Think of Olymp Trade as your gateway into the world of online trading. It is a popular international trading platform where you can speculate on the price movements of various financial assets. You are not buying the asset itself, but rather forecasting its direction. Will the price go up or down? If your forecast is correct, you earn a profit.

The platform is designed to be user-friendly, catering to both beginners and seasoned traders. It offers a clean interface, educational resources, and powerful tools to help you analyze the market. The core idea is to make financial markets accessible to everyone, right from their computer or smartphone.

- The Trading Process in a Nutshell

- Key Platform Features at a Glance

- Is Olymptrade Legal and Regulated in the Philippines?

- Getting Started with Olymptrade Philippines: Account Registration

- Step-by-Step Account Creation

- Account Verification Process

- Funding Your Olymptrade Account: Deposit Methods for Filipinos

- Popular Local Deposit Options

- Withdrawing Funds from Olymptrade in the Philippines: A Step-by-Step Guide

- Withdrawal Limits and Processing Times

- Available Trading Instruments on Olymptrade

- Understanding Olymptrade Trading Platforms

- Strategies for Successful Trading on Olymptrade

- Beginner-Friendly Trading Strategies

- Olymptrade Fees and Commissions Explained

- Olymptrade Customer Support for Philippine Traders

- How to Contact Olymptrade Support

- Support Channel Quick Guide

- Risks and Rewards of Trading with Olymptrade

- The Potential Rewards

- The Inherent Risks

- A Quick Look: Balancing the Scales

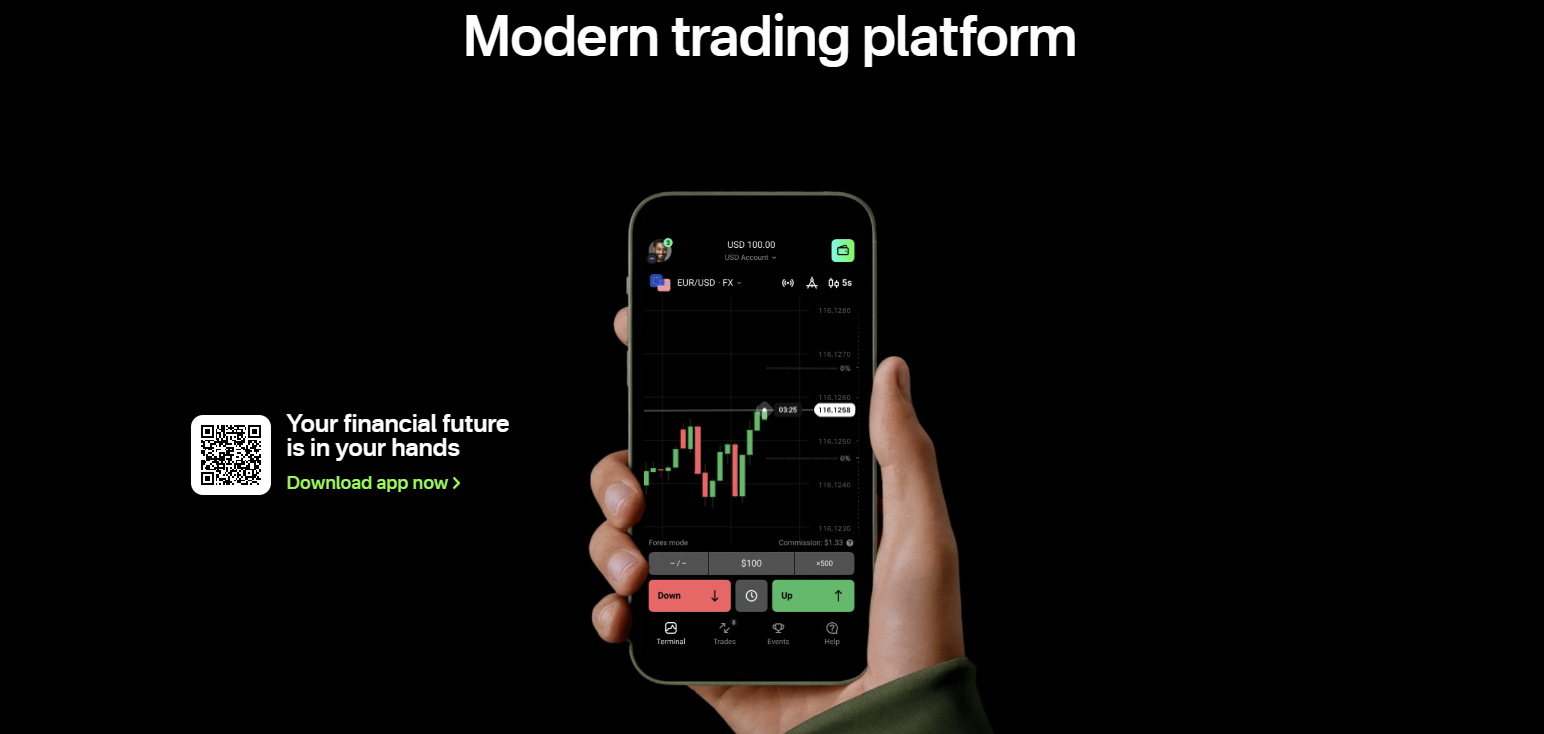

- Olymptrade Mobile App Review: Trading on the Go

- Key Advantages and Potential Drawbacks

- Olymptrade vs. Other Trading Platforms in the Philippines

- Frequently Asked Questions About Olymptrade Philippines

- Is Olymptrade Philippines the Right Choice for You?

- Key Questions to Ask Yourself

- Frequently Asked Questions

The Trading Process in a Nutshell

Getting started on the platform is straightforward. Once you have your account set up, the trading mechanics are simple to grasp. Here is how a typical trade unfolds:

- Choose Your Asset: First, you select a financial instrument to trade. This could be a currency pair like EUR/USD, a stock, a commodity like gold, or even a cryptocurrency.

- Set Your Amount: Next, you decide how much money you want to invest in this specific trade.

- Select the Duration: You then choose the time frame for your trade. This can range from one minute to several hours.

- Make a Forecast: This is the crucial step. You predict whether the asset’s price will be higher (Up) or lower (Down) than the current price when the time expires.

- Execute the Trade: After making your prediction, you open the position and wait for the outcome.

