Ever looked at the stock market and felt a mix of excitement and confusion? You see giants like Apple, Tesla, and Google making headlines, and a part of you thinks, “I want a piece of that action.” The great news is, you can. Welcome to your starting line.

This guide is your personal roadmap. We’re cutting through the noise and complexity to give you a clear, straightforward path to trading stocks on the Olymptrade platform this year. Forget the confusing jargon and overwhelming charts. We’ll break down everything you need to know, step-by-step, to go from a complete novice to a trader who acts with confidence.

- What You’ll Discover Inside This Guide

- What is Olymptrade and How Does Stock Trading Work on the Platform?

- The Stock Trading Mechanism Explained

- Key Advantages for Traders

- The Trading Process at a Glance

- Is Olymptrade a Good Choice for Trading Stocks? A Quick Review

- Key Features for Stock Traders

- Pros and Cons of Trading Stocks on Olymptrade

- So, Who Is It Really For?

- Step-by-Step Guide: How to Start Trading Stocks on Olymptrade

- Step 1: Create and Verify Your Trading Account

- Step 2: Fund Your Account

- Step 3: Select a Stock to Trade

- Step 4: Execute Your Trade

- Account Registration and Verification (KYC)

- Your Quick Guide to Registration

- Understanding Verification (KYC)

- Documents You’ll Need for a Smooth Verification

- Making Your First Deposit

- A Simple, Secure Funding Process

- Popular Deposit Methods at a Glance

- Your Security is Our Priority

- Placing Your First Stock Trade on the Platform

- A Look at the Stocks Available for Trading on Olymptrade

- Why Trade Stocks on This Platform?

- A Glimpse of the Available Assets

- Olymptrade Stock Trading Fees, Commissions, and Spreads Explained

- The Big Question: What About Commissions?

- Understanding the Spread

- Are There Other Potential Costs?

- Your Quick Guide to Trading Costs

- Understanding Leverage and Margin When Trading Stocks

- So, What Exactly is Leverage?

- And Where Does Margin Fit In?

- Leverage in Action: A Practical Example

- The Double-Edged Sword: Pros and Cons

- Advantages of Using Leverage

- Disadvantages and Risks

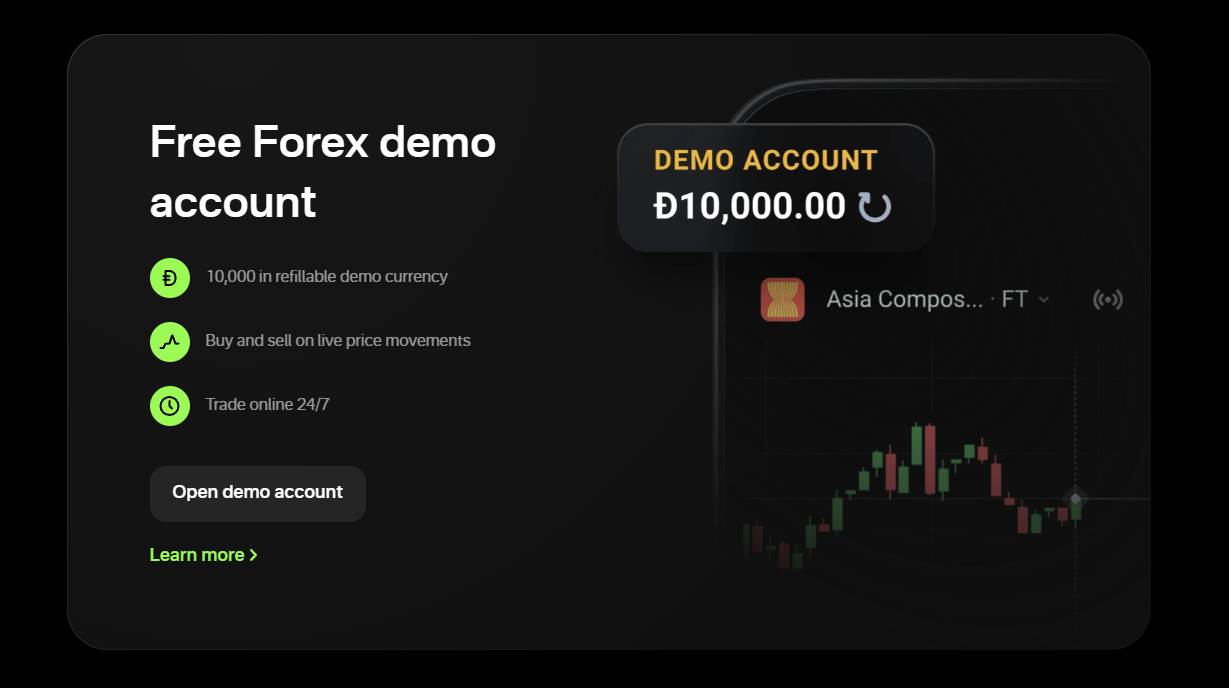

- The Olymptrade Demo Account: Practice Trading Stocks Risk-Free

- What’s Inside the Demo Account?

- Demo vs. Live Account: Key Differences

- Key Features and Analytical Tools for Stock Traders

- Essential Platform Features You Can’t Trade Without

- Harnessing the Power of Analysis

- Technical Analysis Tools

- Fundamental Analysis Tools

- Simple Stock Trading Strategies for the Olymptrade Platform

- Strategy 1: Riding the Trend

- Strategy 2: The Power of Support and Resistance

- Strategy 3: Trading the News

- Security and Regulation: Is Your Investment Safe with Olymptrade?

- Key Pillars of Your Account Security

- Pros and Cons of Using Olymptrade for Stock Trading

- The Upside: What Makes It Attractive

- The Downsides: What to Be Aware Of

- At-a-Glance Summary

- Key Advantages of the Olymptrade Platform

- Platform Features at a Glance

- Potential Disadvantages to Consider

- Navigating the Hurdles

- Withdrawing Your Profits: Methods and Processing Times

- Common Withdrawal Methods at Your Fingertips

- What to Expect: A Look at Processing Times

- Tips for a Hassle-Free Withdrawal

- Olymptrade vs Competitors: A Comparison for Stock Traders

- Key Differentiators for Stock Traders

- Direct Comparison: Olymp Trade vs The Field

- The Trader’s Experience: Beyond the Numbers

- Final Verdict: Should You Trade Stocks with Olymptrade?

- So, Who Is This Platform Really For?

- Frequently Asked Questions

What You’ll Discover Inside This Guide

We’ve designed this journey to be as practical as possible. Here’s a sneak peek at what we’ll cover to get you market-ready:

- Understanding the Fundamentals: What exactly are stocks and how does their value change?

- Account Setup Made Easy: A simple, visual walkthrough of getting your Olymptrade account ready for action.

- Executing Your First Trade: From choosing a stock to clicking the button, we’ll guide you through the entire process.

- Core Trading Strategies: Learn simple yet effective methods for making trading decisions.

- Smart Risk Management: Discover the most crucial skill of all—how to protect your investment.

- Using Olymptrade’s Platform: A tour of the tools and features that will become your best friends.

Our mission is simple: to demystify stock trading and empower you with the knowledge to start your journey on the right foot. The world of stocks is waiting. Let’s get you ready to join it.

What is Olymptrade and How Does Stock Trading Work on the Platform?

If you’ve been in the trading world for a while, you’ve likely heard of Olymptrade. Many traders know it for its fixed-time trading mode, but it’s evolved into a much more robust platform. Today, it offers a diverse range of assets, including a solid selection of stocks. Let’s break down what Olymptrade is and how you can trade stocks on its platform.

At its core, Olymptrade is an online broker that provides a gateway to the financial markets. It offers a user-friendly interface designed to make trading accessible to everyone, from beginners to seasoned pros. The platform allows you to speculate on the price movements of various assets without needing to own them physically.

The Stock Trading Mechanism Explained

Trading stocks on Olymptrade operates differently from their other modes. It’s more aligned with traditional CFD (Contract for Difference) trading you might find on other forex platforms. You aren’t buying a share of the company directly; you are opening a position based on your prediction of its price movement.

Here’s a step-by-step look at how you open a stock trade:

- Select Your Asset: First, you navigate to the asset list and choose “Stocks.” You’ll find shares of major global companies like Apple, Microsoft, Tesla, and Amazon.

