Are you exploring online trading opportunities with Olymptrade in Saudi Arabia? You’ve come to the right place. The buzz around financial markets is growing across the Kingdom, offering exciting prospects for savvy traders. But before you jump in, two critical questions likely come to mind: legality and safety. Let’s tackle them head-on.

Navigating the regulatory environment is the first step for any trader. In Saudi Arabia, the Capital Market Authority (CMA) is the primary body overseeing financial activities. While many international brokers offer services to residents, it is your responsibility to understand the local financial regulations. Operating with Olymptrade in Saudi Arabia means being an informed participant. Staying aware of the guidelines from local authorities helps you make better decisions for your trading journey.

Beyond regulations, your personal financial security is what truly matters. Smart trading is safe trading. Here are essential practices to protect yourself and your capital while trading in the Kingdom:

- Start with a Demo Account: Before you commit any real funds, use the demo account. It’s a risk-free way to master the platform, test your strategies, and build confidence without spending a single riyal.

- Educate Yourself Continuously: The markets are always changing. Dedicate time to learning about fundamental and technical analysis. Understand the assets you are trading, whether it’s currency pairs, stocks, or commodities. Knowledge is your greatest asset.

- Implement Strict Risk Management: This is non-negotiable. Use tools like Stop Loss to define your maximum acceptable loss on a trade. Never invest more money than you are prepared to lose. This single rule can save you from significant financial stress.

- Secure Your Digital Footprint: Protect your trading account as you would your bank account. Use a strong, unique password and always enable two-factor authentication (2FA) for an extra layer of security against unauthorized access.

By combining a clear understanding of the trading environment with disciplined, safe practices, you can confidently navigate the financial markets. Your path to successful trading with Olymptrade in Saudi Arabia begins with knowledge and caution.

- Navigating Online Trading Platforms in Saudi Arabia

- Understanding OlympTrade’s Status and Regulations in KSA

- Key Points for Traders in Saudi Arabia

- The Saudi Capital Market Authority (CMA) and Online Brokers

- Exploring Sharia-Compliant Trading with OlympTrade

- How to Register an OlympTrade Account from Saudi Arabia

- Deposit Methods for OlympTrade Saudi Arabia Users

- Withdrawing Funds: Payout Options for KSA Traders

- Key Features of the OlympTrade Trading Platform

- Platform Feature Summary

- Available Assets and Financial Instruments for Saudi Traders

- Ensuring Security and Trust on OlympTrade for KSA Residents

- OlympTrade Customer Support for Saudi Arabian Clients

- Key Advantages for Saudi Traders:

- Pros and Cons of Using OlympTrade in Saudi Arabia

- Trading On-the-Go: The OlympTrade Mobile App in KSA

- Educational Resources and Tools for Saudi Beginners

- Top OlympTrade Alternatives for Saudi Arabian Traders

- Key Platform Feature Comparison

- What to Prioritize When Choosing a New Broker

- Important Tips for Safe Online Trading in Saudi Arabia

- Essential Safety Checklist for Traders

- Frequently Asked Questions

Navigating Online Trading Platforms in Saudi Arabia

The financial markets are buzzing with opportunity, and traders in Saudi Arabia are right in the heart of the action. Choosing the right online trading platform is your first critical step. It’s more than just a tool; it’s your command center for accessing global markets. With so many options available, how do you find the one that fits your trading style and meets local requirements? Let’s break down what truly matters.

First, focus on regulation. Your peace of mind is paramount. Look for platforms regulated by respected authorities. In Saudi Arabia, the Capital Market Authority (CMA) sets the local standard, but many traders also use platforms regulated by other top-tier global bodies. A well-regulated broker ensures your funds are segregated and that you’re trading in a fair environment.

Next, consider the features that cater specifically to your needs as a trader in the Kingdom. Here’s a quick checklist of must-haves:

- Sharia-Compliant Accounts: Does the platform offer Islamic accounts? These accounts operate without swap or rollover interest on overnight positions, adhering to Riba-free principles. This is a non-negotiable for many traders in the region.

- Arabic Language Support: A platform and customer service team that speaks your language can make a world of difference, especially when you need help quickly.

- Local Funding Methods: Easy deposits and withdrawals using local bank transfers or payment systems save you time and potential conversion fees.

- Asset Availability: Ensure the platform offers the markets you want to trade, whether it’s forex, stocks from Tadawul, commodities like oil, or global indices.

To give you a clearer picture, let’s compare some essential features you might find across different online trading platforms available to Saudi residents.

| Feature | What to Look For | Why It Matters |

|---|---|---|

| Regulation | CMA, FCA, CySEC, ASIC | Ensures your funds are protected and the broker operates transparently. |

| Islamic Account | Swap-free option available | Allows you to trade in compliance with Sharia law. |

| Customer Support | 24/5 or 24/7 in Arabic | Provides timely assistance in your native language when markets are open. |

| Spreads & Fees | Low, transparent costs | High fees can significantly eat into your trading profits over time. |

“Your trading platform is your primary partner in the markets. Choose it with the same diligence you’d use to analyze a trade.”

