You’ve seen the name pop up, maybe a friend mentioned it, and now you’re asking the most important question a trader can ask: Is Olymp Trade a legitimate platform or a scam waiting to happen? It’s a valid concern. As a trader who has navigated these markets for over ten years, I’ve learned that your choice of broker is one of the most critical decisions you’ll make. It can be the difference between a successful journey and a frustrating dead end.

That’s why I decided to create this in-depth Olymp Trade review for 2024. This isn’t just a summary of features scraped from their website. This is a hands-on analysis from one trader to another. We’re going to cut through the marketing hype and get down to what really matters for your trading performance and the safety of your funds.

So, how do we determine if a broker is the real deal? We need to evaluate it based on several non-negotiable criteria:

- Regulation & Trust: Is the broker accountable to any financial authority? This is the first and most crucial checkpoint.

- Trading Platform: Is the software stable, fast, and intuitive? A clunky platform can cost you money.

- Assets & Trading Conditions: What can you trade, and are the fees, spreads, and leverage competitive?

- Deposits & Withdrawals: How easy is it to fund your account and, more importantly, withdraw your profits?

- Customer Support: When you need help, is there a competent team ready to assist you?

Throughout this review, we’ll break down each of these elements piece by piece. My goal is to give you a clear, unbiased picture so you can decide confidently if Olymp Trade aligns with your trading goals. Let’s get started.

- What is Olymp Trade? An Overview for Beginners

- Why Beginners Often Start with Olymp Trade

- Two Main Ways to Trade: FTT vs. Forex

- Is Olymp Trade Safe? A Deep Dive into Regulation and Security

- The Shield of Regulation: The Financial Commission

- Your Account’s Digital Fortress: Security Tech

- Safety Features at a Glance

- Membership with the Financial Commission (FinaCom)

- User Fund Protection and Security Protocols

- Evaluating the Olymp Trade Trading Platform

- First Impressions: User Interface and Experience

- Key Platform Features at a Glance

- Available Assets to Trade

- Platform Pros and Cons

- Web Platform and Desktop App Features

- Core Functionality at Your Fingertips

- Web Platform vs. Desktop App

- Olymp Trade Mobile App Review (iOS & Android)

- Core Functionality at Your Fingertips

- User Experience and Interface

- Tradable Assets and Markets Available

- A Look at the Asset Classes

- Quick Glance: Popular Assets

- Account Types Explained: From Demo to Expert Status

- The Demo Account: Your Risk-Free Training Ground

- The Standard Account: Where the Real Action Begins

- Reaching the Top: Advanced and Expert Status

- How to Choose the Right Account for You

- Olymp Trade Fees, Commissions, and Spreads

- Understanding the Spread

- The Commission Model: Pros and Cons

- Advantages

- Disadvantages

- Watch Out for Other Fees

- Deposit and Withdrawal Methods: Speed & Reliability

- Funding Your Account: The Deposit Process

- Cashing Out: The Withdrawal Experience

- Key Advantages and Considerations

- Advantages

- Points to Keep in Mind

- Assessing the Quality of Customer Support

- Educational Resources and Tools for Traders

- Key Tools for Your Arsenal

- Pros and Cons: A Balanced Olymp Trade Review

- Key Advantages of Using Olymp Trade

- Potential Disadvantages to Consider

- How Does Olymp Trade Compare to Other Brokers?

- Platform & User Experience

- Asset Diversity

- Key Differences at a Glance

- The Bottom Line: Accessibility and Education

- What Real Users Say: Olymptrade Reviews from Trustpilot & Reddit

- Insights from Trustpilot

- The Reddit Deep Dive

- Key Takeaways from Reddit Discussions:

- Trustpilot vs. Reddit: A Quick Comparison

- Final Verdict: Should You Trade with Olymp Trade in 2024?

- Who is Olymp Trade Best For?

- Frequently Asked Questions

What is Olymp Trade? An Overview for Beginners

Hey fellow trader! If you’re just starting your journey into the exciting world of online trading, you’ve likely come across the name Olymp Trade. It’s a platform that gets a lot of attention, so let’s cut through the noise and see what it’s all about. Think of this as a straightforward look at what you can expect.

At its core, Olymp Trade is an international online trading platform that gives you access to financial markets. It allows you to speculate on the price direction of various assets, from currency pairs in the Forex market to stocks and commodities. The platform’s main goal is to make trading accessible, especially for those who are just starting out and might feel intimidated by more complex brokerage systems.

When crafting any honest Olymp Trade review, it’s vital to highlight the features designed specifically for newcomers. The platform isn’t just a single tool; it’s a complete ecosystem built to help you learn and grow.

Why Beginners Often Start with Olymp Trade

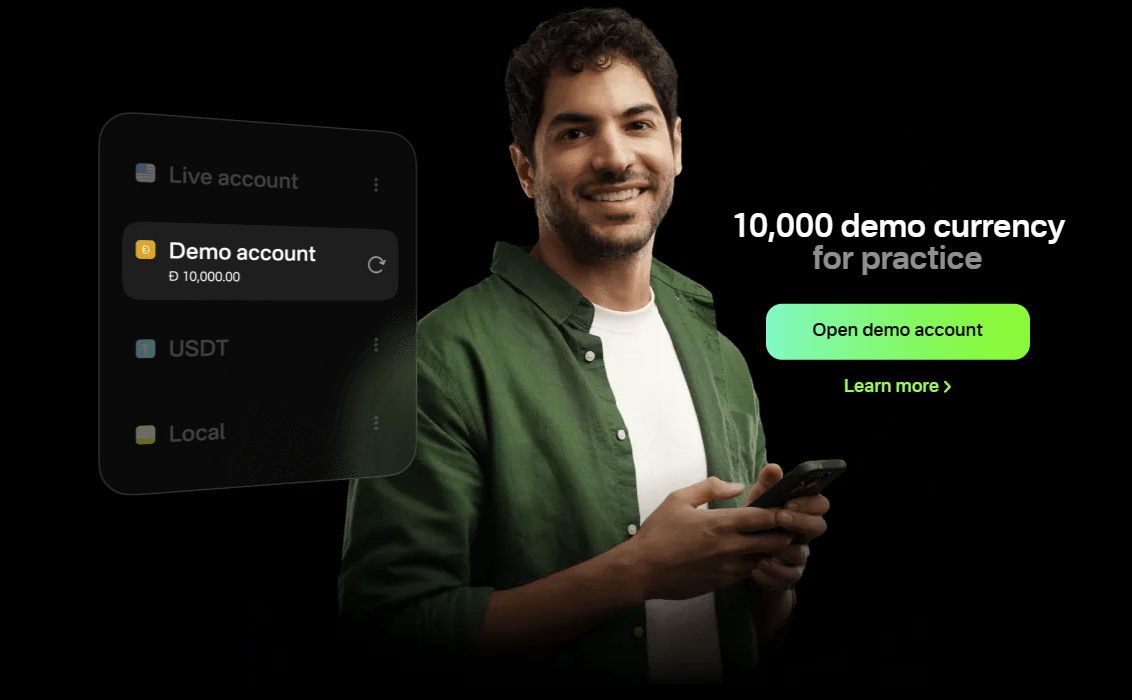

- Free Demo Account: You get $10,000 in virtual funds to practice with. This is your risk-free sandbox to test strategies, understand how the platform works, and build your confidence before committing real capital.

- Low Entry Barrier: You don’t need a huge bankroll to start. The minimum deposit is typically very low, allowing you to get a feel for real-money trading without significant financial risk.

