Have you ever looked at the financial markets and felt a mix of excitement and confusion? You see the potential for profit, but the path to get there seems complicated. I’ve been there. The good news is that starting your journey in online trading has never been more accessible, and this guide is your roadmap. We are going to explore Olymptrade trading, breaking down everything a beginner needs to know to navigate the markets confidently.

Forget the image of Wall Street sharks yelling into phones. Today, anyone with an internet connection can participate. This guide is designed to cut through the noise. We’ll provide you with clear, actionable steps to move from a complete novice to a trader who makes informed decisions. This isn’t about getting rich overnight; it’s about building a solid foundation for consistent success.

So, what exactly is Olymptrade? Think of it as your all-in-one hub for accessing the world of trading. It’s a platform built with a focus on user experience, which makes it a fantastic starting point for newcomers. Whether you’re interested in the fast-paced world of Forex or other assets, this platform provides the tools you need in one place.

Here’s why many new traders find it to be a great starting point:

- Free Demo Account:

You get to practice with virtual money. This is a game-changer. It allows you to test strategies, get comfortable with the platform, and make mistakes without risking a single dollar of your real capital.

- Low Entry Barrier: You don’t need a massive fortune to start. The minimum deposit is low, making it accessible for almost everyone who wants to try their hand at trading.

- Educational Resources: The platform offers a wealth of free learning materials, from tutorials and webinars to market analysis. They invest in your knowledge, which is crucial for long-term success.

- Intuitive Interface: The trading terminal is clean and easy to understand. You won’t be overwhelmed by a dozen confusing charts and buttons. Everything you need is right where you expect it to be.

This beginner’s guide will be your trusted companion. We will walk through setting up your account, understanding the different trading modes, developing a simple strategy, and, most importantly, managing risk. Let’s get you prepared for a successful year of trading!

- What is Olymp Trade and How Does it Work?

- Is Olymp Trade Trading Safe and Legit? A Look at Regulation

- What FinaCom Membership Guarantees You

- Safety and Legitimacy at a Glance

- Setting Up Your Account: A Step-by-Step Guide

- Choose a Reputable Forex Broker

- Select Your Trading Account Type

- Complete the Registration Form

- Verify Your Identity (KYC Process)

- Fund Your Account

- Download and Set Up Your Trading Platform

- Navigating the Olymptrade Trading Platform Interface

- Your First Trade: A Simple Walkthrough

- Key Platform Features at a Glance

- Mastering the Basics with the Olymp Trade Demo Account

- Key Advantages of Using the Demo Account

- From Practice to Performance: Demo vs. Real Account

- Key Assets You Can Trade on Olymp Trade

- Forex: The King of the Markets

- Stocks: Trade the Giants

- Commodities: The World’s Raw Materials

- A Quick Look at Different Asset Classes

- Indices and Cryptocurrencies

- Fixed Time Trades (FTT)

- How They Work: A Simple Breakdown

- The Good and The Bad: A Balanced View

- Forex Trading

- Key Advantages of the Forex Market

- The Major Currency Pairs to Watch

- Stocks & Commodities

- Why Look Beyond Forex? Diversification is Key!

- Getting Started with Stocks and Major Indices

- The Power of Commodities: Gold vs. Oil

- Connecting the Markets for a Winning Edge

- Effective Olymptrade Trading Strategies for Beginners

- 1. Follow the Trend: The Classic Approach

- 2. Support and Resistance: The Price Bounce

- Advantages and Disadvantages of Support/Resistance Trading

- 3. The Moving Average Crossover Strategy

- Advanced Trading Techniques and Technical Indicators

- Mastering Fibonacci Retracements

- The All-in-One Ichimoku Cloud

- Advantages

- Disadvantages

- The Power of Confluence: A Trade Example

- Deposits and Withdrawals: Managing Your Funds

- Funding Your Account Instantly

- Accessing Your Profits: Fast & Reliable Withdrawals

- Best Practices for Managing Your Forex Funds

- Available Payment Methods

- Understanding Withdrawal Times and Limits

- Factors That Influence Your Withdrawal Time

- Navigating Withdrawal Limits

- The Pros and Cons of Trading with Olymp Trade

- Advantages of Choosing Olymp Trade

- Potential Drawbacks to Consider

- A Quick Side-by-Side Comparison

- Trading on the Go: The Olymp Trade Mobile App Reviewed

- Core Functionality at Your Fingertips

- Mobile Trading: The Good and The Bad

- The Verdict: Is It Your Pocket Co-Pilot?

- Educational Resources to Improve Your Trading Skills

- Your Path to Trading Mastery

- Which Resource is Right for You?

- Our Final Verdict: Is Olymptrade Trading Right for You?

- Who Will Find a Home at Olymptrade?

- For the Trader Just Starting Out

- For the Experienced Market Navigator

- A Balanced Look: The Highs and Lows

- Ask Yourself These Key Questions

- Frequently Asked Questions

What is Olymp Trade and How Does it Work?

Ever felt overwhelmed by complex trading platforms? I get it. That’s where Olymp Trade comes in. Think of it as your all-in-one trading hub, designed to be straightforward without cutting corners. It’s a popular online broker that gives you access to financial markets right from your phone or computer. Whether you’re just dipping your toes into trading or you’ve been charting for years, this platform has something for you.

So, how do you go from zero to your first trade? It’s simpler than you might think. Here’s the typical journey on the platform:

- Start Risk-Free: You begin by opening an account, which immediately gives you access to a free demo account. It’s loaded with virtual cash, so you can practice your strategies and get a feel for the market without risking a single penny. This is a crucial first step for any trader.

- Pick Your Playground: Once you’re comfortable, you choose an asset to trade. This could be anything from currency pairs like EUR/USD, stocks of major companies, commodities like gold, or even popular cryptocurrencies. The variety keeps things interesting.

- Analyze and Predict: Now for the fun part. You use the platform’s built-in charts and technical indicators to analyze the asset’s price movement. Your goal is to forecast where the price will go next: up or down.

- Execute Your Trade: Based on your analysis, you open a position. You decide on your investment amount and set your parameters. The platform offers a couple of primary ways to do this, which really defines the experience.

Understanding the two main trading modes is key to using the platform effectively. Let’s break them down side-by-side.

| Feature | Forex Mode | Fixed Time Trades (FTT) Mode |

|---|---|---|

| Primary Goal | Profit from the magnitude of price change over time. | Profit from correctly predicting the price direction in a set time. |

| Profit & Loss | Unlimited potential profit/loss; controlled with Stop Loss & Take Profit. | Fixed percentage payout (e.g., 82%) if your prediction is correct. |

| Trade Duration | You decide when to close the trade, from minutes to days. | Pre-defined, short-term duration, from 1 minute to several hours. |

| Best For | Traders who prefer traditional market mechanics and longer-term analysis. | Traders who enjoy a fast-paced environment and quick results. |

“As a trader, the most important thing is a platform that just works. It should be fast, reliable, and give you the tools you need without the clutter. For me, the ability to switch between long-term Forex positions and quick FTTs on a single interface is a game-changer. It allows for a dynamic trading strategy that adapts to market conditions.”