Key Platform Features at a Glance

To give you a clearer picture, let’s break down some of the essential characteristics of the Olymp Trade platform in a simple table.

| Feature | Description |

|---|---|

| Platform Type | Proprietary web-based and mobile platform. No download is needed for the desktop version. |

| Trading Modes | Offers different mechanics, including Fixed Time Trades (FTT) and a Forex-style mode. |

| Demo Account | A free practice account loaded with replenishable virtual funds to test strategies risk-free. |

| Available Assets | A wide range including currency pairs, stocks, indices, commodities, and cryptocurrencies. |

| Minimum Deposit | Features a low entry threshold, making it accessible for traders with smaller capital. |

The free demo account is perhaps one of the most valuable tools available. It allows you to explore the platform’s functionality, test your analytical skills, and build a trading strategy without risking any real money. It’s the perfect playground to build your confidence before you dive into the live markets.

Is Olymptrade Legal and Regulated in the Philippines?

This is a critical question for every trader in the Philippines, and the answer requires a clear understanding of how online trading platforms operate. Let’s dive into the details so you can trade with confidence.

First, it’s important to distinguish between being “legal” and being “locally regulated.” The operation of Olymptrade is not prohibited for citizens in the Philippines, making it legal for you to access and use the platform for your trading activities.

When it comes to regulation, Olymptrade is a member of the International Financial Commission (FinaCom). Think of FinaCom as an independent, external dispute resolution body for the financial markets. This membership provides a significant layer of security for traders.

What FinaCom Membership Means for You:

- Dispute Resolution: If you ever have a dispute with the platform that you cannot resolve directly, FinaCom provides a neutral third-party to mediate and make a judgment.

- Compensation Fund: FinaCom members are covered by a Compensation Fund. This acts as an insurance policy for traders, protecting their funds up to a certain amount in case of a judgment.

- Quality Assurance: To maintain membership, brokers must adhere to high standards of business conduct and transparency.

Now, regarding local authorities like the Securities and Exchange Commission (SEC) or the Bangko Sentral ng Pilipinas (BSP), Olymptrade operates as an international broker and is not directly regulated by these Philippine bodies. This is a common setup for many global online trading platforms available to Filipino users.

Here is a quick breakdown to summarize the situation:

| Aspect | Status in the Philippines |

|---|---|

| Legality of Use | Permitted for traders to use. |

| Local Regulation (SEC/BSP) | Not directly regulated by local bodies. |

| International Oversight | Yes, as a member of the Financial Commission. |

| Trader Protection | Provided through FinaCom’s framework. |

In conclusion, you can legally use Olymptrade in the Philippines. Your primary regulatory protection comes from its international FinaCom membership, which ensures fair practices and provides recourse in case of issues. As with any financial activity, it is always wise to understand the framework you are operating within.

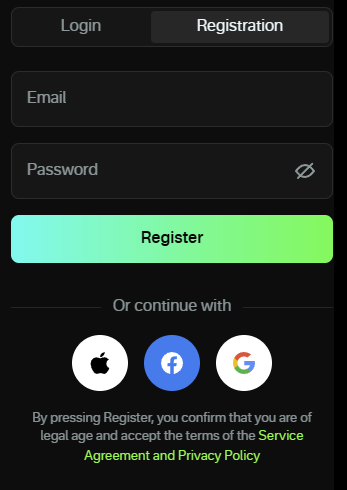

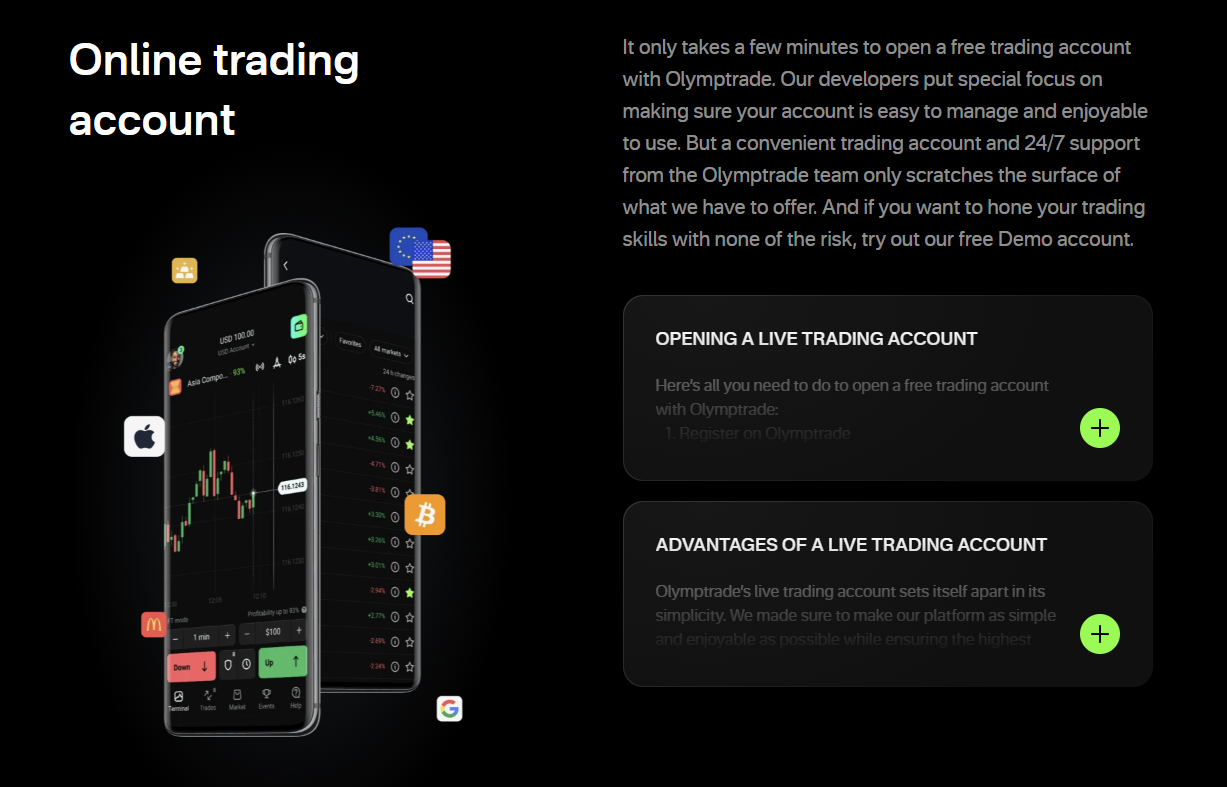

Getting Started with Olymptrade Philippines: Account Registration

Ready to start your trading journey? Great! The first step is creating your account, and with Olymptrade Philippines, this process is incredibly simple and fast. You can be up and running in just a few minutes. Forget about complicated paperwork or long waiting times. Let’s walk through the exact steps to get your account registered so you can explore the platform right away.

Follow this straightforward guide to create your personal trading account:

- Visit the Official Platform: Head over to the Olymptrade website. You will immediately see the registration form right on the main page.