Finding the right fit from the many online trading platforms can feel overwhelming, but focusing on these key aspects—regulation, account types, and local support—will guide you to a reliable partner for your trading journey. Make a choice that empowers you to navigate the markets with confidence from within Saudi Arabia.

Understanding OlympTrade’s Status and Regulations in KSA

The primary financial regulator in Saudi Arabia is the Capital Market Authority (CMA). The CMA oversees and licenses financial companies that are physically based and operating within the Kingdom. Their focus is on local entities. Many international online trading platforms, however, operate globally and serve clients in numerous countries, including KSA, under international regulatory frameworks.

So, how does this apply to you? It means that while you might not find a platform like OlympTrade on the CMA’s list of locally licensed brokers, it operates as an international broker accessible to traders in Saudi Arabia. These global platforms are typically regulated by other international financial bodies. For example, OlympTrade is a member of the Financial Commission (FinaCom), an independent self-regulatory organization and external dispute resolution body.

This structure provides a layer of protection for traders. It ensures that there are standards for service quality and a neutral third party to mediate any disputes. For many traders in KSA, this offers a gateway to global markets that might not be available through purely local brokers.

Key Points for Traders in Saudi Arabia

- Local vs. International Regulation: The CMA regulates local Saudi Arabian brokers. International platforms like OlympTrade fall under global regulatory bodies, such as FinaCom.

- Access to Global Markets: Using an international platform gives you access to a wide range of assets and trading opportunities from around the world.

- Dispute Resolution: Membership in bodies like FinaCom provides a mechanism for dispute resolution, offering a safety net for your trading activities.

- Personal Due Diligence: It’s always essential for you, the trader, to understand the platform you’re using. Read the terms, understand the features, and start with a demo account to get comfortable before trading with real funds.

Navigating the world of online trading means understanding these distinctions. By choosing an established international platform, you gain access to powerful tools and opportunities while operating within a framework designed to protect your interests as a trader.

The Saudi Capital Market Authority (CMA) and Online Brokers

If you’re trading within Saudi Arabia, the Saudi Capital Market Authority (CMA) is the most important organization you need to know. Think of the CMA as the financial market’s chief referee. It sets the rules of the game to ensure everything is fair, transparent, and secure for investors like you and me. Its primary mission is to protect your interests and build a trustworthy trading environment.

So, how does this affect online brokers? Simple. Any broker that wants to operate legally and offer services within the Kingdom must get the green light from the CMA. This isn’t just a piece of paper; it’s a rigorous process that vets the broker’s financial stability, business practices, and commitment to client safety.

The CMA’s key responsibilities include:

- Issuing licenses to financial intermediaries, including online brokerage firms.

- Supervising all listed securities and market activities to prevent manipulation.

- Ensuring brokers follow strict rules on segregating client funds from their own operational capital.

- Setting standards for transparency and disclosure, so you always know what you’re getting into.

Choosing a CMA-regulated broker gives you a powerful layer of security. It means you are trading with a company that is held accountable to one of the region’s strongest financial regulators. Below is a quick breakdown of what this means for your trading journey.

| Advantages of a CMA-Regulated Broker | Potential Considerations |

|---|---|

| Your funds are held in segregated accounts, protecting them in case of broker insolvency. | The account opening process may be more thorough due to strict identity verification rules. |

| You have a clear legal path for dispute resolution within the country. | Leverage offerings might be more conservative compared to unregulated offshore brokers. |

| Brokers must adhere to strict operational and ethical standards. | The range of tradable instruments might be focused on what the CMA approves for the local market. |

Ultimately, trading with a broker under the CMA’s watch is a strategic decision. It swaps the wild west of unregulated markets for a structured and protected environment. For any serious trader, that peace of mind is priceless.

Exploring Sharia-Compliant Trading with OlympTrade

For many traders, faith and finance go hand in hand. If you follow Islamic principles, you know that certain financial activities are off-limits. This can make entering the world of online trading seem complicated. But what if you could trade markets while respecting your beliefs? OlympTrade addresses this need directly with its Sharia-compliant account option, often called an Islamic account.

With OlympTrade, opting for an Islamic account means you get the same powerful platform and access to assets, but without the swap fees. Your trades are executed instantly, and you can hold positions for as long as you need without worrying about accumulating interest charges that go against your principles.

This special account type is built around the core principles of Islamic finance. It removes the elements of trading that conflict with Sharia law. Let’s break down what makes a trading account Halal:

- No Riba (Interest): The most significant rule is the prohibition of interest. Standard trading accounts charge or pay a fee, known as a swap, for positions held overnight. An Islamic account is completely swap-free, so you never pay or receive interest.

- No Gharar (Excessive Uncertainty): Islamic finance discourages transactions with extreme uncertainty or ambiguity. Trading on a platform that provides analytical tools and real-time data helps you make informed decisions based on market analysis, reducing this uncertainty.

