Are you ready to dive into the dynamic world of online trading? Perhaps you’ve heard about the financial markets and are looking for a clear, accessible entry point. You’re in the right place. This guide is your complete roadmap to setting up and using your Olymptrade online account in 2024. We’ll cut through the jargon and show you exactly what you need to do, step by step.

As a fellow trader, I know how intimidating the first steps can be. That’s why I created this resource. We will walk through the entire process together, from the initial sign-up to understanding the platform’s features and preparing for your first trade. My goal is to equip you with the confidence and knowledge to navigate Olymptrade effectively.

Think of this as your personal launchpad. Whether your goal is to explore a new skill or actively engage with global markets, getting your account ready is the crucial first step. So, let’s get started and unlock your trading potential today.

- What is an Olymp Trade Online Account?

- Demo vs. Live Account: What’s the Difference?

- Step-by-Step Guide: How to Open Your Olymp Trade Account

- The Quick Registration Process

- Choosing Your Account: Demo vs. Live

- Account Verification: A Crucial Security Step

- Registration on the Official Website

- Your Quick Start Guide: 4 Simple Steps

- What You Immediately Unlock After Registration

- Registration Best Practices

- Choosing Your Account Currency and Type

- First Up: Your Account Base Currency

- Next: Finding the Right Account Type for You

- Understanding Olymp Trade Account Types

- Start with Zero Risk: The Demo Account

- Real Trading: Live Account Tiers

- Which Account Is Your Perfect Match?

- The Risk-Free Demo Account for Practice

- What You Gain from Practice Trading

- Demo vs. Live Trading at a Glance

- Trading with a Real Account (Starter, Advanced, Expert)

- The Starter Account: Your Gateway to Live Trading

- The Advanced Account: For the Serious Trader

- The Expert Account: Professional Grade Trading

- Account Features at a Glance

- Securely Accessing Your Olymptrade Login Portal

- The Right Way to Log In, Every Time

- Your Personal Security Checklist

- Two-Factor Authentication (2FA): Your Account’s Bodyguard

- The Essential Olymp Trade Account Verification Process (KYC)

