Are you in Pakistan and curious about the world of online trading? You’ve likely heard people talking about financial markets, and now you’re ready to see what it’s all about. Welcome! This guide is built just for you. We are here to walk you through every step of starting your journey with Olymptrade, one of the most accessible platforms available today.

Forget confusing jargon and complicated steps. Our goal is to give you a clear, simple roadmap. We’ll show you how to get set up, understand the platform, and take your first steps into trading. Think of this as your personal handbook for Olymptrade in Pakistan.

This guide is designed to empower you with the knowledge needed to navigate the platform confidently. We believe that with the right information, anyone can learn to participate in the markets.

- What You Will Discover Inside:

- Is Olymptrade Legal and Regulated in Pakistan?

- Getting Started with Olymptrade in Pakistan: A Step-by-Step Guide

- How to Register Your Olymptrade Account

- What to Expect After Registration

- Account Verification Process for Pakistani Users

- Depositing Funds to Olymptrade from Pakistan

- Popular Deposit Methods for Pakistani Traders

- A Quick Guide to Making Your First Deposit

- Things to Keep in Mind

- Popular Payment Methods in Pakistan

- Minimum Deposit and Transaction Fees

- Withdrawing Profits from Olymptrade in Pakistan

- Popular Withdrawal Methods

- Your Step-by-Step Guide to Cashing Out

- Important Things to Remember

- Withdrawal Options and Processing Times

- Addressing Common Withdrawal Issues

- Quick-Fix Table for Withdrawal Problems

- Olymptrade Platform Features and Tools for Pakistani Traders

- Key Analytical Tools at Your Disposal

- Available Assets and Markets on Olymptrade

- The Olymptrade Mobile App: Trading on the Go in Pakistan

- Olymptrade Bonuses, Promotions, and Educational Resources

- Customer Support and Assistance for Olymptrade Pakistan Users

- Risks and Benefits of Trading with Olymptrade in Pakistan

- The Advantages of Using Olymp Trade

- The Inherent Risks to Consider

- A Balanced View: Pros vs. Cons

- Olymptrade Alternatives and Competitors in the Pakistani Market

- Key Trading Platforms to Consider

- What to Look For in an Alternative Broker

- Tips for Successful Trading on Olymptrade

- Master the Fundamentals First

- Key Do’s and Don’ts for Olymptrade Traders

- Olymptrade Pakistan Reviews and User Experiences

- A Quick Glance at User Sentiments

- Conclusion: Making an Informed Decision About Olymptrade in Pakistan

- Frequently Asked Questions

What You Will Discover Inside:

- Account Setup Made Easy: A simple, step-by-step process for creating and verifying your account from Pakistan.

- Funding Your Account: Clear instructions on how to deposit and withdraw funds using popular local methods.

- Platform Navigation: A tour of the Olymptrade interface, so you know exactly where everything is and what it does.

- Your First Trade: Practical guidance on placing your first Fixed Time and Forex trades.

- Essential Strategies: Foundational tips to help you make informed decisions and manage your risk effectively.

Ready to begin? Let’s dive in and unlock your trading potential together.

Is Olymptrade Legal and Regulated in Pakistan?

This is a critical question for any trader in Pakistan looking to start their journey. Let’s get straight to the point. The legal status of online trading platforms in Pakistan can be complex, as there isn’t a specific local framework that directly governs all international brokers. However, this doesn’t mean you can’t trade.

Olymp Trade operates on a global scale. While it is not directly regulated by the Securities and Exchange Commission of Pakistan (SECP), it holds membership with the Financial Commission (FinaCom). This is a very important detail. FinaCom is an independent external dispute resolution body that specializes in financial markets. This membership provides a significant layer of protection for you as a trader.

What does this mean in practice? It means your funds have a degree of protection, and you have an impartial third party to turn to in case of any disputes. This is a safety net that many other platforms do not offer.

Here’s a quick breakdown of what you need to consider:

- International Regulation: The platform’s commitment to the Financial Commission provides a standard of conduct and a path for dispute resolution.

- Local Laws: Pakistan does not explicitly prohibit citizens from trading with international brokers. Thousands of traders across the country use such platforms daily.

- Your Responsibility: It is always smart to stay informed about local financial regulations and to use payment methods that are reliable and secure in Pakistan, such as e-wallets.

In conclusion, while you won’t find Olymp Trade on an SECP-regulated list, its international regulatory membership provides a trustworthy framework. Traders in Pakistan can and do use the platform, relying on this global standard of protection for their trading activities.

Getting Started with Olymptrade in Pakistan: A Step-by-Step Guide

Are you ready to dive into the world of trading? Getting your account set up is the first exciting step. Many traders in Pakistan find the process straightforward. You don’t need to be a tech wizard to get started. Just follow these simple steps, and you’ll be exploring the platform in no time. Let’s walk through the journey from registration to your first trade together.

- Create Your Account

First things first, head over to the official website and find the registration form. You will need to provide a valid email address and create a secure password. You can also choose to sign up using your social media accounts for even faster access. Once you fill in the details, you instantly get access to both a live and a demo account. It’s that simple! - Verify Your Identity (KYC)

Before you can deposit and withdraw funds freely, you must verify your account. This is a standard security procedure known as Know Your Customer (KYC). You’ll be asked to submit a photo of your national ID card (CNIC) and sometimes a proof of address. This process protects your account and ensures a secure trading environment for everyone. - Practice with a Demo Account

Don’t rush into trading with real money. Olymptrade provides a free demo account pre-loaded with virtual funds. Use this amazing tool to get familiar with the platform’s interface. Practice different strategies, understand how assets move, and build your confidence without risking a single rupee. Treat it like your personal trading gym! - Make Your First Deposit

Feeling confident? It’s time to fund your live account. The platform offers several convenient deposit methods suitable for users in Pakistan, including local bank transfers and popular e-wallets. Choose the option that works best for you, enter the amount, and follow the on-screen instructions. The funds usually appear in your account very quickly. - Start Trading!

With your account funded, you are now ready to place your first real trade. Choose an asset you’ve been watching, analyze the chart, decide on your trade amount, and execute your trade. Remember to start small and manage your risk. Welcome to the market!

How to Register Your Olymptrade Account

Getting started on your trading journey is exciting, and the first step is always creating your account. The good news? It’s a super quick and straightforward process. You’ll be ready to explore the platform in just a couple of minutes. Let’s walk through it together so you can get set up without any hassle.