- No Maysir (Gambling): Trading should be a skill-based activity, not a game of chance. Halal trading involves strategy, analysis, and risk management, distinguishing it clearly from gambling.

| Islamic Finance Principle | How It’s Addressed in a Sharia-Compliant Account |

|---|---|

| Prohibition of Riba | The account is 100% swap-free. No interest is ever charged or paid on overnight positions. |

| Immediate Settlement | Trades are executed in real-time, fulfilling the principle of direct exchange. |

| Ethical Foundation | You trade with peace of mind, knowing your financial activities align with your faith. |

This approach makes the financial markets accessible to everyone, allowing traders to focus on developing their strategies without compromising their core beliefs.

How to Register an OlympTrade Account from Saudi Arabia

Ready to start your trading journey in Saudi Arabia? Fantastic! Setting up your Olymp Trade account is your first step into the exciting world of financial markets. The process is quick, simple, and designed to get you trading in minutes. Forget about long, complicated procedures. We will guide you through every easy step to get your account ready for action.

Follow this simple guide to create your trading account:

- Visit the Platform: First, head over to the official Olymp Trade website. You can use your computer or mobile phone. The registration form is usually the first thing you see.

- Enter Your Information: You will need to provide a valid email address and create a strong password. This is also where you choose your account currency, typically between USD and EUR. Think about which one works best for you.

- Agree to the Terms: Next, you’ll find a checkbox to confirm you are of legal age and that you accept the platform’s service agreement. It’s always smart to review the terms before you proceed.

- Confirm Your Email: Once you submit the form, check your inbox. Olymp Trade sends a confirmation email with a link. Click that link to verify your email and officially activate your new account. That’s it!

Congratulations, you are now a registered trader! The platform instantly grants you access to a free demo account loaded with virtual funds. This is the perfect place to practice your strategies without any risk. Before you can deposit and trade with real money, you will need to complete the identity verification process, which is a standard step to keep your account secure.

| Feature | Availability | What it’s for |

|---|---|---|

| Demo Account | Instantly | Practice trading with virtual money. |

| Real Account | Instantly | Deposit funds to trade on live markets. |

| Educational Resources | Instantly | Learn trading strategies and analysis. |

| Account Verification | Required for withdrawals | Secures your funds and personal information. |

See how easy that was? In just a few minutes, you can have a fully functional Olymp Trade account right from Saudi Arabia. Now you are free to explore the platform, sharpen your skills on the demo account, and prepare to conquer the financial markets. Your trading adventure is just getting started.

Deposit Methods for OlympTrade Saudi Arabia Users

Getting your trading account funded is your first real step into the market. It needs to be fast, secure, and simple. For traders in Saudi Arabia, OlympTrade offers a variety of deposit methods designed to get you into the action without any hassle. You can choose the option that best fits your needs, whether you prioritize speed, convenience, or using your local banking services.

Let’s break down the most common ways you can fund your account. From traditional bank cards to modern e-wallets, the flexibility is there. This ensures you can move your capital efficiently and start focusing on what truly matters: your trading strategy.

| Deposit Method Category | Typical Processing Time | Main Advantage |

|---|---|---|

| Bank Cards (Visa/Mastercard) | Instant | Widely used and highly convenient for quick funding. |

| E-Wallets (e.g., Skrill, Neteller) | Instant to a few minutes | Excellent for speed and keeping trading funds separate from your main bank account. |

| Local Bank Transfers | Varies by bank | A familiar and trusted method for many traders in Saudi Arabia. |

To ensure your deposit goes through smoothly, keep these quick tips in mind:

- Use Your Own Account: Always make deposits from a bank card or e-wallet that is registered in your own name. Third-party payments are generally not accepted for security reasons.

- Check Your Limits: Be aware of any daily or monthly transaction limits set by your bank or e-wallet provider to avoid any interruptions.

- Verify Your Information: Double-check all the details before confirming the transaction. A small typo can cause unnecessary delays.

- Consider Currency: Depositing in your account’s base currency (like USD) can help you avoid conversion fees from your payment provider.

Choosing the right deposit method is all about what works for you. The variety of options available makes it easy for anyone in Saudi Arabia to get started with OlympTrade quickly and securely.

Withdrawing Funds: Payout Options for KSA Traders

You did it. You navigated the charts, managed your risk, and closed a profitable trade. That feeling of success is what every trader strives for. Now, the next logical step is securing those profits. A reliable and swift withdrawal process is non-negotiable. For traders in the Kingdom of Saudi Arabia, understanding your payout options ensures you can access your funds smoothly and efficiently. Let’s break down the common methods available to you.

Most reputable brokers offer several ways to get your money out. The key is to find the balance between speed, cost, and convenience that works for your trading style. Here are the most popular choices:

- Bank Wire Transfers: A classic and secure method. This sends funds directly from your brokerage account to your local Saudi bank account, like Al Rajhi, NCB, or SABB.