- Educational Resources: The platform offers a wealth of free educational materials. You’ll find webinars, video tutorials, and articles covering everything from basic concepts to advanced trading strategies.

- User-Friendly Interface: The platform is clean, intuitive, and easy to navigate. You won’t be overwhelmed by a dozen confusing charts and buttons. Everything you need is clearly laid out.

Two Main Ways to Trade: FTT vs. Forex

Olymp Trade offers two primary modes for trading, each catering to a different style. Understanding the difference is key to choosing the right path for you.

| Feature | Fixed Time Trades (FTT) | Forex Mode |

|---|---|---|

| Concept | Predict if an asset’s price will go up or down within a fixed time frame (e.g., 1 minute). | Traditional Forex trading where you open a position and close it when you want. |

| Profit & Loss | Profit is a fixed percentage of your investment. You know the exact potential gain or loss upfront. | Profit/loss is unlimited and depends on how much the price moves in your favor. You use tools like Stop Loss and Take Profit. |

| Complexity | Simpler. Great for beginners learning to read price action. | More complex. Involves understanding leverage, margin, and pips. |

| Best For | Quick, short-term trades and learning market direction. | Longer-term strategies and potentially larger returns. |

Ultimately, Olymp Trade provides a structured environment for you to step into the trading arena. Its focus on education and a low barrier to entry makes it a popular choice for traders taking their first steps. The best approach? Open a demo account and see for yourself. There’s no better way to understand a platform than by using it.

Is Olymp Trade Safe? A Deep Dive into Regulation and Security

Let’s cut to the chase. As traders, our number one question before depositing a single dollar is: \”Is my money safe?\” It’s the foundation of everything. You could have the best strategy in the world, but it means nothing if your broker is a ghost. So, let’s put Olymp Trade under the microscope and look at the facts surrounding its regulation and security features.

The Shield of Regulation: The Financial Commission

One of the first things I check is a broker’s regulatory status. Olymp Trade has been a member of the International Financial Commission (FinaCom) since 2016. What does this mean for you and me? FinaCom is an independent external dispute resolution (EDR) body that specializes in forex and financial markets. Their oversight provides several layers of protection for traders.

- Neutral Dispute Resolution: If you ever have a dispute with the broker that you can’t resolve directly, FinaCom acts as a neutral third-party judge. They will investigate your case impartially.

- Compensation Fund: This is a massive confidence booster. As a member, Olymp Trade’s clients are protected by a Compensation Fund that covers up to €20,000 per case. This means if the broker were to act improperly and a judgment is made in your favor, your funds are protected up to that amount.

- Quality Assurance: FinaCom regularly assesses brokers for compliance, ensuring high standards of business practice are maintained.

Your Account’s Digital Fortress: Security Tech

Beyond formal regulation, the platform’s own security is crucial for protecting your data and funds from online threats. Here’s where Olymp Trade stands:

- Segregated Funds: The company keeps client funds in separate bank accounts, completely apart from its own operational funds. This is standard practice for reputable brokers and ensures your money isn’t used for company expenses.

- SSL Encryption: All data transmitted between your device and the platform’s servers is secured with SSL encryption. This protects your personal information and transaction details from being intercepted.

- Two-Factor Authentication (2FA): I strongly recommend enabling this feature. It adds an extra layer of security to your account, requiring a code from your phone in addition to your password to log in.

When you read a detailed Olymp Trade review, these security protocols are often highlighted as a key strength. It shows a commitment to creating a secure trading environment, which is something I personally value highly. It allows me to focus on my charts and analysis, not on worrying about the safety of my capital.

“I’ve personally processed multiple withdrawals from my Olymp Trade account over the years. The process has always been straightforward and timely. For me, seeing the money arrive in my bank account consistently is the ultimate proof of a broker’s reliability.”

Safety Features at a Glance

To make it even clearer, here is a simple breakdown of the core safety components that protect you as a trader on the platform.

| Feature | Benefit for the Trader |

|---|---|

| FinaCom Membership | Provides third-party dispute resolution and a compensation fund. |

| Segregated Accounts | Your funds are kept separate from the company’s, ensuring they can’t be misused. |

| Regular Audits | The platform’s execution quality is verified by independent parties. |

| 2FA & SSL | Protects your account and personal data from unauthorized access. |

In conclusion, based on its long-standing membership with FinaCom, robust technical security measures, and a proven track record, Olymp Trade establishes itself as a safe platform for traders. The combination of external oversight and internal security protocols creates a framework where you can trade with peace of mind.

Membership with the Financial Commission (FinaCom)

As traders, we always look for an edge. But sometimes, the most important edge isn’t a strategy—it’s security. What happens when you have a serious dispute with your broker? This is where an independent body like the Financial Commission (FinaCom) becomes your most valuable ally.

FinaCom is a neutral, third-party organization that specializes in resolving disputes within the financial markets. Think of it as a dedicated referee for traders and brokers. Their involvement ensures that your complaints are heard fairly and impartially. When I conduct a thorough Olymp Trade review, for example, their long-standing membership with FinaCom is a significant checkmark in the trust column. It shows they are committed to transparency and are not afraid of external oversight.

So, what does this mean for you as a trader? It means you have a powerful safety net.

- Impartial Dispute Resolution: If you can’t resolve an issue directly with your broker, you can file a complaint with FinaCom. They will investigate your case and provide a fair, unbiased decision.

- Compensation Fund Protection: This is a game-changer. FinaCom members contribute to a Compensation Fund. If a broker refuses to adhere to a judgment from the Commission, you may be eligible for compensation of up to €20,000 from this fund.

- Expert Evaluation: Your case is reviewed by a Dispute Resolution Committee made up of industry professionals, ensuring a high level of expertise.

- Broker Vetting: For a broker to become a member, they must demonstrate a history of consistent and reliable business practices. This acts as a quality filter for you.

Choosing a broker with FinaCom membership isn’t just about following rules. It’s about ensuring your capital is protected by more than just the broker’s own promises. It’s an independent layer of security for your peace of mind.

Ultimately, trading with a FinaCom member broker means you are not alone. You have a powerful, recognized body ready to stand up for your rights. It’s a critical factor to consider before you deposit your hard-earned money with any platform.

User Fund Protection and Security Protocols

Let’s talk about something that keeps many traders up at night: the safety of their money. You can have the best strategy in the world, but it means nothing if your funds aren’t secure. Before I commit my capital to any platform, I perform a deep dive into its security framework. This is a non-negotiable part of any serious evaluation.

So, what should you look for? A solid broker builds a fortress around your funds and data. In my own Olymp Trade review process, I specifically check for a multi-layered security approach. These are the critical pillars of protection that I insist on seeing:

- Segregated Accounts: This is the big one. It means the broker holds client funds in accounts completely separate from their own operational funds. Your money isn’t used to pay their bills. This ensures that even in the unlikely event the company faces financial trouble, your capital remains protected.

- Data Encryption: All communication between your device and the broker’s servers must be encrypted. Look for Secure Sockets Layer (SSL) or Transport Layer Security (TLS) protocols. This scrambles your personal information, passwords, and transaction details, making them unreadable to potential eavesdroppers.

- Two-Factor Authentication (2FA): This adds a crucial second layer of security to your account. Even if someone manages to steal your password, they can’t log in without access to your secondary device, like your phone. I always enable 2FA wherever it’s offered.