- Enter Your Details: You only need to provide a valid email address and create a secure password. You can also choose to sign up using your Google or Facebook account for even quicker access.

- Select Your Currency: Choose the currency for your trading account. Most traders select either USD or EUR. Pick the one that is most convenient for you to manage.

- Agree to the Terms: Tick the box to confirm you are of legal age and that you agree to the service agreement. It’s always a good practice to review these terms.

- Complete Your Registration: Click the big “Register” button. That’s it! Your account is now created.

Once you complete these steps, you will instantly gain access to a free demo account. This practice account comes with virtual funds, allowing you to explore the platform, test different strategies, and build your confidence without any financial risk. After you feel comfortable with the interface and your trading approach, you can easily switch to a live account to start trading with real funds.

Step-by-Step Account Creation

Ready to join the action? Setting up your trading account is fast and secure. We designed the process to be as simple as possible, so you can focus on the markets. Follow these quick steps, and you will be ready to trade in no time.

- Complete the Registration Form: The first step is to fill out our simple online form. We just need your basic details like your name, email address, and phone number. Double-check your information for accuracy to ensure a smooth setup.

- Verify Your Identity: Security is our top priority. To protect your account and comply with financial regulations, we need to verify who you are. Simply upload a clear copy of a government-issued ID (like a passport or driver’s license) and a document for proof of address (like a recent utility bill). This entire process is quick and secure.

- Fund Your Account: Now it’s time to add capital to your account. You can choose from several convenient and safe deposit methods, including credit/debit cards, bank transfers, and popular e-wallets. Your funds are always held in segregated accounts for your peace of mind.

- Access Your Trading Platform: Once your account is funded, you get full access to our powerful trading platform. You can download it to your desktop or use the web and mobile versions to trade from anywhere, anytime.

- Start Trading: That’s it! You are all set. Log in to your platform, explore the markets, and place your first trade. Welcome to the community!

A Quick Tip for New Traders: Consider starting with a demo account. It’s a fantastic way to get comfortable with the trading platform and test your strategies using virtual funds before you risk any real capital.

Account Verification Process

Let’s get you set up to trade! The account verification process is a crucial step. Think of it as the digital handshake that secures your trading environment. It’s a standard requirement in the financial industry that protects your funds and personal information, ensuring we all operate in a safe and regulated space. We’ve streamlined this process to make it as quick and straightforward as possible.

To get started, you will need to prepare a couple of documents. Having them ready will make the process a breeze. Here is what you’ll typically need:

- Proof of Identity (POI): This must be a clear, valid government-issued photo ID. The entire document, including all four corners, should be visible. We accept documents like your Passport, National ID Card, or a Driver’s License.

- Proof of Address (POA): This is a document that confirms where you live. It must be recent, usually issued within the last 3 to 6 months. Good examples include a utility bill (like water or electricity), a bank statement, or a credit card statement. Ensure your full name and address are clearly visible.

Once you have your documents ready, the rest is easy. Here’s a simple breakdown of the steps to get your account fully verified.

| Step | Action to Take |

|---|---|

| 1. Prepare Your Files | Take clear, high-resolution photos or scans of your documents. Avoid any blurriness or glare. Save them as a common file type like JPG, PNG, or PDF. |

| 2. Upload Your Documents | Log in to your client area, navigate to the “Verification” or “Profile” section, and follow the on-screen instructions to upload your POI and POA files. |

| 3. Submit for Review | After uploading, submit your documents. Our compliance team will then review them. This is usually a quick process. |

| 4. Get Approved | You’ll receive an email notification once your account is verified. Then, you’re all set to fund your account and begin trading! |

Following these steps carefully helps prevent delays. A smooth verification means you can access all account features and hit the markets sooner.

Funding Your Olymptrade Account: Deposit Methods for Filipinos

Ready to jump into the markets? The first step is funding your account, and thankfully, Olymptrade makes this incredibly simple for traders in the Philippines. You don’t need complex international bank wires or credit cards with high fees. You can use the local payment methods you already trust and use every day. Getting your capital into your trading account is fast, secure, and straightforward, letting you focus on what really matters: making smart trades.

Here’s a look at the most popular and convenient deposit options available to you:

- GCash: The go-to e-wallet for millions of Filipinos. Depositing with GCash is almost instant, allowing you to fund your account in just a few taps on your phone. It’s one of the fastest ways to get started.

- PayMaya: Another leading digital wallet in the Philippines. Similar to GCash, PayMaya offers a seamless and rapid deposit process directly from your app.

- Local Bank Transfers: You can fund your account directly from your local bank. Olymptrade supports major banks like BDO, BPI, Metrobank, and more through online banking or over-the-counter deposits.

- UnionBank Online: If you are a UnionBank client, you can enjoy direct and hassle-free deposits through their online portal.

- Skrill & Neteller: These international e-wallets are a popular choice for traders worldwide. They offer quick transactions and are a reliable way to manage your trading funds.

Choosing the right method often comes down to personal preference and what you’re most comfortable with. To help you decide, here’s a quick comparison of the most common choices:

| Deposit Method | Typical Speed | Best For |

|---|---|---|

| GCash / PayMaya | Near-Instant | Traders who want maximum speed and mobile convenience. |

| Local Bank Transfer | A few hours to 1 business day | Those who prefer using their primary bank account for larger deposits. |

| Skrill / Neteller | Near-Instant | Traders who manage funds across multiple platforms. |

“The ease of depositing with GCash was a game-changer for me. I was funded and ready to trade within minutes, without any complicated steps.” – A fellow trader from Cebu

With so many user-friendly options, you can fund your Olymptrade account with confidence and begin your trading journey without delay.

Popular Local Deposit Options

Funding your trading account should be simple and fast. Forget about complicated international wire transfers and long waiting times. Using popular local deposit options means you can get your capital into the market using the methods you already use every day. This makes the entire process faster, more secure, and incredibly convenient, letting you focus on what truly matters: your trading strategy.

We believe in making access to the markets as easy as possible. That’s why a wide range of familiar choices is essential. Here are some of the go-to methods traders love:

- Local Bank Transfers: Send funds directly from your local bank account. It’s a trusted method that often clears within hours, sometimes even instantly.

- Mobile Money Wallets: A game-changer in many regions. Use your mobile wallet to top up your account on the go, anytime, anywhere.

- Domestic Payment Gateways: Utilize well-known local online payment systems that you are comfortable with for seamless transactions.

- QR Code Payments: A quick and modern solution. Simply scan a QR code with your banking app to complete your deposit in seconds.