- Set Your Investment Amount: Decide how much capital you want to allocate to this specific trade. The platform allows for small starting amounts, making it very accessible.

- Apply a Multiplier: Olymptrade offers a multiplier, which is essentially leverage. This tool can amplify your potential profit (and loss). For example, a x20 multiplier means a 1% price movement in your favor results in a 20% profit on your investment. Use it wisely!

- Set Risk Management Orders: This is crucial. Before opening the trade, you can set a “Take Profit” level (to automatically close the trade when it hits a certain profit) and a “Stop Loss” level (to limit your potential losses). Never trade without these.

- Open Your Position: Finally, you decide whether you think the stock’s price will go up (Buy) or down (Sell) and open your position.

Key Advantages for Traders

So, why would a trader consider using Olymptrade for stocks? Here are a few compelling reasons:

- Low Barrier to Entry: You don’t need thousands of dollars to start. You can open positions with very small amounts of capital.

- Leverage (Multiplier): The multiplier allows you to control a larger position with a smaller investment, maximizing potential returns.

- Go Long or Short: You can profit from both rising (Buy) and falling (Sell) markets, giving you trading opportunities in any market condition.

- Integrated Platform: You can trade stocks, currencies, and other assets all from a single account and interface.

The Trading Process at a Glance

| Action | Description |

|---|---|

| Choose Stock | Select a company from the available list (e.g., GOOG, AAPL, TSLA). |

| Set Amount & Multiplier | Define your investment size and your desired leverage. |

| Set TP/SL | Establish your exit points for profit and loss. This is your safety net. |

| Execute Trade | Click “Buy” if you predict a price increase or “Sell” for a decrease. |

| Monitor & Close | Keep an eye on your open position and close it manually or let your TP/SL handle it. |

Remember, trading stocks on a platform like Olymptrade is about strategy, not just luck. Understanding the tools, like the multiplier and stop loss, is what separates a successful trader from a gambler. The platform gives you the tools; it’s up to you to use them effectively.

Is Olymptrade a Good Choice for Trading Stocks? A Quick Review

You probably know Olymptrade for its forex and fixed-time trading options. But what about trading stocks? Many traders ask if the platform holds up when it comes to equities like Apple, Tesla, or Amazon. Let’s break it down and see if it’s the right fit for your stock trading strategy.

First, it’s crucial to understand how you trade stocks on this platform. You are not buying the actual shares of the company. Instead, you are trading Stock CFDs (Contracts for Difference). This means you speculate on the price movement of the stock without owning the underlying asset. This approach has its own set of benefits and drawbacks.

Key Features for Stock Traders

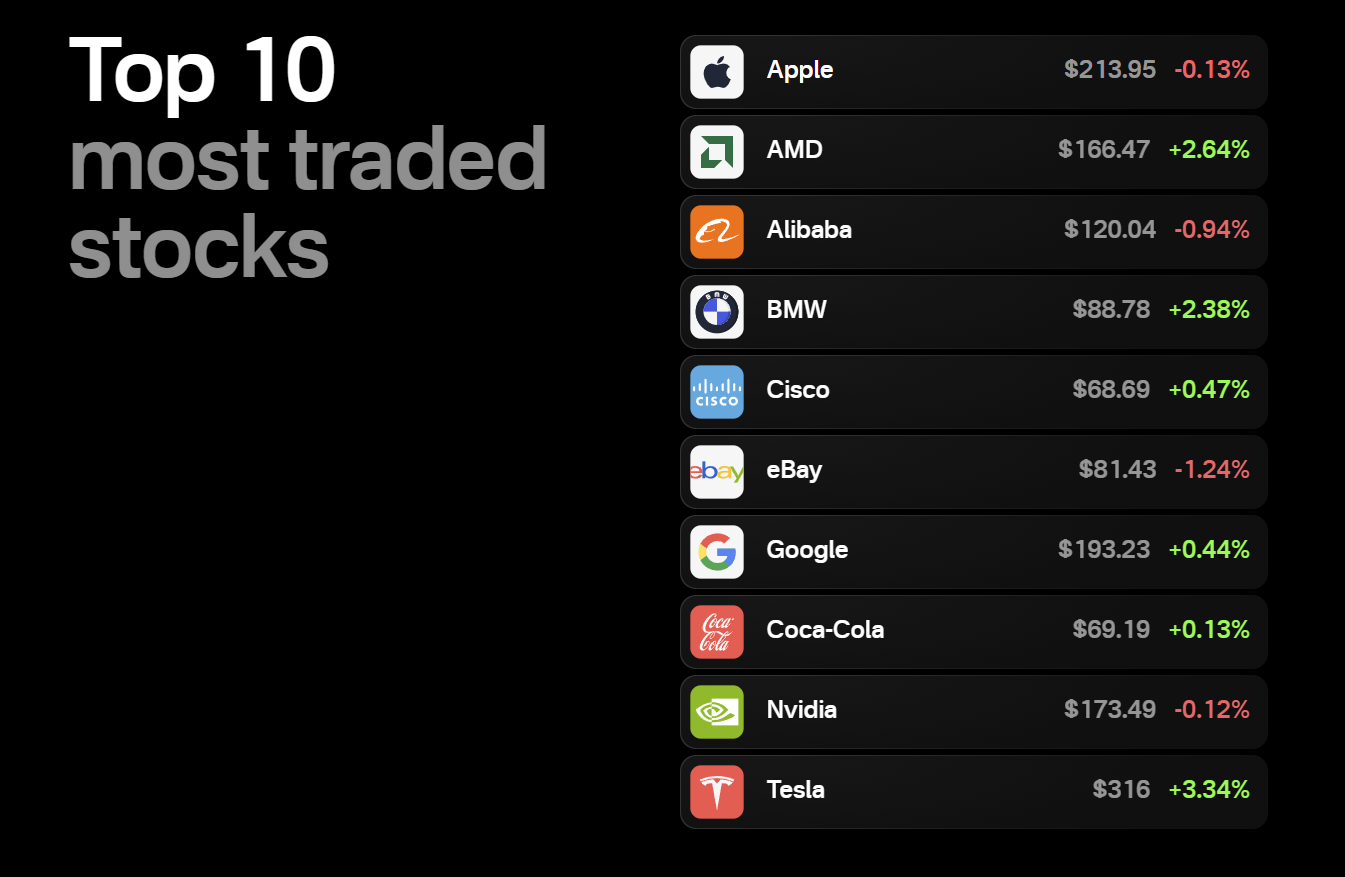

When you dive into the stock section, you’ll find a selection of major global companies. While not as extensive as a dedicated stockbroker, it covers the big names that most traders watch.

- Asset Selection: You get access to popular stocks from US and European markets, including tech giants, financial institutions, and leading industrial companies.

- Leverage: The platform offers leverage for stock trading, allowing you to control a larger position with a smaller amount of capital. Be mindful, as this magnifies both potential profits and losses.

- A Single Platform: A huge plus is trading stocks, currencies, and commodities all from one single account and interface. This simplifies your analysis and portfolio management.

Pros and Cons of Trading Stocks on Olymptrade

No platform is perfect for everyone. Your choice depends on your trading style and goals. Here’s a straightforward comparison to help you decide.

| Advantages | Disadvantages |

|---|---|

| Low entry barrier with a small minimum deposit. | Limited number of stocks compared to specialized brokers. |

| Simple and user-friendly interface, great for beginners. | You are trading CFDs, not owning the actual stock. |

| Ability to use leverage to amplify potential returns. | Overnight fees (swaps) can add up for long-term positions. |

| Integrated ecosystem for trading multiple asset classes. | Spreads might be wider than on some other platforms. |

So, Who Is It Really For?

Olymptrade can be an excellent choice for certain types of traders. If you are already using the platform for forex and want to diversify into stocks without opening another account, it’s incredibly convenient. It’s also a great starting point for beginners who want to get a feel for the stock market with a small investment.

For serious, long-term investors or traders who need access to thousands of stocks, ETFs, and advanced research tools, a dedicated stockbroker might be a more suitable option.

Ultimately, Olymptrade provides a solid, accessible way to speculate on the price movements of the world’s biggest companies. It excels in simplicity and integration. Before you commit, check their asset list and fee structure to ensure it aligns with your trading plan.