- Regular Audits and Compliance: Reputable platforms often undergo independent audits to verify their financial statements and operational integrity. Adherence to Know Your Customer (KYC) and Anti-Money Laundering (AML) policies also helps prevent fraudulent activity on the platform.

To make it even clearer, here’s a breakdown of why these security features are so vital for you, the trader:

| Security Feature | What It Protects | Why It’s a Game-Changer |

|---|---|---|

| Segregated Funds | Your Trading Capital | Protects your money from the broker’s business risks and potential insolvency. |

| SSL/TLS Encryption | Your Personal & Financial Data | Prevents hackers from intercepting and stealing sensitive information during transactions. |

| Two-Factor Authentication (2FA) | Your Account Access | Stops unauthorized logins even if your password is compromised. |

“Trust is earned in drops and lost in buckets. For a broker, that trust begins and ends with how they secure your funds.”

Ultimately, a comprehensive Olymp Trade review or an analysis of any other broker must prioritize these security protocols. Trading involves enough risk as it is; your broker’s security shouldn’t be one of them. Always choose a platform that treats your financial safety as its top priority.

Evaluating the Olymp Trade Trading Platform

As a trader, your platform is your primary tool. It’s your cockpit, your analysis station, and your execution desk all in one. A slow or confusing interface can mean the difference between a winning trade and a missed opportunity. That’s why, when I conduct an Olymp Trade review, I start with a hands-on evaluation of the trading platform itself. It needs to be fast, reliable, and intuitive. Let’s break down what you get.

First Impressions: User Interface and Experience

The first thing you’ll notice is the clean, modern design. The layout isn’t cluttered with a million buttons and windows. They clearly designed it with the user in mind. Finding assets, changing chart types, and executing a trade is straightforward. This is a huge advantage for traders who are just starting out, as it significantly shortens the learning curve. You can focus on your strategy, not on figuring out the software.

Key Platform Features at a Glance

A pretty interface is nice, but what’s under the hood? The platform packs a solid set of tools that cater to both new and intermediate traders. Here’s what you can expect:

- Charting Tools: You get access to multiple chart types, including classic Japanese Candlesticks, Heikin Ashi, and Bars. Adjusting timeframes from a few seconds to a month is simple.

- Technical Indicators: The platform comes loaded with popular indicators. You’ll find everything from Moving Averages and Bollinger Bands to RSI and MACD to build your technical strategy.

- Integrated Analysis: They provide market analysis and trading signals directly within the platform. This is a great feature for spotting potential opportunities without having to leave your trading screen.

- Risk Management: You can easily set Stop Loss and Take Profit levels on your Forex trades, which is a non-negotiable feature for responsible trading.

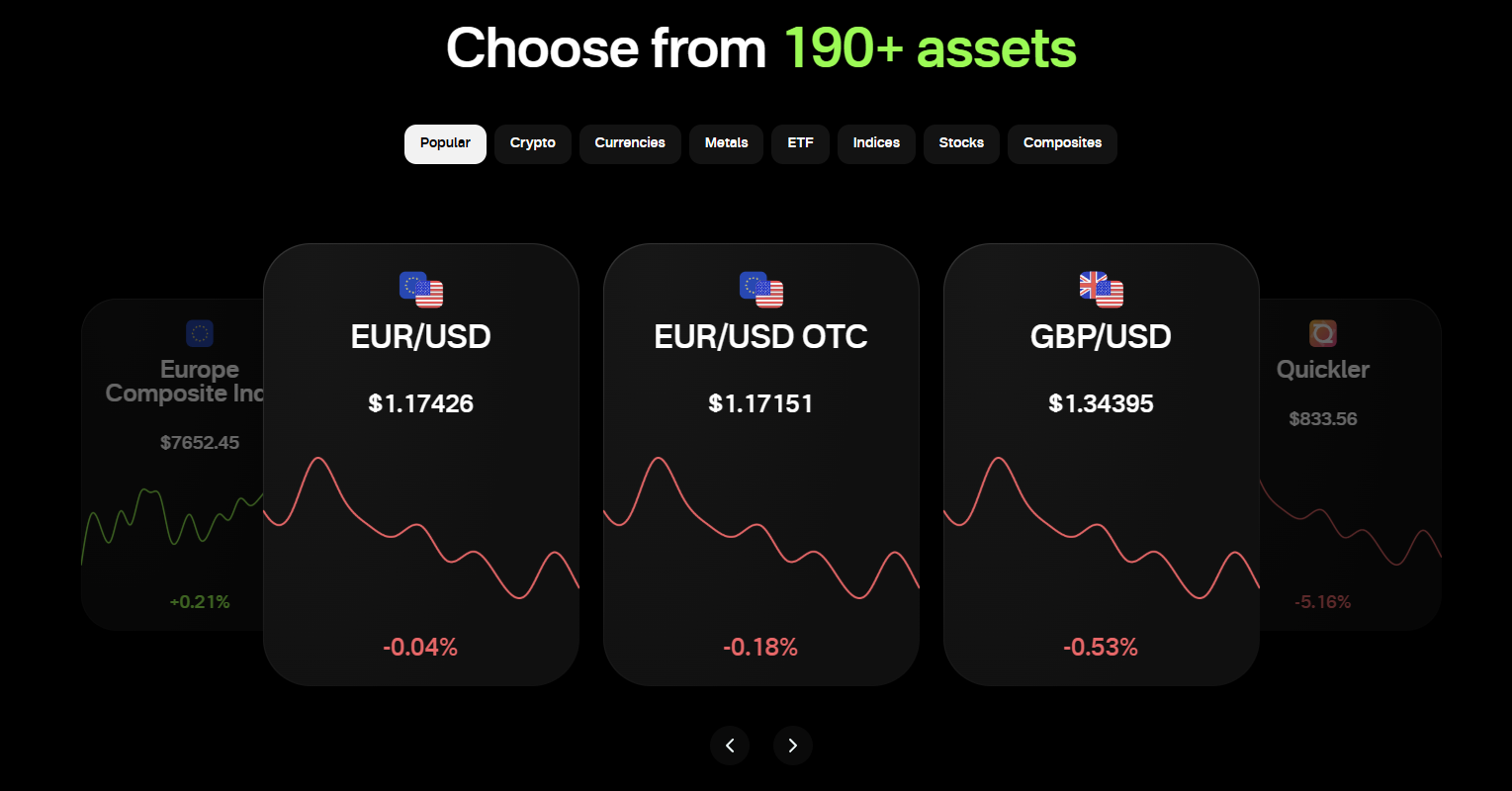

Available Assets to Trade

A good platform needs a good variety of instruments. Olymp Trade offers a diverse selection across different markets, allowing you to diversify your trading activities. Here’s a quick look at what’s on offer:

| Asset Category | Examples |

|---|---|

| Forex Pairs | EUR/USD, GBP/JPY, AUD/CAD |

| Stocks | Apple, Microsoft, Tesla |

| Indices | S&P 500, Dow Jones |

| Commodities | Gold, Silver, Brent Oil |

| Cryptocurrencies | Bitcoin, Ethereum |

Platform Pros and Cons

No Olymp Trade review would be complete without a balanced look. Every platform has its strengths and weaknesses depending on the trader’s needs.

| Advantages | Disadvantages |

|---|---|

| Extremely user-friendly and intuitive interface. | Pro traders may miss some niche indicators found on platforms like MT4/MT5. |

| Excellent integration of educational resources and market analysis. | Leverage options might be more limited than on some specialized Forex brokers. |

| Solid performance on both desktop and mobile app. | The focus on simplicity means fewer advanced customization options. |

The platform’s greatest asset is its accessibility. It successfully removes the intimidating barriers many new traders face, allowing them to build confidence and skills in a supportive environment.

