hit your account. While trading is all about speed, sometimes the process of withdrawing funds can involve a bit of a wait. Don’t let it stress you out; understanding the common causes and solutions helps you navigate these moments like a pro.

For many traders, especially those using platforms like Olymp Trade, understanding the typical Olymp Trade withdrawal time is key. It’s easy to get anxious when your money isn’t instant, but remember that various factors influence how quickly your funds move from the platform to your personal bank account or e-wallet.

Here are some common reasons you might experience a delay and what you can do about them:

- Account Verification: Is your account fully verified? Unverified accounts are the most frequent cause of withdrawal hold-ups. Complete your Know Your Customer (KYC) documents proactively to prevent future issues.

- Bank Processing Times: Banks operate on their own schedules. Weekends, public holidays, or even specific bank cut-off times can add extra days to your withdrawal. Plan accordingly if you need funds by a certain date.

- Payment Method Type: Different payment methods have varying speeds. E-wallets like Neteller or Skrill often process faster than traditional bank transfers, which can take several business days. Choose your withdrawal method wisely.

- High Traffic Periods: Just like busy trading times, withdrawal departments can experience peak volumes. During major market events or significant platform updates, processing might take a little longer due to increased requests.

- Incorrect Information: Double-checking your bank details, card numbers, or e-wallet IDs before confirming a withdrawal seems obvious, but a small typo can cause significant delays and even failed transactions. Always verify!

If your funds aren’t appearing within the expected Olymp Trade withdrawal time, don’t panic. First, check the platform’s FAQ or support section for stated processing times. If it’s still outside that window, reaching out to customer support is your next step. Provide them with all the transaction details you have ready. Patience, preparedness, and clear communication are your best tools when dealing with these inevitable pauses in your trading journey.

Tips for a Successful Olymp Trade Withdrawal

As a seasoned Forex trader, I know the thrill of a successful trade. But let’s be honest, the real victory comes when you can actually access your profits. Withdrawing funds from your Olymp Trade account should be a smooth, stress-free process. Over the years, I’ve picked up some invaluable tips that ensure your money lands in your bank account or e-wallet without a hitch. Here’s how you can make your Olymp Trade withdrawal experience as seamless as possible.

1. Verify Your Account Promptly

This is arguably the most crucial step. Olymp Trade, like all reputable brokers, requires account verification to comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. You might need to submit identification documents and proof of address. Complete this process early, ideally right after you open your account. Waiting until you want to withdraw can cause significant delays. Think of it as laying the groundwork for future success!

2. Choose Consistent Payment Methods

When depositing and withdrawing, try to use the same payment method. If you funded your account via Skrill, for instance, try to withdraw to your Skrill account. This consistency simplifies the process for Olymp Trade’s finance department and often speeds up the transaction. It reduces the need for additional security checks that might arise from using disparate methods.

3. Understand Withdrawal Limits and Fees

Before initiating a withdrawal, always check Olymp Trade’s current minimum and maximum withdrawal limits. While Olymp Trade typically prides itself on no withdrawal fees, it’s wise to be aware if your payment provider charges any. A quick check prevents surprises and helps you plan your withdrawals efficiently.

4. Be Mindful of Olymp Trade Withdrawal Time

Every trader wants their money instantly, but processing times vary. The official Olymp Trade withdrawal time often states anywhere from a few hours to a few business days. E-wallets like Skrill or Neteller usually process faster, sometimes within a few minutes to a few hours after approval. Bank transfers, on the other hand, can take 2-5 business days due to bank processing times. Patience is key here; once Olymp Trade processes it, your bank or payment system takes over.

5. Double-Check All Details

A simple typo can send your funds into limbo. Before you hit “confirm,” meticulously review all the information you’ve entered: account numbers, wallet IDs, names, and amounts. A five-second check can save you hours of potential troubleshooting later. It’s a small effort for significant peace of mind.

6. What to Do If Delays Occur

Sometimes, despite your best efforts, a withdrawal might take longer than expected. Here’s a quick checklist:

- Check your email: Olymp Trade might have sent a request for additional verification or information.

- Review your transaction history: Confirm the status of your withdrawal request within your Olymp Trade account.

- Contact support: If a significant amount of time has passed beyond the expected Olymp Trade withdrawal time, reach out to their customer support. Provide them with your transaction ID and all relevant details. They are there to help!

By following these steps, you’ll ensure your Olymp Trade withdrawal experience is as smooth and quick as possible. Happy trading, and even happier withdrawing!

Comparing Olymptrade Withdrawal with Other Platforms

As traders, we know the thrill of a successful trade. But the real satisfaction comes when those profits hit your bank account. That’s why withdrawal speed and reliability are paramount when choosing a trading platform. You work hard for your money, and you deserve to access it quickly and without hassle.