Step-by-Step Guide: How to Start Trading Stocks on Olymptrade

Are you ready to jump into the exciting world of the stock market? Trading stocks from global giants like Apple, Google, and Tesla is more accessible than you think. The Olymptrade platform simplifies the process, making it a great starting point for new and experienced traders alike. Let’s break down the exact steps to get you from zero to executing your first stock trade.

Step 1: Create and Verify Your Trading Account

First things first, you need a place to trade. Getting your account set up is quick and straightforward.

- Visit the Olymptrade Website: Navigate to the official site and find the registration button.

- Fill in Your Details: Enter your email address and create a secure password. You can also sign up using your Google or Facebook account for convenience.

- Choose Your Currency: Select the base currency for your account (e.g., USD or EUR).

- Practice on the Demo Account: Before you risk any real money, the platform gives you a free demo account, usually pre-loaded with $10,000 in virtual funds. Use this to explore the platform and test your ideas without any pressure.

- Complete Verification (KYC): To trade with real money and withdraw your profits, you must verify your identity. This is a standard security procedure. Just follow the on-screen instructions to upload the required documents.

Step 2: Fund Your Account

Once you feel comfortable navigating the platform, it’s time to fund your live account. Olymptrade offers a variety of deposit methods to make this process smooth. Common options include:

- Bank Cards (Visa/Mastercard)

- E-wallets (Skrill, Neteller, etc.)

- Bank Transfers

- Cryptocurrency

Choose the method that works best for you, enter the amount you wish to deposit, and follow the prompts. Your funds should appear in your account balance shortly after.

Step 3: Select a Stock to Trade

Now for the fun part! With your account funded, you can browse the available stock assets. On the trading interface, you will see a list of assets. Click on it and navigate to the \”Stocks\” category. Here, you’ll find a list of companies you can trade.

How do you choose? You can research companies you’re familiar with or look for market news that might cause a stock’s price to move. Here’s a quick look at what you might consider:

| Company | Ticker Symbol | Industry | What to Watch |

|---|---|---|---|

| Apple Inc. | AAPL | Technology | New product launches, quarterly earnings reports. |

| Tesla, Inc. | TSLA | Automotive & Energy | Vehicle delivery numbers, new factory announcements. |

| Amazon.com, Inc. | AMZN | E-commerce & Cloud | Holiday sales data, AWS growth figures. |

Step 4: Execute Your Trade

You’ve picked your stock. The trading panel is now active. It’s time to place your trade. Here’s a breakdown of the essential settings:

- Trade Amount: Decide how much money you want to invest in this specific trade. Start small!

- Direction: Do you think the stock price will go Up or Down? Click the corresponding button.

- Stop Loss (Crucial!): This is your safety net. Set a price level where your trade will automatically close to limit potential losses. Never trade without a Stop Loss.

- Take Profit: Set a target price. If the stock reaches this price, your trade will automatically close, locking in your profits.

Once you’ve set these parameters, double-check everything and click the button to open your trade. Congratulations, you are now actively trading stocks!

A Trader’s Tip: Don’t just jump in. Spend your first few days or even a full week on the demo account. Open and close trades, test different stocks, and get a feel for how the market moves. Building good habits with virtual money is the key to success when you start trading with real capital.

Account Registration and Verification (KYC)

Ready to jump into the market? Great! First things first, let’s get your trading account set up. The registration and verification process is a vital step. Think of it as the secure foundation for your entire trading journey. It’s quick, straightforward, and ensures your funds and data are protected right from the start.

Your Quick Guide to Registration

Getting your account registered is a simple, three-step process that takes just a few minutes. Follow along:

- Initial Sign-Up: Kick things off by entering your basic details like your email address and creating a strong password. This creates your initial profile and gives you access to the client portal.

- Personal Information: Next, you’ll fill in some personal details as required by financial regulators. This is standard procedure and helps us confirm your identity.

- Trading Profile: We’ll ask a few simple questions about your trading knowledge and experience. This is not a test! It simply helps us understand your needs and ensure we provide a suitable trading environment for you.

Understanding Verification (KYC)

After registration, the next crucial step is verification, also known as KYC or ‘Know Your Customer’. Don’t let the acronym intimidate you! It’s a global standard in the financial industry, and here’s why it’s so important for you as a trader:

- Enhanced Security: It confirms you are who you say you are, preventing unauthorized access to your account and funds.

- Regulatory Compliance: It’s a legal requirement that allows us to operate as a trusted and regulated broker, giving you peace of mind.

- Fraud Prevention: KYC is our first line of defense against financial crime, which ultimately creates a safer trading environment for our entire community of traders.

Documents You’ll Need for a Smooth Verification

To make the process seamless, have clear digital copies of these documents ready. High-quality photos taken with your smartphone are usually perfect.

| Document Type | Examples of Accepted Documents |

|---|---|

| Proof of Identity (POI) | A valid, government-issued photo ID where your photo, name, and date of birth are clearly visible. This can be your Passport, National ID card, or Driver’s License. |

| Proof of Address (POA) | A recent document (issued within the last 3-6 months) that clearly shows your full name and residential address. This can be a Utility Bill (water, electricity), a full-page Bank Statement, or a credit card statement. |

Pro Trader Tip: For the fastest verification, ensure your documents are not expired and that all four corners are visible in the image you upload. The name and address on your documents must exactly match the details you used to register your account. This is the #1 reason for delays, so a quick double-check here saves a lot of time!

And that’s it! It’s a simple, one-time process. Once your account is fully verified, you unlock all platform features, including the ability to fund your account and open your first trade. We’ve streamlined these steps to get you into the markets as quickly and securely as possible.

Making Your First Deposit

You’ve opened your account, and now you’re just one step away from entering the live markets. Funding your account is the moment you equip yourself with the trading capital needed to pursue your strategy. Think of it as fueling your engine before a big race. It’s a straightforward and secure process designed to get you trading as quickly as possible.

A Simple, Secure Funding Process

Getting your funds into your trading account is easy. Just follow these simple steps:

- Log In: Access your secure client portal using your credentials.

- Navigate to Funding: Look for the “Deposit,” “Add Funds,” or “Payments” section in your dashboard.

- Choose Your Method: Select your preferred deposit method from the list of available options.

- Enter the Amount: Specify the amount of capital you wish to add to your account.

- Confirm & Complete: Follow the on-screen prompts to finalize the transaction securely. Most deposits reflect in your account almost instantly.

Popular Deposit Methods at a Glance

We offer a variety of payment methods to suit your needs. Each one is designed for security and convenience. Here’s a quick comparison to help you choose the best option for you:

| Payment Method | Processing Time | Best For |

|---|---|---|

| Credit/Debit Card (Visa, Mastercard) | Instant | Quick and easy access to trading capital. |

| Bank Wire Transfer | 1-3 Business Days | Larger deposit amounts and traditional banking. |

| E-Wallets (e.g., Skrill, Neteller) | Instant | Fast, secure online payments without sharing card details. |

| Cryptocurrency (e.g., BTC, ETH, USDT) | Network Dependent (Usually Fast) | Modern, decentralized, and secure funding. |

Your Security is Our Priority

We understand that the safety of your funds is crucial. That’s why every transaction is protected by state-of-the-art SSL encryption. Furthermore, we hold all client funds in segregated accounts with top-tier banks, completely separate from our own operational funds. You can make your first deposit with complete peace of mind, knowing your trading capital is safe and secure.

Placing Your First Stock Trade on the Platform

You’ve done the prep work, your account is ready, and now it’s time for the exciting part. Making your first stock trade can feel like a huge step, but our platform makes it straightforward. Let’s break down the process so you can place your trade confidently.

Follow these simple steps to get started:

- Find Your Stock: Use the search bar to look for the company you’re interested in. You can type its name or its unique ticker symbol (for example, TSLA for Tesla). Select it from the list to open its dedicated trading page.

- Open the Order Window: On the stock’s page, you will see prominent ‘Buy’ and ‘Sell’ buttons. Click ‘Buy’ to initiate a purchase. This will launch the order ticket where you’ll define all the details of your trade.

- Choose Your Order Type: You have a few options, but for your first trade, let’s focus on the two most common ones.

- Market Order: This is the simplest option. It tells the platform to buy the stock for you immediately at the best price currently available. It’s fast and ensures your trade goes through.