Is Olymp Trade Trading Safe and Legit? A Look at Regulation

Let’s cut right to the chase. When you’re putting your hard-earned money on the line, the first question you should ask is: \”Is this platform safe?\” It’s the most critical question for any trader, from rookie to veteran. So, let’s break down the legitimacy and security of Olymp Trade.

The core of any broker’s trustworthiness lies in its regulation. An unregulated platform is like the Wild West – no rules, no sheriff, and no one to turn to if things go wrong. Olymp Trade addresses this concern by being a member of the International Financial Commission, also known as FinaCom.

What does this mean for you as a trader? FinaCom is an independent, external dispute resolution (EDR) body. Its primary role is to ensure that platforms like Olymp Trade adhere to honest practices and provide a transparent service. Think of them as a neutral referee between you and the broker.

What FinaCom Membership Guarantees You

Being a member of FinaCom isn’t just a fancy badge. It provides several concrete layers of protection for your trading activity.

- Neutral Dispute Resolution: If you ever have a serious disagreement with the platform that you can’t resolve directly, you can file a case with FinaCom. They will investigate your claim impartially.

- Compensation Fund: This is a massive confidence booster. FinaCom members contribute to a compensation fund. If a broker fails to comply with a FinaCom ruling, traders may be eligible for compensation of up to €20,000 from this fund. This provides a significant safety net for your capital.

- Service Quality Audits: The platform’s performance and execution quality are regularly checked by FinaCom to ensure they meet the required standards. This helps maintain a fair trading environment.

Beyond formal regulation, the platform also implements standard security protocols you’d expect from any financial service. This includes data encryption (SSL) to protect your personal and financial information and options for two-factor authentication (2FA) to secure your account access.

Safety and Legitimacy at a Glance

Here’s a quick summary to weigh the pros and cons of Olymp Trade’s regulatory standing.

| Advantages (Pros) | Considerations (Cons) |

|---|---|

| Member of the Financial Commission (FinaCom). | Not regulated by a top-tier government body like the FCA (UK) or CySEC (Cyprus). |

| Access to a compensation fund up to €20,000. | FinaCom is a self-regulatory organization, not a government entity. |

| Provides an external dispute resolution mechanism. | Regulatory oversight might be perceived as less stringent than tier-1 regulators. |

| Long operational history, active since 2014. |

“As a trader, I always look for regulation first. FinaCom provides a solid layer of security and a clear path for recourse if issues arise. It’s a green flag that shows the broker is committed to fair practices.”

So, is Olymp Trade safe and legit? Based on its long-standing membership with the Financial Commission and the protections it offers, it operates as a legitimate platform. While it doesn’t have the top-tier government regulation some traders might prefer, it has established a framework that prioritizes fund security and fair dispute resolution for its users. This makes it a viable option for many traders around the world.

Setting Up Your Account: A Step-by-Step Guide

So, you’re ready to jump into the forex market? Fantastic! Before you can place your first trade, you need to set up your trading account. Think of this as building your command center. Getting it right from the start saves you headaches later. Don’t worry, it’s a straightforward process, and I’ll walk you through every single step. Let’s get you geared up for success.

Choose a Reputable Forex Broker

This is the most critical decision you’ll make. Your broker is your partner in trading. They provide the platform, access to the market, and hold your funds. Look for a broker that is regulated by a top-tier authority (like the FCA, CySEC, or ASIC). Regulation is your safety net. Also, check their spreads, commissions, and available trading instruments. Read reviews, but take them with a grain of salt. Your goal is to find a reliable partner for your trading journey.

Select Your Trading Account Type

Most brokers offer a few different account types. The main choice you’ll face initially is between a demo account and a live account. I always recommend starting with a demo account to get a feel for the platform and test your strategy without risking real money.

Pro Tip: Treat your demo account like it’s real money. This builds the discipline you’ll need when you start live trading.

When you’re ready to go live, you’ll choose from accounts like Standard, ECN, or Micro. Here’s a quick breakdown:

Account Type Best For Key Feature Demo Account Beginners & Strategy Testing Uses virtual funds, no risk involved. Micro/Cent Account Transitioning to Live Trading Trade with very small amounts to limit risk. Standard Account Most Traders Standard lot sizes, often commission-free (spread-based). ECN/Raw Spread Account Experienced Traders & Scalpers Very tight spreads plus a fixed commission per trade. Complete the Registration Form

Once you’ve picked your broker and account type, it’s time for some paperwork. You’ll fill out an online application form. It’s pretty standard stuff: name, address, email, phone number, and some financial details. Be honest here. They’ll also ask about your trading experience. This isn’t a test; it’s for regulatory purposes to ensure they offer you appropriate products.

Verify Your Identity (KYC Process)

Every regulated broker must verify your identity. This is part of the Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. It’s a sign you’re dealing with a legitimate company. You’ll typically need to upload a couple of documents. The process is usually quick, often completed within 24 hours.

Common documents required:

- Proof of Identity: A clear copy of your passport, driver’s license, or national ID card.

- Proof of Address: A recent utility bill or bank statement (usually less than 3-6 months old) showing your name and address.

Fund Your Account

Your account is approved! Now, you need to add funds to start trading. Reputable brokers offer various secure deposit methods. Common options include:

- Bank Wire Transfer

- Credit/Debit Cards (Visa, Mastercard)

- E-wallets (PayPal, Skrill, Neteller)

Choose the method that works best for you. Check for any deposit fees and processing times. Your first deposit doesn’t have to be huge, especially if you’re starting with a micro account. Only trade with capital you can afford to lose.

Download and Set Up Your Trading Platform

The final step! Download the broker’s trading platform. Most offer the industry-standard MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Some have their own proprietary web-based or mobile platforms too. Install it on your device, log in with the credentials your broker sent you, and you’re in! You can now see the charts, analyze the market, and prepare to place your first trade. Welcome to the market, trader.

Navigating the Olymptrade Trading Platform Interface

Jumping into a new trading platform can feel like learning a new language. But don’t worry, I’ve been there. The good news is that the Olymptrade interface is designed with traders in mind. It’s clean, intuitive, and you’ll be navigating it like a pro in no time. Let’s break down the main dashboard so you know exactly what you’re looking at.

Your screen is your command center. Understanding each section is key to making swift and informed decisions. Here’s a quick tour of the essential components of the Olymptrade trading platform.

- The Main Chart: This is the heart of the platform. It’s where you’ll see the real-time price movement of your chosen asset. You can change the chart type (like Japanese candlesticks or Heikin Ashi), zoom in and out, and apply various technical indicators directly onto it.

- The Asset Selection Menu: Located usually at the top of your chart, this is where you choose what you want to trade. From currency pairs for forex trading to stocks and commodities, the Olymptrade platform offers a wide selection.

- The Trade Execution Panel: Typically on the right side, this is where the action happens. You’ll set your trade amount, duration (for FTT trading), and choose your direction (Up or Down). It’s also where you can set up Stop Loss and Take Profit levels for forex trades.

- Trades & History: Look for a section at the bottom or left of your screen. Here you can monitor your open positions and review your entire trading history. Analyzing your past trades is a crucial step to improving your strategy.

Your First Trade: A Simple Walkthrough

Ready to place a trade? It’s simpler than you think. Here is the exact process for making a trade on the Olymptrade interface:

- Pick Your Asset: Click the asset menu and select the currency pair or instrument you want to trade.