Follow these simple steps to create your personal trading space:

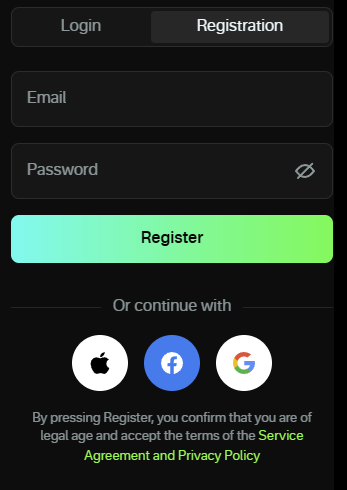

- Visit the Official Platform: Head over to the Olymptrade website. You’ll immediately see the registration form right on the homepage.

- Enter Your Details: Fill in your email address and create a strong, secure password. Remember this password, as you’ll need it to log in later.

- Choose Your Currency: You will be asked to select the currency for your account. You can typically choose between USD and EUR. Think carefully, as you usually can’t change this setting later.

- Agree to the Terms: Tick the box to confirm you are of legal age and that you accept the service agreement. It’s always a good idea to quickly review the terms.

- Click Register: Hit that big “Register” button, and you’re in! You’ll be instantly redirected to the trading platform.

What to Expect After Registration

Once you register, you are immediately given access to both a live account and a demo account. The demo account comes pre-loaded with virtual funds, allowing you to practice and get comfortable with the platform without risking any real money. We highly recommend starting here!

Trader’s Tip: Use your demo account to test strategies, understand the interface, and build your confidence. It’s the perfect training ground before you make your first deposit.

| Registration Step | Key Action | Why It’s Important |

|---|---|---|

| Email & Password | Provide a valid email and create a secure password. | Secures your account and is used for verification and communication. |

| Account Currency | Select your preferred currency (e.g., USD, EUR). | Determines the currency for all your deposits, trades, and withdrawals. |

| Terms Agreement | Accept the platform’s terms of service. | Confirms you understand and agree to the rules of trading on the platform. |

That’s all there is to it. Your account is now active, and you have taken the first crucial step. Now the real fun begins: exploring the charts, learning the tools, and placing your first practice trades.

Account Verification Process for Pakistani Users

Ready to fund your account and start trading? First, let’s complete the account verification. This is a crucial step required by financial regulations, often known as KYC (Know Your Customer), and it exists to protect your funds and prevent fraud. We have streamlined this process to make it as quick and simple as possible for all Pakistani traders.

To get your account verified, you’ll need to provide two types of documents. Make sure you have clear, readable copies or photos of them ready.

- Proof of Identity (POI): This document confirms who you are. You can use any one of the following valid government-issued documents:

- Smart National Identity Card (SNIC)

- Passport

- Driver’s License

- Proof of Address (POA): This document confirms where you live. It must show your full name and address and be recent. You can use one of these:

- A recent utility bill (electricity, gas, water, or internet)

- A bank or credit card statement

Simply log in to your client area, navigate to the verification section, and upload your documents. Our compliance team works efficiently to review submissions. Usually, the entire account verification is completed within one business day. We will notify you by email as soon as you are all set to start trading!

Depositing Funds to Olymptrade from Pakistan

Ready to start your trading journey with Olymptrade? The first step is getting your account funded, and thankfully, the platform makes it a smooth process for traders in Pakistan. You have several convenient options right at your fingertips. Forget complicated procedures; Olymptrade focuses on getting you into the market quickly and securely. Let’s explore the popular methods you can use to make a deposit.

Choosing the right payment method depends on your preference for speed, convenience, and what you already use. Olymptrade supports a variety of modern and traditional payment systems.

Popular Deposit Methods for Pakistani Traders

| Payment Method | Type | Typical Processing Time |

|---|---|---|

| Bank Cards (Visa/Mastercard) | Debit/Credit Card | Instant to a few minutes |

| Skrill | E-Wallet | Nearly Instant |

| Neteller | E-Wallet | Nearly Instant |

| Perfect Money | E-Wallet | Nearly Instant |

| Cryptocurrency (e.g., BTC, USDT) | Digital Currency | Depends on network confirmation |

A Quick Guide to Making Your First Deposit

Follow these simple steps to add funds to your Olymptrade account:

- Log In: Access your Olymptrade account using your credentials.

- Find the Deposit Button: Look for the “Payments” or “Deposit” button, usually located prominently on your dashboard.

- Choose Your Method: Select your preferred payment option from the list available for Pakistan.

- Enter the Amount: Type in the amount you wish to deposit. Pay attention to any available bonus offers you might be able to claim!

- Provide Details: Follow the on-screen instructions. This might involve entering your card information or logging into your e-wallet to authorize the payment.

- Confirm and Trade: Finalize the transaction. The funds should reflect in your trading account shortly, and you’ll be ready to open your first trade.

Things to Keep in Mind

- Name Consistency: To ensure a smooth process and avoid any potential holds, always use a payment method that is registered in your own name. The name must match the one on your Olymptrade profile.

- No Third-Party Deposits: Olymptrade does not accept payments from third-party accounts. This is a standard security measure to protect your funds.

- Minimum Deposit: The platform offers a very accessible entry point with a low minimum deposit, making it easy for new traders to get started without a large capital commitment.

- No Deposit Fees: Olymptrade does not charge any commission for depositing funds into your account. However, your payment provider might have its own transaction fees, so it’s a good idea to check with them.

Popular Payment Methods in Pakistan

Getting your funds into and out of your trading account should be the easiest part of your journey. In Pakistan, traders have several reliable options. Choosing the right one for your deposit or withdrawal depends on your priorities: speed, cost, or convenience. Let’s break down the most common choices to help you manage your capital smoothly.

Here are the key funding options available to most traders in the region:

- Local Bank Transfer: This is a go-to method for many. It’s secure and straightforward. You simply transfer funds directly from your Pakistani bank account to the forex broker. While it’s very reliable, withdrawals can sometimes take a few business days to process.

- E-Wallets (Skrill & Neteller): These are superstars in the global trading community. Skrill and Neteller offer instant deposits and fast withdrawals. They act as a bridge between your bank and your trading account, providing an extra layer of privacy and speed.

- Mobile Wallets (JazzCash & EasyPaisa): The convenience of local mobile wallets is undeniable. While not all international brokers support them directly, some local exchangers or payment agents do. They are perfect for funding smaller accounts or for traders who prefer using their mobile balance.

- Cryptocurrencies: Using crypto, like USDT (Tether) or Bitcoin, is rapidly gaining popularity. It offers blazing-fast transaction times and can often have lower fees than traditional methods. This is a great option if you are comfortable with digital currencies.

