Welcome, fellow traders! The financial markets are buzzing with activity, and from the vibrant economic landscape of the United Arab Emirates, you have a front-row seat. Whether you’re in Dubai’s bustling financial district or charting from Abu Dhabi, the world of online trading offers a gateway to global opportunities. This guide is your ultimate resource for navigating the markets with confidence.

We built this comprehensive overview specifically for traders in the UAE. Forget the complex jargon and confusing guides. Here, you will find clear, straightforward information to help you get started or sharpen your existing skills. We will explore how platforms like Olymptrade provide the tools you need to engage with a variety of financial instruments. Our goal is to empower you to make smarter, more informed decisions on your trading journey.

So, what can you expect from this guide? We’ve broken down everything you need to know:

- An introduction to the core principles of online trading.

- A look at the features and tools available to traders in the region.

- Key strategies that you can start applying right away.

- Practical tips for managing risk and protecting your capital.

Get ready to dive deep into the mechanics of the market. Let’s unlock your potential and explore the exciting possibilities that await in the world of online trading. Your journey to becoming a more proficient trader starts now.

- Is Olymptrade Legal and Regulated in the UAE?

- What is Olymptrade? An Introduction for UAE Traders

- Navigating Online Trading Regulations in the United Arab Emirates

- Olymptrade Account Registration Process for UAE Residents

- Exploring Olymptrade Account Types and Their Benefits

- Trading Instruments Available on Olymptrade’s Platform

- Key Asset Categories on the Platform

- At a Glance: Your Trading Options

- Deposit and Withdrawal Methods for Olymptrade UAE Users

- Popular Deposit Options

- Comparing Common Withdrawal Methods

- Olymptrade Trading Platform: Features and User Interface

- Core Platform Features at a Glance

- How the Platform Empowers Your Trading

- Mobile Trading Experience with Olymptrade in the UAE

- Key Features of the Mobile App

- Mobile vs. Desktop Trading at a Glance

- Customer Support and Localized Assistance for Olymptrade UAE

- What Sets the Support Apart?

- Advantages and Disadvantages of Olymptrade for UAE Investors

- Effective Risk Management Strategies for Online Trading

- Understanding Risk vs. Reward

- Olymptrade Alternatives and Competitors in the UAE Market

- Expert Tips for Successful Trading with Olymptrade United Arab Emirates

- The Future Outlook for Online Trading in the UAE

- Frequently Asked Questions

Is Olymptrade Legal and Regulated in the UAE?

Many traders in Dubai, Abu Dhabi, and across the Emirates ask this crucial question before they start trading. The answer requires looking at both local and international financial frameworks. While Olymptrade does not hold a license from a local UAE regulatory body, it is entirely legal for residents of the UAE to access and trade on the platform.

The key here is understanding the platform’s international regulatory status. Olymptrade is an active member of the International Financial Commission (FinaCom). This is not a government body but an independent, self-regulatory organization and external dispute resolution (EDR) body. FinaCom specializes in resolving disputes within the financial markets, acting as a neutral third party to protect traders.

This membership provides a significant layer of security and trust for traders. Here’s a simple breakdown of the advantages this brings to you as a trader in the UAE:

| FinaCom Feature | How It Protects You |

|---|---|

| Dispute Resolution | Provides a fair and impartial process to handle any complaints you might have, ensuring your voice is heard. |

| Compensation Fund | Your funds are protected by a compensation fund of up to €20,000 per case, offering a safety net for your investment. |

| Order Execution Quality | The platform undergoes regular audits to ensure transparent and high-quality trade execution. |

In short, while you won’t find Olymptrade listed with the local SCA or DFSA, its global regulation through FinaCom offers a robust system of oversight. This structure allows traders in the UAE to legally and securely participate in the financial markets through the platform.

What is Olymptrade? An Introduction for UAE Traders

Think of Olymp Trade as your personal gateway to the world’s financial markets, right here in the UAE. It is an online trading platform designed to make participating in the markets straightforward and accessible. You don’t need a massive bankroll or a degree in finance to get started.

The platform provides all the tools you need to trade on the price movements of various assets, all from your computer or smartphone.

At its core, Olymp Trade simplifies the trading process. It offers a user-friendly interface where you can analyze charts, plan your strategy, and execute trades in just a few clicks. Whether you are taking your first step into online trading or you are an experienced professional, the platform has features tailored to your needs.

So, what exactly can you trade? The platform offers a diverse range of financial instruments, allowing you to build a varied portfolio. Here are the main categories:

- Forex: Trade on the exchange rates of popular currency pairs like EUR/USD, GBP/JPY, and many others.

- Stocks: Take positions on the price movements of shares from leading global companies.

- Commodities: Access popular markets like gold, silver, and oil.

- Indices: Trade on the performance of entire market sectors through major stock indices.

- Crypto: Gain exposure to the dynamic world of digital currencies.