- Limit Order: This gives you more control. You set a specific price, and the trade will only execute if the stock’s price hits your target level or better. It’s great if you have a specific entry point in mind.

- Set Your Trade Size: Decide how much you want to invest. You can typically do this in two ways: by entering the number of shares you want to buy or by specifying the total cash amount you want to spend. The platform will automatically calculate the corresponding value for you.

- Review and Execute: This is your final check. Carefully review all the details on the order ticket: the stock, the direction (Buy), the number of shares, and the estimated total cost. Once you confirm everything is correct, hit the ‘Place Order’ button.

That’s it! You’ll receive a confirmation once your trade is executed. You can now track your new investment in the ‘Portfolio’ section of the platform. Congratulations on making your first move in the stock market!

A Look at the Stocks Available for Trading on Olymptrade

Hey fellow traders! While we all love the fast-paced world of currency pairs, diversifying your portfolio is a key strategy for long-term success. Have you considered diving into the world of stocks? Trading company shares opens up a whole new universe of opportunities, and Olymptrade makes this transition incredibly smooth. You can access a fantastic range of stocks on the same platform you already use for your Forex trades.

One of the first things that impressed me was the sheer variety of assets available. You aren’t limited to just a few obscure companies. We are talking about the titans of industry. This allows you to trade based on real-world events you hear about every day, like earnings reports, new product launches, or major global news that directly impacts these corporations. You can trade the companies that shape our world.

Why Trade Stocks on This Platform?

You might wonder what the advantages are compared to a traditional stockbroker. Here’s a quick breakdown from my experience:

- Access to Global Giants: You get direct access to trade on the price movements of the world’s biggest companies.

- Trade Both Ways: You don’t need to own the actual stock. With CFDs, you can profit from both rising (going long) and falling (going short) market prices.

- Use a Multiplier: Amplify your trading power to control a larger position with a smaller amount of capital. This can increase potential profits, but always remember it increases risk too.

- Seamless Integration: Manage your Forex and stock trades all from a single account and a familiar interface. No need to juggle multiple platforms.

A Glimpse of the Available Assets

To give you a better idea, here’s a sample of the types of popular stocks you can typically find on the platform. The list is always growing, so be sure to check the platform for the latest additions.

| Category | Example Stocks |

|---|---|

| Technology | Apple, Google, Microsoft, Meta |

| E-commerce & Retail | Amazon, Alibaba, Walmart |

| Finance | JPMorgan Chase, Visa, Mastercard |

| Entertainment | Netflix, Disney |

| Automotive | Tesla, Ford |

The best way to see the full potential is to log in and explore the asset list for yourself. You can apply the same technical analysis skills and charting techniques you’ve honed in Forex to these stocks. Give it a look—you might just find your next big winning trade waiting for you in a market you already know as a consumer.

Olymptrade Stock Trading Fees, Commissions, and Spreads Explained

Ever felt that sting when you close a profitable trade, but your final balance doesn’t quite reflect your win? We’ve all been there. Hidden costs are the silent portfolio killers for many traders. To succeed, you must understand every single cost associated with your trading activity. That’s why we’re going to break down the Olymptrade stock trading fees, commissions, and spreads. Knowing these details is fundamental to protecting your capital and maximizing your real returns.

The Big Question: What About Commissions?

Let’s get straight to the point. A commission is a fee a broker charges you for executing a trade. It can be a flat rate or a percentage of the trade volume. This is often the biggest cost for active stock traders on other platforms.

So, what’s the policy on Olymp Trade? For stock trading within the platform’s Forex mode, the structure is designed to be incredibly straightforward.

Olymp Trade charges zero commission on opening and closing stock positions. This means the price you click to execute a trade is the price you get, without an additional broker fee being deducted from your account for the transaction itself.

Understanding the Spread

If there are no direct commissions, how does the platform facilitate trading? The answer lies in the spread. The spread is not a direct fee but rather an integral part of how all financial markets function.

- What it is: The spread is simply the small difference between the buying price (Ask) and the selling price (Bid) of a stock at any given moment.

- How it works: When you open a “buy” position, you do so at the Ask price. When you close it, you do so at the Bid price. This tiny gap is the primary way the market operates.

Think of it like a currency exchange booth. They buy a currency from you at one rate and sell it at a slightly different rate. That small difference is their margin. The spread in trading works the same way but is typically much tighter and constantly changing with market liquidity and volatility.

Are There Other Potential Costs?

A transparent trading environment means knowing all the potential costs, not just the main ones. Here are other factors to keep in mind, which are standard across the industry.

Advantages and Disadvantages of Overnight Fees (Swaps)

- The Cost (Disadvantage)

- If you hold a leveraged stock position open past the market’s closing time, a small fee called an overnight fee, or swap, is applied. This fee covers the cost of the leverage you are using to keep the position open.

- The Transparency (Advantage)

- You are never in the dark. The platform clearly shows you the exact swap rate for any stock before you open the trade. This allows you to factor the cost into your decision if you plan on holding a position for several days.

Your Quick Guide to Trading Costs

Here is a simple table summarizing the cost structure for trading stocks on the Olymp Trade platform. This makes it easy to see where your money is going—and where it isn’t.

| Cost Type | Is it Charged on Olymp Trade Stocks? | Key Details |

|---|---|---|

| Trading Commission | No | Your entries and exits are not charged a separate broker fee. |

| The Spread | Yes | This is the natural difference between the buy and sell price. |

| Overnight Fee (Swap) | Yes | A small, transparent fee for holding leveraged positions overnight. |

| Inactivity Fee | Yes | A minor fee may apply only after 180 days of complete account dormancy. |

| Deposit/Withdrawal Fees | No | Olymp Trade does not charge for deposits or withdrawals, though your payment provider might. |

Ultimately, a low-cost, zero-commission environment means your trading strategy is the star of the show. You can focus more on your analysis and less on calculating how much of your profit will be lost to fees. This puts you, the trader, in a much stronger position to build your account effectively.

Understanding Leverage and Margin When Trading Stocks

Let’s talk about one of the most powerful—and most misunderstood—tools in a trader’s arsenal: leverage. When you’re trading stocks, you hear the terms leverage and margin all the time. They might sound complex, but the core idea is simple. They allow you to control a large position with a relatively small amount of your own capital. Think of it as a way to amplify your trading power.

But with great power comes great responsibility. Misunderstanding how these tools work is one of the fastest ways to blow up your account. So, let’s break it down in a way that makes sense for fellow traders.

So, What Exactly is Leverage?

In simple terms, leverage is using borrowed money to invest. Your broker lends you capital, which allows you to buy more shares of a stock than you could with just your own cash. We express leverage as a ratio, like 2:1 or 4:1. A 2:1 ratio means for every $1 of your own money, you can control $2 worth of stock.

Think of it like putting a down payment on a house. You put down 20% of your own money (your margin), and the bank lends you the other 80% (the leverage). You get to control a $500,000 asset with just $100,000 of your capital. It’s the same principle in trading.

And Where Does Margin Fit In?

Margin is the money you must have in your account to open and maintain a leveraged position. It’s the \”good faith deposit\” your broker requires. It’s not a fee; it’s your skin in the game. You need to know two key types of margin:

- Initial Margin: This is the minimum amount of equity you must deposit to open a new position. For stocks in the U.S., this is typically 50% under Regulation T.

- Maintenance Margin: This is the minimum amount of equity you must maintain in your account to keep your positions open. If your account value drops below this level, you’ll face the dreaded \”margin call.\”

A margin call is your broker’s notification that you need to deposit more funds or close positions to bring your account back to the minimum maintenance level. If you ignore it, your broker will forcibly liquidate your positions, often at the worst possible time for you.

Leverage in Action: A Practical Example

Let’s see how this plays out. Imagine you want to buy 100 shares of Company XYZ, currently trading at $50 per share.

| Scenario | Without Leverage (Cash Account) | With 2:1 Leverage (Margin Account) |

|---|---|---|

| Total Position Value | 100 shares x $50 = $5,000 | 100 shares x $50 = $5,000 |

| Your Capital Used (Margin) | $5,000 | $2,500 (50% initial margin) |

| Broker’s Loan | $0 | $2,500 |

| If Stock Rises to $60 (+20%) | Profit: $1,000 (20% ROI on your capital) | Profit: $1,000 (40% ROI on your capital) |

| If Stock Falls to $40 (-20%) | Loss: $1,000 (-20% ROI on your capital) | Loss: $1,000 (-40% ROI on your capital) |

The Double-Edged Sword: Pros and Cons

As you can see from the table, leverage magnifies both your profits and your losses. It’s critical to understand both sides of the coin before you start trading on margin.