To make your choice easier, here’s a quick comparison:

| Payment Method | Deposit Speed | Withdrawal Speed | Typical Fees |

|---|---|---|---|

| Local Bank Transfer | 1-3 Business Days | 2-5 Business Days | Low to Medium |

| Skrill / Neteller | Instant | Usually within 24 hours | Medium |

| JazzCash / EasyPaisa | Instant (via agents) | Fast (via agents) | Varies by agent |

| Cryptocurrency | Near-Instant | Near-Instant | Low (network fees) |

Your best bet is to check which of these options your preferred forex broker supports. Finding a broker with flexible payment methods makes managing your trading funds a hassle-free experience from the very start.

Minimum Deposit and Transaction Fees

Let’s talk about the real cost of your trading journey. Your initial investment and the ongoing fees are crucial elements that directly impact your profitability. Understanding a broker’s minimum deposit and transaction fee structure isn’t just a box-ticking exercise; it’s a fundamental part of crafting a winning strategy.

The minimum deposit is simply the smallest amount required to open a live trading account. This amount varies widely across the industry. Some brokers allow you to start with as little as $10, which is fantastic for beginners who want to test their skills with real money but minimal risk. On the other hand, premium accounts with enhanced features, tighter spreads, or dedicated account managers often demand a higher initial deposit.

Beyond the entry ticket, you must watch out for the various transaction fees that can affect your trades. Being aware of these costs is key to managing your capital effectively.

- Spreads: This is the most common trading cost. It’s the difference between the bid (sell) price and the ask (buy) price of a currency pair. A lower spread means a lower cost for you to enter a trade.

- Commissions: Some accounts, particularly ECN or raw spread accounts, charge a fixed commission per trade. In return, they offer extremely narrow spreads, which can be beneficial for high-frequency traders and scalpers.

- Swap/Rollover Fees: If you keep a trading position open overnight, you will either pay or earn a small fee known as a swap. This fee is based on the interest rate differential between the two currencies in the pair.

- Non-Trading Fees: Always check for other potential charges. These can include fees for depositing or withdrawing funds, or an inactivity fee if you don’t trade for a certain period.

Choosing the right fee structure depends entirely on your trading style. A commission-free account with wider spreads might be perfect for a swing trader who makes a few trades a month. However, a scalper opening dozens of trades a day would likely find a commission-based account with tighter spreads more cost-effective. Analyze your approach before you commit.

Withdrawing Profits from Olymptrade in Pakistan

Congratulations, trader! You’ve successfully navigated the markets and earned a profit. Now comes the best part: cashing out your winnings. Getting your money from Olymptrade in Pakistan is a straightforward process. Let’s walk through how you can access your funds quickly and securely, so you can enjoy the fruits of your smart trading decisions.

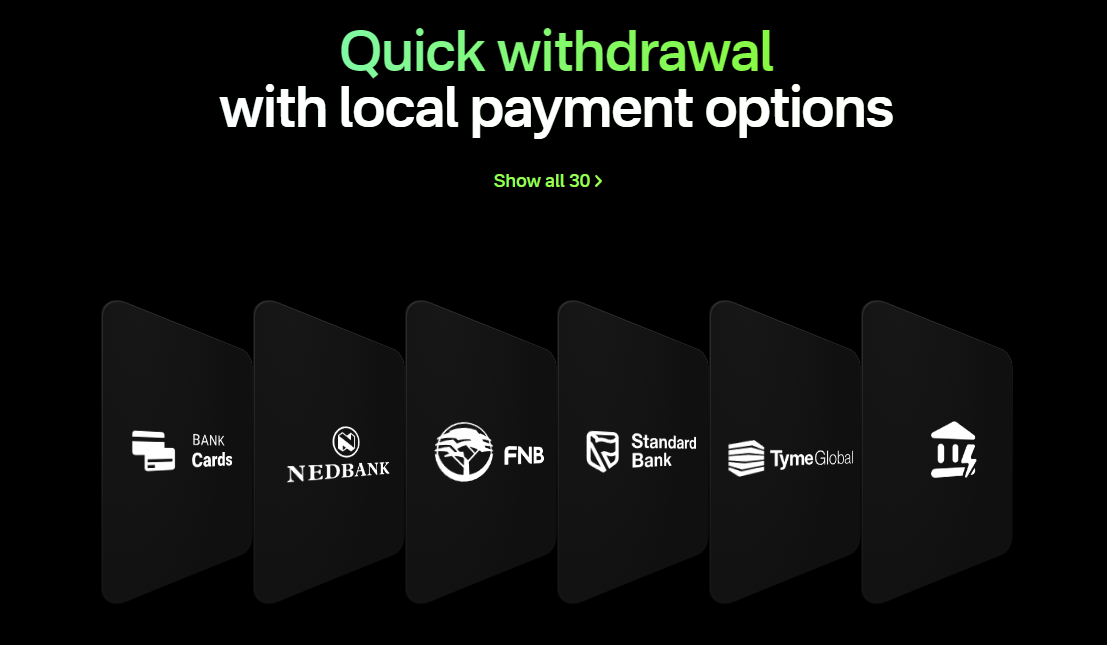

First, it’s important to know your options. Olymptrade provides several withdrawal methods tailored for users in Pakistan. Choosing the right one depends on your convenience and what you used for your initial deposit.

Popular Withdrawal Methods

- E-wallets: Services like Skrill, Neteller, and Perfect Money are extremely popular. They are known for fast processing times, often completing transactions within 24 hours after approval.

- Cryptocurrency: If you prefer digital currencies, you can withdraw your profits using Bitcoin or other supported cryptocurrencies. This is a modern and often speedy option.

- Bank Transfers: While sometimes available, direct bank transfers might take longer to process compared to e-wallets. Always check the platform for the most current local banking solutions.

Your Step-by-Step Guide to Cashing Out

Ready to make a withdrawal? Just follow these simple steps on the platform:

- Log In: Access your Olymptrade account using your credentials.

- Navigate to Payments: Find and click on the “Withdrawal” or “Payments” section in your user dashboard.

- Select a Method: Choose the withdrawal method you prefer. Remember the golden rule: you must withdraw funds using the same payment system you used to make a deposit.

- Enter the Amount: Specify how much money you wish to withdraw from your available balance.

- Confirm and Submit: Double-check all the details and confirm your withdrawal request. You will receive a notification once it’s submitted.