To give you a clearer picture, let’s see who can benefit from using the platform.

| Trader Profile | Why Olymp Trade is a Great Fit |

|---|---|

| The Beginner | Offers a free demo account to practice without risk, a low minimum deposit to start small, and a wealth of educational materials to learn the ropes. |

| The Experienced Trader | Provides advanced charting tools, technical indicators, and fast trade execution to support complex strategies and quick market decisions. |

For traders in the UAE, the platform’s accessibility is a huge plus. It removes many of the traditional barriers to entering financial markets, offering a modern and efficient way to trade. The focus on education empowers you to make informed decisions rather than just guessing. It is a comprehensive ecosystem built to support your trading journey from start to finish.

Navigating Online Trading Regulations in the United Arab Emirates

Thinking about trading in the UAE? You’ve picked a fantastic hub. The region is buzzing with financial activity, attracting traders from all over the globe. But before you jump in, it’s smart to get a handle on the local rules. Don’t worry, it’s not as complicated as it sounds. Understanding the regulatory landscape is your first step to trading with confidence and security.

The United Arab Emirates has a unique structure. It’s not just one big market with one single rulebook. Instead, it has several jurisdictions, including the “onshore” UAE and two major “offshore” financial free zones. Each has its own top-tier regulator to protect you and your capital. Knowing who’s who is key to picking the right broker.

| Regulator | Jurisdiction | Primary Role |

|---|---|---|

| Securities and Commodities Authority (SCA) | Onshore UAE | Oversees the primary financial markets across the Emirates, excluding the financial free zones. They set the rules for brokers operating locally. |

| Dubai Financial Services Authority (DFSA) | Dubai International Financial Centre (DIFC) | An independent regulator for the DIFC, a major financial hub. The DFSA upholds international standards for financial services. |

| Financial Services Regulatory Authority (FSRA) | Abu Dhabi Global Market (ADGM) | Regulates financial activities within the ADGM. The FSRA is known for its progressive approach and strong investor protection framework. |

So, what does all this mean for your trading journey? It means you have choices, and those choices come with powerful protections. When you choose a broker regulated by the SCA, DFSA, or FSRA, you gain a significant layer of security. These regulators enforce strict rules that brokers must follow.

Here are some of the direct benefits of trading with a locally regulated entity:

- Segregated Funds: Regulators require brokers to keep client funds in separate bank accounts. This means your money is not mixed with the company’s operational cash.

- Fair Trading Practices: These authorities monitor brokers to ensure they provide fair pricing, transparent execution, and do not engage in market manipulation.

- Dispute Resolution: If you ever have a problem with your broker, you have a formal channel to file a complaint and seek resolution.

- Capital Adequacy: Regulated brokers must maintain a certain level of capital. This proves they are financially stable and can meet their obligations to clients.

Navigating the rules in the UAE is your first winning trade. It sets you up for success by ensuring you partner with a trustworthy and secure online brokerage. Take a moment to check a broker’s regulatory status. It’s a simple step that pays off big time in peace of mind.

Olymptrade Account Registration Process for UAE Residents

Ready to start your trading journey from Dubai, Abu Dhabi, or anywhere in the UAE? Getting your Olymp Trade account set up is a straightforward process. You can go from zero to trading on a demo account in just a few minutes. Let’s walk through the simple steps to get you on the platform and ready for the markets.

Your Quick Guide to Getting Started:

- Visit the Platform: Head over to the official Olymp Trade website. You will immediately see the registration form waiting for you.

- Enter Your Details: Provide a valid email address and create a secure password. For even faster access, you can use your Google or Apple ID to sign up.

- Select Your Currency: Choose your preferred account currency. Most traders in the UAE select USD for its universal application in the financial markets.

- Agree and Register: Tick the box to confirm you are of legal age and accept the service agreement. Then, click the “Register” button.

- Confirm Your Email: Check your inbox for a confirmation email and click the link inside to activate your new account. That’s it! You now have access.

Once you complete the Olymptrade account registration, you instantly get access to both a demo and a real account. This allows you to practice risk-free before you decide to trade with real funds. Here’s a quick look at what you get right away:

| Feature | Demo Account | Real Account |

|---|---|---|

| Funds | Replenishable Virtual Money | Your Deposited Funds |

| Risk Level | Zero Risk | Real Financial Risk |

| Purpose | Practice & Strategy Testing | Earning Real Profit |

Before making your first withdrawal, you must complete the identity verification process. This is a standard security measure (KYC) that protects your account and complies with financial regulations. You will typically need to provide a copy of your Emirates ID or passport and proof of address. It’s a one-time process that ensures a secure trading environment for everyone.

A smart trader prepares. Use the demo account to master the platform and test your strategies before you put a single Dirham on the line.