Advantages of Using Leverage

- Amplified Profits: This is the primary appeal. You can generate significant returns from relatively small price movements.

- Increased Buying Power: It allows you to control larger positions and diversify your trades without tying up all your capital.

- Capital Efficiency: You can free up capital for other opportunities while still maintaining your desired market exposure.

Disadvantages and Risks

- Magnified Losses: This is the biggest danger. A small move against you can wipe out a significant portion of your trading capital, and you can even lose more than your initial deposit.

- Margin Call Risk: The threat of having your positions forcibly closed at a loss is always present in volatile markets.

- Interest Costs: You are borrowing money, so you must pay interest on the loan from your broker (known as margin interest). This cost can eat into your profits, especially on long-term holds.

Ultimately, using leverage and margin when trading stocks is a strategic decision. It is not a tool for beginners who have not yet mastered risk management. But for the disciplined trader with a solid plan, it can be a powerful way to enhance returns. Always start small, fully understand the risks involved, and never trade with money you cannot afford to lose.

The Olymptrade Demo Account: Practice Trading Stocks Risk-Free

Ever wished you could test your trading instincts without risking your hard-earned cash? That’s exactly what the Olymptrade demo account offers. Think of it as your personal trading gym. It’s a powerful tool that gives you a realistic feel for the market, allowing you to practice trading stocks and other assets in a completely safe environment. You can experiment, make mistakes, and learn from them without any financial consequences.

This isn’t just a basic simulator. You get access to the full power of the trading platform. It’s the perfect launchpad for beginners and a fantastic sandbox for experienced traders looking to refine a new approach.

What’s Inside the Demo Account?

When you open your practice account, you’re not just getting an empty screen. You’re equipped with everything you need to start trading immediately:

- Replenishable Virtual Funds: You start with a generous balance of virtual money. If you run low, you can easily top it up and keep practicing.

- Real-Time Market Data: Trade with live charts and asset prices. The conditions you experience in the demo account mirror the real market, providing an authentic trading experience.

- Full Access to Tools: Use all the same indicators, analysis tools, and features available on a live account. This helps you build a solid and repeatable trading strategy.

- Wide Range of Assets: Practice trading not just stocks, but also other instruments available on the platform to find what works best for you.

Demo vs. Live Account: Key Differences

Understanding the distinction between a demo and a live account is crucial for managing your expectations. While the technical environment is identical, the psychological aspect changes significantly when real money is on the line.

| Feature | Demo Account | Live Account |

|---|---|---|

| Capital | Virtual, risk-free funds. | Real, deposited money. |

| Emotional Impact | Low. Easy to make objective decisions. | High. Fear and greed can influence choices. |

| Primary Goal | Education, strategy testing, platform familiarity. | Profit generation, wealth management. |

| Market Access | Identical to live account with real-time data. | Direct participation in the financial markets. |

Using the demo account is the smartest first step you can take. It allows you to build the mechanical skills and confidence needed to navigate the live markets successfully. Take your time, develop your edge, and prepare for your trading journey the right way.

Key Features and Analytical Tools for Stock Traders

In today’s fast-paced market, having the right arsenal of tools is not just an advantage; it’s a necessity. Successful stock traders know that their edge comes from a combination of strategy, discipline, and powerful analytical tools. A top-tier trading platform equips you with everything you need to find opportunities, manage risk, and execute trades with confidence. Let’s break down the essential features that can transform your trading journey from guesswork to a calculated science.

Essential Platform Features You Can’t Trade Without

Before we dive into deep analysis, your trading environment itself must be robust. Think of it as your digital trading floor. Here are the non-negotiables:

- Real-Time Data Feeds: Lagging quotes are a trader’s worst enemy. You need instantaneous access to price action and market data to make timely decisions.

- Advanced Charting Tools: A great chart is your canvas. Look for platforms that offer multiple chart types, drawing tools, and a wide array of timeframes.

- One-Click Trading: When volatility strikes, speed is everything. The ability to enter and exit positions directly from the chart can save you precious pips.

- Customizable Watchlists: Keep your eyes on the prize. A well-organized watchlist helps you monitor your target stocks and spot potential setups without distraction.

- Integrated News and Economic Calendar: Market-moving events can turn a trend on a dime. Having an economic calendar built into your platform keeps you ahead of scheduled news releases.

Harnessing the Power of Analysis

Once your setup is solid, it’s time to analyze the market. Most analytical tools fall into two broad categories: technical and fundamental. While some traders are purists, many of the best use a blend of both to get a complete picture.

Technical Analysis Tools

This is the art of reading charts. Technical analysis assumes that all known information is already reflected in the price. Your job is to identify patterns and trends using various indicators. A good platform provides a full suite of tools for technical analysis, including moving averages, RSI, MACD, and Bollinger Bands. These instruments help you gauge momentum, volatility, and potential reversal points with greater accuracy.

Fundamental Analysis Tools

Where technical analysis looks at the chart, fundamental analysis looks at the company behind the stock. This involves examining a company’s financial health, earnings reports, industry trends, and overall economic conditions. Key tools here include a robust stock screener to filter companies based on P/E ratios, market cap, and dividend yields, as well as access to detailed financial statements and analyst ratings.

| Analytical Approach | What It Answers | Primary Tools | Best For |

|---|---|---|---|

| Technical Analysis | \”When should I buy or sell?\” | Charting tools, indicators, trend lines | Short to medium-term timing |

| Fundamental Analysis | \”What should I buy or sell?\” | Stock screener, financial reports, news | Long-term value investing |

I used to just follow the hype. It wasn’t until I started using a proper stock screener and learning to read charts that I saw real consistency. The right tools don’t trade for you, but they clear the fog so you can see the path.

Ultimately, the best features are the ones you master and integrate into a cohesive trading plan. A platform that provides a seamless experience for both technical and fundamental research gives you a significant edge. It empowers you to build a strategy based on comprehensive market data, not just emotion. Explore the tools, find what works for your style, and start making more informed trading decisions today.

Simple Stock Trading Strategies for the Olymptrade Platform

Diving into the world of stocks can feel like a huge leap, especially if you’re used to the pace of Forex. But here’s a secret: you don’t need a PhD in finance to start trading stocks effectively. The Olymptrade platform gives you access to some of the biggest company stocks, and with the right approach, you can build solid, simple trading strategies. Let’s break down a few methods that work well and are easy to grasp, even for a beginner trader.

Strategy 1: Riding the Trend

This is one of the most classic stock trading strategies for a reason—it works. The core idea is simple: identify the direction the market is moving (the trend) and trade with it, not against it. Think of it like swimming in a river; it’s much easier to go with the current.

On the Olymptrade platform, you can easily spot trends using technical analysis tools like Moving Averages (MA). A stock price consistently staying above its 50-day moving average suggests a healthy uptrend.

Here’s how you can apply it:

- Identify the Trend: Add a 50-period Simple Moving Average (SMA) to your stock chart. Is the price generally staying above or below this line? That’s your primary trend.

- Wait for a Pullback: In an uptrend, prices don’t go up in a straight line. Wait for the price to dip back towards the moving average line. This is your potential entry point.

- Confirm the Entry: Look for a bullish candlestick pattern (like a hammer or engulfing candle) right at the moving average. This confirms that buyers are stepping back in.

- Set Your Exits: Always practice good risk management. Place a Stop Loss just below the recent swing low and a Take Profit at a previous high or a calculated risk-to-reward ratio.

Strategy 2: The Power of Support and Resistance

Imagine a stock’s price is a ball bouncing in a room. The floor is the \”support\” level, where the price tends to stop falling and bounce back up. The ceiling is the \”resistance\” level, where the price often stops rising and turns back down. Trading stocks using these levels is a cornerstone of price action analysis.

You can draw these horizontal lines directly on your Olymptrade chart, connecting the significant peaks (resistance) and troughs (support). The more times a price touches a level and reverses, the stronger that level becomes.