Ultimately, the platform is well-built for its target audience. It provides all the essential tools you need to analyze the markets and manage your trades effectively, without overwhelming you with unnecessary complexity. For traders looking for a straightforward and reliable entry point into the markets, it’s a very strong contender.

Web Platform and Desktop App Features

Your trading platform is your command center. It’s where you analyze charts, place trades, and manage your risk. A clunky, slow platform can cost you money. A slick, responsive one can give you an edge. Let’s break down what you get with both the web-based version and the dedicated desktop application.

Core Functionality at Your Fingertips

Both the web and desktop platforms are designed for efficiency. You won’t get lost in a maze of confusing menus. Everything you need is right there.

- Intuitive Interface: Clean charts and a simple layout mean you can focus on trading, not on figuring out how the platform works.

- Advanced Charting Tools: You can switch between different chart types like Japanese candlesticks, bars, and Heikin Ashi. Plus, you get a full suite of technical indicators and drawing tools to perform your analysis.

- One-Click Trading: Speed is critical in trading. The option for one-click order execution helps you enter or exit a position without delay, which is vital during fast-moving market events.

- Personalized Layout: Arrange your workspace the way you want it. Set up multiple charts, save your favorite indicators, and create a trading environment that suits your style.

Web Platform vs. Desktop App

While both options offer a robust trading experience, there are subtle differences. Here’s a quick comparison to help you decide which is right for you.

| Feature | Web Platform | Desktop App |

|---|---|---|

| Accessibility | Access from any computer with a browser and internet | Requires installation on your specific Mac or Windows PC |

| Performance | Good, but can depend on browser performance | Generally faster and more stable, independent of browser tabs |

| Updates | Automatic, always the latest version | May require occasional manual updates |

| Notifications | Browser-based pop-ups | Native desktop notifications |

During my comprehensive Olymp Trade review, I personally tested both versions extensively. I found the desktop app offers a slight performance advantage, especially when running multiple charts and indicators. It feels a bit snappier and is my go-to for serious trading sessions at home. The web platform, however, is unbeatable for its convenience and flexibility.

“A great platform doesn’t guarantee profits, but a bad one can certainly guarantee losses. Choose the tool that best fits your trading routine and hardware.”

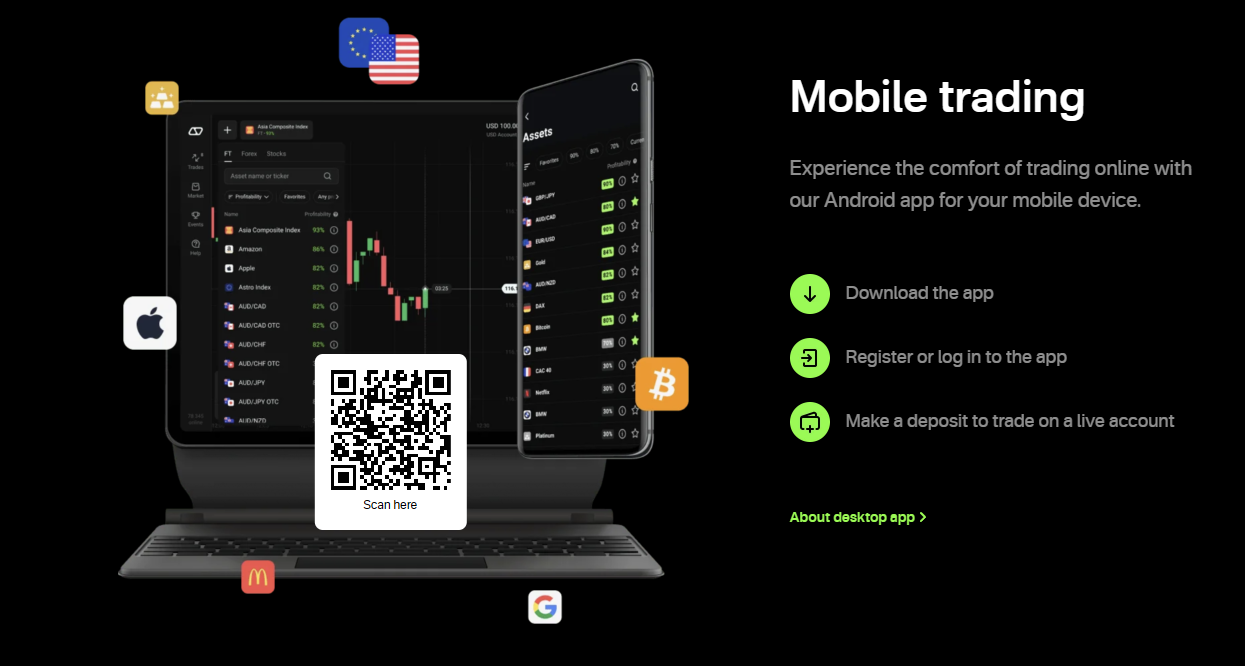

Olymp Trade Mobile App Review (iOS & Android)

As traders, we live and breathe the markets. The action doesn’t stop when you step away from your desktop. That’s why a reliable mobile trading app is non-negotiable. I’ve put the Olymp Trade app through its paces on both iOS and Android devices to give you a real-world perspective. This isn’t just a feature list; it’s a trader’s take on whether this app can handle the pressure.

Right out of the gate, the app provides a seamless transition from the desktop platform. You don’t feel like you’re using a watered-down version. You get access to the core tools you need to make informed decisions on the go.

Core Functionality at Your Fingertips

What can you actually do with it? Pretty much everything you need for daily trading. The app isn’t just for checking your balance; it’s a full-fledged trading station.

- Full-Featured Charting: Access various chart types, timeframes, and a solid selection of technical indicators and drawing tools.

- Complete Trade Management: Open, monitor, and close positions for Forex, Fixed Time Trades, and other available assets. Setting up Stop Loss and Take Profit is straightforward.

- Account Operations: Easily deposit funds or request withdrawals directly within the app. The process is secure and intuitive.

- Market Analysis & Education: Stay updated with built-in market signals, economic calendars, and access to the educational content Olymp Trade provides.

- Customizable Alerts: Set price alerts for your favorite assets so you never miss a potential trading opportunity.

User Experience and Interface

The design is clean and uncluttered. On both my iPhone and my Samsung tablet, the interface adapted perfectly to the screen size. Finding assets is quick, and placing a trade takes just a few taps. There’s no frustrating lag or confusing menus, which is critical when you need to act fast on a market move. The dark mode is a nice touch for late-night analysis sessions, reducing eye strain significantly.

| Advantages | Disadvantages |

|---|---|

| Intuitive and user-friendly interface. | The smaller screen can limit complex, multi-indicator analysis. |

| Full functionality of the desktop platform. | Can be a drain on your phone’s battery during long sessions. |

| Fast execution and stable performance. | Notifications can be distracting if not managed properly. |

| Available and optimized for both iOS and Android. | Reliant on a good mobile data or Wi-Fi connection. |

“For a trader on the move, the Olymp Trade app isn’t just a convenience; it’s a powerful tool that keeps you connected to the markets without compromise.”

Ultimately, my complete Olymp Trade review for its mobile app is overwhelmingly positive. It’s stable, fast, and gives you the power to manage your portfolio effectively from anywhere. Whether you’re a beginner who appreciates simplicity or an experienced trader who demands reliability, the app delivers on its promises. It has earned a permanent spot on my phone’s home screen.