- Why Completing KYC is a Non-Negotiable Step

- A Trader’s Guide to Required Documents

- Common Mistakes vs. Pro Trader Tips

- Common Rejection Reasons

- Pro Tips for First-Time Approval

- Why Verification is Mandatory for Withdrawals

- The Core Reasons for Verification

- What We Ask For and Why

- Funding Your Account: Popular Deposit Methods

- The Go-To Classics: Credit & Debit Cards

- For Larger Sums: Bank Wire Transfers

- The Digital Age: E-Wallets & Crypto

- At a Glance: Comparing Your Options

- How to Withdraw Funds from Your Olymp Trade Account

- Your Step-by-Step Withdrawal Guide

- Available Withdrawal Methods and Rules

- Important Factors for a Smooth Withdrawal

- Navigating the Olymp Trade Platform Interface

- The Main Chart: Your Trading Arena

- Asset Selection and Management

- The Trade Execution Panel

- Adding Technical Indicators and Trading Tools

- Is Your Olymp Trade Online Account Safe? Key Security Features

- A Quick Look at How You’re Protected

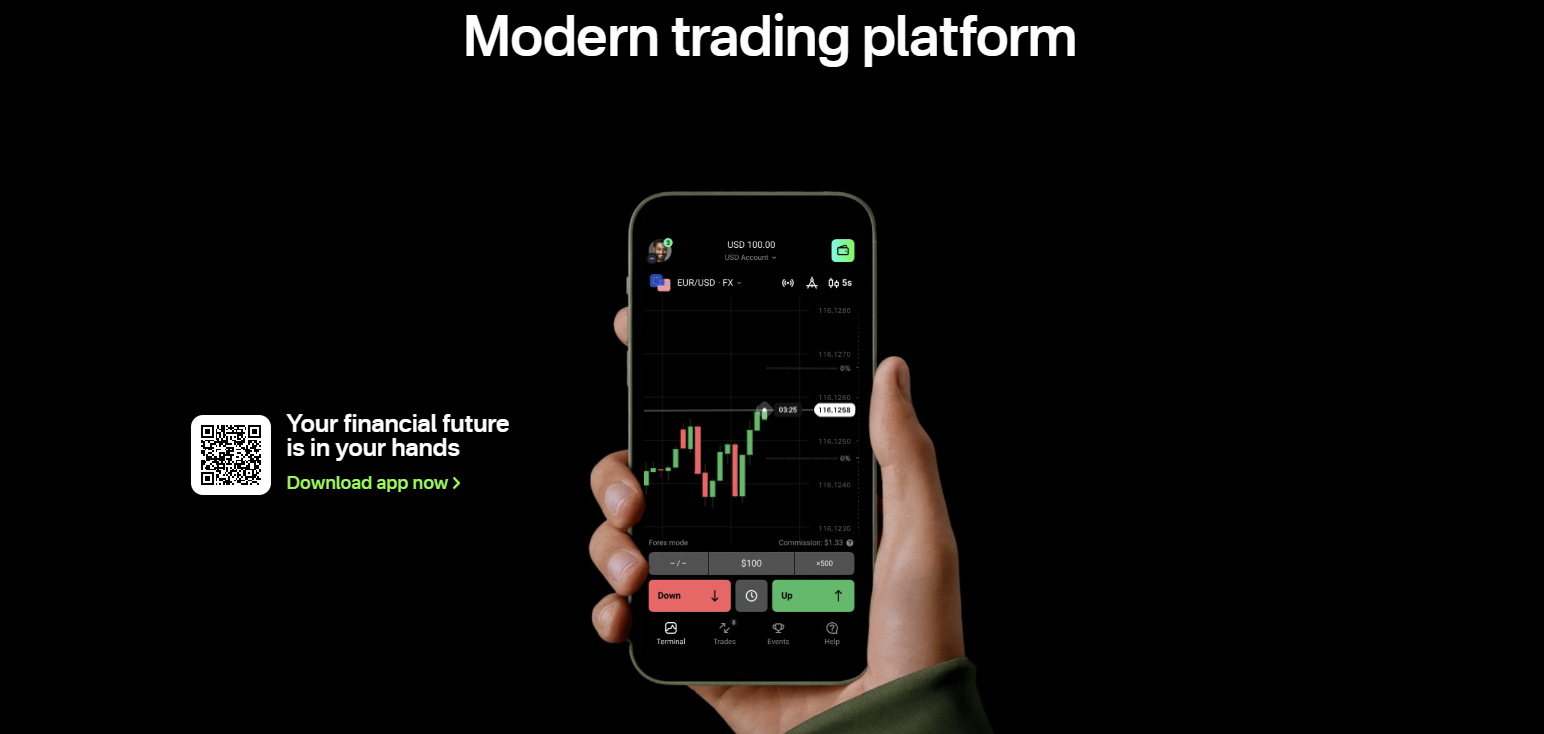

- Trading on the Go with the Olymp Trade Mobile App

- Key Features at Your Fingertips

- The Freedom to Trade Your Way

- Get Started in 3 Simple Steps

- Managing Your Account Profile and Settings

- Your Profile: More Than Just a Name

- Fortify Your Defenses: Security Settings

- Fine-Tune Your Experience: Trading & Notification Preferences

- Your Quarterly Account Health Checklist

- Troubleshooting Common Olymptrade Account Issues

- Can’t Log In? Let’s Fix It.

- The Verification Voyage: Navigating KYC

- Deposit and Withdrawal Glitches

- How to Deactivate or Delete Your Olymp Trade Account

- Understanding the Difference: Deactivate vs. Delete

- Step-by-Step: How to Deactivate Your Account

- For a Permanent Break: How to Delete Your Account

- Deactivation vs. Deletion: A Quick Comparison

- A Final Thought Before You Go

- Final Verdict: Is an Olymptrade Account Right for You?