- Credit/Debit Cards: You can often withdraw funds back to the same card you used for your initial deposit. This is typically limited to your deposit amount.

- Electronic Wallets (E-Wallets): Services like Skrill, Neteller, and Perfect Money are incredibly popular. They act as a digital intermediary, often providing the fastest transaction times.

To help you decide, let’s compare these methods side-by-side:

| Payout Method | Typical Speed | Common Fees | Best For |

|---|---|---|---|

| Bank Wire Transfer | 3-7 business days | Can be higher, both from the broker and receiving bank | Large withdrawal amounts and maximum security |

| Credit/Debit Card | 1-5 business days | Often low or zero from the broker | Withdrawing your initial deposit amount quickly |

| E-Wallets | Instant to 24 hours | Variable, can be a percentage or flat fee | Fast access to funds and frequent, smaller withdrawals |

“Your trading strategy doesn’t end when you close a position. It ends when the profit is in your bank account. Always plan your withdrawals.”

Before you request a payout, keep a few things in mind. Ensure your account is fully verified to avoid delays. Also, consider currency conversion. Most trading accounts are in USD, so withdrawing to your SAR account will involve a conversion. Check the rates and any fees your local bank might charge for receiving an international transfer. Choosing the right withdrawal method makes the final step of a successful trade a satisfying one, not a frustrating one.

Key Features of the OlympTrade Trading Platform

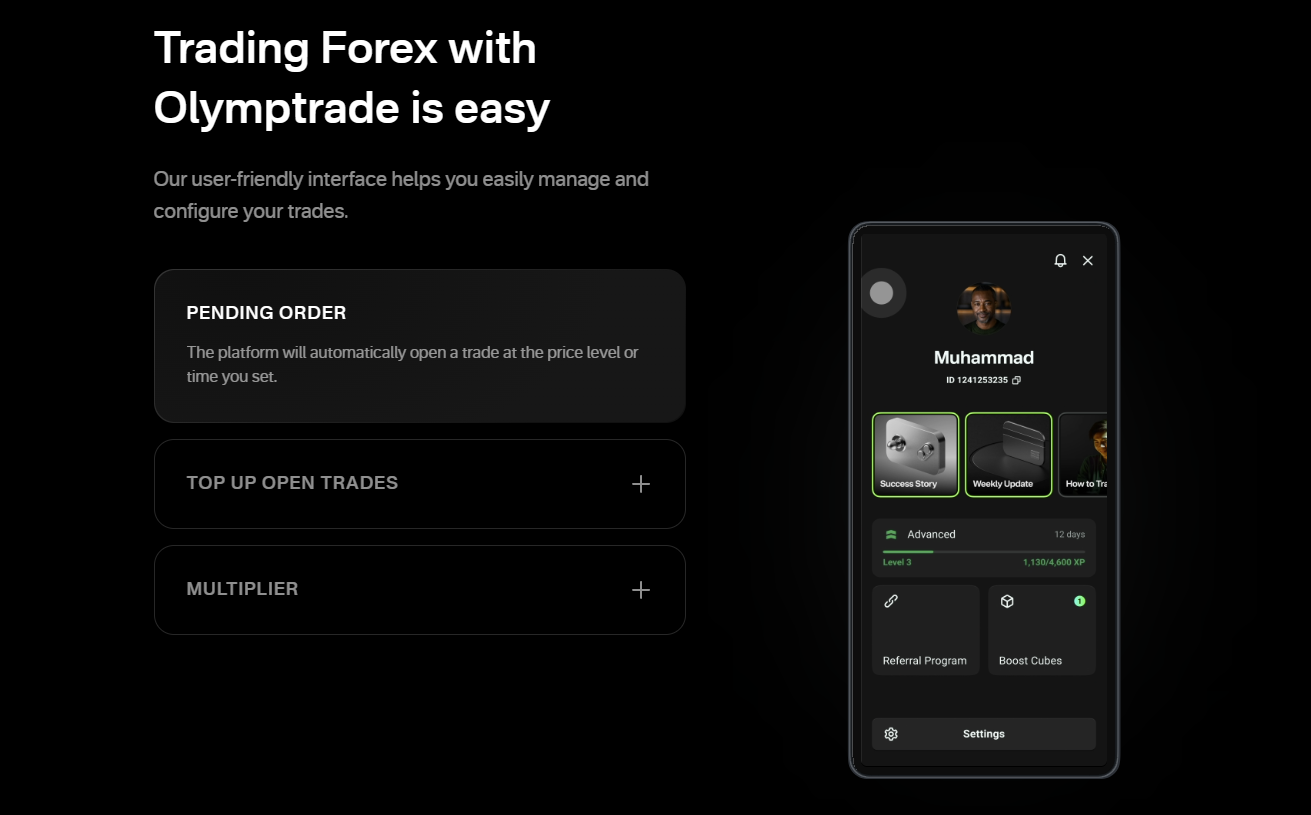

The platform’s design immediately stands out for its simplicity. You won’t get bogged down by endless menus or a cluttered screen. Key functions like selecting an asset, choosing a trade amount, and executing an order are all incredibly intuitive. This clean and user-friendly interface helps you stay focused on price action and making clear-headed decisions, which is crucial in fast-moving markets.