Tradable Assets and Markets Available

As a trader, your playground is the market. The more assets you have access to, the more opportunities you can find. A platform that limits your choices is like trying to build a house with only a hammer. You need a full toolbox. In this section of our comprehensive Olymp Trade review, we’ll explore the variety of instruments you can trade, giving you a clear picture of the possibilities.

Having a diverse portfolio isn’t just for Wall Street veterans; it’s a smart strategy for every trader. It allows you to adapt to global news, economic shifts, and changing market sentiment without being stuck in a single, underperforming asset class.

A Look at the Asset Classes

The platform offers a robust selection across several major categories, ensuring there’s something for every trading style and strategy.

- Forex Pairs: This is the bread and butter for many traders. You’ll find all the majors like EUR/USD and GBP/USD, minors, and even some exotic pairs to capitalize on global currency movements.

- Stocks: Want a piece of the action from global giants? You can trade stocks of leading companies like Apple, Microsoft, and Tesla. This is perfect for reacting to earnings reports or industry news.

- Indices: Instead of picking one stock, you can trade the performance of an entire market. Access popular indices like the S&P 500, Dow Jones, and NASDAQ to take a position on the health of the U.S. economy.

- Commodities: Trade the raw materials that power the world. This includes precious metals like Gold and Silver, which often act as safe-haven assets, as well as energies like Oil.

- Cryptocurrencies: The digital frontier of finance is right here. You can trade major cryptocurrencies like Bitcoin and Ethereum, capitalizing on their famous volatility and 24/7 market action.

Quick Glance: Popular Assets

Here’s a simple table to show you the kind of diversity you can expect. This helps you quickly see how different assets serve different strategic purposes.

| Asset Category | Example | Best For Trading… |

|---|---|---|

| Forex | EUR/USD | High-volume, news-driven intraday moves. |

| Stocks | AAPL (Apple Inc.) | Company-specific news and earnings reports. |

| Commodities | Gold (XAU/USD) | Market uncertainty and inflation hedging. |

| Cryptocurrencies | Bitcoin (BTC) | High volatility and trend-following strategies. |

“Don’t ever let your platform dictate your strategy. Your strategy should demand a platform with options. If I only traded one asset, I’d have missed 90% of my best trades last year.”

The wide selection of assets is a major plus we had to highlight in this Olymp Trade review. It empowers you to not just follow one market but to truly scan the global financial landscape for the best possible opportunities, no matter where they arise.

Account Types Explained: From Demo to Expert Status

Every trader’s journey is unique, but we all start somewhere. Choosing the right account type is like picking the right gear for a climb. You wouldn’t tackle Mount Everest in flip-flops, right? The same logic applies to trading. Your account should match your skill level, your goals, and your strategy. Let’s break down the typical path from a complete beginner to a seasoned trading expert.

The Demo Account: Your Risk-Free Training Ground

Think of the demo account as your personal trading simulator. It’s the single most important tool for any new trader. Here, you get to play with virtual money on the live market. You can test strategies, get a feel for the platform’s speed, and learn to manage your emotions without risking a single cent of your own capital. It’s your sandbox to build your trading castle in.

What makes a demo account essential?

- Zero Financial Risk: Learn the ropes completely free. Make mistakes, learn from them, and it won’t cost you anything.

- Real Market Conditions: You trade on the same charts and with the same asset prices as live account holders. The experience is genuine.

- Strategy Testing: Got a new trading idea? Try it out on the demo first. See if it works before you commit real funds.

- Platform Familiarity: Every platform has its quirks. Use the demo to master every button, chart tool, and feature.

The Standard Account: Where the Real Action Begins

Once you’ve built confidence and a solid strategy on your demo account, it’s time to go live. The standard account is your entry into the real market. This is where your trades have real consequences and, more importantly, real profits. Most brokers offer a standard account with a relatively low minimum deposit, making it accessible for almost everyone. When you check out an honest Olymp Trade review, you’ll see that transitioning from demo to a live account is a seamless process. This account gives you full access to all the essential trading instruments and tools you need to start growing your capital.

Reaching the Top: Advanced and Expert Status

As you gain experience and increase your trading volume, new opportunities open up. Brokers reward their dedicated and successful traders with higher-tier accounts, often called Advanced or Expert. These accounts come with significant perks designed to give you a competitive edge. The benefits directly impact your bottom line and trading efficiency.

Let’s see how these accounts typically stack up against each other:

| Feature | Standard Account | Expert Account |

|---|---|---|

| Profit Rate | Up to 82% | Up to 92% (Increased Profitability) |

| Personal Analyst | No | Yes, dedicated expert support |

| Exclusive Strategies | Limited access | Full access to private webinars & strategies |

| Withdrawal Speed | Standard processing | Priority, often faster processing |

| Risk-Free Trades | Occasionally as a bonus | Regularly available |

How to Choose the Right Account for You

So, which account should you pick? The answer depends entirely on you. Don’t rush to get an Expert account if you’re not ready. The best account is the one that serves your current needs and helps you grow sustainably.

Your trading account is a tool, not a status symbol. Choose the sharpest tool for the job you need to do today, and you can always upgrade as your skills improve.

Start with a demo. Master it. Then, move to a standard account and build your track record. As your skills and capital grow, the benefits of an expert-level account will become a logical next step in your successful trading career. The path is clear, so take that first step with confidence!

Olymp Trade Fees, Commissions, and Spreads

Let’s get straight to the point, because as traders, our bottom line is what counts. You can have the best trading strategy in the world, but if your broker’s fees are eating up your profits, you’re fighting a losing battle. When I put together any comprehensive Olymp Trade review, I always start with a deep dive into the cost of doing business on the platform. Let’s break down exactly what you’ll be paying, so there are no surprises.

The cost structure is fairly straightforward and primarily revolves around three key areas:

- Spreads: This is the most common cost you’ll encounter. It’s the difference between the buy (ask) and sell (bid) price of an asset.

- Commissions: Some trades or account types may have a fixed commission fee, which is a charge for executing your trade.

- Overnight Fees (Swaps): If you hold a leveraged position open past the market’s closing time, you’ll either pay or receive a small fee known as a swap.

Understanding the Spread

For most Forex traders on the platform, the spread is the main cost. Olymp Trade uses dynamic, or floating, spreads. This means they aren’t fixed; they widen or tighten based on market conditions like liquidity and volatility. For example, you can expect spreads on major pairs like EUR/USD to be much tighter during peak trading hours than during a major news announcement or a market holiday.

Here’s a quick look at what you might expect for some popular instruments. Keep in mind these are just examples and can change.

| Asset Pair | Typical Spread (Pips) | Notes |

|---|---|---|

| EUR/USD | 1.1 | Very liquid, typically the tightest spread. |

| GBP/USD | 1.4 | Slightly wider due to higher volatility. |

| XAU/USD (Gold) | 2.0 | Commodities generally have wider spreads. |

| BTC/USD | Variable | Crypto spreads can fluctuate significantly. |

Disclaimer: The values in this table are for illustrative purposes only and do not reflect real-time data. Always check the platform for current spreads before trading.

The Commission Model: Pros and Cons

One of the appealing aspects I found during my Olymp Trade review is that for many standard trades, the platform rolls its fee into the spread. This means you don’t see a separate commission fee deducted from your account, which simplifies cost calculation. However, this isn’t always the case, as some assets or higher-tier accounts might operate on a commission-based model. Let’s weigh the primary spread-based model.