- Who is Olymp Trade Best For?

- Our Final Thoughts

- Frequently Asked Questions

What is an Olymp Trade Online Account?

Think of your Olymp Trade online account as your personal command center for navigating the financial markets. It’s your secure, digital gateway that gives you access to the trading platform. This is where you will manage your funds, analyze charts, and execute your trades. Essentially, it’s the key that unlocks your entire trading journey from a single, unified dashboard.

With this one account, you can perform all the essential actions a trader needs. You gain the power to:

- Access and trade a wide range of financial assets.

- Analyze price movements using built-in indicators and charting tools.

- Practice your strategies risk-free in a demo environment.

- Manage your deposits and withdrawals with secure payment methods.

- Stay updated with market news and economic calendars.

One of the best features for new and experienced traders alike is the clear distinction between practicing and trading with real money. The platform provides two primary modes within your account to support your growth.

Demo vs. Live Account: What’s the Difference?

Understanding the two main account types is crucial for starting on the right foot. Each serves a unique purpose designed to build your skills and confidence.

| Feature | Demo Account | Live Account |

|---|---|---|

| Capital | Virtual, replenishable funds ($10,000) | Your own deposited, real money |

| Risk Level | Zero risk | Real financial risk and reward |

| Primary Purpose | Practice, strategy testing, platform learning | Earning real profit from market movements |

| Market Access | Real-time market quotes and conditions | Real-time market quotes and conditions |

“I tell every new trader the same thing: live on the demo account first. Test every forex pair, every indicator, every strategy you can think of. Your Olymp Trade online account makes this seamless. When you switch to live trading, you’re not guessing anymore; you’re executing a plan you’ve already proven.”

In short, your online account is more than just a login. It is a comprehensive toolkit designed to support you at every stage of your trading career, from your very first practice trade to your most advanced strategies.

Step-by-Step Guide: How to Open Your Olymp Trade Account

Ready to jump into the exciting world of online trading? Excellent choice! Your first step on this journey is setting up your personal trading account. We’ve made the process to open your Olymp Trade account incredibly simple and fast. This guide will walk you through every step, ensuring you can get from sign-up to the trading platform in just a few minutes.

The Quick Registration Process

Getting started is a breeze. Just follow these simple steps to complete your initial registration and access the platform.

- Visit the Official Website: Navigate to the Olymp Trade homepage and locate the prominent “Registration” button.

- Fill in Your Details: A simple form will pop up. You’ll need to enter a valid email address and create a strong, secure password for your account.

- Select Your Currency: Choose the currency for your account (e.g., USD or EUR). Make this choice carefully, as it typically cannot be changed later.

- Agree to the Terms: Take a moment to review the Service Agreement and check the box to confirm you are of legal age and accept the terms.

- Click “Register”: And just like that, you’re in! You will be automatically logged into the trading platform, where your journey begins.

Choosing Your Account: Demo vs. Live

Upon creating your account, you instantly gain access to two powerful tools: a free demo account and a real trading account. Understanding the difference is key to starting off on the right foot.

| Feature | Demo Account | Live Account |

|---|---|---|

| Funds | Comes pre-loaded with $10,000 in virtual funds that you can replenish anytime. | Uses the real money you deposit into your account. |

| Risk Level | Absolutely zero. It’s a risk-free training ground. | Involves real financial risk and the potential for real profit. |

| Main Purpose | To practice trading strategies, learn the platform’s features, and build your confidence. | To execute real trades in the live market and earn potential returns. |

Account Verification: A Crucial Security Step

Before you can withdraw any profits, you must complete the identity verification process. This is a standard industry practice known as KYC (Know Your Customer) and is essential for securing your funds and preventing fraud. We recommend completing this step soon after your registration for a smooth trading experience.

You will generally need to provide:

- Proof of Identity: A clear, valid copy of a government-issued ID like a passport or driver’s license.