To give you a clearer picture, let’s compare some of these options:

| Deposit Method | Typical Speed | Ease of Use |

|---|---|---|

| Local Bank Transfer | Near-Instant to a few hours | Very Easy |

| Mobile Money | Instant | Extremely Easy |

| QR Code Payment | Instant | Very Easy |

Trader’s Tip: Always double-check if your chosen local deposit method has any fees. The best brokers offer zero-fee deposits, which helps you keep more of your trading capital for the market.

By providing these familiar and efficient options, you can deposit funds in your local currency without the usual headaches. This removes a major barrier, allowing you to seize market opportunities the moment they arise.

Withdrawing Funds from Olymptrade in the Philippines: A Step-by-Step Guide

You’ve navigated the markets and earned your profits. Now comes the most exciting part: enjoying the rewards of your successful trades. Withdrawing your funds from Olymptrade in the Philippines is a simple and secure process. We’ve created this clear guide to walk you through every step, so you can access your cash quickly and get back to planning your next market move.

To ensure a smooth transaction, follow these steps carefully:

- Access Your Account: First, log in to your personal Olymptrade trading account using your credentials.

- Navigate to the Withdrawal Menu: Once logged in, locate your profile icon or user menu. From there, select the “Payments” option and then click on “Withdraw.” This will take you to the withdrawal interface.

- Select a Withdrawal Method: You will see a list of available payment systems. Olymptrade provides several convenient methods popular in the Philippines, such as GCash, Maya, Skrill, Neteller, and direct local bank transfers. A key rule to remember is that you must withdraw funds using the same payment method you used to make your deposit.

- Enter the Withdrawal Amount: Specify the exact amount you wish to withdraw from your account balance. Be sure to check any minimum or maximum withdrawal limits that may apply to your chosen method.

- Confirm Your Details: The system will prompt you to confirm your payment details. Whether it’s your GCash number or your bank account information, double-check every detail for accuracy to prevent any delays or issues with your transaction.

- Submit Your Request: After verifying all the information is correct, click the “Submit Request” button. Olymptrade will then begin processing your withdrawal. You will typically receive an email or notification confirming that your request has been received and is in progress.

That’s it! Processing times can vary, with e-wallet transactions often completing faster than bank transfers. By following this guide, you can confidently and efficiently manage the withdrawal process for your funds.

Withdrawal Limits and Processing Times

Closing a successful trade is a great feeling. The next step is getting your profits into your bank account. This process should be simple and fast. Let’s look at what you should expect regarding withdrawal limits and how long it takes to get your money.

The speed of your withdrawal heavily depends on the method you select. Some methods are almost instant, while others can take several business days. Understanding these timelines is crucial before you even start trading.

\n

| Withdrawal Method | Average Processing Time |

|---|---|

| E-Wallets (e.g., Skrill, Neteller) | Within 24 hours |

| Credit/Debit Card | 2-5 business days |

| Bank Wire Transfer | 3-7 business days |

| Cryptocurrency | A few minutes to several hours |

Brokers also enforce withdrawal limits. This includes both minimum and maximum amounts you can take out at one time. Minimums often exist to cover transaction fees, while maximums are usually in place for security and regulatory compliance. Knowing these limits helps you plan your withdrawals and avoid any unexpected issues.

“For any trader, liquidity is key. I need to be confident that I can access my funds quickly and without hassle. A broker’s withdrawal policy tells you a lot about how they treat their clients.”

Several factors can affect the speed of your withdrawal. Keep these points in mind:

- Account Verification: Ensure your account is fully verified. Incomplete verification is the most common cause of withdrawal delays.

- Chosen Method: As shown in the table, e-wallets and crypto are generally much faster than bank wires.

- Timing of Request: A withdrawal requested late on a Friday will likely not be processed until the following week. Public holidays can also cause delays.

- Broker’s Internal Process: Each broker has a unique internal system for handling payments. Some are simply more efficient than others.

Before committing to a broker, always read their withdrawal policy. A clear, fair, and efficient withdrawal system is a sign of a trustworthy partner in your trading journey.