Advantages

- Simplicity: Calculating your potential profit and loss is easier without adding a separate commission fee.

- Transparency: The cost is built directly into the price you see on your screen. What you see is what you get.

Disadvantages

- Wider Spreads: To compensate for the lack of a direct commission, spreads might be slightly wider than on a raw ECN-style account.

- Less Ideal for Scalpers: Scalpers who make many small trades might find that even slightly wider spreads can impact their profitability over time.

Watch Out for Other Fees

A thorough trader always looks beyond the trading costs. You need to be aware of other potential charges that can affect your account balance.

My advice to every trader is to treat your trading account like a business account. You must be aware of every single expense, no matter how small. Surprises are for birthdays, not for your trading statement.

Be mindful of things like inactivity fees, which the platform may charge if your account remains dormant for an extended period (usually 180 days). Also, check the fees associated with your chosen withdrawal method. While Olymp Trade doesn’t charge a fee for withdrawals, the payment system or bank you use might impose its own charges.

Deposit and Withdrawal Methods: Speed & Reliability

Let’s talk about what really matters: your money. As a trader, you know that speed and reliability aren’t just conveniences; they are critical. Nothing is more frustrating than spotting a perfect entry point only to be held up by a slow deposit. Even worse is the anxiety of waiting for a withdrawal of your hard-earned profits to clear. It’s a make-or-break aspect of any trading platform.

When I was conducting my initial, in-depth Olymp Trade review, I put their entire financial system under a microscope. I needed to know if I could trust them not just with my strategy, but with my capital. The results were impressive and have kept me as an active user.

Funding Your Account: The Deposit Process

Getting your account funded is refreshingly simple and, most importantly, fast. The platform supports a wide range of methods to cater to traders from different parts of the world. The goal is to get you from decision to execution with minimal friction.

- Bank Cards: The classic choice. Using your Visa or Mastercard is straightforward and funds usually appear in your account almost instantly.

- E-Wallets: This is my preferred method for speed. Services like Skrill and Neteller offer lightning-fast transactions, both for putting money in and taking it out.

- Local Bank Transfers & Payment Systems: Depending on your region, you’ll find a variety of local options. This shows a commitment to making the platform accessible for everyone, which is a huge plus.

- Crypto Wallets: For those who operate in the crypto space, you can also fund your account using popular cryptocurrencies like Bitcoin and USDT (Tether).

Cashing Out: The Withdrawal Experience

This is the moment of truth for any broker. A smooth withdrawal process builds immense trust. The platform adheres to a simple but vital rule: you withdraw using the same method you used to deposit. This is a standard anti-money laundering (AML) practice and actually makes the process smoother and more secure for you.

Here’s a quick look at what you can typically expect in terms of timing. Keep in mind that while the platform processes requests quickly, the final clearing time can depend on your bank or e-wallet provider.

| Payment Method | Typical Deposit Time | Typical Withdrawal Processing Time |

|---|---|---|

| E-Wallets (Skrill, Neteller) | Instant | Within a few hours (up to 24 hours) |

| Bank Cards (Visa/Mastercard) | Instant | 1-3 business days |

| Bank Transfer | 1-2 business days | 2-5 business days |

| Crypto (USDT, BTC) | ~15-30 minutes (network dependent) | Within a few hours |

Key Advantages and Considerations

Like any system, it’s good to know the pros and what to keep in mind.

Advantages

- No Commissions: The platform does not charge any fees for deposits or withdrawals. The amount you deposit is the amount that hits your account. This is a huge advantage over some brokers who take a cut.

- High Speed: Most requests, especially for e-wallets, are processed on the same day, often within a couple of hours.

- Variety of Options: The wide selection of methods means you’re likely to find one that is convenient and low-cost for you.

Points to Keep in Mind

- Provider-Side Delays: While the platform processes withdrawals quickly, your own bank might take extra time to credit the funds. This is outside the broker’s control.

- Verification is Key: You must complete the identity verification process before you can make a withdrawal. Do this right after you sign up to avoid any delays when you’re ready to cash out your profits. This is for your own security.

Pro Trader’s Tip: To ensure the fastest and smoothest experience, I always use an e-wallet like Skrill or Neteller. I have a dedicated wallet just for my trading activities. Deposits are instant, and I usually see my withdrawn profits in my wallet the very same day. It completely removes the anxiety of waiting.

Assessing the Quality of Customer Support

Let’s talk about something every trader hopes they never need but is grateful for when they do: customer support. In the heat of trading, when a platform glitches or a withdrawal seems stuck, a slow or unhelpful support team can be infuriating. It’s the difference between a minor hiccup and a major headache. That’s why, when I put together any analysis, a significant part of my Olymp Trade review process is dedicated to stress-testing the support team. You need to know there’s a competent crew ready to back you up 24/7.

So, what makes a support team truly great? It’s more than just being available. Here are the key things I look for:

- Speed of Response: How long does it take to get a real human on the line or in the chat? In trading, time is literally money. Waiting hours for a simple answer is unacceptable.

- Multiple Contact Channels: A good broker offers options. You should be able to reach them via live chat for quick queries, email for detailed issues with attachments, and phone for urgent matters.

- Knowledge and Competence: Does the support agent actually understand trading? Can they resolve your issue without escalating it ten times? A knowledgeable agent saves you time and stress.

- Problem Resolution: The ultimate test. Did they actually solve your problem? A friendly chat is nice, but results are what matter. I track whether my test issues were resolved on the first contact.

To give you a clearer picture, here’s a breakdown of what to expect from different support channels provided by a top-tier broker.

| Support Channel | Best For | Expected Response Time |

|---|---|---|

| Live Chat | Quick questions, platform navigation help | Under 60 seconds |

| Email Support | Detailed inquiries, document submission | 1 – 3 hours |

| Phone Support | Urgent issues, security concerns | Immediate connection |

A trader once told me, \”You judge a broker not by their spreads, but by how they handle your call when your money is on the line.\” I couldn’t agree more. The quality of support reveals the true character and reliability of the platform.

Never underestimate the value of solid customer service. Before you commit your capital to any platform, do your homework. Read a detailed Olymp Trade review, or better yet, test their support yourself. Send them a question, see how fast they reply, and gauge their professionalism. This simple step can save you a world of trouble down the road and ensure you’re trading with a partner you can truly trust.

Educational Resources and Tools for Traders

Every successful trader knows a secret: the learning never stops. The forex market is a dynamic beast, and staying ahead means constantly sharpening your skills. It’s not about finding a magic button; it’s about building a solid foundation with the right knowledge and tools. Your trading platform should be more than just a place to execute orders—it should be your training ground and your co-pilot.

So, what should you look for? A top-tier trading environment provides a rich ecosystem of resources designed to help you grow. Here’s what a great educational suite looks like:

- Live Webinars and Workshops: Learn directly from market experts. They break down complex strategies and provide live analysis of market conditions.

- In-depth Video Tutorials: Perfect for visual learners. These cover everything from platform basics to advanced technical analysis patterns.

- A Comprehensive Blog or Help Center: Your go-to source for articles, guides, and strategy breakdowns. A good Olymp Trade review, for instance, often points out the strength of their educational blog for both new and experienced traders.

- Strategy Advisors and Indicators: Built-in tools that help you spot potential opportunities based on popular trading strategies.