- Proof of Address: A recent document like a utility bill or bank statement showing your name and address.

Trader’s Tip: Always start with the demo account. Use it to get a feel for the market’s pulse and to test your trading ideas without any pressure. Once you feel comfortable and are seeing consistent results in a practice environment, you’ll be much better prepared to manage a live account.

Registration on the Official Website

Ready to join the trading floor? Your first step is a quick and secure registration on the official website. We’ve streamlined the process to get you from a visitor to a trader in just a few minutes. Think of it as your simple, fast pass to the world of Forex trading. Let’s get you set up.

Your Quick Start Guide: 4 Simple Steps

Follow this straightforward path to create your personal trading account. We prioritize your security from the very first click.

- Find the ‘Sign Up’ Button: Head over to the homepage. You will see a clear ‘Register’ or ‘Create Account’ button, usually at the top right corner. Give it a click.

- Fill in Your Core Details: A registration form will appear. We only ask for the essentials to get started: your name, a valid email address, and a contact number.

- Create a Secure Password: This is your key. Create a strong, unique password that you’ll remember. We recommend a mix of uppercase and lowercase letters, numbers, and symbols to keep your account safe.

- Verify and Access: We will send a verification link to your email. Click it to confirm your account, and that’s it! You can now log in to your brand-new client dashboard. Welcome aboard!

What You Immediately Unlock After Registration

Completing the sign-up isn’t just about creating a login. It’s about unlocking a suite of powerful tools, even before you make your first deposit.

- Free Demo Account: Gain immediate access to a fully functional demo account. Test your strategies with virtual funds in real market conditions, completely risk-free.

- Educational Hub: Dive into our library of tutorials, e-books, and video guides designed for traders of all levels.

- Platform Tour: Get a first-hand look at our trading platform, its advanced charting tools, and technical indicators.

- Market Analysis: Receive daily market news and expert analysis directly in your client area to help you spot potential opportunities.

Registration Best Practices

As a fellow trader, here are a couple of tips to ensure your setup is smooth and secure for the long term.

| Action | Why It’s Important |

|---|---|

| Use Your Primary Email | Ensures you receive all critical account alerts, trade confirmations, and support messages without delay. |

| Bookmark the Official Login Page | Helps you avoid phishing sites and ensures you are always logging into the secure, official portal. |

“Your trading journey begins with a single, simple step. The registration is that step. Make it a confident one. It’s the gateway to everything that follows.”

The registration on the official website is designed for your convenience and security. It’s the deliberate, first move in a successful trading career. Take these few minutes now to set up your account and start exploring what we have to offer.

Choosing Your Account Currency and Type

Alright, let’s talk about setting up your trading account. This isn’t just a box-ticking exercise. The choices you make here—your account currency and type—directly impact your trading costs and overall experience. Getting this right from the start saves you headaches and money down the line. Think of it as choosing the right gear before a big race.

First Up: Your Account Base Currency

What’s a base currency? It’s the currency your account is denominated in. All your trades, profits, losses, and account balance will be calculated and displayed in this currency. So, which one should you pick?

The answer is simpler than you think. You want to minimize currency conversion fees. Every time you deposit or withdraw funds in a currency different from your account’s base currency, your bank or broker will charge you for the conversion. These small fees add up!

Pro Trader Tip: Always choose a base currency that matches the currency of the bank account you’ll use for deposits and withdrawals. If you live in the UK, choose GBP. In the Eurozone? Go for EUR. In the US? USD is your best bet. This simple step eliminates unnecessary conversion costs completely.