Important Things to Remember

To ensure a smooth and hassle-free withdrawal experience, keep these points in mind. This is professional advice that can save you a lot of time.

| Consideration | Why It Matters |

|---|---|

| Account Verification | Your account must be fully verified before you can withdraw. Complete the KYC (Know Your Customer) process by submitting the required documents as soon as you sign up. |

| Withdrawal Limits | Check for any minimum or maximum withdrawal limits for your chosen method. These can vary between different payment systems. |

| Processing Times | While Olymptrade processes most requests quickly, the time it takes for money to reach you depends on your payment provider. E-wallets are typically the fastest. |

| No Commission | Olymptrade does not charge a commission on withdrawals, which is a fantastic benefit. However, your payment provider might have its own fees, so it’s wise to check with them. |

Withdrawal Options and Processing Times

You’ve traded well, and now it’s time to enjoy your profits. Getting your money out of your trading account should be a straightforward process. A broker’s reliability often shines through in how efficiently they handle withdrawals. Let’s break down the common methods and what you can expect in terms of timing.

Different brokers offer various ways to access your funds. The method you choose can significantly impact how quickly the money lands in your bank account. Below is a quick guide to the most common options available.

| Withdrawal Method | Typical Processing Time | Key Considerations |

|---|---|---|

| Bank Wire Transfer | 2-5 business days | Highly secure, ideal for large amounts, but can be slower and may involve bank fees. |

| Credit/Debit Card | 1-3 business days | Convenient and fast, but often limited to the amount you initially deposited with that card. |

| E-Wallets (e.g., Skrill, Neteller) | Within 24 hours | Very popular among traders for its speed and ease of use. Great for quick access to funds. |

| Cryptocurrency | Minutes to a few hours | Extremely fast but requires a crypto wallet and understanding of the process. Network fees apply. |

It’s important to remember that the “processing time” has two parts: the broker’s internal processing and the payment provider’s time. Most regulated brokers process withdrawal requests within one business day. However, several factors can influence the total duration.

- Account Verification: Your account must be fully verified (KYC/AML checks) before any withdrawal can be processed. Make sure all your documents are submitted and approved well in advance.

- Cut-Off Times: Brokers have daily cut-off times for processing payments. If you submit your request after this time, they will likely process it on the next business day.

- Weekends and Holidays: Banks and payment processors do not operate on weekends or public holidays, which can add delays to your withdrawal.

- Withdrawal Method: As shown in the table, the method you select is one of the biggest factors determining speed.

A smart trader’s tip: Always make a small test withdrawal after funding a new account. This helps you understand the process and timing before you need to withdraw a larger sum. Peace of mind is priceless.

Addressing Common Withdrawal Issues

Nothing sours a trading success story faster than a problem getting your profits. We get it. Hitting a roadblock when you try to withdraw your funds is frustrating. The good news is that most withdrawal issues are easy to prevent and quick to solve. Let’s walk through the common hiccups and how to handle them like a pro.

Most of the time, delays are not a sign of a problem with the broker, but rather a simple procedural snag. Understanding the process helps you navigate it smoothly. Here are the most frequent reasons a withdrawal might get flagged or delayed:

- Incomplete Account Verification: This is the number one reason for delays. Global regulations require brokers to verify your identity (KYC) before processing payouts.

- Payment Method Mismatch: You tried to withdraw funds to an account or card that is under a different name than your trading account.

- Third-Party Deposits: Funds were deposited from an account that wasn’t yours, and now you’re trying to withdraw. This is a red flag for anti-money laundering checks.

- Unmet Bonus Conditions: If you accepted a trading bonus, you often need to meet a specific trading volume before you can withdraw the bonus funds or associated profits.

- Incorrect Withdrawal Information: A simple typo in your bank account number or SWIFT code can cause a transaction to fail.

Quick-Fix Table for Withdrawal Problems

Stuck on a withdrawal? Find your issue in the table below for a straightforward solution.

| Common Issue | How to Solve It |

|---|---|

| Verification Request | Check your email and client portal immediately. Upload clear copies of the requested ID and proof of address documents. The support team can’t proceed without them. |

| “Method Not Allowed” Error | You must withdraw funds back to the original deposit source first. For example, if you deposited via a credit card, you must withdraw your initial deposit amount back to that same card. |

| Processing is “Pending” | Allow for the standard processing time (usually 1-3 business days). If it extends beyond that, contact the support team with your withdrawal ID for an update. Often, the delay is with the bank, not the broker. |

| Bonus-Related Rejection | Log into your account and check the terms of the bonus you accepted. Ensure you have met the volume requirements. If not, you may need to forfeit the bonus to withdraw your own capital. |

A little preparation goes a long way. The easiest withdrawal is one that is requested from a fully verified account to a payment method you’ve already used for a deposit. Keep it simple, and you’ll get your funds without a fuss.

Remember, a transparent and regulated broker wants you to get your money. Their reputation depends on it. If you encounter an issue not listed here, don’t hesitate to reach out to the customer support team. Clear communication is the key to resolving any withdrawal problem swiftly.

Olymptrade Platform Features and Tools for Pakistani Traders

As a trader, I value a platform that is both powerful and straightforward. When you’re analyzing charts and making quick decisions, you don’t want to fight with a complicated interface. Olymp Trade provides a clean and intuitive environment that helps you focus on what truly matters: your trading strategy. It strips away the unnecessary clutter, making it an excellent starting point for new traders in Pakistan and a reliable tool for seasoned professionals.

Let’s dive into the core features that you can use to your advantage.

- Flexible Trading Modes: You get the freedom to choose how you want to trade. You can engage in classic Forex trading for long-term positions or use the Fixed Time Trades (FTT) mode for faster, short-term opportunities. This versatility allows you to adapt your approach to different market conditions.

- Diverse Asset Selection: The platform offers a wide array of assets. You can trade major and minor currency pairs, leading company stocks, global indices, and popular commodities. Having this variety at your fingertips means more chances to find a profitable setup.

- Risk-Free Demo Account: Before you deposit a single rupee, you can sharpen your skills on a demo account. It comes with virtual funds that you can replenish anytime. This is the perfect space to test new strategies, understand market movements, and get comfortable with the platform’s tools without any financial pressure.

- Low Entry Barrier: Getting started doesn’t require a huge investment. The low minimum deposit and trade amounts make the platform highly accessible for traders in Pakistan who want to start small and build their accounts over time.