Key Tools for Your Arsenal

Beyond articles and videos, you need practical tools for daily analysis. Here’s a quick breakdown of the essentials that can make a huge difference in your trading day.

| Tool Type | What It Is | Why You Need It |

|---|---|---|

| Economic Calendar | A schedule of major economic news releases, like interest rate decisions or GDP reports. | Helps you anticipate market volatility and trade around key events. |

| Charting Software | Visual representation of price movements with customizable indicators like RSI, MACD, and Moving Averages. | Essential for technical analysis to identify trends, patterns, and entry/exit points. |

| Demo Account | A risk-free practice account funded with virtual money. | Allows you to test strategies, learn the platform, and build confidence without risking real capital. |

“An investment in knowledge pays the best interest.” – Benjamin Franklin

This couldn’t be more true for trading. The time you invest in learning directly impacts your potential for success. Don’t just look for a place to trade; look for a partner in your trading education. The right platform will empower you with the tools and knowledge to navigate the markets with confidence.

Pros and Cons: A Balanced Olymp Trade Review

Alright traders, let’s get straight to it. You’re looking for an honest Olymp Trade review, not a fluffy sales pitch. I’ve been in the trenches with this platform, running trades and testing its limits. Every broker has its strengths and weaknesses, and Olymp Trade is no exception. To give you a clear picture, I’ve broken down my experience into a simple pros and cons table. This way, you can weigh the good against the bad and see if it aligns with your trading strategy.

| The Upside (Pros) | The Downsides (Cons) |

|---|---|

|

|

So, what’s the final verdict in this Olymp Trade review? It shines as an accessible and straightforward platform, making it a strong contender for traders who are starting their journey or prefer a no-fuss environment. The low deposit and robust demo account are major highlights. However, if your strategy demands sophisticated analytical power, you might feel a bit constrained. My advice? The best review is your own experience. Open a demo account and see how it feels—it costs you nothing to try.

Key Advantages of Using Olymp Trade

As a trader, I’ve seen my fair share of platforms. Some are clunky, some are overly complex, and some just don’t feel right. Finding a broker that fits your style is half the battle. That’s why I want to talk about the distinct benefits that make Olymp Trade stand out from the crowd. It’s not just about flashy features; it’s about practical tools that actually help you trade better.

Let’s break down what makes this platform a solid choice for many traders, from rookies to seasoned pros.

- Intuitive and Clean Interface: The first thing you’ll notice is how clean the platform is. There are no unnecessary buttons or confusing charts cluttering your screen. Everything is exactly where you expect it to be, allowing you to focus on what truly matters: your trading strategy and market analysis. You can execute trades quickly and efficiently, which is critical in fast-moving markets.

- Low Barrier to Entry: You don’t need a huge bankroll to get started. With a very low minimum deposit and the ability to open trades for as little as $1, it’s incredibly accessible. This allows new traders to get a feel for real-money trading without risking a significant amount of capital. It’s all about starting small and building your confidence.

- Free and Unlimited Demo Account: Before you risk a single dollar, you can practice. Olymp Trade offers a free demo account loaded with 10,000 virtual units. You can refill it anytime. Use it to test your strategies, get comfortable with the platform, and build your skills in a risk-free environment. This is a feature I always look for and recommend.

- Comprehensive Educational Suite: The platform is invested in your success. You gain access to a wealth of free educational materials, including webinars with professional analysts, step-by-step tutorials, and market insights. They equip you with the knowledge needed to make informed decisions.

Here’s a quick snapshot of some core features that often come up when you read any detailed Olymp Trade review.

| Feature | Details |

|---|---|

| Minimum Deposit | $10 |

| Minimum Trade | $1 |

| Demo Account | Free with 10,000 rechargeable units |

| Available Assets | Currencies, Stocks, Indices, Commodities, Crypto |

Ultimately, the combination of user-friendliness, accessibility, and strong educational support makes Olymp Trade a compelling option. It empowers traders to enter the market with confidence, providing the tools and resources necessary to navigate the complexities of financial trading.

Potential Disadvantages to Consider

Okay, let’s keep it real. No trading platform is perfect, and any honest trader knows you have to look at both sides of the coin. Pretending a platform has zero flaws is a red flag. So, let’s dive into some potential drawbacks you should weigh before committing your capital. Being aware of these is just smart trading.

Here are a few things that might be deal-breakers for some traders:

- No MetaTrader Support: If you are a veteran trader who lives and breathes MT4 or MT5, this is a big one. Olymp Trade operates on its own proprietary platform. While it’s clean and very user-friendly, especially on mobile, you can’t integrate your favorite custom Expert Advisors (EAs) or complex third-party indicators. You have to use the tools they provide.

- Geographic Restrictions: This is a major hurdle for many. Due to strict regulations, the platform is not available to traders in several key regions, including the USA, Canada, Japan, Australia, and the UK. Always double-check their list of supported countries before you get your hopes up.

- Asset Selection for Specialists: While they offer a solid range of currency pairs, stocks, and commodities for the average trader, it might not be enough for a specialist. If your strategy relies on trading exotic currency pairs or obscure company stocks, you might find the selection a bit restrictive compared to some larger brokers.

To put it simply, here’s who these issues might affect the most:

| Potential Downside | Who Should Pay Attention? |

|---|---|

| Proprietary Platform Only | Traders who rely heavily on custom EAs and MT4/MT5 tools. |

| Country Limitations | Traders residing in the USA, UK, Canada, Japan, and other restricted zones. |

| Limited Niche Assets | Advanced traders looking for highly specific or exotic instruments. |

Considering these factors is an essential step in forming your own complete Olymp Trade review. These aren’t necessarily reasons to avoid the platform entirely, but they are crucial for setting realistic expectations. It all comes down to what you, as an individual trader, need to succeed.

How Does Olymp Trade Compare to Other Brokers?

Choosing a broker is like picking a co-pilot for your trading journey. You need a partner you can rely on, one whose platform feels right for your strategy. I’ve navigated the markets with dozens of brokers, from the industry giants to the newer innovators. So, how does Olymp Trade measure up in this competitive landscape?

Let’s cut through the noise and compare the features that actually impact your trading day. This isn’t just a technical summary; it’s a practical breakdown from one trader to another.

Platform & User Experience

Many brokers rely on the standard MetaTrader 4 or 5 platforms. They are powerful workhorses, but let’s be honest, they can feel clunky and overwhelming, especially if you’re new. Olymp Trade took a different path by building its own proprietary platform. The result is a clean, intuitive, and web-based interface that feels modern and fast. You can find your tools, place a trade, and analyze charts without getting lost in complex menus. This focus on user experience is a major win.

Asset Diversity

What can you actually trade? A broker’s asset list is your menu of opportunities. While some platforms specialize heavily in just one area like Forex, Olymp Trade provides a well-rounded selection. This is great for traders who like to react to news across different markets. You typically get access to:

- Forex: Major, minor, and exotic currency pairs.

- Stocks: Shares in top global companies like Apple, Tesla, and Google.

- Indices: Trade the performance of entire markets like the S&P 500 or NASDAQ.

- Commodities: Classic safe-havens and essentials like Gold, Silver, and Oil.

- ETFs: Diversified funds that track specific sectors or strategies.