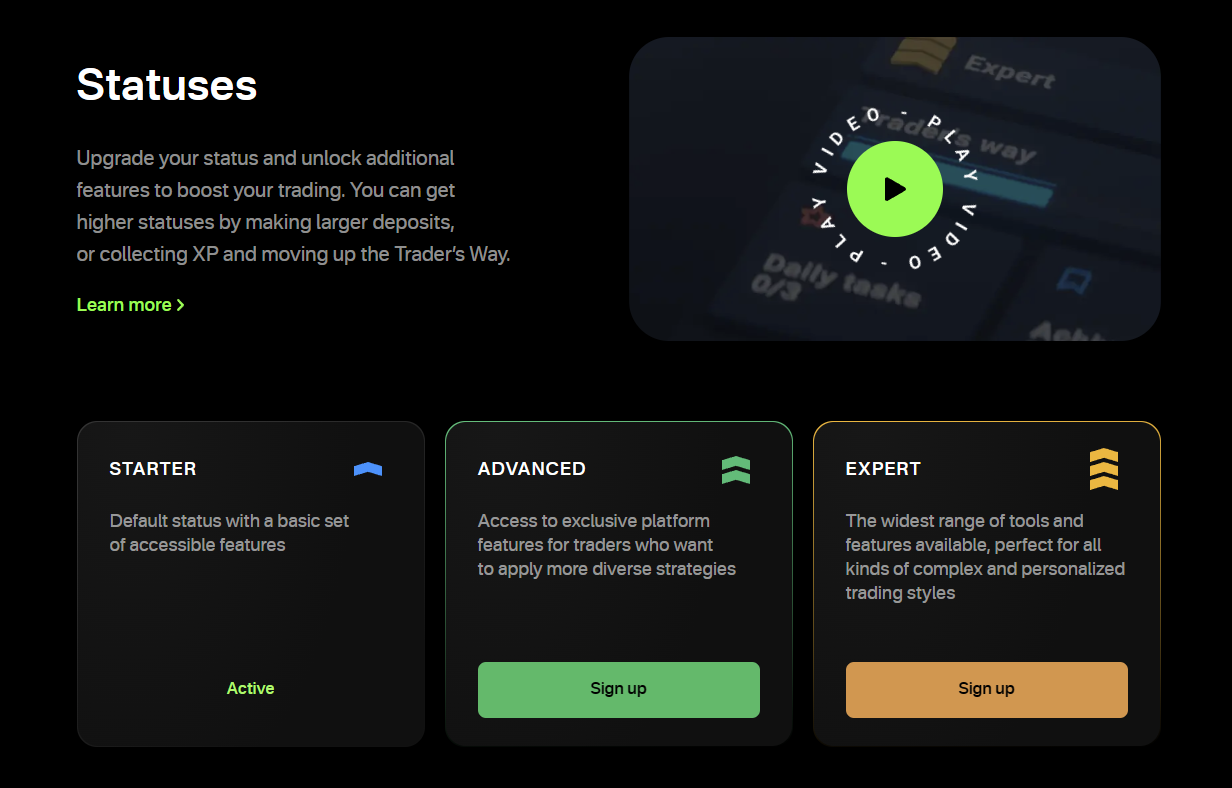

Exploring Olymptrade Account Types and Their Benefits

Choosing the right trading account is a crucial first step on your trading journey. It’s not just about depositing funds; it’s about aligning the platform’s features with your skill level, strategy, and goals. Olymp Trade understands this perfectly by offering a clear progression of account types. Each tier unlocks new tools and better trading conditions, creating a path for you to grow from a novice to a seasoned pro. Let’s break down what each account offers and how you can benefit.

Before you even think about live trading, you should get familiar with the platform. This is where the Demo Account comes in. It’s your personal training ground.

- Risk-Free Practice: You get a replenishable balance of virtual money. Use it to test strategies, understand market movements, and get comfortable with the interface without risking a single dollar.

- Full Feature Access: The demo environment mirrors the real market. You can access the same assets and tools as a live account, making it the perfect place to build confidence.

- Unlimited Use: There’s no time limit. Practice for as long as you need until you feel ready to step into the real arena.

Once you are ready to trade with real capital, you can choose from several live account tiers. Your status depends on your deposit amount, and you can always upgrade as you grow. Think of it as leveling up in your trading career.

Your trading account should be a partner in your success, not a barrier. Find the one that matches your ambition and start building your strategy from there.