Key Analytical Tools at Your Disposal

Success in trading often comes down to solid analysis. The platform integrates a comprehensive suite of technical analysis tools directly into the chart, so you can make informed decisions without needing external software.

| Tool Type | Examples & Use Cases |

|---|---|

| Indicators | Use tools like the Relative Strength Index (RSI) to spot overbought or oversold conditions, or apply Moving Averages (SMA, EMA) to identify the prevailing trend direction. |

| Charting Tools | Draw trend lines, support and resistance levels, and Fibonacci retracements directly on your chart to visualize your analysis and pinpoint potential entry and exit points. |

| Chart Types | Switch between Area, Japanese Candlesticks, and Heiken Ashi charts to view price action in a way that best suits your trading style. |

“I always advise new traders to master one or two built-in indicators first. Don’t overcomplicate your chart. A simple combination of a trend indicator and an oscillator is often all you need to find great opportunities on this platform.”

By combining these features, Olymp Trade creates a balanced ecosystem. It provides the necessary tools for serious analysis while maintaining a simple interface that helps you execute trades efficiently. This focus on user experience gives you the confidence to navigate the financial markets effectively.

Available Assets and Markets on Olymptrade

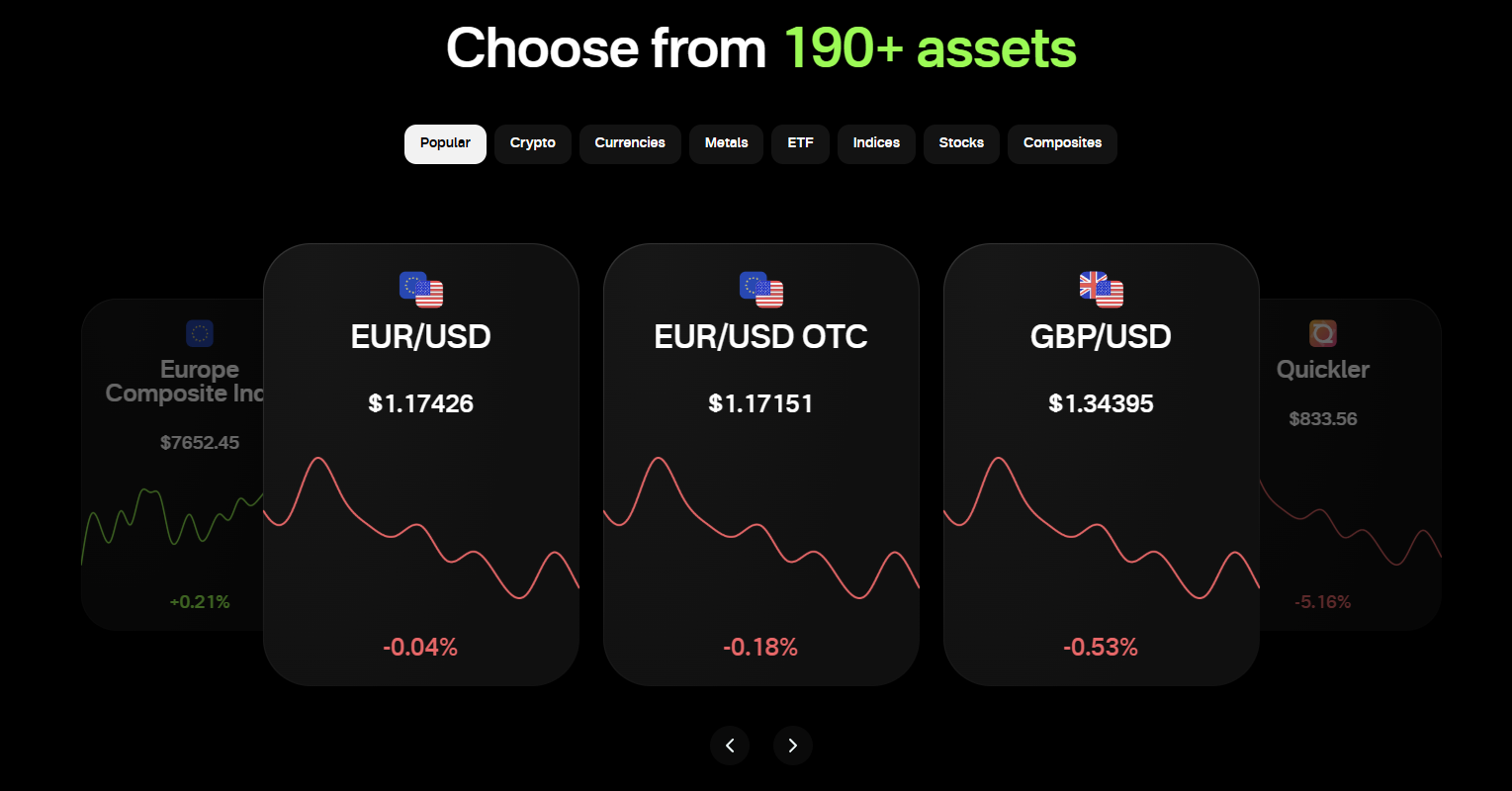

A smart trader never puts all their eggs in one basket. Your strategy’s success often depends on having access to diverse market opportunities. Olymptrade understands this fundamental principle by offering a wide spectrum of trading instruments. This variety allows you to pivot your strategy based on global news, market sentiment, and economic events, ensuring you can always find a potential trade, no matter the conditions.

Whether you are a seasoned forex trader or just starting to explore the financial markets, the platform provides the tools to build a diversified portfolio. Let’s break down the key asset classes you can access.

- Forex Pairs: This is the heart of the trading world. You can trade major pairs like EUR/USD, popular minor pairs, and even exotic currency pairs to capitalize on global currency fluctuations.

- Stocks: Gain exposure to the world’s leading companies. Trade contracts on the price movements of giants like Apple, Tesla, and Microsoft without needing to own the underlying stock.

- Commodities: Trade essential raw materials that drive the global economy. This includes precious metals like gold and silver, which often act as safe-haven assets, as well as energy products like oil.

- Indices: Instead of focusing on a single company, trade the performance of an entire stock market sector. Access popular indices like the S&P 500, NASDAQ, and Dow Jones to trade on broader economic trends.

- Cryptocurrencies: Dive into the dynamic world of digital assets. You can trade popular cryptocurrencies like Bitcoin and Ethereum, taking advantage of their high volatility and unique market drivers.