Next: Finding the Right Account Type for You

Brokers don’t offer a one-size-fits-all account. They provide different types tailored to various traders, from complete beginners to seasoned professionals. Your trading style, starting capital, and experience level will determine the best fit. Let’s break down the most common options.

| Account Type | Best For | Key Features |

|---|---|---|

| Standard Account | Beginners & Casual Traders | – Zero commission – Slightly wider spreads – Easy to understand |

| ECN / Raw Spread Account | Experienced & High-Volume Traders | – Ultra-tight, raw spreads – Fixed commission per trade – Faster execution |

| Cent Account | Absolute Beginners & Testers | – Trade with cents, not dollars – Extremely low-risk environment – Perfect for testing strategies with real money |

| Demo Account | Everyone! | – Trade with virtual money – Zero financial risk – Essential for practice and strategy testing |

A Closer Look at Each Type

- The Standard Account: This is the workhorse for most traders. You get straightforward trading with costs built into the spread (the difference between the buy and sell price). No complex commission calculations to worry about. It’s a fantastic starting point.

- The ECN/Raw Spread Account: This is for traders who mean business. You get direct access to market prices, resulting in razor-thin spreads. Instead of a wider spread, you pay a small, fixed commission on each trade you open and close. For scalpers and frequent traders, this model is often more cost-effective.

- The Cent Account: Feeling nervous about risking real money? The Cent Account is your perfect training ground. It allows you to trade with micro-lots where your balance is shown in cents. A $10 deposit becomes 1,000 cents, giving you the psychological experience of trading a larger account without the high risk.

Before you commit any real capital, I strongly urge you to open a Demo account first. Get a feel for the platform, test your strategy, and make your beginner mistakes with fake money. Once you’re consistently profitable on the demo, you’re ready to choose the right live account and step into the real market.