Pro Tip: Old support can become new resistance, and old resistance can become new support. When a price breaks decisively through one of these levels, it often flips its role. Keep an eye out for these \”flips\” as they present powerful trading opportunities.

The basic strategy is to buy near strong support levels and sell near strong resistance levels. Combining this with trend analysis makes it even more powerful. For instance, in an uptrend, you’d focus on buying at support levels.

Strategy 3: Trading the News

Sometimes, the market moves because of real-world events. This is where fundamental analysis comes into play. Major announcements can cause significant volatility in a stock’s price, creating short-term opportunities.

You don’t need to be a Wall Street analyst. Just keep an eye on major economic calendars and company-specific news. Olymptrade often provides insights and a news feed to help you stay informed. This approach is less about technical chart patterns and more about understanding market reactions.

| Event Type | Potential Impact | Example |

|---|---|---|

| Earnings Report (Better than expected) | Positive (Price may rise) | Apple Inc. reports record iPhone sales. |

| Earnings Report (Worse than expected) | Negative (Price may fall) | Tesla Inc. misses its vehicle delivery targets. |

| New Product Announcement | Positive (Price may rise) | NVIDIA announces a groundbreaking new GPU. |

| Regulatory Scrutiny or Lawsuit | Negative (Price may fall) | A major bank faces a government investigation. |

Remember, the key to any successful strategy is consistency and risk management. No single strategy is foolproof. The best traders often combine elements from different approaches. Use the Olymptrade demo account to practice these simple stock trading strategies and find what works best for your style before putting real capital on the line.

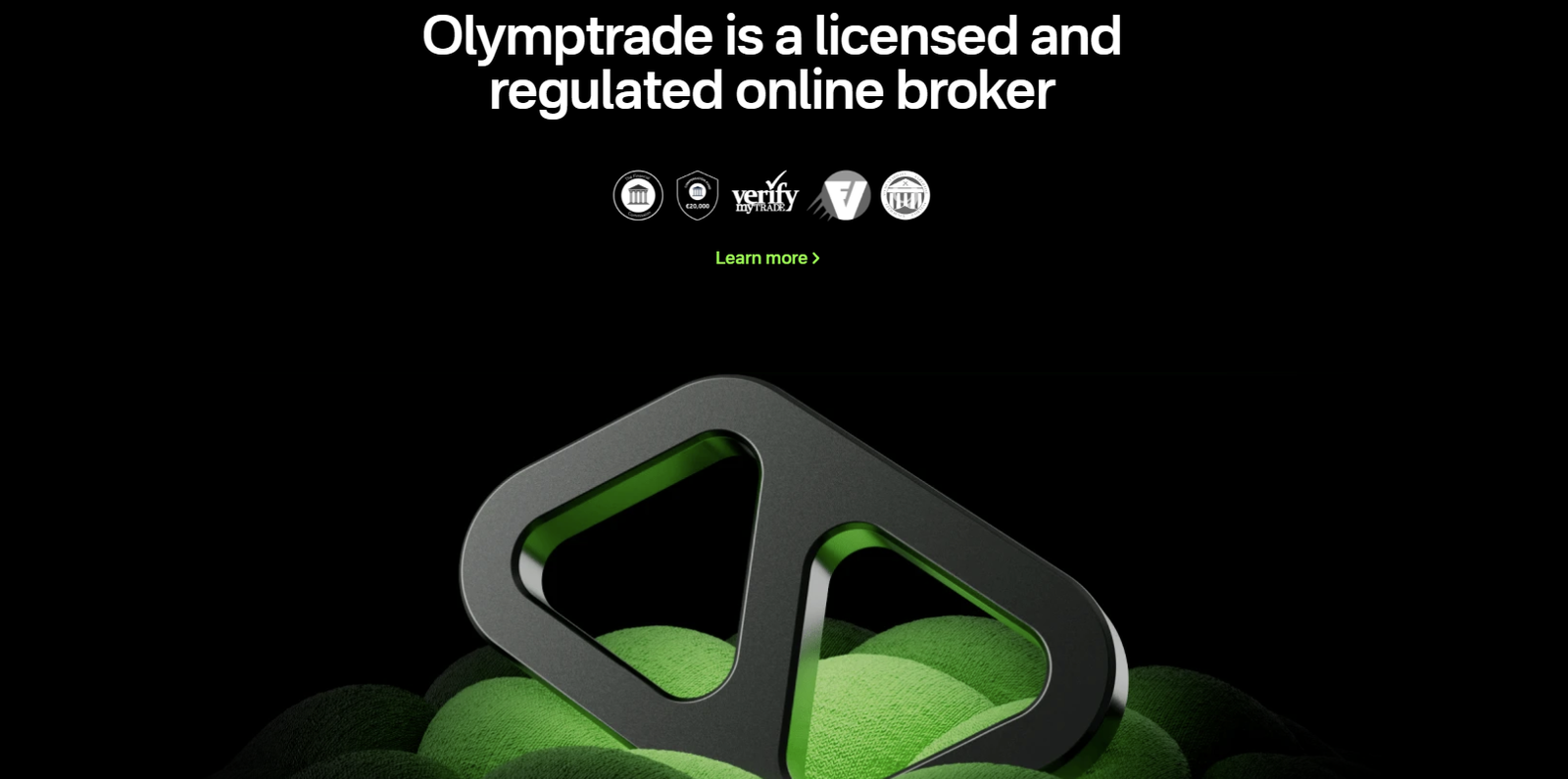

Security and Regulation: Is Your Investment Safe with Olymptrade?

Let’s talk about the most important question every trader asks before depositing a single dollar: \”Is my money safe?\” In the fast-paced world of trading, we focus on managing market risk. However, we must trust our broker to handle security risk. I’ve looked deep into Olymptrade’s framework, and I want to share what I found so you can trade with peace of mind.

The first thing any serious trader checks is regulation. Olymptrade is a verified member of the Financial Commission (FinaCom). This isn’t just a fancy badge; it’s a significant layer of protection for you, the trader.

So, what does being a member of the Financial Commission actually mean for your investment?

- Independent Dispute Resolution: If you have a dispute with the broker that you can’t resolve directly, FinaCom acts as a neutral third party to mediate and deliver a fair judgment.

- Compensation Fund: This is a massive confidence booster. FinaCom protects traders with a compensation fund of up to €20,000 per case. This means if the broker fails to adhere to a judgment, the commission can compensate you from this fund.

- Quality of Service: To maintain its membership, the platform must consistently meet high standards for business practices and execution quality. FinaCom regularly assesses its members to ensure they comply.

Key Pillars of Your Account Security

Beyond external regulation, the platform itself implements several crucial security measures. These work together to create a secure trading environment and protect your capital from unauthorized access.

One of the most critical practices is the segregation of funds. Olymptrade holds client funds in separate bank accounts, completely apart from the company’s own operational funds. This ensures that your money isn’t used for company expenses and is protected even in the unlikely event of company insolvency.

Here’s a quick breakdown of the security features protecting you:

| Security Feature | How It Protects You |

|---|---|

| SSL/TLS Encryption | Secures the connection between your device and the platform’s servers, making your personal and financial data unreadable to hackers. |

| Account Verification (KYC) | Ensures that you are the true owner of your account. This process prevents identity theft and financial fraud. |

| Anti-Money Laundering (AML) Policies | Follows international standards to prevent illegal activities, adding another layer of legitimacy and security to the platform. |

| Two-Factor Authentication (2FA) | Adds an extra security step to your login process. I highly recommend you enable this for maximum account protection. |

In trading, your job is to analyze the market. Your broker’s job is to provide a secure and stable arena for you to do it. Never settle for a platform that doesn’t take your investment safety seriously.

Ultimately, a combination of external regulation through the Financial Commission and robust internal security protocols creates a safe environment. This strong foundation allows you to shift your focus from worrying about your funds’ safety to what truly matters: making smart and profitable trades.

Pros and Cons of Using Olymptrade for Stock Trading

Thinking about diving into stock trading with Olymp Trade? Smart move to do your homework first. I’ve been in the trading trenches for years, and I can tell you every platform has its shiny spots and its rough edges. Let’s break down what Olymp Trade offers for stock traders, with no fluff, just the straight facts from my experience.

The Upside: What Makes It Attractive

Olymp Trade definitely has some compelling features, especially if you’re not a Wall Street veteran. Here’s what I find works well:

- Simple to Start: You don’t need a massive bankroll. The low minimum deposit makes it incredibly accessible for anyone wanting to test the waters of stock trading without risking a fortune.