Each asset class behaves differently, offering unique advantages. Understanding these differences is key to making informed trading decisions. Here’s a quick comparison to help you see the bigger picture:

| Asset Type | Typical Volatility | Key Market Drivers |

|---|---|---|

| Forex | Medium to High | Interest rates, economic data, geopolitical events |

| Stocks | Medium | Company earnings, industry news, market sentiment |

| Commodities | Varies (High for Oil) | Supply and demand, global economic health |

| Indices | Low to Medium | Overall economic performance, major political news |

| Cryptocurrencies | Very High | Adoption rates, regulations, market speculation |

Having all these options under one roof gives you incredible flexibility. You can hedge your positions, diversify your risk, and seize opportunities across different global markets. This extensive selection of assets ensures that your trading journey is never limited.

The Olymptrade Mobile App: Trading on the Go in Pakistan

In today’s fast-moving world, you can’t be tied to your desk. Opportunities in the financial markets wait for no one. That’s why mobile trading has become a game-changer for traders across Pakistan. Imagine catching a crucial market move while you’re commuting or on a lunch break. The Olymp Trade app makes this a reality, putting the power of a full trading platform right into your pocket.

This isn’t just a scaled-down version of the desktop site; it’s a robust tool designed for performance and ease of use. You get instant access to forex trading, stocks, and other instruments without missing a beat. Let’s look at what makes it stand out.

- Full Functionality: Execute trades, set stop-loss and take-profit orders, and manage your portfolio with just a few taps.

- Advanced Charting Tools: Analyze price movements with a suite of indicators and graphical tools, all optimized for your mobile screen.

- Instant Alerts: Set up custom notifications for price levels or market events so you never miss a trading opportunity.

- User-Friendly Interface: The app is designed to be intuitive. Whether you are a beginner or a pro, you’ll find navigating the platform simple and fast.

- Secure and Quick Deposits: Easily fund your account using popular payment methods available in Pakistan, ensuring you’re always ready to trade.

Of course, trading on the go has its own unique dynamics. Here’s a quick breakdown of what to expect when you switch from your desktop to your phone.

| Advantages of Mobile Trading | Potential Considerations |

|---|---|

| Trade from anywhere, anytime. Total freedom and flexibility. | Smaller screen size can make complex technical analysis challenging. |

| React instantly to market news and price spikes. | Dependent on a stable internet connection (Wi-Fi or mobile data). |

| Simplified interface helps you focus on essential actions. | Potential for distractions in a mobile environment. |

For me, the ability to manage my trades while away from my PC is not just a convenience; it’s essential. The Olymp Trade app gives me that control without compromise.

Ultimately, having a reliable mobile trading solution is crucial for any serious trader in Pakistan. It bridges the gap between opportunities and action, ensuring you are always connected to the markets. It’s about making the market work around your schedule, not the other way around.

Olymptrade Bonuses, Promotions, and Educational Resources

Every trader looks for an edge. It’s not just about finding the perfect entry point; it’s about maximizing every opportunity you get. Olymptrade understands this principle and offers a suite of tools that extend far beyond the trading chart. They provide real value through bonuses that boost your capital and educational resources that sharpen your mind. This combination gives you the firepower needed to navigate the markets with greater confidence.

Let’s talk about adding more to your trading account. Olymptrade frequently rolls out promotions that can give your balance a healthy lift. These aren’t just one-time welcome offers; they are ongoing opportunities designed to reward active traders and enhance your trading potential. Think of it as having more ammunition to test your strategies.

- Deposit Bonuses: Receive extra trading funds credited to your account when you make a deposit, giving you more to work with from the start.

- Promo Codes: Keep an eye out for special codes that unlock exclusive perks, from bonus funds to improved trading conditions.

- Risk-Free Trades: A fantastic way to execute a trade on a volatile asset or test a new strategy without putting your own capital on the line.

- Experience Points (XP): You earn points simply by trading. As you accumulate XP, you advance to higher statuses, unlocking better perks and more favorable terms.

A bonus is great, but knowledge is the true power in trading. A platform that invests in your education is a platform that invests in your success. Olymptrade shines here with a comprehensive learning hub built to hone your skills, whether you are just starting or have been trading for years. They provide the tools you need to make smarter, more informed decisions.

| Resource Type | What It Offers | Best For |

|---|---|---|

| Webinars | Live sessions with market analysts and pro traders covering strategies and market analysis. | Interactive learners who want to ask questions and get real-time insights. |

| Strategy Guides | In-depth articles and tutorials on a wide range of trading techniques and indicators. | Traders looking to expand their tactical toolkit and understand market mechanics. |

| Video Tutorials | Short, easy-to-follow videos explaining platform features and basic trading concepts. | Visual learners and beginners who need a clear starting point. |

| Market Insights | Daily analysis, news updates, and economic calendars to keep you informed. | All traders who want to stay ahead of market-moving events. |

“In the markets, a well-informed trader is a prepared trader. Capital gives you the opportunity, but knowledge tells you how to use it.”

By combining powerful promotions with a rich educational center, Olymptrade creates a dynamic trading environment. You get the capital to act on opportunities and the knowledge to spot them in the first place. This dual approach helps you grow not just your account balance, but your skills as a trader for the long haul. It is a complete package for anyone serious about mastering the financial markets.

Customer Support and Assistance for Olymptrade Pakistan Users

When you’re navigating the fast-paced financial markets, solid support is non-negotiable. You need quick answers and effective solutions to keep your trading on track. For traders in Pakistan, having access to reliable customer support can make all the difference. Olymptrade ensures you have a dedicated team ready to help with any questions or issues you might encounter on the trading platform.

Getting in touch with the support team is straightforward. They offer several channels so you can choose the one that best suits your needs. Whether you have a simple question or a complex technical problem, help is always just a few clicks away.

| Contact Method | Typical Response Time | Best For |

|---|---|---|

| Live Chat | Instant / Within minutes | Urgent platform queries and quick technical help. |

| Email Support | Within 24 hours | Detailed inquiries, account verification, and document submission. |

| Online Help Center | Immediate | Finding answers to common questions and learning platform features. |

The support staff is well-trained to handle a wide range of topics. You can expect professional assistance with:

- Account Management: Help with verification, profile settings, and security.

- Financial Operations: Guidance on deposits, withdrawals, and transaction issues.

- Platform Navigation: Questions about using trading tools, indicators, and other features.

- Technical Troubleshooting: Resolving any bugs or errors you experience while trading.

Knowing that a capable support team is available gives you peace of mind. It allows you to focus on your trading strategies and market analysis, confident that any platform-related issues will be handled efficiently. This level of assistance is a key part of a smooth and successful trading experience.