- Set Your Terms: In the trade panel, enter the amount you wish to invest. If you are executing a Fixed Time Trade, select the trade duration.

- Make Your Prediction: Based on your analysis of the chart, decide if you think the price will go up or down from its current level within your chosen timeframe.

- Execute the Trade: Click the corresponding “Up” or “Down” button. That’s it! Your trade is now active and you can monitor it in the ‘Trades’ section.

Key Platform Features at a Glance

The Olymptrade platform comes packed with features designed to enhance your trading experience. Here are some of the most useful ones:

| Feature | What It Does For You |

|---|---|

| Technical Indicators & Oscillators | Helps you analyze market trends, momentum, and potential reversal points directly on your chart. |

| Demo Account | A risk-free environment with virtual funds to practice your strategies and get comfortable with the platform. |

| Stop Loss / Take Profit | Essential risk management tools for forex trading that automatically close your position at a predetermined loss or profit level. |

| Market Insights & Analytics | Provides news, analysis, and an economic calendar to keep you informed about market-moving events. |

“My best advice for anyone starting out is to spend your first full day just clicking around. Open every menu, apply every indicator on the demo account, and get a feel for the layout. The Olymptrade interface is powerful, but its true strength is its simplicity. Master the tool before you try to master the market.”

– A Fellow Trader

Ultimately, the best way to learn is by doing. The platform is your gateway to the financial markets. Take your time, explore its features, and use the demo account to its full potential. A clear understanding of your trading environment is the first step toward consistent and confident trading.

Mastering the Basics with the Olymp Trade Demo Account

Every seasoned trader will tell you the same thing: you don’t jump into the deep end without learning how to swim first. The financial markets are exciting, but they can be unforgiving. That’s why smart traders start with practice. The Olymp Trade demo account is your personal training ground, designed to turn you from a novice into a confident market participant.

So, what exactly is it? Think of it as a perfect clone of the live trading environment. You get access to the same assets, the same real-time charts, and the same trading tools. The only difference? You trade with $10,000 in replenishable virtual money. This allows you to learn to trade and explore the platform without any financial pressure.

Key Advantages of Using the Demo Account

- Zero Financial Risk: This is the biggest benefit. You can experiment, make mistakes, and learn valuable lessons without losing a single cent of your hard-earned money. It’s truly risk-free trading.

- Realistic Market Simulation: The demo account uses live market data. This means you get a genuine feel for how assets move and how the market behaves. The experience is as real as it gets.

- Strategy Development: Have a new trading strategy you want to test? The demo account is the perfect place to refine it. You can see what works and what doesn’t before applying it to a live account.

- Platform Familiarization: Get comfortable navigating the Olymp Trade trading platform. Learn how to place orders, use indicators, and manage your trades effectively through hands-on practice trading.

From Practice to Performance: Demo vs. Real Account

The goal of the demo account is to prepare you for the real thing. Understanding the key differences is crucial for a smooth transition. While the platform mechanics are identical, the psychological aspect changes significantly when real money is on the line.

| Feature | Demo Account | Real Account |

|---|---|---|

| Funds | Virtual, replenishable funds | Your own deposited capital |

| Objective | Learning, practice, strategy testing | Generating real profit |

| Emotional Factor | Low-stress, analytical mindset | Higher stress, emotional decision-making |

| Risk | None | Risk of capital loss |

A crucial tip from one trader to another: Treat your practice trading seriously. Manage your virtual money as if it were real. The habits you build in the demo account will become the foundation for your success when you go live.

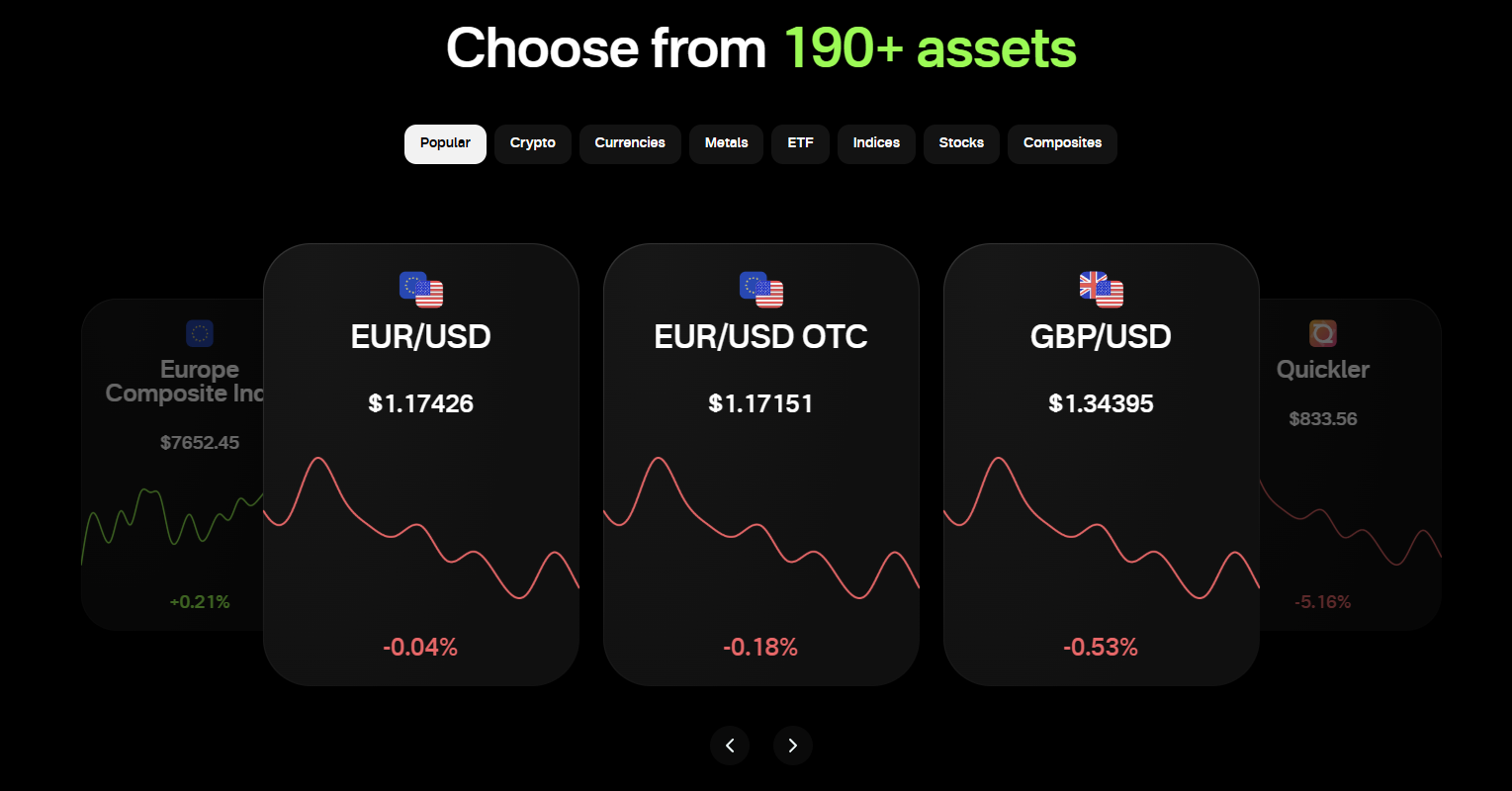

Key Assets You Can Trade on Olymp Trade

As a trader, your power lies in choice. Having a diverse portfolio of assets means you can find trading opportunities no matter what the global markets are doing. Olymp Trade understands this perfectly, offering a rich selection of instruments across various categories. Let’s dive into the key assets you can get your hands on and find your next winning trade.