To make the choice easier, here is a simple comparison of the main live Olymptrade account types and their core benefits:

| Feature | Starter | Advanced | Expert |

|---|---|---|---|

| Ideal For | Beginners making their first trades. | Traders with some experience. | Serious, experienced traders. |

| Profitability Rate | Standard | Increased (Up to 84%) | Maximum (Up to 92%) |

| Open Positions Limit | Up to 10 | Up to 20 | Up to 30 |

| Educational Resources | Basic access | Access to private webinars and strategies. | Exclusive strategies and personal analyst. |

| Risk-Free Trades | No | Yes | Yes, with better terms. |

| Withdrawal Speed | Standard | Faster | Priority / Fastest |

Ultimately, the best Olymptrade account type is the one that fits you right now. Don’t feel pressured to jump to the highest tier immediately. Start with the Starter account if you’re new, gain experience, build your capital, and then move up to Advanced or Expert status. The platform is designed to support your growth, providing more powerful tools and better trading conditions as your skills and investment level increase. Choose wisely and focus on what truly matters: making smart trades.

Trading Instruments Available on Olymptrade’s Platform

As a trader, your playground is the market, and the more instruments you have, the more opportunities you can seize. A diverse portfolio is your best friend in the ever-changing world of finance. The Olymptrade platform understands this perfectly, offering a wide array of asset classes to suit every trading style and strategy. You get everything you need in one place, which means less time switching between accounts and more time focusing on your charts.

Let’s break down what you can find and trade. The selection is broad, allowing you to diversify your activities and adapt to different market conditions. Whether you’re a long-term investor or a short-term speculator, there’s something here for you.

Key Asset Categories on the Platform

Having access to various markets from a single account is a massive advantage. It allows you to pivot your strategy when one market is quiet while another is buzzing with activity. Here’s a quick look at the main groups of trading instruments you can work with:

- Forex: The heart of the financial world. You can trade major currency pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs. The forex market offers high liquidity and is open 24/5, providing constant opportunities.

- Stocks: Want a piece of the world’s biggest companies? Trade on the price movements of stocks from giants like Apple, Tesla, and Amazon. This is a great way to capitalize on corporate news and earnings reports.

- Indices: Instead of picking a single stock, you can trade the overall performance of an entire market segment. Access popular indices like the S&P 500, NASDAQ 100, and the Dow Jones to speculate on broader economic trends.

- Commodities: Trade essential raw materials that drive the global economy. This includes precious metals like gold and silver, which are often seen as safe-haven assets, and energy products like Brent oil.

- Cryptocurrencies: Dive into the dynamic world of digital currencies. The platform provides access to leading cryptocurrencies like Bitcoin and Ethereum, allowing you to take advantage of their significant volatility.

At a Glance: Your Trading Options

To make it even clearer, here is a simple table summarizing the types of assets and some popular examples available for trading. This helps you see the sheer breadth of what’s on offer.

| Asset Class | Description | Popular Examples |

|---|---|---|

| Currencies (Forex) | Trading on the exchange rate between two currencies. | EUR/USD, AUD/CAD, USD/CHF |

| Stocks | Speculating on the share prices of public companies. | Microsoft, Netflix, Google |

| Indices | Trading a basket of stocks representing a market. | S&P 500, FTSE 100, Nikkei 225 |

| Commodities | Trading on raw materials like metals and energy. | Gold, Silver, Brent Oil |

| Cryptocurrencies | Trading on the value of digital currencies. | Bitcoin, Ethereum, Litecoin |

Ultimately, the variety of trading instruments on the Olymptrade platform gives you the flexibility to build a robust and diversified trading portfolio. You can hedge your positions, explore new markets, and find new opportunities without ever leaving the platform. This convenience is a powerful tool for any serious trader.

Deposit and Withdrawal Methods for Olymptrade UAE Users

Seamlessly moving your money in and out of your trading account is crucial. You need fast, reliable, and convenient options to seize market opportunities without delay. For traders in the UAE, Olymp Trade offers a variety of payment methods designed to make funding your account and cashing out your profits a smooth experience.

Getting started is simple. The platform ensures that depositing funds is a hassle-free process, allowing you to focus on your trading strategy instead of worrying about transactions. You can choose from several trusted options right from your dashboard.

Popular Deposit Options

- Bank Cards (Visa/Mastercard): A classic and straightforward choice. Using your debit or credit card is one of the fastest ways to fund your account instantly.

- E-Wallets: Digital wallets provide an excellent combination of speed and security. Options like Skrill and Neteller are popular among traders for their quick processing times and ease of use.

- Local Bank Solutions: Depending on availability, you may find options for direct bank transfers, which cater specifically to the banking systems within the UAE.

When it’s time to enjoy your trading success, the withdrawal process is just as important. Olymp Trade aims to process withdrawal requests efficiently. A key rule to remember is that you typically withdraw funds using the same method you used for your deposit. This is a standard security measure to protect your account.

Comparing Common Withdrawal Methods

| Method | Typical Processing Speed | Best For |

|---|---|---|

| Bank Cards | 1-3 business days | Traders who prefer funds sent directly to their bank account. |

| E-Wallets | Often within 24 hours | Speed and flexibility in managing funds online. |

Ultimately, having access to diverse and reliable deposit and withdrawal methods empowers you as a trader. It gives you the confidence to manage your capital effectively, knowing that your funds are accessible when you need them. This focus on financial convenience allows you to dedicate your full attention to navigating the markets and achieving your trading goals.