Risks and Benefits of Trading with Olymptrade in Pakistan

Diving into the world of online trading from Pakistan is an exciting prospect, and platforms like Olymp Trade have made it more accessible than ever. But before you jump in, it’s crucial to look at the full picture. Like any form of trading, it’s a double-edged sword with significant potential for both profit and loss. Understanding these risks and benefits is the first step any smart trader takes.

Let’s break down what you can expect when you start your trading journey with this platform.

The Advantages of Using Olymp Trade

Many traders in Pakistan are drawn to the platform for several good reasons. Here are some of the key benefits that make it an attractive option:

- Low Barrier to Entry: You don’t need a fortune to start. The minimum deposit is quite low, allowing new traders to test the waters with a small amount of capital without taking on massive financial risk.

- User-Friendly Platform: The interface, both on the web and the mobile app, is clean and intuitive. This makes it easy for beginners to navigate the markets, place trades, and analyze charts without feeling overwhelmed.

- Free Demo Account: This is perhaps the most valuable feature for newcomers. You get a replenishable demo account with virtual funds to practice your strategies and get comfortable with the platform before you risk any of your own money.

- Educational Resources: The platform offers a range of learning materials, from webinars to tutorials and articles. This helps you build your knowledge base and improve your trading skills over time.

- Asset Variety: You are not limited to just one market. You can trade a variety of assets, including currency pairs, stocks, and commodities, allowing you to diversify your trading activities.

The Inherent Risks to Consider

It’s vital to approach trading with a clear understanding of the potential downsides. Ignoring these risks is a recipe for disaster. Here’s what you must keep in mind:

- Market Volatility: Financial markets are unpredictable. Prices can move rapidly due to economic news, political events, or market sentiment, leading to sudden and significant losses.

- The Risk of Overleveraging: While leverage can magnify your profits, it also magnifies your losses. A small market movement against your position can wipe out your account balance if you are not careful with your risk management.

- Emotional Trading: Fear and greed are a trader’s worst enemies. Making impulsive decisions based on emotion rather than a solid strategy often leads to poor outcomes and financial loss.

- Withdrawal and Deposit Concerns: While many transactions are smooth, traders sometimes report delays or issues with payment processing. It’s important to be aware of the specific methods available in Pakistan and their typical processing times.

A Balanced View: Pros vs. Cons

To make it even clearer, here is a simple table summarizing the key points:

| Benefits (The Pull) | Risks (The Push) |

|---|---|

| Small initial investment required | High risk of losing your capital |

| Easy-to-use platform for beginners | Psychological pressure and emotional decisions |

| Practice for free with a demo account | Leverage can lead to rapid, large losses |

| Access to various global markets | Potential for delays in fund withdrawal |

Ultimately, trading with Olymp Trade in Pakistan offers a genuine opportunity but carries substantial risk. Success isn’t guaranteed; it depends on your knowledge, strategy, and discipline. The best approach is to start small, educate yourself continuously, and never trade with money you cannot afford to lose.

Olymptrade Alternatives and Competitors in the Pakistani Market

While Olymptrade has made a name for itself in Pakistan, smart traders always keep their options open. The online trading landscape is packed with powerful platforms, and finding the one that truly fits your strategy can make all the difference. You might be looking for lower spreads, a wider variety of assets, or simply a platform with more convenient deposit and withdrawal methods for Pakistani users.

Exploring alternatives isn’t about ditching a good platform; it’s about discovering a great one. Every trader has unique needs. Some prioritize lightning-fast execution for scalping, while others need advanced analytical tools for long-term forex analysis. Let’s dive into some of the key competitors that are gaining traction among traders in Pakistan.

Key Trading Platforms to Consider

Here’s a quick look at some popular brokers that serve the Pakistani market. Each has its own strengths, so consider what matters most to your trading style.

| Broker | Key Feature | Best For Traders Who… | Local Payment Support |

|---|---|---|---|

| IQ Option | Proprietary user-friendly platform | …are new to trading or focus on binary options and CFDs. | Yes |

| Exness | Instant withdrawals and high leverage | …need quick access to profits and trade with high leverage. | Yes |

| OctaFX | Excellent copy trading service | …want to follow and automatically copy successful traders. | Yes |

| FBS | Generous bonuses and promotions | …are looking to maximize their initial deposit with bonuses. | Yes |

What to Look For in an Alternative Broker

When you are comparing platforms, don’t just look at the marketing claims. Focus on the features that directly impact your trading and finances. Here are a few critical points to check:

- Regulation and Trust: Does a top-tier international authority regulate the broker? A regulated broker offers a higher level of security for your investment.

- Local Payment Methods: This is a big one. Check if the platform supports easy deposits and withdrawals through local banks, JazzCash, or Easypaisa. Smooth and fast transactions are essential.

- PKR Trading Accounts: Some brokers offer accounts denominated in Pakistani Rupees (PKR). This helps you avoid costly currency conversion fees on every deposit and withdrawal.

- Trading Costs: Look at the spreads on major forex pairs like EUR/USD. Are they competitive? Also, check for any commissions or hidden fees that could eat into your profits.

- Customer Support: Is their support team available when you are trading? Good customer service that understands the local market can be a lifesaver when you run into an issue.

Ultimately, the best platform is a personal choice. Your goal is to find a reliable partner for your trading journey. We recommend opening demo accounts with a few different brokers to test their platforms firsthand. See how they feel, check their execution speed, and find the one that gives you the confidence to trade effectively.

Tips for Successful Trading on Olymptrade

Jumping into the trading world with Olymptrade can be an exciting journey. But let’s be real: consistent success isn’t about finding a magic button. It’s about building solid habits and a smart approach. I’ve spent years in the trenches, and I can tell you that the traders who last are the ones who treat it like a business, not a casino. Ready to build your foundation for success? Let’s dive into some practical tips that actually work.

Master the Fundamentals First

Before you even think about putting real money on the line, you need to understand the game. Success on any platform, including Olymptrade, is built on a strong foundation of knowledge and discipline. Here are the core pillars to focus on:

- Educate Yourself Relentlessly: The market is always changing, and you should always be learning. Use the educational resources available to understand different assets, analysis techniques, and market dynamics. Never stop being a student of the market.

- Practice with a Demo Account: The demo account is your best friend. Use it to test your strategies, get comfortable with the platform’s interface, and make mistakes without any financial consequences. Treat the demo money like it’s real to build good habits.

- Develop a Concrete Trading Plan: Never enter a trade without a plan. Your plan should define what asset you’ll trade, your entry and exit points, and how much you’re willing to risk. A plan removes emotion and keeps you disciplined.