- User-Friendly Interface: The platform is clean and intuitive. You won’t get lost in a sea of complicated menus. It’s designed to get you trading quickly, which is a big plus for new and intermediate traders.

- All-in-One Platform: You get more than just stocks. You can easily switch between trading stocks, currency pairs, and other assets all from a single account. This is great for diversifying your trading strategies.

- Practice Makes Perfect: The free demo account is a fantastic tool. You can practice your stock trading strategies with virtual money until you feel confident enough to go live. I always recommend traders spend quality time on a demo account first.

The Downsides: What to Be Aware Of

Now for the other side of the coin. No platform is perfect, and it’s crucial to know the limitations before you commit.

- Limited Stock Selection: If you’re looking to trade obscure or newly listed company stocks, you might not find them here. Olymp Trade focuses on the most popular and major company stocks, which is fine for many, but restrictive for specialists.

- Not a Stock Specialist: The platform’s DNA is rooted in Forex and Fixed Time Trades. While they offer stocks, they lack the deep, specialized tools that a dedicated stockbroker provides, such as advanced screeners or in-depth fundamental data.

- Trading Costs: While accessible, the spreads or commissions for stock trades might not be the absolute tightest in the market. Hardcore stock traders who execute high volumes of trades might find more competitive pricing elsewhere.

At-a-Glance Summary

Here’s a quick table to help you weigh your options:

| Advantages | Disadvantages |

|---|---|

| Low entry barrier and minimum deposit | Fewer individual stocks than specialized brokers |

| Clean, easy-to-navigate platform | Lacks advanced stock analysis tools |

| Access stocks, Forex, and more in one place | Trading costs may be higher for pure stock traders |

| Excellent demo account for risk-free practice | Platform is primarily focused on Forex/FTT |

My final take? Olymp Trade is a fantastic starting point for traders who want to explore stocks alongside other markets. It simplifies the process and gets you in the game fast. However, if your goal is to become a dedicated stock trading specialist, you may eventually outgrow its features and want to look at a more focused platform.

Key Advantages of the Olymptrade Platform

When you’re choosing a broker, you need to look past the marketing fluff and focus on what really impacts your trading. What tools will you actually use? How easy is it to get started? After spending countless hours on the platform, I’ve pinpointed several key advantages that make Olymptrade a strong contender, especially for traders who value efficiency and accessibility.

Here’s a quick rundown of what stands out:

- An Exceptionally User-Friendly Interface: The platform is clean and intuitive. You won’t waste time hunting for basic functions, which means you can focus more on your analysis and trade execution.

- A Free and Unlimited Demo Account: Before you risk any real money, you get $10,000 in virtual funds. This is your sandbox. Use it to test strategies, learn the platform’s mechanics, and build confidence. Best of all, you can replenish it anytime.

- Low Entry Barrier: You don’t need a fortune to start. The low minimum deposit makes the financial markets accessible to almost everyone, allowing you to get your feet wet without a huge initial commitment.

- Rich Educational Resources: The platform offers a wealth of free learning materials. From webinars with market experts to detailed tutorials and articles, there are plenty of resources to help you sharpen your skills.

- Versatile Trading Modes: You have the flexibility to trade in different ways, including Forex and Fixed Time Trades, all from a single account. This allows you to adapt your approach based on market conditions and personal preference.

Platform Features at a Glance

To give you a clearer picture, let’s break down how some of these features directly benefit you as a trader.

| Feature | What It Means For You |

|---|---|

| Mobile Trading App | Stay connected to the markets and manage your trades from anywhere. The app is fully functional, not just a watered-down version of the desktop platform. |

| Wide Range of Assets | Diversify your portfolio by trading currency pairs, stocks, indices, and commodities. More opportunities mean more potential setups to find. |

| 24/7 Customer Support | Get help when you need it. Whether you have a technical question or an issue with your account, responsive support is crucial. |

| Integrated Analytical Tools | Analyze price charts directly on the platform with a solid selection of indicators and graphical tools. No need for third-party software for basic analysis. |

A Trader’s Take: For me, the biggest win is the seamless experience. I can do my morning analysis on my laptop, place a trade, and then monitor it from my phone while I’m out. The platform doesn’t get in your way; it simply works as a reliable tool to execute your strategy.

Ultimately, these advantages combine to create a trading environment that feels less intimidating and more empowering. The focus is clearly on providing traders with the necessary tools and knowledge to navigate the markets effectively.

Potential Disadvantages to Consider

Let’s be completely transparent. No trading strategy is a flawless money-printing machine, and it’s crucial to understand the potential drawbacks before you commit. Acknowledging the challenges is what separates professional traders from hopeful gamblers. Seeing the full picture helps you prepare, adapt, and ultimately, succeed where others fail.

Here are a few realities to keep in mind:

- It Requires Emotional Control: The market will test your patience and discipline. You will have losing trades—it’s a mathematical certainty. The real test is sticking to your trading plan without letting fear of loss or greed for more profit dictate your actions. This psychological battle is often more difficult than reading a chart.

- There is a Learning Curve: While we aim to simplify the process, you won’t become a master overnight. You must invest time to internalize the strategy, practice on a demo account, and understand the \”why\” behind every trade. Expect to dedicate real effort to build your confidence and skill.

- This is Not a Passive Venture: Successful trading requires active participation. You need to be present to identify setups, manage your open positions, and review your performance. Your results are directly correlated with the focused effort you apply.

Navigating the Hurdles

Being aware of a challenge is the first step to overcoming it. Here is how we address these potential disadvantages head-on.

| The Challenge | How to Mitigate It |

|---|---|

| Risk of Capital Loss | We enforce iron-clad risk management. You will learn to apply strict rules, like risking only 1-2% of your capital per trade, to ensure you can withstand losses and stay in the game long-term. |

| Analysis Paralysis | Our approach is built on a clean, simplified system. We cut out the noise from dozens of indicators and focus on a few high-probability patterns, allowing for quicker and more confident decision-making. |

| Going It Alone | Trading can feel isolating. That’s why our community is a core part of the experience. You get to share ideas, ask questions, and learn alongside others who are on the exact same path. |

“The market is a device for transferring money from the impatient to the patient.” – Warren Buffett

This couldn’t be more true in forex trading. The disadvantages we’ve outlined are primarily tests of your patience and discipline. By facing them with a solid plan and a supportive community, you transform potential weaknesses into your greatest strengths.

Withdrawing Your Profits: Methods and Processing Times

Let’s talk about the best part of trading: getting paid. Closing a profitable position feels great, but the real satisfaction comes when that money is in your hands. A smooth withdrawal process is just as important as a tight spread or fast execution. You need to trust that you can access your hard-earned profits easily and efficiently. Let’s break down how it typically works.

Common Withdrawal Methods at Your Fingertips

Most reputable brokers offer several ways to get your profits. The key is choosing the one that balances speed, cost, and convenience for your situation. Here are the usual suspects:

- Bank Wire Transfer: The classic. This method sends money directly to your bank account. It’s highly secure and great for larger sums, but often comes with the longest processing times and potentially higher fees from both the broker and your bank.

- Credit/Debit Cards: A very popular choice. Usually, you can only withdraw up to the amount you initially deposited using a specific card. It’s a convenient way to get your initial investment back quickly.

- E-Wallets (Skrill, Neteller, PayPal, etc.): The digital wallet revolution has made Forex withdrawal faster than ever. These services act as an intermediary, often providing the quickest processing times once the broker approves the request.

- Cryptocurrency (Bitcoin, Ethereum, etc.): A newer but increasingly common option. Crypto withdrawals can be extremely fast and offer a degree of anonymity, but you need to be comfortable handling digital assets and aware of network fees.

What to Expect: A Look at Processing Times

“How long will it take?” is the number one question every trader asks. The total time is a combination of the broker’s internal processing and the payment provider’s timeline. Here’s a general guide:

| Withdrawal Method | Broker Internal Processing | Provider Processing Time | Best For |

|---|---|---|---|

| Bank Wire Transfer | 1-2 Business Days | 2-5 Business Days | Large, secure transfers |

| Credit/Debit Card | 1 Business Day | 3-5 Business Days | Refunding initial deposits |

| E-Wallets | Same Day – 1 Business Day | Instant – a few hours | Speed and convenience |

| Cryptocurrency | Same Day – 1 Business Day | Minutes – 1 hour | Fast transfers and tech-savvy traders |

Always remember: the withdrawal process begins after your request is approved. This approval step is a crucial security measure, not a delay tactic.