Olymptrade Trading Platform: Features and User Interface

As a trader, your platform is your command center. A clunky, confusing interface can lead to missed opportunities and costly mistakes. That’s why I always look for a platform that feels like an extension of my trading strategy. The Olymptrade trading platform delivers an experience that is both powerful and incredibly intuitive, stripping away the noise so you can focus on what truly matters: the markets.

The first thing you will notice is the clean and uncluttered user interface. It avoids the overwhelming feeling some platforms give you. Everything you need is right where you expect it to be. You can easily switch between assets, adjust your trade amount, and execute orders with just a few clicks. Customization is also a key part of the experience, allowing you to set up your charts and workspace to match your personal trading style.

Core Platform Features at a Glance

- Diverse Charting Options: Choose from popular chart types like Japanese Candlesticks, Bars, Heikin Ashi, and Area charts to visualize price action your way.

- Extensive Technical Indicators: Access a full suite of built-in indicators, including Moving Averages, RSI, MACD, Bollinger Bands, and many more to build and confirm your trading signals.

- Helpful Drawing Tools: Analyze market trends with precision using tools like trend lines, horizontal lines, and Fibonacci levels directly on your charts.

- Wide Range of Assets: Easily navigate between different markets, including forex currency pairs, stocks, and commodities, all from a single interface.

- Instant Order Execution: The platform is designed for speed, ensuring your trades are placed quickly to help you enter the market at your desired price point.

How the Platform Empowers Your Trading

It is one thing to have features, but it is another for them to actively help you trade better. The user interface is built around the trader’s workflow, making analysis and execution a seamless process.

| Feature Focus | Benefit for You as a Trader |

|---|---|

| Customizable Workspace | Arrange charts and tools how you see fit. This helps you monitor multiple assets or timeframes without feeling disorganized. |

| Integrated Analysis Tools | No need for third-party software. Perform your full technical analysis directly within the platform, saving you time and hassle. |

| Clear Trade Management | Your open positions and trading history are displayed clearly, making it simple to track your performance and manage your risk. |

Ultimately, the Olymptrade platform provides a balanced environment. It is simple enough for new traders to grasp quickly, yet it packs the powerful charting and analysis tools that seasoned professionals demand for effective forex trading. This combination allows you to build confidence and execute your strategy with precision.

Mobile Trading Experience with Olymptrade in the UAE

Life in the UAE moves at lightning speed. Whether you are commuting between Dubai and Abu Dhabi or simply enjoying a coffee at The Walk, the market never stops. You need a trading platform that keeps up with your dynamic lifestyle. This is where the mobile trading experience with Olymptrade truly shines, putting the power of the global markets right in the palm of your hand.

Forget being tied to your desk. The Olymptrade app delivers a seamless and powerful trading environment designed for traders on the move. It mirrors the functionality of the desktop platform, ensuring you never miss an opportunity. The interface is clean, intuitive, and responsive, making it easy to navigate even for beginners.

Key Features of the Mobile App

- Full-Featured Trading: Access all the same assets, including currency pairs, stocks, and commodities, that you would on your computer.

- Intuitive Interface: The app is designed for touchscreens, with simple swipes and taps to open, manage, and close your positions.

- Advanced Charting Tools: Analyze market trends directly from your phone with a suite of built-in indicators and graphical tools.

- Instant Notifications: Set up price alerts and get instant push notifications so you are always aware of significant market movements.

- Secure and Fast: Enjoy quick order execution and the peace of mind that comes with robust security measures protecting your account.

Mobile vs. Desktop Trading at a Glance

| Aspect | Mobile App | Desktop Platform |

|---|---|---|

| Accessibility | Trade from anywhere with an internet connection. | Requires access to a laptop or PC. |

| Best For | Monitoring positions and making quick trades. | In-depth technical analysis with multiple screens. |

| Alerts | Instant push notifications directly to your device. | On-screen and browser-based alerts. |

As a trader based in Dubai, I am rarely in one place for long. The Olymptrade app gives me the freedom to manage my portfolio effectively, whether I’m in a meeting or stuck in traffic on Sheikh Zayed Road. The execution speed is fantastic, which is critical in a volatile market.

Ultimately, the Olymptrade mobile platform provides traders in the UAE with the flexibility and control needed to succeed. It transforms your smartphone into a powerful trading terminal, ensuring you are always connected to the markets, no matter where your day takes you.

Customer Support and Localized Assistance for Olymptrade UAE

In the fast-paced world of trading, a single question can make the difference between a profit and a loss. You need answers, and you need them fast. We all know that feeling. That’s why having a robust support system isn’t just a nice feature; it’s a critical tool for every trader in the UAE. It’s about having a reliable partner you can count on, anytime.