The platform’s design immediately stands out for its simplicity. You won’t get bogged down by endless menus or a cluttered screen. Key functions like selecting an asset, choosing a trade amount, and executing an order are all incredibly intuitive. This clean and user-friendly interface helps you stay focused on price action and making clear-headed decisions, which is crucial in fast-moving markets.

You have access to different trading mechanics, catering to various styles and strategies. This flexibility allows you to adapt to market conditions or simply trade in the mode you prefer.

- Fixed Time Trades (FTT): This mode is perfect for traders who thrive on speed and clear outcomes. You analyze the chart and forecast whether the price of an asset will rise or fall within a specific duration, from minutes to hours. It’s a direct way to trade on short-term volatility.

- Forex Trading: For a more traditional approach, the platform offers a robust forex mode. Here you can trade major and minor currency pairs, use leverage to amplify your positions, and manage your risk with essential tools like Stop Loss and Take Profit orders.

A trader is only as good as their analytical tools. The platform is equipped with a solid suite of technical indicators and graphical tools built directly into the chart. You can easily overlay your charts with:

- Moving Averages (SMA, EMA)

- Relative Strength Index (RSI)

- Stochastic Oscillator

- MACD

- Bollinger Bands

This allows for comprehensive technical analysis without ever needing to leave the platform.

Platform Feature Summary

| Advantages | Disadvantages |

|---|---|

| Integrated educational materials and trading strategies. | The asset selection is good but not as vast as some specialized brokers. |

| Free, replenishable demo account for risk-free practice. | Advanced charting tools for custom scripting are not available. |

| Low minimum deposit makes it accessible to beginners. | Weekend trading is limited to specific assets. |

“The best feature is the one you actually use. This platform strips away the noise and provides the essential tools you need to execute your trading plan effectively.”

Finally, one of the most valuable features is the free demo account. It mirrors the live trading environment, allowing you to practice with virtual funds. Use this space to test new strategies, get a feel for different assets, and build your confidence before you put any real capital on the line. It is an essential training ground for any serious trader.

Available Assets and Financial Instruments for Saudi Traders

The global markets are buzzing with opportunity, and traders in Saudi Arabia have a front-row seat. Gone are the days of limited choices. Today, a diverse world of financial instruments is at your fingertips, allowing you to build a trading strategy that truly fits your goals and risk appetite. Whether you’re a seasoned pro or just starting, understanding your options is the first step to success.

From the fast-paced world of currency pairs to the steady giants of the stock market, the key is diversification. Let’s explore the most popular available assets you can trade.

- Forex Majors, Minors & Exotics: This is the largest financial market in the world. You can trade popular pairs like EUR/USD and GBP/USD, or explore more exotic options involving currencies from emerging markets.

- Global Stocks (CFDs): Gain exposure to the world’s biggest companies without owning the underlying asset. Trade the price movements of giants like Tesla, Apple, and even local powerhouses like Saudi Aramco through CFDs.

- Essential Commodities: For many Saudi traders, commodities feel like home. Trade the price of Brent and WTI crude oil, or hedge with precious metals like gold and silver. These markets are driven by global supply and demand, offering unique opportunities.

- Major World Indices: Instead of picking individual stocks, you can trade the performance of an entire stock market. Access indices like the S&P 500 (USA), DAX (Germany), and FTSE 100 (UK) to tap into broader economic trends.

- Cryptocurrencies: Dive into the dynamic world of digital assets. Trade popular cryptocurrencies like Bitcoin and Ethereum, known for their volatility and potential for significant price swings.

We understand that adhering to faith-based principles is crucial. That’s why many platforms now offer Islamic accounts. These Sharia-compliant accounts operate without swap fees or interest (Riba), ensuring your trading activities align with your values. This feature makes it easier than ever for Saudi traders to participate in the global financial instruments market ethically.

Ensuring Security and Trust on OlympTrade for KSA Residents

When you step into the world of online trading, your first question should always be: “Is my capital secure?” For traders in the Kingdom of Saudi Arabia, this concern is paramount. We understand that trust is the bedrock of any financial partnership. That’s why we build our platform on a foundation of robust security measures, designed to give you peace of mind so you can focus on the markets.

Your financial security is not just a feature; it’s our core responsibility. We employ a multi-layered approach to protect your funds and personal data around the clock. Here’s a clear look at how we safeguard your trading journey:

- Regulatory Oversight: OlympTrade is a member of the Financial Commission (FinaCom). This independent body provides an external dispute resolution service, adding a significant layer of protection and ensuring fair practices for all traders.