Available Trading Instruments on Olymptrade

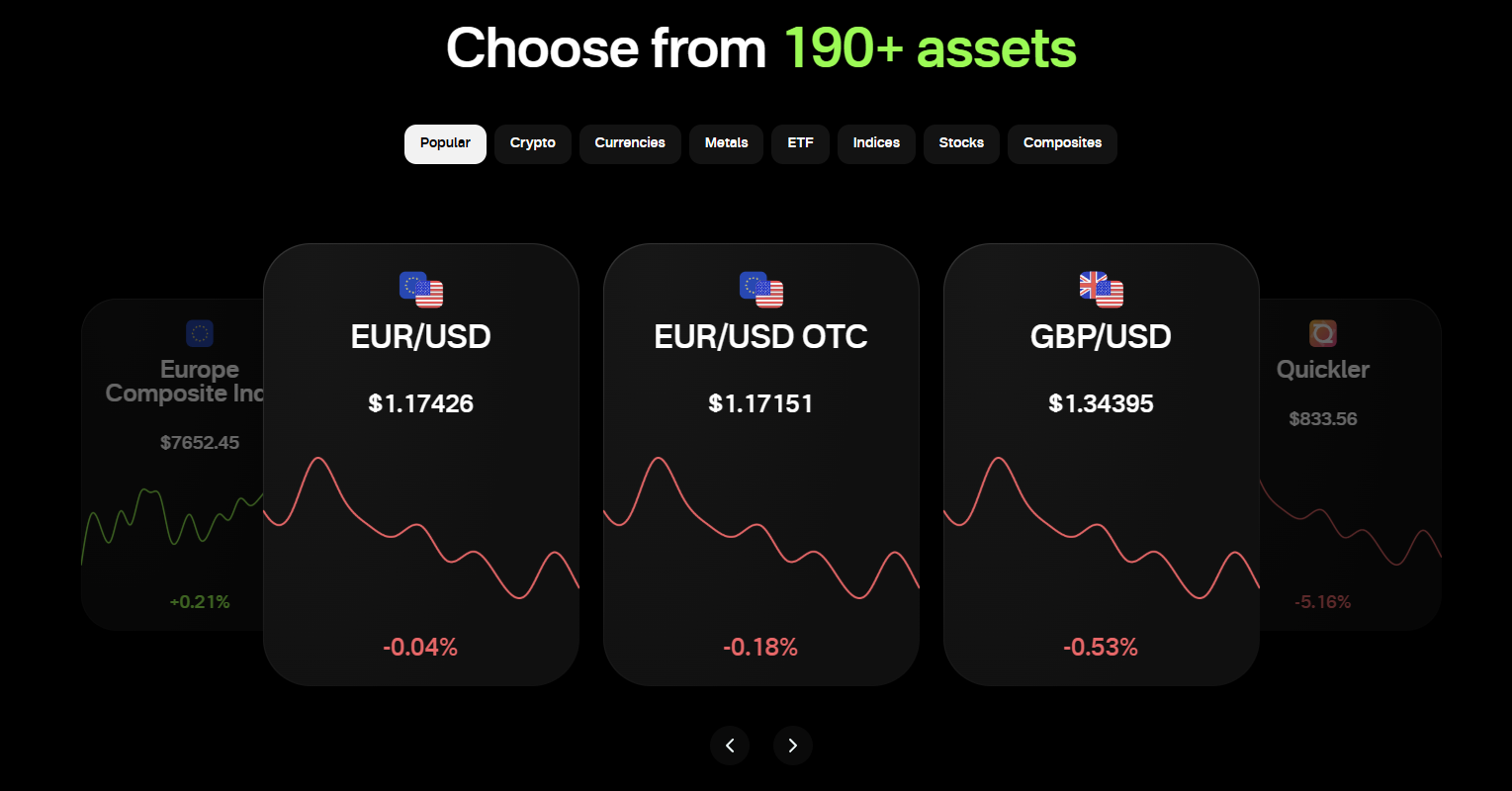

Ever feel boxed in by limited market choices? A key to consistent trading is having the flexibility to move where the action is. The Olymptrade platform opens up a universe of financial instruments, ensuring you can always find a market that fits your strategy and the current economic climate. Whether you scalp the fast-moving currency markets or prefer to take a longer-term view on stocks, having options is your greatest asset.

We believe in empowering traders. That’s why you get access to a diverse collection of trading assets, all from a single interface. Here’s a quick glimpse into the markets you can conquer:

- Forex Currency Pairs: Trade the world’s most liquid market. This includes major pairs like EUR/USD, minors, and even exotic pairs for those seeking higher volatility.

- Stocks: Take positions on the price movements of global giants. Think Apple, Google, Tesla, and other household names.

- Indices: Get a broad view of the market by trading indices like the S&P 500, NASDAQ, and Dow Jones. It’s a great way to trade an entire sector’s performance.

- Commodities: Profit from the raw materials that power the global economy. This includes precious metals like gold and silver, as well as energies like Brent oil.

- Cryptocurrencies: Tap into the exciting and volatile world of digital currencies. Trade popular coins like Bitcoin and Ethereum without needing a crypto wallet.

- ETFs: Diversify your portfolio with ease by trading Exchange-Traded Funds, which bundle together various assets into a single instrument.

Not all instruments behave the same way. Understanding their unique characteristics can give you an edge. Here’s a simple breakdown to help you find your niche:

| Instrument Type | Best for Traders Who… | Key Characteristic |

|---|---|---|

| Forex Majors | Enjoy fast-paced, 24/5 action and technical analysis. | High liquidity and tight spreads. |

| Stocks | Follow corporate news and earnings reports. | Influenced by company performance and industry trends. |

| Gold (Commodity) | Seek a safe-haven asset during economic uncertainty. | Tends to have an inverse relationship with the US Dollar. |

| Indices | Want to diversify and reduce single-stock risk. | Represents the overall health of a specific stock market. |

Having a wide array of choices is a powerful advantage. When the forex market is quiet, opportunities might be heating up in commodities. This ability to pivot is what separates successful traders from the rest. The Olymptrade platform provides the market opportunities; your job is to find them. By exploring these different financial instruments, you can build a resilient and diversified portfolio designed to thrive in any market condition.

Understanding Olymptrade Trading Platforms

Choosing the right trading platform is like a pilot picking the right cockpit. It needs to be intuitive, powerful, and reliable. Olymptrade understands this critical need and offers robust solutions designed to fit your unique trading style. Let’s break down the environments where you’ll be making your trading decisions.

The primary Olymptrade platform is a custom-built, web-based powerhouse. The first thing you’ll notice is its clean and simple interface. The design focuses on getting you from analysis to execution with zero friction. This makes it a fantastic starting point for new traders, but it packs enough punch for veterans too. Key features include:

- An incredibly user-friendly and intuitive layout.

- Integrated charts with a wide range of timeframes.

- A solid set of built-in technical indicators and drawing tools.

- Seamless switching between different trading modes.

- Direct access to market analysis and educational materials.

For traders who crave more advanced tools and deep customization, Olymptrade also provides access to the legendary MetaTrader 4. MT4 is an industry standard for a reason. It is renowned for its powerful charting capabilities, an extensive library of custom indicators, and the ability to run automated trading strategies, known as Expert Advisors (EAs).

Here’s a quick comparison to help you choose:

\n

| Feature | Olymptrade Platform | MetaTrader 4 (MT4) |

|---|---|---|

| Best For | Beginners & Intermediate Traders | Experienced & Technical Traders |

| Interface | Simple, intuitive, web-based | Highly customizable, requires download |

| Tools | Essential indicators & drawing tools | Advanced charting & vast indicator library |

| Automation | Not supported | Full support for Expert Advisors (EAs) |

| Accessibility | Instant access via browser or app | Requires software installation |

And what about trading on the move? A sleek mobile app mirrors the functionality of the web platform, allowing you to manage your trades, analyze charts, and react to market news from anywhere. Whether you prefer the streamlined simplicity of the native platform or the raw power of MT4, you have the tools you need to navigate the markets effectively.

Strategies for Successful Trading on Olymptrade

Ready to move beyond guesswork and start trading with a purpose on Olymptrade? Success in the financial markets isn’t about finding a single magic indicator. Instead, it’s about building a robust framework that guides your decisions. A solid strategy combines technical analysis, risk management, and a disciplined mindset. It turns you from a gambler into a calculated market participant. Let’s explore the core components that create a winning approach.

First, you need a clear trading plan. This is your personal rulebook for every trade you make. It removes emotion from the equation and ensures consistency. Your plan should be written down and followed without exception.

- Define Your Goals: Are you looking for small, consistent daily profits or larger, long-term gains? Your goal shapes your strategy.

- Select Your Assets: Don’t try to trade everything. Focus on a few currency pairs or assets you understand well. Learn their behavior and what moves their prices.

- Set Entry and Exit Rules: Specify the exact conditions that must be met before you enter a trade (e.g., a specific indicator signal). Do the same for when you will exit, both for a profit (Take Profit) and for a loss (Stop Loss).

- Determine Your Position Size: Decide how much capital you will risk on a single trade. A common rule is to risk no more than 1-2% of your total account balance.