When you trade from Dubai, Abu Dhabi, or anywhere in the Emirates, you deserve support that understands you. This means more than just a generic helpdesk. It means assistance tailored to your specific needs, in your language, and available when your market is active. This commitment to localized service ensures your trading journey is smooth and free from unnecessary hurdles.

What Sets the Support Apart?

- Around-the-Clock Availability: The forex market never sleeps, and neither does the support team. Get help 24/7, whether it’s early morning or late at night.

- Multiple Contact Channels: Reach out the way you prefer. Use the instant live chat for quick questions, send an email for detailed inquiries, or call for urgent matters.

- Professional and Trained Staff: Speak with specialists who understand the platform and the world of trading. They provide clear, effective solutions to get you back on track.

- Arabic Language Support: Communicate your needs clearly and effectively with dedicated support available in Arabic, ensuring nothing gets lost in translation.

Choosing the right way to get in touch can save you valuable time. Here’s a quick guide to the support options available to you:

| Support Method | Typical Response Time | Ideal For |

|---|---|---|

| Live Chat | Under 1 minute | Urgent platform questions and quick troubleshooting. |

| A few hours | Detailed account inquiries or document submissions. | |

| Phone Call | Immediate | Complex issues requiring a direct conversation. |

“As a trader, confidence is key. Knowing I have a support team that responds instantly gives me the peace of mind to focus purely on my market analysis and execution.”

Ultimately, strong customer service acts as your safety net. It allows you to trade boldly, knowing that a professional team is ready to assist with any technical or account-related issue. This frees you up to concentrate on what truly matters: making informed trading decisions and reaching your financial goals.

Advantages and Disadvantages of Olymptrade for UAE Investors

Choosing the right trading platform is a critical first step for any investor in the UAE. Olymp Trade has gained significant popularity, but is it the right fit for you? Like any broker, it comes with its own set of strengths and weaknesses. Understanding these can help you make an informed decision that aligns with your trading goals and risk appetite. Let’s break down what traders in Dubai, Abu Dhabi, and across the Emirates should consider.

To give you a clear picture, we’ve laid out the key points in a simple comparison table. This side-by-side view makes it easy to weigh the pros against the cons.

| Advantages for UAE Traders | Disadvantages to Consider |

|---|---|

| Low Minimum Deposit: You can start trading with a very small initial investment. This makes the platform highly accessible for beginners who want to test the waters without significant financial risk. | Regulatory Scrutiny: While regulated by the FinaCom, it lacks oversight from top-tier authorities like the UAE’s DFSA or ADGM. This might be a concern for larger investors seeking maximum fund security. |

| Intuitive Trading Platform: The platform is clean, simple, and very easy to navigate. This is a huge plus if you are new to trading and feel overwhelmed by more complex interfaces from other brokers. | Limited Asset Range: The selection of forex pairs, stocks, and commodities is not as extensive as what you might find on other global brokerage platforms. This can limit advanced diversification strategies. |

| Free Demo Account: You get immediate access to a free demo account with virtual funds. This allows you to practice strategies and get comfortable with the platform before committing real dirhams. | Withdrawal Process Concerns: Some users have reported that the withdrawal process can be slower than expected. It sometimes requires additional verification steps that can cause frustrating delays. |

| Excellent Educational Hub: Olymp Trade provides a wealth of free educational materials. You can find webinars, tutorials, and market analysis, which is invaluable for building your trading skills. | High-Risk Instruments: Features products like FTTs, which are high-risk. |

| Efficient Mobile App: Their mobile trading application is well-designed and fully functional. It allows you to manage your trades and monitor the market from anywhere in the UAE, fitting a busy lifestyle. | Variable Spreads: While some spreads are competitive, they can widen during periods of high market volatility. This can increase your trading costs unexpectedly and eat into potential profits. |

**Important Risk Warning:** The platform heavily features Fixed Time Trades (FTTs), which carry a very high level of risk. Inexperienced traders can lose capital quickly if they don’t fully understand these products.

Ultimately, the decision rests on your personal trading style and priorities. If you are a new trader in the UAE looking for a low-cost entry point with a simple platform and good educational support, Olymp Trade offers compelling advantages. However, if you are an experienced trader needing a wide variety of assets and the assurance of top-tier regulation, you might find its disadvantages more significant.

Effective Risk Management Strategies for Online Trading

Let’s talk about the single most important skill in a trader’s toolkit. It’s not about finding the perfect entry or predicting every market move. It’s about staying in the game long enough to win. That’s where effective risk management comes in. Forgetting this crucial step is the fastest way to blow up an account. Your primary goal in online trading isn’t to make a million dollars overnight; it’s capital preservation. Protect your funds, and the profits will follow.

So, how do you build a fortress around your trading capital? It starts with a few non-negotiable rules. These aren’t just suggestions; they are the bedrock of a sustainable trading career. Think of them as your personal trading commandments.