- Secure Data Transmission: All data exchanged between your device and our servers is protected using modern encryption protocols. This means your personal information and transaction details are kept confidential and safe from unauthorized access.

- Account Verification (KYC): We adhere to strict Know Your Customer (KYC) policies. This verification process helps prevent fraud and ensures that you, and only you, can access and manage your funds.

- Segregated Accounts: We keep client funds in separate bank accounts, completely segregated from the company’s own operational funds. This practice ensures that your money is protected and available for withdrawal at all times.

A secure trading environment isn’t a luxury; it’s a necessity. We are committed to providing a platform where KSA traders can operate with confidence, knowing their assets are well-protected.

Security is a shared responsibility. While we build the fortress, you hold the key. Here is a simple breakdown of how we work together to keep your account safe.

| Your Role in Account Security | Our Commitment to Platform Security |

|---|---|

| Create a strong, unique password and never share it. | Implement advanced encryption across the entire platform. |

| Activate Two-Factor Authentication (2FA) for an extra layer of protection. | Conduct regular security audits to identify and patch vulnerabilities. |

| Be cautious of phishing attempts and only log in through the official site or app. | Monitor for suspicious activity and proactively protect accounts. |

By combining cutting-edge technology with internationally recognized standards, we create a transparent and reliable trading space. This allows our traders from Saudi Arabia to engage with the financial markets confidently, knowing a secure framework supports every decision they make.

OlympTrade Customer Support for Saudi Arabian Clients

In the dynamic world of trading, having reliable support is not just a benefit; it’s a necessity. When you have a question about a withdrawal or face a technical issue, you need fast and effective help. For traders in Saudi Arabia, knowing that a dedicated support team is ready to assist in your language and understands your needs provides crucial peace of mind. This allows you to focus on your trading strategy instead of worrying about platform problems.

Getting in touch with the support team is straightforward. OlympTrade offers several channels, ensuring you can always find help when you need it. Each method is designed for different types of queries, so you can choose the one that best suits your situation.

| Contact Method | Best For | Typical Response Time |

|---|---|---|

| Live Chat | Quick questions, platform navigation, and immediate technical issues. | Instant / Within minutes |

| Email Support | Detailed account inquiries, document submission, and non-urgent matters. | Within 24 hours |

| Online Help Center | Finding answers to common questions about deposits, verification, and tools. | Instant (Self-Service) |

Key Advantages for Saudi Traders:

- Arabic Language Support: Communicate your issues clearly in your native language. This eliminates misunderstandings and ensures you get the precise help you need without any language barrier.

- Cultural Understanding: The support team is familiar with the specific needs and common queries from the region, including questions related to local payment methods and verification processes.

- 24/7 Availability: The market never sleeps, and neither does support. Whether you trade early in the morning or late at night, a support agent is always available to assist you.

As a trader, I value speed and clarity above all else. Knowing I can open a chat and talk to someone in Arabic who understands my problem right away is a huge advantage. It lets me resolve issues quickly and get back to the charts.

The support team can help you with a wide range of topics. From initial account setup and verification (KYC) to navigating complex platform features, they are trained to provide comprehensive assistance. If you have questions about transaction history, bonus conditions, or how to use a specific indicator, the support team is your first point of contact for a clear and helpful explanation.

Pros and Cons of Using OlympTrade in Saudi Arabia

Are you a trader in Saudi Arabia considering OlympTrade? It’s a popular platform, but it’s crucial to look at both sides of the coin before you commit. Every trading platform has its unique advantages and potential drawbacks. Understanding these can help you decide if it aligns with your trading strategy and goals. Let’s dive into an honest breakdown to see if OlympTrade is the right fit for you.

| Advantages for Traders | Potential Drawbacks |

|---|---|

|

|

As a fellow trader, my best advice is this: Your choice of broker directly impacts your trading journey. Always prioritize what makes you feel secure, whether that’s strong regulation, fast withdrawals, or a simple interface.

Ultimately, the decision rests on your priorities. If you are starting out and value simplicity and a low entry cost, OlympTrade presents a compelling option. However, if your focus is on robust regulatory protection and advanced trading tools, you may want to weigh your options carefully. Always conduct your own due diligence before investing.

Trading On-the-Go: The OlympTrade Mobile App in KSA

Life in Saudi Arabia moves fast. You are always on the move, from business meetings to family gatherings. So why should your trading be stuck at a desk? The market waits for no one, and crucial opportunities can appear in an instant. This is where the OlympTrade mobile app completely changes the game for traders across the Kingdom. It puts the full power of a trading platform directly into the palm of your hand.

Imagine catching a crucial market reversal while waiting for your coffee in Jeddah or managing your positions from the comfort of your majlis. The power to trade Forex, stocks, and other assets is right in your pocket. This flexibility means you never miss a potential setup again. The OlympTrade mobile app puts the global markets at your fingertips, wherever you are in KSA.

What makes this app a favorite among local traders? It packs a powerful punch without being complicated. Here’s a quick look at what you get:

- An intuitive and clean user interface, perfect for both beginners and seasoned pros.