Olymp Trade Withdrawal: A Closer Look

Olymp Trade has built a strong reputation for being user-friendly, and that extends to their withdrawal process. They aim for efficiency, understanding that quick access to funds is a top priority for traders. Typically, the Olymp Trade withdrawal time is quite impressive, often processing requests within 24 hours, especially for verified accounts. While they state it can take up to 2-5 business days depending on the payment method, many traders report much faster turnarounds.

Here’s what you generally need to know about withdrawing from Olymp Trade:

- Verification: Ensure your account is fully verified. This is the biggest factor in speeding up your withdrawals.

- Payment Method Consistency: Always withdraw using the same method you used to deposit. This helps prevent fraud and speeds up processing.

- Common Methods: They support various options like e-wallets (Skrill, Neteller, WebMoney), bank cards (Visa, MasterCard), and sometimes even cryptocurrencies.

How Does Olymp Trade Stack Up Against Competitors?

Let’s put Olymp Trade’s withdrawal process into perspective by comparing it with some other popular platforms. Keep in mind that actual times can vary based on your location, verification status, and the specific payment provider.

| Platform | Typical Withdrawal Time | Key Considerations |

|---|---|---|

| Olymp Trade | 1-2 business days (often within 24 hours) | Fast for verified accounts, consistent payment methods recommended. |

| IQ Option | 1-3 business days | Similar to Olymp Trade, e-wallets often faster than bank transfers. |

| Pocket Option | 1-5 business days | Can be slightly slower, but generally reliable. Supports many crypto options. |

| Binomo | 1-3 business days | Focus on quick e-wallet withdrawals. |

Tips for Faster Withdrawals, No Matter the Platform

While each platform has its own processes, some universal tips can help you get your money faster:

- Complete Verification Promptly: Don’t wait until you need to withdraw. Get your ID, address proof, and payment method verified upfront.

- Choose E-Wallets: Digital wallets like Skrill, Neteller, or Perfect Money often have the quickest processing times compared to bank transfers or card withdrawals.

- Stick to One Method: Using the same deposit and withdrawal method streamlines the process and reduces security checks.

- Withdraw During Business Hours: Initiating your withdrawal request during weekdays and standard business hours (platform’s time zone) can sometimes lead to quicker processing.

- Monitor Your Email: Platforms often send updates or request additional information via email. Respond quickly to avoid delays.

“In the world of trading, liquidity is king. Knowing you can access your profits swiftly provides peace of mind and fuels your next strategic move.” – A Veteran Trader’s Insight

Final Thoughts on Withdrawals

Ultimately, Olymp Trade stands out with its commitment to efficient withdrawals. While no platform guarantees instant cash, their typical Olymp Trade withdrawal time is competitive and often surpasses the stated averages, especially for traders who follow the verification and payment method guidelines. Focus on solid trading strategies, and rest assured that getting your profits out won’t be a hurdle.

Enhancing Security During Olymptrade Withdrawals

As a seasoned Forex trader, I know that securing your profits is just as crucial as making them. When it comes to withdrawing funds from your trading account, especially with platforms like Olymp Trade, ensuring robust security measures is paramount. You’ve worked hard for your gains, and safeguarding them during the withdrawal process should be your top priority. Let’s explore how you can fortify your financial security and make sure your funds reach you without a hitch.

Best Practices for Secure Withdrawals

Protecting your funds during an Olymp Trade withdrawal doesn’t have to be complicated. Following these simple, yet effective, practices can significantly reduce risks and give you peace of mind.

- Use Strong, Unique Passwords: Never reuse passwords. Create complex combinations of letters, numbers, and symbols for your Olymp Trade account and your linked payment methods.

- Enable Two-Factor Authentication (2FA): This is your digital bodyguard. Activating 2FA adds an extra layer of security, requiring a code from your mobile device in addition to your password for login and withdrawal confirmations.

- Verify Your Account: Complete all necessary identity verification steps with Olymp Trade. This not only speeds up the Olymp Trade withdrawal time but also prevents unauthorized access to your funds.

- Use Trusted Payment Methods: Stick to widely recognized and secure payment gateways that offer their own security protocols and encryption.

- Beware of Phishing Scams: Always double-check the URL before logging in. Phishing sites can look identical to the real platform. Always type the URL directly or use official bookmarks.

- Regularly Monitor Account Activity: Periodically review your transaction history and account statements for any suspicious activity. Report anything unusual immediately.

The Role of Account Verification

One of the most critical steps in ensuring secure and smooth withdrawals is completing the account verification process. Olymp Trade, like other regulated brokers, requires users to verify their identity and address. This isn’t just a formality; it’s a vital security measure designed to protect both you and the platform from fraud and money laundering. A fully verified account often experiences faster processing, which can positively impact your Olymp Trade withdrawal time.