- Always Use a Stop-Loss: This is your safety net. A stop-loss order automatically closes your position at a predetermined price, capping your potential loss on any single trade. Trading without one is like driving without brakes.

- Know Your Position Sizing: Never risk a huge chunk of your account on one idea. Proper position sizing ensures that a single losing trade won’t cripple your ability to trade tomorrow. The famous 1% rule, where you risk no more than 1% of your capital per trade, is a fantastic starting point.

- Calculate Your Risk-to-Reward Ratio: Before you even enter a trade, you must know your potential profit versus your potential loss. A favorable risk-to-reward ratio means your potential winnings are significantly greater than what you stand to lose.

- Use Leverage Wisely: Leverage is a powerful tool, but it’s a double-edged sword. It can amplify gains, but it can also magnify losses just as quickly. Using excessive leverage is a common mistake that can wipe out an account with a small market move against you.

Understanding Risk vs. Reward

Aiming for trades where the potential reward outweighs the risk is a game-changer. Why risk $100 to make $50? It just doesn’t make sense long-term. A healthy risk-to-reward ratio improves your odds of profitability over time, even if you don’t win every trade. Here’s a simple breakdown:

| Risk Amount | Potential Reward | Ratio | Is it a good trade? |

|---|---|---|---|

| $100 | $100 | 1:1 | Acceptable, but could be better. |

| $100 | $200 | 1:2 | Good. Your potential profit is double your risk. |

| $100 | $300 | 1:3 | Excellent. This gives you a significant edge. |

Consistently finding trades with a ratio of 1:2 or better means you can be wrong more often than you are right and still come out ahead. This simple math is the foundation of a solid trading plan.

The best risk management happens in your head. A solid strategy is useless if you let fear or greed take over. Emotional trading leads to breaking your rules—widening your stop-loss on a losing trade or closing a winner too early. Discipline is your greatest asset. Stick to your trading plan no matter what.

Olymptrade Alternatives and Competitors in the UAE Market

As a trader in the dynamic UAE market, you know that having the right platform is key to your success. While Olymp Trade is a popular entry point for many, seasoned traders often explore other options to find features that better match their evolving strategies. The search for the best forex brokers is a continuous journey, and understanding the competitive landscape is crucial for making an informed decision.

The regulatory environment in the UAE is robust, offering a level of security that traders value highly. When looking for Olymp Trade alternatives, prioritizing regulated brokers is non-negotiable. Platforms supervised by top-tier authorities provide peace of mind, ensuring your funds are segregated and that you are trading in a fair environment. This focus on security is a hallmark of professional forex trading in UAE.

Let’s look at some strong contenders in the region. Each platform offers a unique blend of tools, assets, and features designed for different types of traders.

| Broker | Key Feature | Trading Platforms | Ideal For |

|---|---|---|---|

| eToro | Social & Copy Trading | Proprietary Platform | Beginners and those looking to follow experienced traders. |

| IG | Extensive Market Range | Proprietary, MetaTrader 4, ProRealTime | Traders seeking access to a vast array of global markets. |

| XTB | Excellent Educational Resources | xStation 5 | Traders who prioritize learning and platform usability. |

When you’re comparing your options, what should you really focus on? Here are the critical factors to consider beyond the brand name:

- Asset Variety: Does the broker offer more than just major forex pairs? Look for access to exotic currencies, indices, commodities like gold and oil, and even stock CFDs.

- Spreads and Commissions: Your trading costs directly impact your profitability. Search for platforms offering competitive and transparent pricing with consistently low spreads.

- Platform Stability and Tools: A great trading experience depends on a solid platform. Check if they offer popular choices like MetaTrader 4 or MetaTrader 5, and assess the quality of their charting tools and indicators.

- Execution Speed: In fast-moving markets, a split second can make all the difference. Fast execution is vital to minimize slippage and get the price you want.

- Customer Support: Look for brokers with responsive, knowledgeable support teams that understand the needs of traders in the UAE.

Ultimately, the best alternative depends on your individual trading style and goals. Take the time to open demo accounts, test the platforms, and see which one feels right for your strategy. The right partner can significantly enhance your trading journey.

Expert Tips for Successful Trading with Olymptrade United Arab Emirates

Trading from the dynamic market of the United Arab Emirates offers incredible opportunities. To navigate the markets successfully with Olymptrade, you need more than just ambition; you need a smart approach. We have distilled years of experience into practical tips to help you elevate your trading game. Forget luck. Focus on strategy and discipline to build a consistent trading career.

Here are the core principles every successful trader in the UAE follows:

- Master Your Tools: Before risking a single Dirham, spend quality time on the Olymptrade demo account. Treat it like real money. Test your strategies, understand every feature of the platform, and build confidence in your execution. Knowing your platform inside and out eliminates costly errors when the pressure is on.