- Full access to a wide range of trading instruments, just like the desktop version.

- Built-in charting tools and indicators for on-the-spot technical analysis.

- Instant notifications and alerts for price movements and market news.

- Secure and fast deposits and withdrawals directly from your phone.

Of course, trading on a smaller screen has its own dynamics. Let’s look at a balanced view:

| Advantages of the Mobile App | Potential Disadvantages |

|---|---|

| Complete freedom to trade from anywhere | Smaller screen can limit complex chart analysis |

| Instant access to markets for timely trades | Relies on a stable mobile internet connection |

| User-friendly design for quick navigation | Can be distracting in a busy environment |

| Real-time alerts keep you informed | Potential for accidental trades if not careful |

“I used to feel chained to my laptop. Now, with the OlympTrade app, I manage my portfolio between meetings in Riyadh. It’s given me a new level of freedom and control over my trading.”

Embracing mobile trading is no longer a luxury; it’s a necessity for the modern trader in Saudi Arabia. The OlympTrade mobile app provides the tools, access, and flexibility you need to stay ahead of the curve. It simplifies your trading journey, allowing you to react to the market in real-time. Take control of your trades and experience the freedom of a truly mobile trading platform.

Educational Resources and Tools for Saudi Beginners

Starting your journey in forex trading is an exciting venture, especially within the dynamic economy of Saudi Arabia. But before you place your first trade, building a strong foundation of knowledge is key. Jumping in without a map can be costly. The good news is, a wealth of educational resources and powerful trading tools are available to help new traders navigate the markets with confidence. Let’s explore the essentials that will shape you into a smarter, more prepared trader.

Your education is your greatest asset. Think of it as the bedrock upon which you’ll build your trading career. Focus on understanding the core principles first.

- Structured Online Courses: Look for comprehensive programs that cover everything from the absolute basics of what forex is, to complex topics like technical analysis and fundamental analysis. A good course provides a clear learning path for beginner traders.

- Webinars and Seminars: Many experts host live sessions where you can learn in real-time and ask questions. These are great for understanding current market sentiment and seeing professional analysis in action.

- Reputable Financial News Outlets: The forex market is driven by global events. Make it a daily habit to read news from major financial sources to understand how economic data, political shifts, and central bank policies affect currency pairs.

- Trading Books: Don’t underestimate the power of a good book. Classic texts on trading psychology, risk management, and charting patterns offer timeless wisdom that is essential for long-term success.

Once you have a grasp of the theory, you need the right trading tools to apply it. These are not just gadgets; they are your instruments for analyzing the market and executing your strategy.

| Tool | Primary Function | Why It’s Essential for Beginners |

|---|---|---|

| Demo Account | Practice trading with virtual money | Allows you to test your strategies, learn the trading platform, and make mistakes without any real financial risk. It’s your personal training ground. |

| Charting Platform | Visualize price movements and apply indicators | This is crucial for technical analysis. Learning to read charts, identify trends, and use indicators is a fundamental skill for every trader. |

| Economic Calendar | Tracks upcoming financial news and events | Helps you anticipate market volatility. You’ll know when major announcements (like interest rate decisions or employment data) are scheduled. |

| Trading Journal | Record your trades, thoughts, and outcomes | This is your feedback loop. It helps you identify what’s working, what’s not, and control your emotions by holding yourself accountable. |

Remember this: The most important tool is not on any platform. It’s a solid risk management plan. Never risk more than you are willing to lose on a single trade, and always know your entry and exit points before you commit capital. This discipline separates successful traders from gamblers.

Top OlympTrade Alternatives for Saudi Arabian Traders

The world of online trading is constantly evolving. As a trader in Saudi Arabia, you need a platform that not only keeps up but also caters specifically to your needs. While many start with popular platforms, exploring OlympTrade alternatives can open doors to better trading conditions, a wider range of assets, and stronger regulatory oversight. Finding the right fit is crucial for your trading journey’s success.

Every trader has a unique style. What works for one might not be ideal for another. That’s why we’ve looked at what makes a great trading platform for the Saudi market. Key factors include robust regulation, availability of Sharia-compliant accounts, and a diverse selection of instruments. Let’s compare some popular characteristics you might find in leading platforms.

Key Platform Feature Comparison

| Feature Focus | Broker Type A (Global Leader) | Broker Type B (CFD Specialist) | Broker Type C (Regional Expert) |

|---|---|---|---|

| Primary Regulation | Top-tier (FCA, CySEC, ASIC) | Varies (Often CySEC or FSA) | Strong regional presence (DFSA, CMA) |

| Islamic Account | Widely available, fully compliant | Available upon request | Standard, core offering |

| Asset Variety | Extensive (Forex, Stocks, Indices, Commodities) | Deep focus on Forex and Indices CFDs | Strong on local stocks (Tadawul) and Forex |

| Customer Support | 24/5 Multilingual support | Standard business hours, email/chat focused | Dedicated Arabic support, local phone lines |

What to Prioritize When Choosing a New Broker

When you decide to switch, keep these critical points in mind to ensure you make the right choice:

- Regulatory Security: Your funds’ safety is paramount. Look for brokers regulated by respected authorities. This provides a layer of protection and ensures the broker adheres to strict financial standards.