Key Differences at a Glance

To really see the contrast, let’s put Olymp Trade side-by-side with what we might call a \”traditional\” high-end broker. This table simplifies the main distinctions you’ll encounter.

| Feature | Olymp Trade | Traditional ECN/STP Broker |

|---|---|---|

| Minimum Deposit | Starts as low as $10 | Often $100 – $500 or more |

| Platform Simplicity | Very high; beginner-friendly | Moderate to complex (e.g., MT4/MT5) |

| Educational Resources | Extensive and free for all users | Varies; premium content may be gated |

| Account Structure | Simple, tiered system | Multiple complex account types (Standard, Pro, Raw) |

The Bottom Line: Accessibility and Education

As you can see, the core difference is accessibility. A low minimum deposit removes a major barrier, allowing anyone to start trading with real money without significant risk. In every detailed Olymp Trade review I’ve conducted, this point is a massive plus. While professional brokers might offer tighter raw spreads, they often come with commissions per trade and a much steeper learning curve. Olymp Trade prioritizes getting you into the market and educating you along the way.

For new and intermediate traders, Olymp Trade offers a superior learning environment and a lower barrier to entry. It’s built to help you grow your skills. More advanced traders seeking deep liquidity and complex order types might prefer a traditional ECN broker, but for the vast majority of retail traders, Olymp Trade provides a powerful and user-friendly package.

What Real Users Say: Olymptrade Reviews from Trustpilot & Reddit

Promotional materials are one thing, but as traders, we know the real truth lies in the trenches. We need to hear from fellow traders who are actively using a platform day in and day out. That’s why we’re diving deep into two of the most honest corners of the internet: Trustpilot and Reddit. Let’s see what the community consensus is and find a genuine Olymp Trade review or two.

Insights from Trustpilot

Trustpilot is often the first stop for users looking for quick, scannable feedback. It provides a broad overview of user satisfaction. When you sift through the comments about Olymp Trade, a few common themes emerge, highlighting both strengths and areas for improvement.

Here’s a summary of the most frequently mentioned points:

- User-Friendly Interface: Many new traders praise the platform for its clean design and intuitive navigation. It lowers the barrier to entry, which is a significant plus.

- Educational Resources: Users often mention the availability of webinars, tutorials, and a demo account as key benefits for getting started without initial risk.

- Withdrawal Process: This is a hot topic for any broker. While many users report smooth and timely withdrawals, others mention that the verification process can take time. This is standard practice in the industry for security, but it’s a recurring point of feedback.

- Customer Support: Feedback on support is mixed. Many find the support team responsive and helpful, while some have experienced delays. This seems to depend on the complexity of the issue at hand.

The Reddit Deep Dive

Reddit offers a different kind of insight. Here, discussions are more nuanced, with traders sharing detailed strategies, asking specific questions, and providing in-depth accounts of their experiences. You won’t just find a rating; you’ll find entire conversations.

In subreddits like r/Forex and r/trading, you often see threads where newcomers ask for opinions. A typical comment might look something like this:

\”I was looking for a solid Olymp Trade review before I committed. Started with their demo account for a few weeks to get the hang of their platform. The execution speed was decent on major pairs. I made a small deposit to test the withdrawal, and the money was in my Skrill account in about 24 hours after I got my documents verified. So far, so good for me.\”

– A typical Reddit user comment

Key Takeaways from Reddit Discussions:

- Emphasis on Risk Management: Experienced traders on Reddit constantly remind newcomers to use proper risk management, regardless of the platform.

- Demo Account is Crucial: The community strongly advises mastering the demo account before going live.

- Verification is Key: Redditors stress the importance of completing the KYC (Know Your Customer) verification process fully before depositing large sums to ensure smooth withdrawals.

Trustpilot vs. Reddit: A Quick Comparison

Both platforms are valuable, but they serve different purposes for a researcher.

| Platform | Type of Feedback | Best For |

|---|---|---|

| Trustpilot | Quick ratings, broad sentiment, highlights of common issues (e.g., withdrawals, support). | Getting a fast, overall impression of user satisfaction. |

| In-depth discussions, specific user stories, strategic advice, and Q&A. | Understanding the nuances of using the platform from a trader’s perspective. |

Final Verdict: Should You Trade with Olymp Trade in 2024?

So, we’ve reached the end of the road. After dissecting the platform, testing its features, and analyzing its offerings, it’s time to answer the big question. Is Olymp Trade the right choice for your trading journey this year? The short answer is: it very well could be, but it depends entirely on who you are as a trader.

To put it simply, no single broker is perfect for everyone. What works for a scalper focusing on Forex might not suit a long-term stock investor. Drawing all the threads together from this comprehensive Olymp Trade review, a clear picture emerges of where this broker truly shines and where it has room to grow.

Let’s break down the core strengths and weaknesses to give you a clear, at-a-glance summary.

| Advantages (Pros) | Disadvantages (Cons) |

|---|---|

| Low Barrier to Entry: With a $10 minimum deposit, it’s incredibly accessible for beginners. | Limited Asset Variety: The range of stocks and crypto is smaller compared to industry giants. |

| Excellent Educational Hub: A wealth of free webinars, articles, and strategy guides. | Geographic Restrictions: Not available in several key regions, including Europe and the USA. |

| Intuitive Platform: The proprietary trading terminal is clean, fast, and easy to navigate. | Spreads Can Vary: While competitive, spreads on some Forex pairs can widen during volatile periods. |

| Free Demo Account: Practice with $10,000 in virtual funds without any risk. | No MetaTrader Support: Traders who rely on MT4 or MT5 will need to adapt to the proprietary platform. |

Who is Olymp Trade Best For?

Based on our findings, Olymp Trade is an exceptional choice for a specific group of traders:

- New Traders: If you’re just starting out, the combination of a low minimum deposit, a user-friendly interface, and outstanding educational resources makes this one of the best platforms to learn the ropes.

- Traders on a Budget: You don’t need a massive bankroll to get started. You can test strategies and gain real-market experience without significant financial risk.

- Fixed Time Trades Enthusiasts: The platform’s FTT mode is robust and a core feature, offering a streamlined experience for those who prefer this trading style.

For highly experienced, professional traders who require a vast portfolio of exotic assets or the advanced functionalities of platforms like MetaTrader 5, Olymp Trade might feel a bit limiting. However, it can still serve as an excellent secondary platform for exploring different strategies or trading FTTs.

My final advice? The best Olymp Trade review is your own. The platform makes it incredibly easy to find out for yourself. Open the free demo account. Spend a few hours testing the interface, executing trades, and exploring the educational materials. It costs you nothing and is the most reliable way to determine if this broker aligns with your personal trading style and goals for 2024.

Frequently Asked Questions

Is Olymp Trade a safe and legitimate broker?

Yes, Olymp Trade is considered a legitimate broker. It has been a member of the International Financial Commission (FinaCom) since 2016, which provides dispute resolution and a compensation fund of up to €20,000 per case. The platform also uses security measures like SSL encryption and segregated client funds.

What is the minimum deposit to start trading on Olymp Trade?

The minimum deposit on Olymp Trade is typically $10, making it highly accessible for beginners who want to start trading with a small amount of capital.

Can I trade on Olymp Trade from my phone?

Yes, Olymp Trade offers a full-featured mobile app for both iOS and Android devices. The app allows you to manage your account, analyze charts, and execute trades from anywhere.

What types of assets can I trade on Olymp Trade?

Olymp Trade provides a diverse range of assets, including Forex currency pairs, stocks of major companies (like Apple and Tesla), market indices (like the S&P 500), commodities (like gold and oil), and some cryptocurrencies.

Does Olymp Trade offer a demo account?

Yes, Olymp Trade provides a free and refillable demo account with $10,000 in virtual funds. It allows new traders to practice strategies and familiarize themselves with the platform without any financial risk.