- Build a Watertight Trading Plan: Never enter the market without a clear plan. A solid plan defines what you trade, when you enter, when you exit, and how much you risk. It is your business plan for every single trade.

- Prioritize Risk Management: Your first job as a trader is not to make money, but to protect your capital. Use tools like Stop Loss to define your maximum acceptable loss on a trade. Never risk more than a small percentage of your account on a single position. This discipline keeps you in the game long enough to be profitable.

- Stay Educated and Adaptable: The markets are always changing. Dedicate time each day to learning. Follow financial news relevant to the assets you trade, especially those impacting the MENA region. Olymptrade often provides educational materials and market analysis—use them to your advantage.

Consider the difference a structured approach makes. Impulsive trading is a recipe for disaster, while disciplined trading builds a foundation for success.

| Aspect | Disciplined Trader | Impulsive Trader |

|---|---|---|

| Entry Signal | Waits for pre-defined criteria from their strategy. | Jumps in based on fear of missing out (FOMO) or a gut feeling. |

| Risk Control | Sets a Stop Loss on every trade before entering. | Hopes the trade turns around, often leading to large losses. |

| Decision Making | Logical and based on a tested plan. | Emotional and reactive to market noise. |

| Outcome | Consistent, manageable results over time. | Unpredictable, with big wins and devastating losses. |

The goal of a successful trader is to make the best trades. Money is secondary.

By integrating these expert tips into your routine, you transform trading from a gamble into a calculated business. Success with Olymptrade in the United Arab Emirates is not about finding a secret formula; it’s about executing a proven process with unwavering discipline, day in and day out.

The Future Outlook for Online Trading in the UAE

The online trading scene in the United Arab Emirates is on an exciting journey. It’s not just growing; it’s evolving at a rapid pace. The region is quickly transforming into a global hub for finance and technology, and this energy is directly fueling the trading landscape. For traders like us, this means more opportunities, better tools, and a more secure environment than ever before.

Several key factors are driving this powerful shift. Understanding them helps us see where the market is heading.

- Supportive Government Initiatives: The UAE government actively promotes economic diversification away from oil. This includes fostering a robust financial services sector and attracting global talent and capital.

- A Tech-Savvy Population: With one of the highest internet and smartphone penetration rates in the world, the population is digitally native and eager to adopt new financial technologies (Fintech).

- Strong Regulatory Frameworks: Authorities like the Securities and Commodities Authority (SCA), the Dubai Financial Services Authority (DFSA), and the Abu Dhabi Global Market (ADGM) are building world-class regulatory environments. This provides traders with confidence and security.

- Increased Access to Education: More resources, webinars, and local seminars are becoming available, empowering new traders to enter the market with greater knowledge and skill.

The evolution is clear when you compare the trading environment of the past with the emerging future. The changes are fundamental and create a completely new playing field.

| Aspect | The Past | The Emerging Future |

|---|---|---|

| Technology | Basic desktop platforms | AI-powered analytics, mobile-first apps, ultra-low latency execution |

| Asset Access | Mainly major forex pairs and some local stocks | Global markets, cryptocurrencies, ETFs, and diverse derivatives |

| Regulation | Less structured, reliance on international brokers | Strong, locally-based regulation offering investor protection |

| Community | Fragmented and mostly online | Growing local networks, physical meetups, and collaborative hubs |

The convergence of capital, clear regulation, and a hunger for innovation is creating a perfect storm in the UAE. Traders who position themselves correctly now will be riding a powerful wave for years to come. It’s less about finding a good setup and more about trading within a good ecosystem.

– Financial Market Analyst

Looking ahead, we can expect to see even greater integration of artificial intelligence for predictive analysis and automated trading strategies. The continued growth of the local fintech scene will likely introduce new, innovative platforms tailored specifically to the needs of traders in the region. The future for online trading in the UAE isn’t just bright; it’s dynamic and full of potential. For the prepared trader, the opportunities are immense.

Frequently Asked Questions

What is the Exness Rebate, and how does it work?

The Exness Rebate is a program that offers cashback on each trade. Every time you make a trade, a portion of the trading fees returns to your account as a rebate, helping reduce overall costs.

Who is eligible for Exness Cashback?

Most Exness accounts qualify for rebates, but eligibility may vary by account type.

How can I maximize my Exness Rebate?

To maximize Exness Cashback, focus on high-volume trading, choose low-spread pairs, and trade during high-liquidity sessions. Additionally, check that your account type qualifies for rebates.

Do rebates impact my trading performance?

No, Exness Rebates do not affect your trading performance, spreads, or execution speed. Rebates only reduce your costs by returning part of the fees on completed trades.

Are there any risks associated with the Exness Rebate program?

The main risk is over-trading in an attempt to earn more rebates. It’s essential to stick to a disciplined strategy and avoid taking unnecessary risks solely to increase rebates.