- Swap-Free Accounts: For traders in Saudi Arabia, the availability of a true Islamic account is non-negotiable. Ensure the platform offers swap-free trading that aligns with Sharia principles, without hidden fees or penalties.

- Trading Costs: Analyze the spreads, commissions, and overnight fees. Low costs can significantly impact your profitability over time. Look for transparent fee structures with no surprises.

- Platform Stability: A platform that freezes or lags during volatile market moments is a trader’s worst nightmare. Test the execution speed and reliability, perhaps with a demo account first.

- Local Services: Check for easy deposit and withdrawal methods popular in Saudi Arabia. A broker that understands the local financial landscape makes managing your funds much smoother.

A trader’s best tool is not a complex indicator, but a reliable and trustworthy broker. Take the time to research your options; your trading capital deserves the best environment to grow.

Ultimately, the best platform is the one that aligns with your personal trading strategy, risk tolerance, and financial goals. Exploring OlympTrade alternatives gives you the power to find a provider that truly supports your ambitions in the dynamic forex market.

Important Tips for Safe Online Trading in Saudi Arabia

Navigating the vibrant financial markets from Saudi Arabia offers incredible opportunities. However, your first priority must always be the security of your capital. Smart trading begins with safe trading. By following a few essential guidelines, you can protect your investments and build a sustainable trading career. Let’s explore the key steps to ensure your online trading journey is both profitable and secure.

The cornerstone of safe online trading is choosing the right broker. A reputable and well-regulated broker acts as your guardian in the markets. Look for brokers overseen by top-tier financial authorities. This regulation ensures that the broker adheres to strict standards, including the segregation of client funds, which means your money is kept separate from the company’s operational funds. This is a critical layer of protection for your investment.

Essential Safety Checklist for Traders

- Verify Broker Regulation: Always double-check a broker’s regulatory claims on the official regulator’s website. Do not just take their word for it.

- Enable Two-Factor Authentication (2FA): Add an extra layer of security to your trading account. This makes it significantly harder for unauthorized users to gain access.

- Beware of Unrealistic Promises: If an offer sounds too good to be true, it almost certainly is. Legitimate trading involves risk, and there are no guarantees of high returns.

- Practice on a Demo Account: Before risking real money, use a demo account to familiarize yourself with the platform and test your strategies in a risk-free environment.

- Secure Your Connection: Avoid using public Wi-Fi networks for trading activities. Use a secure, private network to protect your sensitive data from potential threats.

Adopting a disciplined mindset is just as important as your technical setup. Here are some fundamental do’s and don’ts to guide your decisions.

| Do’s | Don’ts |

|---|---|

| Conduct thorough research on any asset before investing. | Invest money you cannot afford to lose. |

| Use risk management tools like stop-loss orders. | Let emotions like fear or greed drive your trading decisions. |

| Keep a detailed trading journal to track your progress. | Follow trading signals from unverified sources blindly. |

The most important rule of trading is to play great defense, not great offense. Every day I assume every position I have is wrong.

By integrating these safety tips into your routine, you create a secure foundation for your trading activities. Protecting yourself from scams and unnecessary risks allows you to focus on what truly matters: analyzing the markets and executing your strategy effectively. Trade smart, stay safe, and unlock your potential in the global markets.

Frequently Asked Questions

What is OlympTrade’s regulatory status in Saudi Arabia?

While OlympTrade is not regulated by the local Saudi Capital Market Authority (CMA), it operates as an international broker accessible to KSA traders and is a member of the Financial Commission (FinaCom), which provides an external dispute resolution service.

Does OlympTrade offer Sharia-compliant accounts for Saudi traders?

Yes, OlympTrade provides a Sharia-compliant (Islamic) account option. These accounts are swap-free, meaning no interest (Riba) is charged or paid on overnight positions, aligning with Islamic finance principles.

What payment methods are available for deposits and withdrawals in Saudi Arabia?

OlympTrade offers various deposit and withdrawal methods for Saudi users, including bank cards (Visa/Mastercard), popular e-wallets (Skrill, Neteller), and local bank transfers, providing flexibility and convenience.

Is the OlympTrade mobile app available for traders in KSA?

Yes, the OlympTrade mobile app is available for traders in Saudi Arabia, offering full platform functionality, charting tools, and secure transactions on-the-go, compatible with both Android and iOS devices.

What kind of customer support can Saudi traders expect from OlympTrade?

OlympTrade provides 24/7 customer support via live chat and email, including Arabic language support, ensuring Saudi traders can receive timely assistance on account queries, technical issues, and platform navigation.