Forex: The King of the Markets

The foreign exchange market is the largest and most liquid market in the world. On this platform, you can trade dozens of currency pairs, capitalizing on the fluctuations in their exchange rates. This market runs 24 hours a day, five days a week, giving you ultimate flexibility.

- Major Pairs: These are the big players, like EUR/USD, GBP/USD, and USD/JPY. They offer high liquidity and typically lower spreads.

- Minor Pairs: Cross-currency pairs that don’t involve the US dollar, such as EUR/GBP or AUD/JPY. They present unique opportunities based on regional economic health.

- Exotic Pairs: Pairs involving a major currency and a currency from an emerging economy, like USD/MXN. These can be more volatile but offer significant profit potential.

Stocks: Trade the Giants

Ever wanted to profit from the success of global powerhouses like Apple, Google, or Tesla without buying the actual shares? With stock CFDs (Contracts for Difference), you can. You speculate on the price movement—up or down—of a company’s stock. It’s a fantastic way to engage with the companies you know and follow in the news.

\”The key to successful trading is diversification. Never put all your capital into a single asset class. By spreading your trades, you spread your risk.\”

Commodities: The World’s Raw Materials

Commodities are the building blocks of the global economy, and you can trade them, too. These hard assets often move based on supply, demand, and geopolitical events, making them exciting to trade.

- Gold (XAU/USD): A classic safe-haven asset. Traders often flock to gold during times of economic uncertainty.

- Silver (XAG/USD): Known as \”gold’s little brother,\” silver is more volatile and offers different trading dynamics.

- Oil (Brent & WTI): Crude oil prices are incredibly sensitive to global politics and economic forecasts, leading to strong trends you can follow.

A Quick Look at Different Asset Classes

Choosing the right asset depends on your trading style and strategy. Here’s a simple breakdown to help you decide where to focus your attention:

| Asset Class | Best For Traders Who… | Primary Market Movers |

|---|---|---|

| Forex | Enjoy fast-paced, 24/5 markets. | Interest rates, economic data, politics. |

| Stocks | Follow corporate news and earnings reports. | Company performance, industry trends. |

| Indices | Prefer trading the overall market sentiment. | Broad economic health, major global events. |

| Commodities | Like trading based on supply and demand. | Geopolitics, weather, inventory reports. |

| Crypto | Seek high volatility and new technology. | Adoption rates, regulations, market hype. |

Indices and Cryptocurrencies

Beyond the core assets, you can also trade Indices. An index like the S&P 500 or NASDAQ 100 represents a basket of top stocks from a particular exchange or sector. Trading an index is like taking a position on the health of an entire economy or industry in a single trade.

And for those who thrive on volatility, there’s the world of Cryptocurrencies. You can trade popular digital currencies like Bitcoin (BTC) and Ethereum (ETH), capitalizing on their rapid price swings. With this incredible variety, Olymp Trade ensures that you always have a market to watch and an opportunity to seize.

Fixed Time Trades (FTT)

Ever looked at a chart and thought, \”I just know it’s going up in the next five minutes\”? Fixed Time Trades, or FTT, are designed for exactly that kind of scenario. This dynamic trading instrument allows you to profit from price fluctuations within a predetermined timeframe. It’s a straightforward approach: you predict the direction, and if you’re right when the time is up, you earn a fixed profit.

How They Work: A Simple Breakdown

The mechanics of placing Fixed Time Trades are incredibly simple, which is a big part of their appeal. Here’s the process from start to finish:

- Select an Asset: Choose from a wide range of financial markets, including currency pairs (like EUR/USD), stocks, or commodities.

- Set Your Expiry Time: Decide how long you want the trade to last. This can be as short as 30 seconds or last for several hours.

- Predict the Direction: Will the price be higher or lower than the current price when the time expires? You choose either Up (Call) or Down (Put).

- Enter Your Trade Amount: Decide how much capital you want to commit to this prediction.

- Execute: Once you confirm the trade, you simply wait for the expiry time to see the result.

The Good and The Bad: A Balanced View

Like any trading method, FTT has its unique set of advantages and challenges. It’s crucial to understand both sides before you dive in. Success here isn’t about luck; it’s about leveraging the pros while managing the cons with a solid trading strategy.

| Advantages | Disadvantages |

|---|---|

| Defined Risk & Reward: You know your exact potential profit and loss before entering a trade. No surprises. | All-or-Nothing Outcome: If your prediction is wrong, even by a single tick, you lose the invested amount. |

| Simplicity: The up-or-down concept is easy to grasp, making it accessible for new traders. | Fixed Payout: The payout is always less than 100% of your stake, meaning the risk is slightly higher than the potential reward on a single trade. |

| Speed and Frequency: Short expiry times allow for numerous trading opportunities throughout the day. | No Early Exit: Once a trade is placed, you are locked in until the expiry time. You can’t cut losses or take early profits. |

“The core of successful FTT trading isn’t just predicting the direction; it’s about proper risk management. Never risk more on a single trade than you can afford to lose. This single rule separates professionals from gamblers.”

– A Seasoned Trader’s Golden Rule

To truly master Fixed Time Trades, you must move beyond simple guessing. This means applying technical analysis, understanding chart patterns, and using indicators to inform your predictions. A well-thought-out trading strategy is your best tool for navigating these fast-paced markets and turning quick decisions into consistent results.

Forex Trading

Welcome to the biggest financial market in the world. As a trader, you know the thrill of identifying an opportunity and executing a plan. The foreign exchange market offers this on a global scale, 24 hours a day, five days a week. It’s a dynamic environment where currencies from around the world are traded, creating constant movement and potential.

At its core, forex trading is the act of speculating on the price fluctuations of currency pairs. You buy one currency while simultaneously selling another. If you believe the Euro will strengthen against the US Dollar, you would buy the EUR/USD pair. If you think it will weaken, you sell. It’s that straightforward, but mastering it is a journey.

Key Advantages of the Forex Market

- Unmatched Liquidity: With trillions of dollars traded daily, you can enter and exit positions almost instantly.

- 24/5 Market Access: Trade whenever it suits you, from the Sydney session opening to the New York close.

- Leverage Potential: You can control a larger position with a smaller amount of capital, amplifying potential returns (and risks).

- Trade in Any Direction: Profit from both rising (going long) and falling (going short) markets.