With a plan in place, you can start applying specific trading techniques. Two popular approaches are trend following and range trading. Trend followers identify the dominant market direction and place trades that align with it, aiming to ride the momentum. Range traders, on the other hand, identify assets moving between clear support and resistance levels, buying at the bottom of the range and selling at the top.

| Smart Trading Habit | Common Pitfall to Avoid |

|---|---|

| Using a Stop Loss on every trade to define your maximum risk. | Hoping a losing trade will turn around, leading to bigger losses. |

| Risking a small, fixed percentage of your capital per trade. | Going “all-in” on one trade you feel certain about. |

| Reviewing your trading journal to learn from wins and losses. | Jumping from one strategy to another after a few losing trades. |

| Waiting patiently for your specific trade setup to appear. | Forcing trades out of boredom or a desire for action. |

The best strategy in the world is useless without discipline. Your ability to follow your own rules, especially during a losing streak, is what separates successful traders from the rest.

Ultimately, successful trading on Olymptrade is a marathon, not a sprint. It involves continuous learning and refinement. Use the demo account to test your strategies without risking real money. Find what works for your personality and risk tolerance. Combine a solid plan with disciplined execution, and you will put yourself on the path to consistent results.

Beginner-Friendly Trading Strategies

Diving into the forex market doesn’t mean you need a super-complex plan from day one. In fact, the most successful traders often rely on simple, proven methods. Forget about overwhelming charts and a dozen indicators. Let’s focus on a couple of powerful, beginner-friendly trading strategies that can help you build a solid foundation.

The key is to pick one strategy, understand its rules, and practice it until it becomes second nature. Here are two fantastic starting points:

- Trend Following: This is exactly what it sounds like. You identify the market’s main direction (the trend) and trade with it, not against it. If the market is consistently making higher highs and higher lows, it’s an uptrend, and you look for buying opportunities. If it’s making lower lows and lower highs, it’s a downtrend, and you focus on selling.

- Support and Resistance Trading: Think of support as a price floor and resistance as a price ceiling. These are levels where the price has historically struggled to break through. The basic idea is to buy near a strong support level and sell near a strong resistance level, anticipating that the price will bounce off these key areas.

To help you choose, let’s break down the core differences between these two approaches.

| Feature | Trend Following | Support & Resistance |

|---|---|---|

| Best Market Condition | Strongly trending markets (up or down) | Ranging or sideways markets |

| Entry Signal | Price pulling back to a moving average or trendline | Price bouncing off a historical support or resistance level |

| Complexity Level | Low. Easy to spot the general direction. | Low to Medium. Requires identifying key levels. |

| Mindset Required | Patience to ride the trend for bigger wins | Discipline to act at specific price points |

Trader’s Tip: Don’t try to master everything at once. Pick the strategy that makes the most sense to you and your personality. A simple plan executed with discipline will always beat a complex plan you can’t follow.

Remember, no strategy wins 100% of the time. The goal is to find a method that gives you an edge. Both of these strategies provide clear rules for when to enter and exit a trade, which is crucial for building confidence and managing risk effectively as a new trader.

Olymptrade Fees and Commissions Explained

Every savvy trader knows that your profits aren’t just about winning trades; they’re also about managing your costs. So, let’s cut through the noise and break down the Olymptrade fees and commissions. Understanding these trading costs is crucial for building a solid strategy and protecting your bottom line. Forget confusing jargon; here is a straightforward look at what you pay when you trade.

Unlike some traditional brokers, Olymptrade does not typically charge a fixed commission per trade on its Forex platform. Instead, their primary fee is built into the spread. The spread is simply the small difference between the buy (Ask) price and the sell (Bid) price of an asset. Think of it as the broker’s markup for facilitating your trade. This is a common model and means your main trading cost is visible right on your screen when you open a position.

Beyond the spread, there are a few other Olymptrade charges you need to be aware of. These aren’t hidden, but you should factor them into your plans, especially if you hold trades for longer periods.

- Overnight Fee (Swap): If you keep a position open overnight, you will encounter a swap fee. This is an interest payment for the leverage you are using. The fee amount varies based on the asset, the size of your position, and whether you are long (buying) or short (selling). It’s a standard part of Forex trading costs.

- Inactivity Fee: If your account remains dormant (no trading, withdrawals, or deposits) for an extended period, an inactivity fee might be applied. This is a maintenance charge for keeping the account open. A single trade or deposit resets the clock, so it’s easy to avoid for active traders.

To make it even clearer, here is a simple table summarizing the main Olymptrade fees:

| Fee Type | Description | What It Means For You |

|---|---|---|

| Spread | The difference between the asset’s buy and sell price. | This is your primary and most frequent trading cost, paid on every trade. |

| Overnight Fee / Swap | A fee for holding a position open past the market’s closing time. | Crucial for swing and position traders to calculate. Day traders are not affected. |

| Inactivity Fee | A monthly charge on accounts that have been inactive for 180 days. | Only affects dormant accounts. Easily avoided by staying active. |

| Deposit & Withdrawal Fees | Olymptrade itself does not charge for deposits or withdrawals. | Your bank or payment system might have its own fees, so check with them. |

Olymptrade itself does not charge for deposits or withdrawals. Your bank or payment system might have its own fees, so check with them.

Knowing these costs upfront empowers you to trade smarter. By understanding how spreads, swaps, and other potential charges work, you can manage your capital more effectively and make trading decisions with a full picture of the potential costs involved.

Olymptrade Customer Support for Philippine Traders

In the fast-paced world of trading, every second counts. You need a broker that has your back, not just with a great platform, but with solid, responsive support. When you have a question or run into an issue, you need answers fast. That’s why having accessible Olymptrade customer support is a game-changer for traders right here in the Philippines.

Feeling stuck is the last thing you want when your capital is on the line. Fortunately, getting help is straightforward. You have several channels to reach out and get the assistance you need, ensuring you can get back to focusing on the charts.

How to Contact Olymptrade Support

Here are the primary ways you can connect with the support team. I’ve used them all at different times, and each one is useful for different situations.

- Live Chat: This is my go-to for quick questions. Whether it’s about a deposit, a platform feature, or a general query, the live chat is available directly on the platform. The response is usually almost instant, which is perfect when you’re in the middle of a trading session.

- Email Support: For more complex issues that might require sending documents or screenshots, email is your best bet. If you have a detailed query about your trading history or a technical problem, laying it all out in an email helps the team investigate thoroughly.

- Help Center: Don’t overlook this resource! The Help Center is a comprehensive database of frequently asked questions and tutorials. Before contacting support, I often check here first. You can find answers on everything from verification to using trading indicators.