Common Withdrawal Security Checks

To further enhance security, Olymp Trade often implements various checks during the withdrawal process. Here’s a quick look at what you might encounter:

| Security Check | Purpose | Trader Action |

|---|---|---|

| ID Verification | Confirms your identity matches the account holder. | Provide clear copies of government-issued ID. |

| Address Verification | Confirms your residential address. | Submit utility bills or bank statements. |

| Payment Method Verification | Ensures the withdrawal method belongs to you. | Provide screenshots or photos of your card/wallet. |

| Source of Funds (Less Common) | Ensures funds are legitimate, for larger withdrawals. | May require bank statements or pay stubs. |

A Trader’s Perspective on Security

From my experience, a secure withdrawal process is a non-negotiable part of effective trading. It’s not just about how quickly you can get your money; it’s about the confidence that your hard-earned profits are safe. Focusing on these security enhancements will not only protect your funds but also streamline your Olymp Trade withdrawal time, making your trading journey more secure and less stressful. Always stay vigilant, protect your credentials, and enjoy the fruits of your successful trades!

When to Contact Olymptrade Customer Support

As a seasoned trader, I’ve learned that a reliable support system is just as crucial as a robust trading strategy. While Olymp Trade offers an intuitive platform, questions and issues inevitably arise. Knowing exactly when to reach out to customer support can save you time, reduce stress, and keep your focus on what truly matters: your trades.

You don’t need to tackle every hiccup alone. Here are the key situations when contacting Olymp Trade’s support team becomes essential:

- Technical Glitches: Are you experiencing issues logging in, navigating the platform, or executing trades? If the platform isn’t responding as it should, or if you encounter error messages that prevent you from trading efficiently, contact support immediately.

- Account Verification Queries: KYC (Know Your Customer) procedures are standard for security. If you have questions about document submission, the verification process itself, or if your account remains unverified after a reasonable period, the support team can provide clarity and guide you through the steps.

- Deposit Issues: Funds not reflecting in your account after a successful transaction? Or perhaps your deposit attempt failed without clear reason? For any discrepancies or problems related to funding your trading account, reach out to support. Provide them with transaction IDs and relevant screenshots for faster resolution.

- Withdrawal Concerns: This is a big one for many traders. If you’ve initiated a withdrawal and it seems to be taking longer than expected, or if you face an error during the withdrawal process, it’s definitely time to contact support. While Olymp Trade aims for efficient processing, the actual Olymp Trade withdrawal time can sometimes be influenced by payment system delays or bank processing. If your funds haven’t arrived within the anticipated Olymp Trade withdrawal time frame, or if you need an update on your request, their team can investigate and offer specific details on your transaction’s status.

- Bonus and Promotion Enquiries: Confused about the terms of a bonus, or why a promotional offer hasn’t been applied to your account? Support can clarify eligibility, usage rules, and ensure you receive the benefits you’re entitled to.

- Suspected Unauthorized Activity: Security is paramount. If you notice any suspicious activity on your account, such as unrecognized logins or trades, contact support without delay. They can help secure your account and investigate any potential breaches.

Trader’s Tip: Be Prepared

When you contact Olymp Trade customer support, always have your account ID ready. Clearly describe your issue, provide specific dates and times, and attach screenshots or transaction details if relevant. This preparation helps the support team quickly understand your problem and provide an effective solution, getting you back to trading faster.

Olymp Trade Withdrawal FAQs

Navigating the world of online trading means understanding every part of the process, including how you get your hard-earned profits. At Olymp Trade, we know that quick and easy withdrawals are key to your trading experience. We’ve compiled the most common questions about withdrawing funds to make sure your journey is smooth and transparent. Let’s dive into the details so you can withdraw with confidence.

How long does Olymp Trade withdrawal take?

This is by far the most frequently asked question! The **Olymp Trade withdrawal time** is typically very fast. Most withdrawals, especially to e-wallets like Skrill, Neteller, or Perfect Money, process within a few minutes to a few hours. Bank transfers or card withdrawals might take a bit longer, usually between 1 to 5 business days. Keep in mind that while Olymp Trade processes your request quickly, the final speed also depends on your chosen payment system and their own processing times. Weekends or public holidays can also affect the overall duration.

What withdrawal methods can I use?

Olymp Trade offers a variety of convenient withdrawal methods designed to suit traders worldwide. You can typically withdraw funds using:

- Bank Cards (Visa, MasterCard, Maestro)

- E-wallets (Skrill, Neteller, WebMoney, FasaPay, Perfect Money, AstroPay, etc.)

- Bank Transfers

- Cryptocurrencies (Bitcoin, Ethereum, Litecoin, USDT)

Always try to withdraw using the same method you used for depositing. This helps speed up the verification process and keeps your funds secure.

Are there any withdrawal fees on Olymp Trade?

Good news for traders! Olymp Trade generally does not charge any commission or fees on withdrawals. This means you receive the full amount you request. However, be aware that your bank or payment system might charge their own fees for processing the transaction. It’s always a good idea to check with your payment provider about any potential incoming transaction charges.

What are the minimum and maximum withdrawal limits?