The Major Currency Pairs to Watch

Most traders start by focusing on the “majors.” These pairs involve the US Dollar and are known for their high liquidity and tight spreads.

| Currency Pair | Common Nickname | Description |

|---|---|---|

| EUR/USD | Fiber | The Euro vs. the US Dollar. The most traded pair in the world. |

| GBP/USD | Cable | The British Pound vs. the US Dollar. Known for its volatility. |

| USD/JPY | Ninja | The US Dollar vs. the Japanese Yen. A key indicator of market sentiment. |

| USD/CHF | Swissy | The US Dollar vs. the Swiss Franc. Often seen as a safe-haven pair. |

A successful trader doesn’t guess. They prepare. Your trading strategy and risk management plan are your two most important tools in this market. Without them, you’re just navigating a storm without a compass.

Every decision must be backed by solid market analysis, whether you favor technical indicators, fundamental news, or a combination of both. Success in this field isn’t about finding a secret formula; it’s about discipline, continuous learning, and executing your well-defined trading strategy with precision.

Stocks & Commodities

As Forex traders, we live and breathe currency pairs. We track pips, analyze central bank decisions, and master the art of market timing. But what if I told you that limiting yourself to just the FX market is like a chef only using salt and pepper? The worlds of stocks and commodities offer a rich palette of opportunities to enhance your trading strategy and grow your portfolio.

Why Look Beyond Forex? Diversification is Key!

Sticking to one market can be risky. When the Forex market is flat, other markets might be buzzing with activity. Diversification isn’t just a buzzword; it’s a core principle of smart trading. Here’s why you should consider it:

- Risk Management: Spreading your capital across different asset classes can cushion your portfolio against unexpected volatility in a single market. A bad day in EUR/USD doesn’t have to sink your entire account.

- New Opportunities: Equity markets and commodities respond to different economic drivers. This opens up a whole new world of trading setups based on corporate earnings, supply and demand dynamics, and geopolitical events.

- Broader Market Insight: Understanding how stocks and commodities move gives you a more complete picture of global economic health. This knowledge can, in turn, make you a much sharper Forex trader.

Getting Started with Stocks and Major Indices

When you trade stocks, you’re speculating on the performance of individual companies. However, a great way to start is by trading indices. Indices like the S&P 500 or the NASDAQ 100 represent a basket of top-performing companies, giving you broad exposure to the health of the US equity markets without the risk of a single company’s poor performance. Trading index CFDs allows you to speculate on the overall market direction with ease.

The Power of Commodities: Gold vs. Oil

Commodities are the raw materials that fuel the global economy. For traders, two giants stand out: Gold and Oil. While both offer incredible trading potential, they move for very different reasons. Let’s break it down:

| Feature | Gold (XAU) | Crude Oil (WTI/Brent) |

|---|---|---|

| Primary Driver | Safe-haven demand, inflation hedge, USD weakness | Global economic growth, supply (OPEC), geopolitical tension |

| Typical Volatility | Tends to trend during uncertainty | Highly volatile, sensitive to news and reports |

| Correlation to USD | Often inverse (USD up, Gold down) | Can be inverse, but less consistently than Gold |

Connecting the Markets for a Winning Edge

The real magic happens when you see how these markets are connected. Is the Australian dollar (AUD) strengthening? Check iron ore prices, a key Australian export. Is the Canadian dollar (CAD) on the move? Look at the price of oil. Understanding these inter-market relationships provides powerful confirmation for your trading ideas. A solid piece of market analysis always considers these connections, giving you an edge over traders who only look at one chart.

Don’t just be a Forex trader. Be a market trader. Expand your horizons, add stocks and commodities to your watchlist, and unlock a new level of trading performance.

Effective Olymptrade Trading Strategies for Beginners

Jumping into the world of trading with Olymptrade is an exciting step! But clicking \”Up\” or \”Down\” without a plan is just gambling. To trade successfully, you need a strategy. A solid strategy is your roadmap; it guides your decisions and helps you manage risk. Let’s explore some effective yet simple strategies that you can start using on the Olymptrade platform today.

1. Follow the Trend: The Classic Approach

You’ve probably heard the saying, \”The trend is your friend.\” This is the cornerstone of one of the most reliable trading strategies. Instead of fighting the market’s momentum, you move with it. It’s like swimming with the current instead of against it.

- Uptrend: The price is consistently making higher highs and higher lows. In this case, you look for opportunities to place \”Up\” or buy trades.

- Downtrend: The price is making lower highs and lower lows. Here, you focus on \”Down\” or sell trades.

How do you spot a trend on Olymptrade? Use simple tools like the Moving Average (MA) indicator. If the price stays consistently above the MA line, it suggests an uptrend. If it stays below, it points to a downtrend.

2. Support and Resistance: The Price Bounce

Imagine a ball bouncing between the floor and the ceiling. In trading, these barriers are called support and resistance levels.

- Support: A price level where a downtrend tends to pause or reverse. Think of it as a price floor where buyers step in.

- Resistance: A price level where an uptrend is likely to pause or reverse. It’s a price ceiling where sellers take control.

The basic strategy is to identify these levels on your chart. You can then look to place an \”Up\” trade when the price bounces off a support level or a \”Down\” trade when it rejects from a resistance level. This method gives you clear entry points for your trades.

Advantages and Disadvantages of Support/Resistance Trading

| Advantages | Disadvantages |

|---|---|

| Provides clear entry and exit points. | Levels can break, leading to false signals. |

| Works well in ranging (sideways) markets. | Requires patience to wait for the price to hit a level. |

| Easy for beginners to understand and identify. | Drawing levels can be subjective. |

3. The Moving Average Crossover Strategy

This is a specific, signal-based strategy that removes a lot of guesswork. It uses two Moving Average indicators on your Olymptrade chart: a \”fast\” one (like a 10-period SMA) and a \”slow\” one (like a 30-period SMA).

- Set up your chart: Add two Simple Moving Average (SMA) indicators. Set one to a shorter period (e.g., 10) and the other to a longer period (e.g., 30).

- Look for the Golden Cross (Buy Signal): When the faster MA crosses above the slower MA, it signals potential upward momentum. This is your cue to look for an \”Up\” trade.

- Look for the Death Cross (Sell Signal): When the faster MA crosses below the slower MA, it indicates potential downward momentum. This is your signal to consider a \”Down\” trade.

Pro Tip: No strategy is foolproof. The key is to combine these signals with good money management. Never risk more than 1-2% of your account balance on a single trade, especially when you are just starting out.

The best way to master these strategies is through practice. Before you risk real capital, use the Olymptrade demo account. Test each strategy, see how it feels, and build your confidence. Happy trading!

Advanced Trading Techniques and Technical Indicators

Once you’ve mastered the basics, the real fun begins. Advanced forex trading isn’t about finding a secret, magical indicator. It’s about understanding the market’s narrative and using a combination of sophisticated tools to confirm your trading ideas. You start to see the charts not as random squiggles, but as a story of supply and demand, fear, and greed. Let’s elevate your technical analysis from a simple sketch to a detailed masterpiece.

Mastering Fibonacci Retracements

Markets don’t move in straight lines. After a strong price move, they often pull back or \”retrace\” a portion of that move before continuing in the original direction. The Fibonacci retracement tool helps you identify potential support and resistance levels where this might happen. It’s a cornerstone of many successful trading strategy frameworks. You apply it by drawing from the low to the high of an uptrend (or high to low of a downtrend). Watch these key levels closely:

- 23.6%: A shallow retracement, often indicating a very strong trend.