Support Channel Quick Guide

To make it even simpler, here’s a quick breakdown of which channel to use and when:

| Support Channel | Best For | Typical Response Time |

|---|---|---|

| Live Chat | Urgent questions, platform navigation, quick clarifications | A few minutes |

| Detailed inquiries, account issues, sending attachments | Within 24 hours | |

| Help Center | General questions, self-help, learning platform features | Instant |

Having reliable Olymptrade customer support tailored for Philippine traders makes a huge difference. It provides peace of mind, knowing that a professional team is ready to assist you whenever you need it. This allows you to trade with more confidence and focus on what truly matters: making smart trading decisions.

Risks and Rewards of Trading with Olymptrade

Every trader knows that the market is a double-edged sword. On one side, you have the exciting potential for profit. On the other, the very real risk of loss. When you choose a platform like Olymptrade, understanding this balance is not just important—it’s everything. Let’s break down the potential highs and lows you might encounter on your trading journey.

The allure is obvious. The platform presents an opportunity to engage with global financial markets from virtually anywhere. The potential rewards can be significant for those who develop a solid strategy and maintain discipline. But it’s crucial to approach it with a clear head, fully aware of both sides of the coin.

The Potential Rewards

Why do traders flock to platforms like this? The upside is compelling, especially for those just starting out or those looking for a streamlined trading experience. The rewards go beyond just monetary gain.

- Accessibility: You can start trading with a relatively small amount of capital. This lowers the barrier to entry, allowing more people to participate in the financial markets without needing a massive initial investment.

- High Potential Returns: Instruments like Fixed Time Trades offer the possibility of high percentage returns in very short time frames. A correct forecast can yield substantial profit quickly.

- Educational Growth: The platform provides a wealth of educational materials, webinars, and a demo account. This allows you to learn and practice trading strategies without risking real money, turning your trading journey into a valuable learning experience.

- Simplicity: The user interface is designed to be intuitive. You can execute trades, analyze charts, and manage your account with ease, which removes a lot of the technical intimidation found on more complex platforms.

The Inherent Risks

Now, let’s talk about the other side. Ignoring the risks is the fastest way to an empty account. Trading is a serious business, and you must treat it that way. The risks are real and should always be at the forefront of your mind.

- Capital Loss: This is the most significant risk. It is possible to lose your entire investment. High-reward opportunities often come with high risk, and the market can move against your position unexpectedly.

- Emotional Trading: The speed of short-term trading can trigger emotional responses like greed and fear. Chasing losses or getting overconfident after a win can lead to poor decision-making and devastating financial consequences.

- Market Volatility: Financial markets can be incredibly volatile. Sudden news events or economic shifts can cause prices to swing wildly, liquidating positions in a matter of seconds.

- Over-Simplification: While the platform is simple to use, the financial markets are not. Relying solely on the platform’s simplicity without developing a deep understanding of market analysis and risk management is a recipe for failure.

A Quick Look: Balancing the Scales

To put it all into perspective, here is a simple breakdown of how rewards and risks often connect on the platform.

| Feature | Potential Reward | Associated Risk |

|---|---|---|

| Low Minimum Deposit | Easy to start trading and test strategies. | May encourage reckless trading with money one can “afford to lose.” |

| Fixed Time Trades | High, fast returns on successful trades. | High, fast losses on unsuccessful trades; can be highly addictive. |

| Demo Account | Practice risk-free and build confidence. | Success on a demo account doesn’t guarantee success with real money due to the absence of real emotional pressure. |

| Leverage (Forex) | Amplify potential profits from small price movements. | Amplify potential losses, which can exceed the initial deposit. |

Ultimately, Olymptrade is a tool. Like any tool, its effectiveness and safety depend entirely on the person using it. Success is not about finding a magic bullet but about mastering the craft. It requires continuous learning, disciplined execution, and a profound respect for the risks involved. Your journey’s outcome will be determined by your strategy, your mindset, and your commitment to responsible trading. Trade smart, stay informed, and never risk more than you are prepared to lose.

Olymptrade Mobile App Review: Trading on the Go

In today’s fast-moving market, you can’t be chained to your desk. A trading opportunity can appear at any moment. That’s why a reliable mobile trading app isn’t just a nice feature; it’s an essential tool for every serious trader. We need the power to analyze, execute, and manage our trades from anywhere. Let’s dive in and see how the Olymptrade mobile app performs under pressure.

From the moment you log in, the app feels clean and built for purpose. The user interface is intuitive, which means you spend less time searching for buttons and more time focusing on the charts. Finding your favorite currency pairs or stocks is simple. Placing a trade is a quick, multi-tap process that feels responsive and secure. You get access to the full range of trading instruments, just like on the desktop platform. This seamless transition is a major advantage.

But does it have the necessary power? The answer is a clear yes. You can apply technical indicators directly onto the mobile charts to conduct your analysis on the move. Setting up your orders, including crucial stop loss and take profit levels, is straightforward. The app also allows you to easily switch between your real and demo accounts, which is perfect for testing a new strategy without risk.

Key Advantages and Potential Drawbacks

| Advantages | Disadvantages |

|---|---|

| Full account functionality in your pocket. | In-depth technical analysis is easier on a larger screen. |

| Clean, user-friendly design is great for beginners. | Reliability depends heavily on your mobile internet connection. |

| Customizable alerts keep you informed of market moves. | The smaller view might cause you to miss broader market context. |

| Fast trade execution for timely entries and exits. | Push notifications can be distracting if not managed properly. |

Ultimately, the Olymptrade mobile app is a solid, well-rounded tool. It successfully translates the core trading experience to a mobile format without sacrificing critical features. It empowers you to stay connected to the markets and manage your portfolio with confidence, no matter where you are. For traders who value flexibility and speed, this app is a strong contender.

Olymptrade vs. Other Trading Platforms in the Philippines

Navigating the world of online trading in the Philippines can feel overwhelming. So many platforms promise the moon, but how do you know which one is the right fit for you? Let’s break down how Olymptrade stacks up against other popular trading platforms available to Filipino traders. We’ll look beyond the marketing and focus on the features that truly matter for your daily trading journey.