Tips for a Hassle-Free Withdrawal

You can play a major role in making the process faster. Follow these steps to ensure your funds arrive without a hitch.

- Verify Your Account Early: Don’t wait until you want to withdraw. Complete your full account verification (ID and proof of address) right after you sign up. This is the single biggest step to prevent delays.

- Match Your Methods: Due to anti-money laundering regulations, most brokers require you to withdraw funds using the same method you used for depositing. Plan ahead!

- Mind the Minimums: Check the broker’s terms for any minimum withdrawal amounts. Trying to take out less than the minimum will result in a rejected request.

- Be Aware of Fees: Understand the fee structure for your chosen method. Some brokers offer one free withdrawal per month, while others may charge for every transaction. This helps you manage your profits effectively.

Ultimately, a transparent and efficient system for accessing your profits is a hallmark of a broker you can trust. It shows they respect you and your success. After all, you did the hard work in the markets; getting your money should be the easy part.

Olymptrade vs Competitors: A Comparison for Stock Traders

As a stock trader, you know the market is a battlefield. But the first battle you face is choosing the right weapon: your trading platform. With a sea of brokers all claiming to be the best, how do you cut through the noise? It’s a crucial decision that directly impacts your efficiency, costs, and ultimately, your profitability.

Let’s move past the flashy ads and get down to what really matters. We’re going to put Olymp Trade under the microscope and see how it stacks up against other popular brokers in the areas that are critical for trading stocks. We’ll look at the tools, the costs, and the overall experience to help you make an informed choice.

Key Differentiators for Stock Traders

When comparing brokers, stock traders should focus on a few core elements. These are the make-or-break features that define your daily trading life:

- Asset Availability: Can you trade the stocks you’re actually interested in? A platform is useless if it doesn’t list the companies you follow, from big tech to emerging industries.

- Platform and Tools: Is the interface intuitive or cluttered? Does it provide the charting tools and technical indicators you need to perform proper analysis without overwhelming you?

- Fee Structure: Hidden costs can destroy your profits. We need to look at commissions, spreads, and any other fees that can eat into your returns. Transparency is key.

- Accessibility and Support: How easy is it to get started? What is the minimum deposit? And if you run into an issue, can you get reliable support quickly?

Direct Comparison: Olymp Trade vs The Field

To make it simple, let’s lay out the differences in a clear table format. This gives you a quick snapshot of what to expect.

| Feature | Olymp Trade | Typical Competitors |

|---|---|---|

| Stock Asset List | Curated list of major global stocks (e.g., Apple, Google, Tesla), ETFs, and indices. Focused on quality and popularity. | Varies widely. Some offer thousands of obscure stocks, which can be overwhelming. Others have a very limited selection. |

| Trading Platform | Proprietary platform designed for ease of use. Clean interface, intuitive for both new and experienced traders. Excellent mobile app. | Often use third-party platforms like MT4/MT5, which are powerful but can have a steep learning curve and feel dated. |

| Commission & Fees | Low, clearly defined commissions on stock trades. No hidden account maintenance or inactivity fees. | Fee structures can be complex. May include higher commissions, withdrawal fees, or inactivity penalties. |

| Minimum Deposit | Very low minimum deposit (typically around $10), making it highly accessible for traders of all budget sizes. | Often requires a higher initial deposit, sometimes ranging from $100 to $500 or more, creating a barrier to entry. |

The Trader’s Experience: Beyond the Numbers

A table tells part of the story, but the day-to-day experience is just as important. Many competing platforms, while powerful, feel like they were designed for institutions, not individual traders. They can be clunky and slow. Olymp Trade’s advantage lies in its user-centric design. Executing a trade, setting a stop-loss, and analyzing a chart feels fluid and natural, which is critical when market opportunities appear for only a few seconds.

\”I’ve used several brokers, and the biggest difference for me was the platform itself. With others, I felt like I was fighting the interface. On Olymp Trade, the platform works for me, not against me. I can focus on my analysis and my trades, which is exactly how it should be.\”

Ultimately, the choice of a broker is personal and depends on your specific trading style. However, when you compare the essential factors for a stock trader—clean interface, access to popular assets, and a fair fee structure—Olymp Trade presents a very compelling case. It strips away the unnecessary complexity, allowing you to focus on what you do best: trading.

Final Verdict: Should You Trade Stocks with Olymptrade?

So, we’ve walked through the features, analyzed the tools, and explored the opportunities. We arrive at the ultimate question: should you use this trading platform to trade stocks? The honest answer from one trader to another is this: it depends entirely on who you are as a trader and what you want to achieve in the financial markets.

To make your decision easier, let’s break down the core strengths and weaknesses in a clear, no-nonsense way.

| The Upside: What We Like | The Downside: What to Consider |

|---|---|

| Incredible Accessibility. The low entry barrier means you don’t need a massive bankroll to start. This opens the door for many aspiring traders. | Fewer Advanced Tools. Seasoned professional traders who rely on complex algorithmic tools or highly specific indicators might find the platform a bit too streamlined. |

| Intuitive & Clean Interface. The platform is beautifully designed. You can find what you need and execute trades without getting lost in a sea of confusing buttons. | Primarily Known for FTT. While stock trading is available, the platform’s reputation is built on its Fixed Time Trading mode, which may not appeal to every type of stock investor. |

| Excellent Educational Suite. From webinars to strategy guides, Olymptrade invests heavily in trader education, which is a massive plus for anyone looking to grow their skills. | Asset Variety. While major stocks are present, you might not find every obscure or newly listed small-cap stock you’re looking for. The focus is on the big, popular names. |

So, Who Is This Platform Really For?

Based on our analysis, Olymptrade is an excellent match for a specific type of trader. You will likely thrive here if you are:

- A Newcomer to the Markets: If you’re just starting out, the platform’s simplicity and educational resources are your best friends.

- A Mobile-First Trader: Do you like to check charts and place trades from your phone? The mobile app is top-notch and makes trading on the go a breeze.

- A Budget-Conscious Trader: You want to get your feet wet in the stock market without making a huge initial deposit.

- A Diversified Trader: You’re interested in trading stocks but also want the flexibility to jump into forex, commodities, or indices all from one account.

From my personal experience, the real value of Olymptrade is its efficiency. When I see a setup on a major stock, I want to act on it quickly. This platform lets me do just that without unnecessary complications. It respects my time, and in trading, time is everything.

Ultimately, no review can replace your own experience. The best way to know if Olymptrade is the right partner for your journey to trade stocks is to test it. Open a demo account—it’s free and risk-free. Play with the charts, explore the assets, and place a few practice trades. See if the workflow feels right to you. Your trading career is your own, and choosing the right tool is the first critical step.

Frequently Asked Questions

What kind of stocks can I trade on Olymptrade?

Olymptrade provides access to trade stock CFDs of major global companies. You can find popular stocks from US and European markets, including technology giants like Apple and Google, e-commerce leaders like Amazon, and automotive companies like Tesla.

Am I actually buying real stocks on Olymptrade?

No, when you trade stocks on Olymptrade, you are trading Contracts for Difference (CFDs). This means you are speculating on the price movement of the stock without physically owning the shares. This allows you to profit from both rising and falling prices.

What are the main costs for trading stocks on Olymptrade?

Olymptrade offers zero-commission stock trading. The main costs are the spread (the difference between the buy and sell price) and overnight fees (swaps) if you hold a leveraged position open after the market closes. The platform is transparent about these costs before you open a trade.

Is it safe to trade stocks and deposit money with Olymptrade?

Yes, Olymptrade is a verified member of the Financial Commission (FinaCom), which provides dispute resolution and a compensation fund of up to €20,000 per case. The platform also uses SSL encryption and holds client funds in segregated accounts for enhanced security.

Can I practice trading stocks before using real money?

Absolutely. Olymptrade offers a free and unlimited demo account pre-loaded with $10,000 in virtual funds. You can use it to practice your strategies, get familiar with the platform, and build confidence in a completely risk-free environment.