- 38.2%: A common and significant pullback level.

- 50.0%: While not an official Fibonacci number, this halfway point is a critical psychological level traders watch.

- 61.8%: Known as the \”Golden Ratio,\” this is often the most significant retracement level for a strong reversal or continuation signal.

- 78.6%: A deep retracement that can sometimes be the last line of defense before a full trend reversal.

The All-in-One Ichimoku Cloud

The Ichimoku Kinko Hyo, or Ichimoku Cloud, looks intimidating at first glance, but it’s a powerful and versatile indicator. It provides more data points than most other tools, offering a comprehensive view of price action, momentum, and future support/resistance zones all in one. It’s a complete system for gauging market sentiment.

Advantages

- Provides a \”future\” view of potential support and resistance via the cloud (Kumo).

- Quickly defines trend direction and momentum at a glance.

- Includes its own crossover signals (Tenkan-sen/Kijun-sen cross).

Disadvantages

- Can clutter the chart, making it confusing for new users.

- Like all indicators, it is lagging. The cloud is shifted forward, but its calculation is based on past prices.

The Power of Confluence: A Trade Example

The real secret of advanced indicators is not using them in isolation, but finding confluence. Confluence is when multiple, independent technical signals all point to the same conclusion. This dramatically increases the probability of a successful trade. Imagine you’re looking for a bullish reversal on the EUR/USD.

| Analysis Tool | Signal | Interpretation |

|---|---|---|

| Price Action | Bullish Engulfing candle at a known support level. | Buyers are stepping in aggressively, rejecting lower prices. |

| Fibonacci Retracement | Price has bounced perfectly off the 61.8% level of the last major upswing. | The pullback is likely over and the original uptrend is resuming. |

| RSI (Relative Strength Index) | Shows bullish RSI divergence (price makes a lower low, but RSI makes a higher low). | Downward momentum is weakening despite the lower price, signaling a potential reversal. |

| Bollinger Bands | Price touched the lower band and is now moving sharply back towards the middle band. | The market was oversold and is now mean-reverting. |

Pro Tip: One of the most powerful signals many traders miss is divergence with indicators like the MACD or RSI. When the price is making new lows but your momentum indicator isn’t, that’s a huge red flag that the trend is running out of steam. This is often a precursor to a sharp reversal. Learning to spot it will fundamentally change how you enter and exit trades.

Remember, no single indicator is a magic bullet. True mastery comes from practice, backtesting, and combining these tools to build a robust trading strategy that fits your style. By layering these techniques, you move from simply reacting to the market to anticipating its next move with confidence.

Deposits and Withdrawals: Managing Your Funds

As a trader, your capital is your primary tool. Moving your money in and out of your trading account should be the last thing you worry about. You need a process that is fast, secure, and straightforward. We get it. That’s why we’ve streamlined how you manage your funds, so you can focus on analyzing charts and spotting opportunities, not waiting for transactions to clear.

Funding Your Account Instantly

Getting started should be simple. Funding your account is your first step into the live markets, and we make it a seamless experience. We offer a variety of popular payment options to get you trading as quickly as possible. Every transaction is protected with top-tier encryption, ensuring your financial data remains confidential and your funds are secure.

- Credit/Debit Cards (Visa, Mastercard): The fastest way to fund your account. Deposits are typically processed instantly, allowing you to seize trading opportunities without delay.

- Bank Wire Transfer: A reliable method for larger deposits. It offers a direct and secure way to move capital from your bank to your trading account.

- E-Wallets (PayPal, Skrill, Neteller): Enjoy the convenience and speed of digital wallets. These are perfect for traders who prefer to keep their trading and personal banking separate.

Accessing Your Profits: Fast & Reliable Withdrawals

Success in trading means earning profits. Accessing those profits should be just as rewarding. We believe in providing you with straightforward and timely withdrawal methods. There are no complicated hoops to jump through. Simply request a withdrawal, and we process it efficiently. Transparency is key, so we’ve outlined the typical processing times and fees for our most common methods below.

| Withdrawal Method | Average Processing Time | Notes on Transaction Fees |

|---|---|---|

| Credit/Debit Card | 1-3 Business Days | We do not charge a fee, but your card issuer might. |

| Bank Wire Transfer | 2-5 Business Days | Ideal for larger amounts. Your bank may apply a fee. |

| E-Wallets | Within 24 Hours | The quickest option. Standard e-wallet provider fees may apply. |

Best Practices for Managing Your Forex Funds

Smart fund management goes beyond just making trades. It involves handling your capital wisely. Here are a few pro tips to ensure your financial operations are always smooth:

- Use Consistent Methods: For security and simplicity, try to use the same method for both deposits and withdrawals whenever possible.

- Verify Your Account Early: Complete your account verification process right after you sign up. This prevents any delays when you decide to make your first withdrawal.

- Plan Your Withdrawals: Avoid making frequent, small withdrawals. Plan them out to minimize any potential transaction fees from your payment provider.

- Check Currency Options: If you deposit in a currency different from your account’s base currency, be aware of potential conversion rates.

Your confidence as a trader is built on a foundation of trust. That trust starts with knowing your broker handles your money with the same care and urgency that you do.

Available Payment Methods

As traders, we know that speed and security are everything. When you spot an opportunity, you need to fund your account fast. When you lock in a profit, you want access to your funds without any hassle. That’s why we offer a streamlined funding process with a variety of trusted and efficient payment methods. We want you to focus on the charts, not on transaction delays.

We’ve integrated a range of options to suit traders from all over the globe. You can choose from traditional methods or modern digital wallets. Our goal is to make your deposits and withdrawals as smooth as your trading.

- Credit & Debit Cards: Instantly fund your account using your Visa or Mastercard. It’s one of the quickest ways to get started.

- Bank Wire Transfers: A reliable method for larger transactions, providing a direct link between your bank account and your trading account.

- E-Wallets: We support popular electronic wallets like Skrill, Neteller, and others. They offer fast processing times and an extra layer of security.

To give you a clearer picture, here’s a quick comparison of our most popular options:

| Method | Deposit Time | Withdrawal Time | Best For |

|---|---|---|---|

| Credit/Debit Card | Instant | 1-3 Business Days | Quick account funding |

| Bank Wire Transfer | 2-5 Business Days | 2-5 Business Days | Large volume transfers |

| E-Wallets (e.g., Skrill) | Instant | Within 24 Hours | Fast withdrawals & security |

Pro Tip for Fellow Traders: Always double-check if your chosen payment provider charges any transaction fees on their end. While we strive to keep our fees minimal, your bank or e-wallet might have its own fee structure. Planning ahead saves you from surprises!

You can find the full list of payment methods available specifically for your region by logging into your client portal. We are constantly working to add more convenient options to serve you better.

Understanding Withdrawal Times and Limits

You’ve closed a profitable trade. The adrenaline fades, and one thought takes over: \”How quickly can I get my money?\” This is a crucial question for every trader. Delays and confusing rules can turn a winning feeling into a frustrating one. Let’s break down how withdrawals really work so you know exactly what to expect.

A withdrawal isn’t just one click. Your request triggers a chain of events. First, your forex broker’s finance team reviews and approves it. Then, the payment processor takes over. Finally, your own bank or e-wallet service processes the incoming funds. Each step has its own timeframe.