- Control Your Emotions: Fear and greed are the two biggest enemies of a trader. Fear makes you close winning trades too early, and greed makes you hold losing trades for too long. Stick to your trading plan no matter what your emotions are telling you.

- Keep a Trading Journal: Document every single trade. Write down why you entered, what happened, and why you exited. Over time, your journal will reveal your strengths and weaknesses, helping you refine your strategy and avoid repeating costly mistakes.

Key Do’s and Don’ts for Olymptrade Traders

Sometimes, a quick checklist is the best way to keep your trading sharp. Here’s a simple table to guide your daily trading activities.

| What You Should Do (The Do’s) | What You Should Avoid (The Don’ts) |

|---|---|

| Follow your trading plan strictly. | Chase your losses by making bigger, riskier trades. |

| Manage your risk on every single trade. | Let emotions like fear or excitement dictate your decisions. |

| Start small and increase your trade size as you gain experience. | Trade with money you cannot afford to lose. |

| Stay updated on economic news that can affect your assets. | Blindly follow tips or signals without doing your own analysis. |

“The goal of a successful trader is to make the best trades. Money is secondary.” – Alexander Elder

Remember, becoming a successful trader is a marathon, not a sprint. It takes patience, discipline, and a commitment to continuous improvement. Apply these tips, stay focused, and you will build the skills needed to navigate the markets with confidence on Olymptrade.

The best approach is to start small, educate yourself continuously, and never trade with money you cannot afford to lose.

Olymptrade Pakistan Reviews and User Experiences

When you’re looking for a trading platform, nothing speaks louder than the voices of fellow traders. What are people actually saying about their experiences? Let’s dive into the common feedback and reviews from the Olymp Trade community in Pakistan. This gives you a real-world look at what to expect, moving beyond the official marketing points.

We’ve gathered the most frequent comments from local traders to give you a balanced perspective. Here’s a breakdown of what users often praise and where they see room for improvement.

What Traders in Pakistan Often Appreciate:

- Accessibility: Many traders highlight the low minimum deposit. This makes it easier for beginners to start their trading journey without a huge initial investment.

- User-Friendly Interface: The platform gets frequent compliments for being clean, intuitive, and easy to navigate, even for those new to online trading.

- Free Demo Account: Users love the unlimited demo account. It provides a risk-free environment to practice strategies and get comfortable with the platform before committing real funds.

- Educational Resources: The availability of webinars, tutorials, and articles directly on the platform is a big plus for traders looking to improve their skills.

Common Criticisms and Concerns:

- Withdrawal Times: Some user reviews mention that withdrawal processing can sometimes take longer than expected. While many experience smooth transactions, delays are a recurring point in feedback.

- Asset Variety: Experienced traders sometimes wish for a broader range of assets, particularly in specific categories like individual stocks or exotic currency pairs.

- Support Response: While support is available, a few users have reported varying response times from customer support during peak trading hours.

A Quick Glance at User Sentiments

| Feature | Common User Feedback in Pakistan |

|---|---|

| Platform Usability | Overwhelmingly positive; seen as clean and beginner-friendly. |

| Deposit & Withdrawal | Deposits are generally fast. Withdrawal speed receives mixed reviews. |

| Learning Tools | Highly rated for helping new traders get started. |

| Mobile App | Praised for its full functionality and smooth performance on the go. |

“I started with their demo account here in Lahore. It was a great way to learn without pressure. When I moved to a real account, the deposit was simple through my local bank card. My first withdrawal took about two days, which was fine. For a beginner, it felt like a good starting point.”

– A trader from a Pakistani trading forum

Ultimately, trader experiences can vary. While many in Pakistan find Olymp Trade to be a solid platform for starting out, it’s crucial to weigh these common pros and cons. The best approach is always to test the platform yourself using the demo account to see if its features and trading environment align with your personal trading style and goals.

Conclusion: Making an Informed Decision About Olymptrade in Pakistan

Choosing the right trading platform is a crucial first step on your journey as a trader in Pakistan. It’s not just about features; it’s about finding a partner that aligns with your financial goals and risk appetite. Olymptrade presents an accessible option for many, but the final decision rests entirely on your shoulders. It requires careful thought and personal research.

Before you commit any real capital, take a step back and weigh all the factors. Think about what matters most to you. Is it the ease of use? The variety of assets? Or the availability of local payment methods? Every trader has unique priorities.

To help you structure your thoughts, consider these final checkpoints:

- Test Thoroughly: Always begin with the demo account. Use it extensively to test your strategies, understand the platform’s quirks, and get comfortable with the interface without risking your money.

- Verify Payment Methods: Double-check that the deposit and withdrawal options are convenient and reliable for you in Pakistan. Test the process with a small amount first if you decide to proceed.

- Assess Your Strategy: Does the platform’s offering of instruments and tools fit your trading style? Whether you are a short-term scalper or a long-term position trader, your broker should support your approach.

- Understand the Risks: Trading always involves risk. Ensure you fully grasp the potential downsides and never invest more than you are prepared to lose. Your education is your best defense.

Ultimately, your success in the markets depends more on your skill, discipline, and risk management than on the platform you choose. A broker is just a tool. Use this information to pick the right tool for your specific needs and start your trading journey on solid ground.

Frequently Asked Questions

Is Olymptrade legal for traders in Pakistan?

While Olymptrade is not directly regulated by Pakistan’s SECP, it holds membership with the Financial Commission (FinaCom), an international dispute resolution body. Pakistani laws do not explicitly prohibit citizens from trading with international brokers, and many traders use the platform.

How can I register an Olymptrade account from Pakistan?

To register, visit the official Olymptrade website, provide a valid email, create a secure password, and accept the terms. You’ll gain instant access to both a live and a free demo account to start practicing.

What payment methods are available for deposits and withdrawals in Pakistan?

Olymptrade supports popular methods like bank cards (Visa/Mastercard), e-wallets (Skrill, Neteller, Perfect Money), and cryptocurrencies (BTC, USDT). Some local options or agents may also facilitate JazzCash/EasyPaisa. Withdrawals typically follow the same method as deposits.

What assets can I trade on Olymptrade from Pakistan?

Olymptrade offers a diverse range of assets including Forex pairs (major, minor, exotic), stocks of leading companies, commodities (gold, oil), global indices (S&P 500), and popular cryptocurrencies (Bitcoin, Ethereum).

What are the main benefits of using Olymptrade for beginners in Pakistan?

Beginners benefit from a low minimum deposit, a user-friendly platform, a free and replenishable demo account for practice, and extensive educational resources like webinars and strategy guides, all designed to help build trading confidence and skills.