Choosing a broker is a personal decision, but a side-by-side comparison can make things much clearer. Instead of just listing features, let’s see how they compare in a practical sense for someone trading from the Philippines.

| Feature | Olymptrade | Other Trading Platforms |

|---|---|---|

| Minimum Deposit | Often very low, making it accessible for beginners. | Varies widely; some require significant initial capital. |

| Platform Simplicity | Designed with a user-friendly interface, great for new traders. | Can be complex (e.g., MT4/MT5), which may have a steep learning curve. |

| Local Payment Options | Supports popular local methods for easy deposits and withdrawals. | May be limited to bank wires and international credit cards. |

| Educational Support | Extensive library of webinars, tutorials, and strategy guides. | \nOften relies on third-party education or assumes prior knowledge. |

| Asset Variety | Offers a curated selection of popular assets including forex, stocks, and commodities. | Can offer thousands of assets, which might be overwhelming for some. |

The table gives a good overview, but the trading experience is more than just numbers. Many traders in the Philippines find the simplicity of the Olymptrade platform a huge plus. You can focus on your strategy without getting lost in a maze of complex tools. While other platforms might offer more bells and whistles, sometimes less is more, especially when you are building your confidence.

What really sets a platform apart for the local market? Here are a few points to consider:

- Accessibility: A low entry barrier means you can start with a smaller capital, which is a huge advantage. You don’t need a fortune to start exploring the markets.

- Community and Support: Having access to support that understands the local context can be invaluable. It makes resolving issues with payments or verification much smoother.

- All-in-One Platform: You get a single, cohesive platform for analysis and execution. You don’t need to juggle multiple applications like you might with some other brokers.

- Risk Management Tools: Features like Stop Loss and Take Profit are integrated directly and are easy to set up, helping you protect your capital from day one.

Ultimately, the best platform is the one that aligns with your trading style and goals. While some experienced traders might prefer the complex analytical power of other trading platforms, many in the Philippines appreciate a broker that makes trading straightforward, accessible, and supportive. It’s about finding the right tool for the job.

Frequently Asked Questions About Olymptrade Philippines

Got questions about trading with Olymptrade in the Philippines? You’re in the right place. We’ve gathered the most common queries from fellow traders to give you clear, straightforward answers. Let’s dive right in and clear up any confusion you might have.

- Is Olymptrade available and regulated in the Philippines?

- Yes, traders from the Philippines can access and use the Olymptrade platform. The platform is regulated by the International Financial Commission (FinaCom), which provides a layer of security and dispute resolution for all traders, ensuring a transparent trading environment.

- How do I open an account?

- Opening an account is simple. You just need to visit the official website, click on registration, and fill out a short form with your email. You can also sign up using your social media accounts. After that, you can immediately access the demo account to practice your skills.

- What is the minimum deposit required?

- The minimum deposit is very accessible, making it easy for new traders to get started. You can begin your live trading journey with a small initial investment, allowing you to manage your risk effectively as you learn the ropes of the market.

- What payment methods can I use for deposits and withdrawals?

- Olymptrade offers a variety of convenient payment options for users in the Philippines. These typically include:\n

- \n

- Local bank transfers \n

- E-wallets like GCash, Skrill, and Neteller \n

- Credit and debit cards (Visa/Mastercard) \n

- Cryptocurrency options \n

\n - How long does it take to process withdrawals?

- Withdrawal times can vary depending on the method you choose. While the platform aims to process most requests within 24 hours, e-wallet transactions are often the fastest. Bank transfers might take a few business days to reflect in your account. The speed also depends on your account status.

- Can I trade using a mobile app?

- Absolutely! Olymptrade provides a fully functional and user-friendly mobile trading app for both Android and iOS devices. This allows you to manage your trades, check charts, and monitor the market from anywhere, anytime, right from your smartphone.

\n

\n

Is Olymptrade Philippines the Right Choice for You?

You’ve likely heard the name buzzing around the local trading communities. Olymptrade Philippines has certainly made a mark, but the big question remains: is it the platform that will help you achieve your financial goals? Choosing a broker is a personal decision, much like choosing a trading strategy. What works wonders for one trader might not fit another’s style. Let’s break down what Olymptrade offers to Filipino traders so you can make an informed choice.

The platform is known for its accessibility, which is a major draw for many starting their journey in the financial markets. But accessibility is just one piece of the puzzle. You also need to consider the trading environment, available assets, and the tools at your disposal. To help you decide, here’s a balanced look at what you can expect.

| Potential Advantages for Filipino Traders | Important Points to Consider |

|---|---|

| Low Entry Barrier: You can start with a very small initial deposit, making it accessible for those who want to test the waters without a large capital commitment. | Trading Mode: The platform is well-known for Fixed Time Trades (FTT). It’s crucial to understand how this instrument works and the risks involved before trading. |

| User-Friendly Interface: The platform is designed to be intuitive and clean. This is a huge plus for beginners who might feel overwhelmed by more complex trading terminals. | Risk Management: The simplicity can sometimes make it easy to overtrade. You must have a solid risk management plan in place and stick to it with discipline. |

| Free Demo Account: You get a replenishable demo account. This is an excellent tool for practicing strategies and getting familiar with the platform without risking real money. | Asset Variety: While it offers a decent range of assets, traders looking for thousands of exotic stocks or specific forex pairs might find the selection more limited than other brokers. |

| Educational Resources: Olymptrade provides a good amount of free educational content, including webinars and tutorials, which is helpful for new traders. | Regulatory Status: The platform is regulated by the International Financial Commission (FinaCom). It’s important to understand what this protection entails for you as a trader. |

Key Questions to Ask Yourself

Before you sign up and deposit, take a moment to reflect on your personal needs:

- What are my primary trading goals? Am I looking for long-term investments or short-term trades?

- How much time am I willing to dedicate to learning and practicing on a demo account?

- What is my personal risk tolerance? Am I comfortable with the fast-paced nature of the instruments offered?

- Does the platform’s interface and set of tools align with the trading strategy I plan to use?

Ultimately, Olymptrade Philippines could be an excellent starting point for many traders, especially those who value simplicity and a low barrier to entry. However, it’s vital to do your own research, understand the products you are trading, and never invest more than you are willing to lose. The right choice is the one that aligns with your knowledge, goals, and discipline.

Frequently Asked Questions

What is the Exness Rebate, and how does it work?

The Exness Rebate is a program that offers cashback on each trade. Every time you make a trade, a portion of the trading fees returns to your account as a rebate, helping reduce overall costs.

Who is eligible for Exness Cashback?

Most Exness accounts qualify for rebates, but eligibility may vary by account type.

How can I maximize my Exness Rebate?

To maximize Exness Cashback, focus on high-volume trading, choose low-spread pairs, and trade during high-liquidity sessions. Additionally, check that your account type qualifies for rebates.

Do rebates impact my trading performance?

No, Exness Rebates do not affect your trading performance, spreads, or execution speed. Rebates only reduce your costs by returning part of the fees on completed trades.

Are there any risks associated with the Exness Rebate program?

The main risk is over-trading in an attempt to earn more rebates. It’s essential to stick to a disciplined strategy and avoid taking unnecessary risks solely to increase rebates.