Factors That Influence Your Withdrawal Time

Why did your friend get their money in an hour while you’re still waiting a day later? Several factors come into play:

- Verification Status: Is your account fully verified with all KYC (Know Your Customer) documents? An unverified account is the number one cause of withdrawal delays.

- Payment Method: E-wallets are often the fastest, while bank wires traditionally take the longest.

- Request Timing: A request made on a Friday afternoon will likely not be processed until Monday morning. Bank holidays also add delays.

- Broker’s Internal Procedures: Every forex broker has its own internal cut-off times and processing schedule.

Navigating Withdrawal Limits

Limits aren’t there to annoy you. They exist for security and to comply with anti-money laundering (AML) regulations. You’ll typically encounter two types:

- Minimum Withdrawal Amount: Usually a small amount, like $10 or $20, to cover processing fees.

- Maximum Withdrawal Amount: This can be a daily, weekly, or monthly limit. It often depends on your account status and the payment method used. High-volume traders can often negotiate higher limits.

Here’s a quick look at what you can generally expect from different payment methods. Keep in mind that the processing time is an estimate after your broker has approved the request.

| Withdrawal Method | Average Processing Time | Common Characteristics |

|---|---|---|

| Bank Wire Transfer | 3-5 Business Days | Highest limits, very secure, but slowest. |

| Credit/Debit Card | 2-5 Business Days | Convenient, but you can often only withdraw up to your initial deposit amount. |

| E-Wallets (Skrill, Neteller, etc.) | Instant to 24 Hours | Very fast withdrawal time, flexible, but may have lower limits than a wire. |

| Cryptocurrency | 1-24 Hours | Fast and modern, but subject to network confirmation times and volatility. |

A smooth and transparent withdrawal process is a sign of a reliable forex broker. It shows they respect you and your capital. Getting your profits should be a simple, straightforward part of your trading journey, not a hurdle.

The Pros and Cons of Trading with Olymp Trade

As traders, we’re always scouting for the right platform. It needs to feel right, work smoothly, and fit our trading style. I’ve spent plenty of time on various platforms, and Olymp Trade is one that frequently comes up in conversation. Like any tool in our toolkit, it has its brilliant aspects and a few things you need to watch out for. Let’s break it down honestly, trader to trader.

Advantages of Choosing Olymp Trade

When you first log in, you can immediately see why many traders, especially those starting out, are drawn to this platform. The appeal is strong and built on several key pillars.

- Low Barrier to Entry: You don’t need a massive bankroll to get started. The minimum deposit is typically very low, which removes a major hurdle for new traders. This allows you to test the financial markets with real money without taking on huge risk.

- Intuitive and Clean Interface: The platform is simply clean. There’s no clutter. Whether you’re on a desktop or using their mobile app, placing a trade is straightforward. You can focus on your charts and strategy instead of fighting with a complicated user interface.

- Excellent Educational Resources: This is a big one. Olymp Trade invests heavily in trader education. You get access to webinars, articles, and video tutorials that cover everything from basic concepts to advanced strategies. They want you to succeed.

- Risk-Free Demo Account: Before you put a single dollar on the line, you can use their demo account. It’s loaded with virtual funds, allowing you to practice your strategies, get a feel for the platform’s execution speed, and build your confidence without any financial pressure.

Potential Drawbacks to Consider

No platform is perfect for everyone. It’s crucial to look at the other side of the coin to make an informed decision. Here are some potential downsides you should be aware of.

- Limited Range of Assets: While they cover the essentials like major forex pairs, some commodities, and indices, the selection isn’t as vast as what you might find at a specialized forex or stockbroker. If you want to trade obscure exotic pairs or a huge variety of single stocks, you might find the options limited.

- Regulatory Status: Olymp Trade is regulated by the International Financial Commission (FinaCom), which provides a degree of protection and dispute resolution. However, it doesn’t hold licenses from top-tier regulators like the FCA (UK) or ASIC (Australia), which is a key factor for some veteran traders.

- Focus on Fixed Time Trades (FTTs): A significant portion of the platform is dedicated to FTTs. While popular, this trading instrument has a different risk-reward structure than traditional forex trading. Its all-or-nothing nature might not align with every trader’s risk management plan.

A Quick Side-by-Side Comparison

Sometimes a simple table cuts through the noise. Here’s a summary of what we’ve discussed.

| Pros (The Good Stuff) | Cons (The Heads-Up) |

|---|---|

| Very user-friendly for beginners. | Fewer tradable assets than larger brokers. |

| Low minimum deposit to start trading. | Lacks top-tier regulatory licenses. |

| Free and unlimited demo account. | Emphasis on high-risk Fixed Time Trades. |

| Strong library of educational materials. | Withdrawal process can sometimes have delays. |

Ultimately, the right platform is a personal choice. Your decision should align with your capital, your experience level, and what you want to achieve in the markets. My best advice? Never skip the demo. Use it extensively. Test your strategies, make every mistake you can with virtual money, and see if the platform’s flow works for you. Only then should you consider trading with real capital.

Trading on the Go: The Olymp Trade Mobile App Reviewed

Let’s be honest, the market doesn’t wait for you to be at your desk. We’ve all been there: you’re out, maybe grabbing coffee or running errands, when a perfect trade setup appears on your alert. What do you do? Panic? Miss the opportunity? This is where a solid mobile trading app becomes not just a convenience, but an essential part of your toolkit. I’ve put the Olymp Trade mobile app through its paces to see if it’s a worthy companion for a serious trader. Here’s what I found.

Core Functionality at Your Fingertips

The first thing I check in any trading app is whether it’s a \”lite\” version or the real deal. I was pleasantly surprised to find that the Olymp Trade app packs a serious punch. It’s not just for checking your balance; it’s a full-fledged trading station in your pocket.

- Full Charting Suite: You get access to the same interactive charts as the web platform. Pinch to zoom, scroll through timeframes, and apply your favorite technical indicators without compromise.

- Multiple Order Types: Execute market orders, or set up pending orders (limit and stop) just as you would on your desktop. This is crucial for planning your trades in advance.

- Complete Account Management: You can handle deposits and withdrawals directly from the app. There’s no need to switch to a browser, which streamlines the entire process.

- Built-in Alerts and Signals: Set up custom price alerts for your favorite assets. The app also provides access to trading signals and market analysis, which can be a great source for new ideas.

Mobile Trading: The Good and The Bad

No platform is perfect, and trading on a smaller screen has its inherent challenges. It’s important to weigh the advantages against the potential drawbacks.

| Advantages | Disadvantages |

|---|---|

| Trade from anywhere, anytime. Never miss an opportunity. | Smaller screen can make complex, multi-indicator analysis feel cramped. |

| Intuitive interface designed for touchscreens. Fast and responsive. | Risk of \”fat-fingering\” an order if you’re not careful. |

| Quick access to deposits and withdrawals on the move. | Reliance on mobile data or Wi-Fi, which can be unstable. |

| Push notifications for price alerts keep you in the loop. | Distractions from other phone notifications can break your focus. |

For me, the app isn’t a replacement for my multi-monitor setup, but it’s the perfect extension of it. It’s my eyes on the market when I can’t be at my main station. The execution speed is reliable, and I’ve confidently managed active trades from my phone without feeling like I was at a disadvantage.

– A Fellow Trader’s Perspective

The Verdict: Is It Your Pocket Co-Pilot?

After extensive use, I can confidently say the Olymp Trade mobile app is a robust and reliable tool. The developers clearly understand what traders need. The interface is clean, execution is swift, and you don’t sacrifice core functionality for portability. While I’ll always prefer the deep analysis possible on a large screen, the mobile app ensures I’m always connected to the market. It’s a powerful co-pilot that gives you the freedom and flexibility to seize opportunities, no matter where you are.

Educational Resources to Improve Your Trading Skills

In the world of forex, the market is a relentless teacher. The best traders I know are the ones who never stop learning. They are constantly sharpening their skills and adapting to new market conditions. Staying static is not an option. If you want to move from inconsistent results to confident trading, dedicating time to quality trading education is non-negotiable.

But where do you start? The internet is flooded with information, and it can be overwhelming. That’s why we’ve curated a suite of powerful resources designed to help you at every stage of your trading journey.

Your Path to Trading Mastery

Think of your education as building a house. You need a solid foundation before you can put up the walls and roof. We provide a structured path that covers everything from the absolute basics to advanced professional techniques. A solid learning plan is the first step toward developing a robust trading strategy.

- Comprehensive Forex Courses: Our guided courses are perfect for building that foundation. They cover topics from \”What is Forex?\” to complex chart patterns and technical indicators.

- Live Webinars: Join our experts for live sessions. Here, you can see real-time market analysis, ask questions directly, and learn how professional traders approach the markets each day.

- In-depth E-books: Want to dive deep into a specific topic? Our e-books cover critical areas like risk management, trading psychology, and advanced strategies in detail.

- Daily Market Analysis: Stay ahead of the curve with our daily market breakdowns. Understand what’s moving the markets and why, helping you make informed decisions instead of just guessing.

Which Resource is Right for You?

Not every resource suits every trader. Your current skill level and learning style will determine what works best for you. Here’s a quick guide to help you choose:

| Resource Type | Ideal for Beginners | Ideal for Intermediate/Advanced Traders |

|---|---|---|

| Beginner Courses | Excellent for learning core concepts, terminology, and platform basics. | Good for a quick refresher on the fundamentals. |

| Live Webinars | Great for seeing theory applied in real-time. | Perfect for discussing advanced strategies and current market events. |

| Strategy Guides | Focus on one or two simple strategies to start. | Explore complex, multi-layered strategies and learn how to build your own. |

| Trading Psychology Articles | Essential for understanding greed, fear, and discipline from day one. | Crucial for refining mental discipline and overcoming performance plateaus. |

\”The goal of a successful trader is to make the best trades. Money is secondary.\”

This quote perfectly captures the essence of a successful mindset. Your focus should be on process, discipline, and continuous improvement. True success isn’t about one lucky trade; it’s about developing the skill and strong trading psychology to perform consistently over the long term. Start investing in your greatest asset today: your knowledge.

Our Final Verdict: Is Olymptrade Trading Right for You?

So, you’ve explored the features, weighed the options, and now you’re at the final hurdle. Deciding on a trading platform is a big step, and it’s a personal one. What works wonders for one trader might not fit another’s style. Our final verdict isn’t a simple \”yes\” or \”no.\” Instead, let’s help you determine if Olymptrade aligns with your personal trading journey.

Who Will Find a Home at Olymptrade?

Every trader has different needs. The platform you choose should feel like a well-fitted glove, not a one-size-fits-all solution. Let’s see where you might fit in.

For the Trader Just Starting Out

If you are new to the world of trading, the initial steps can feel intimidating. Olymptrade excels at lowering the barrier to entry. Here’s why it’s a strong contender for beginners:

- Low Capital Requirement: You don’t need a massive bankroll to get started. The low minimum deposit lets you dip your toes in the market without significant financial risk.

- Free Demo Account: This is your personal trading sandbox. You can practice strategies, learn the platform’s mechanics, and build confidence with virtual money before you risk a single real dollar.

- Educational Hub: The platform provides a wealth of learning materials, from basic tutorials to more advanced webinars. It’s designed to help you grow as a trader.

For the Experienced Market Navigator

If you’re a seasoned trader, you look for different things. You need efficiency, reliable tools, and a good range of assets. While Olymptrade might not have the ultra-complex charting tools of some specialized desktop platforms, it offers a streamlined and efficient mobile and web experience perfect for traders on the go. The asset variety is solid, giving you plenty of opportunities across different markets.

A Balanced Look: The Highs and Lows

No platform is without its strengths and weaknesses. To make an informed decision, you need to see both sides of the coin. Here’s a straightforward breakdown of what we found.

| Advantages | Potential Drawbacks |

|---|---|

| Extremely user-friendly and intuitive interface. | Fewer advanced analytical tools compared to professional platforms. |

| High accessibility with a low minimum deposit and trade size. | Asset selection might not be as vast as some larger brokers. |

| Excellent educational resources and a risk-free demo account. | Regulatory status can vary by region, which requires user verification. |

| Fast and responsive platform, great for mobile trading. | Best suited for short to medium-term trading styles. |

Ask Yourself These Key Questions

The final decision rests with you. Grab a coffee, sit down, and honestly answer these questions. Your answers will point you in the right direction.

- What are my primary trading goals? Am I aiming for quick profits or building a long-term portfolio?

- How much time can I realistically commit to learning and actively trading each week?

- What is my risk tolerance? Am I comfortable with higher-risk, higher-reward instruments?

- Is a simple, clean interface more important to me than having hundreds of complex indicators I might never use?

Ultimately, the best trading platform is the one you will actually use. Olymptrade presents a compelling case for new and intermediate traders who value simplicity, education, and accessibility. If your goal is to get into the market, learn the ropes, and trade efficiently without being overwhelmed, then it is absolutely a platform worth considering for your trading career.

Frequently Asked Questions

What is Olymptrade and how can I start trading?

Olymptrade is an online trading platform designed for both beginners and experienced traders. You can start by opening a free demo account to practice with virtual money, then choose from assets like Forex, stocks, and commodities to trade in either Forex or Fixed Time Trades (FTT) mode.

Is my money safe with Olymptrade?

Olymptrade is a member of the International Financial Commission (FinaCom), an independent body that provides dispute resolution and a compensation fund of up to €20,000 for traders, offering a significant layer of security for your funds.

What is the main difference between FTT and Forex trading on the platform?

In FTT (Fixed Time Trades), you predict if the price will be higher or lower within a fixed timeframe for a fixed payout. In Forex mode, you profit from the magnitude of the price change over an open-ended duration, using tools like Stop Loss and Take Profit.

Can I trade on my phone with Olymptrade?

Yes, Olymptrade offers a full-featured mobile app for both Android and iOS. It allows you to manage your account, analyze charts, and execute trades from anywhere, ensuring you never miss an opportunity.

What is the minimum deposit to start trading on Olymptrade?

Olymptrade is known for its low entry barrier. The minimum deposit is typically very low (e.g., $10), making it accessible for new traders who want to start with a small amount of capital.