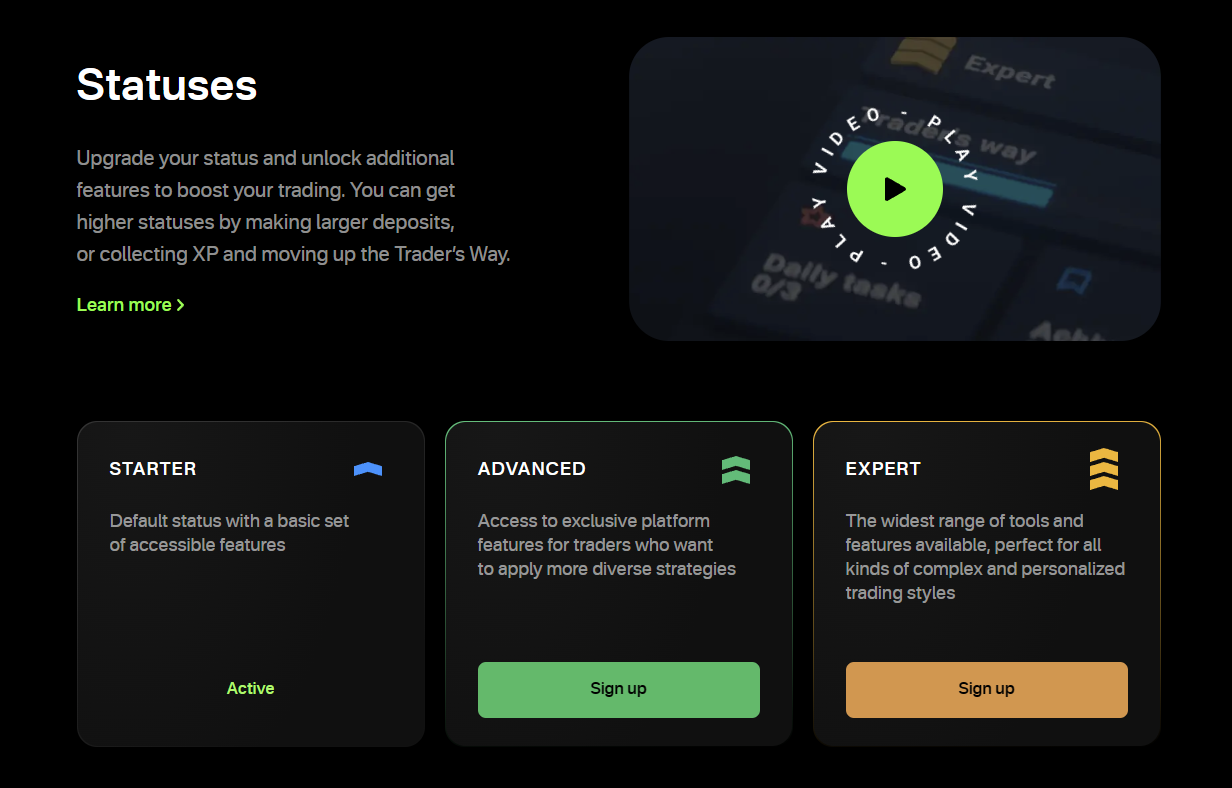

Understanding Olymp Trade Account Types

Choosing the right trading account is like a pilot picking the right aircraft for a mission. You wouldn’t take a crop duster into a dogfight, right? Similarly, your trading account should match your experience, goals, and strategy. Olymp Trade gets this. They’ve designed a flexible system of account types that grows with you, from your very first practice trade to becoming a seasoned market professional. Let’s break down what they offer so you can find your perfect fit.

Start with Zero Risk: The Demo Account

Before you put any real capital on the line, you need a playground. The Olymp Trade demo account is exactly that—a powerful, risk-free training ground. Every trader, new or experienced, should start here. It’s not just for learning the basics; it’s for mastering the platform and testing new strategies without any financial pressure.

- Practice Makes Perfect: Get a feel for the market’s rhythm and the platform’s interface.

- Strategy Testing: Got a new trading idea? Test it here first to see if it holds up in live market conditions.

- Build Confidence: Place trades, learn from mistakes, and build the confidence you need to trade with real money.

- Replenishable Balance: Run out of your 10,000 demo units? No problem. You can replenish it with a single click and keep practicing.

Real Trading: Live Account Tiers

Once you’re comfortable and ready to trade for real profits, you can move to a live account. Olymp Trade offers several tiers, each unlocking more benefits and tools to enhance your trading potential. The main difference lies in the deposit amount, which then unlocks higher status levels with better perks.

Here’s a quick comparison to see how the main account statuses stack up:

| Feature | Starter | Advanced | Expert |

|---|---|---|---|

| Best For | Beginners | Experienced Traders | Professionals |

| Profit Rate | Up to 82% | Up to 84% | Up to 92% |

| Trading Signals | Basic | More Signals | Private Signals |

| Educational Resources | Standard Access | Private Webinars | Personal Analyst |

| Risk-Free Trades | – | Yes | Yes (More) |

| Withdrawal Speed | Standard | Priority | Highest Priority |

Which Account Is Your Perfect Match?

Still not sure where you fit in? Let’s simplify it.

“Your account type should be a tool, not a limitation. Choose the one that gives you the resources you need to succeed right now, with an eye on upgrading as you grow.”

- If you are just starting out: The Starter status is your gateway. It gives you full access to all trading instruments with a low barrier to entry. Combine this with the knowledge you gained on your demo account, and you’re ready to go.

- If you have some experience: The Advanced status is your sweet spot. The increased profit rate, access to more analytics, and consultations with analysts can significantly sharpen your trading edge.

- If you are a serious, high-volume trader: The Expert status is tailored for you. You get the highest profit rates, exclusive trading strategies, a personal manager, and risk-free trades. This account is designed to maximize the potential of professional traders.

Ultimately, the beauty of the Olymp Trade platform is its scalability. You can start small with a Starter account and level up your status as your skills and capital grow. The path is clear, and the tools are there for the taking. Your trading journey is unique, and your account should reflect that. Choose wisely and trade on!

The Risk-Free Demo Account for Practice

Are you ready to dive into the world of Forex trading? Before you put your hard-earned money on the line, let’s talk about the single most powerful tool for any new trader: the demo account. Think of it as your personal trading simulator. It’s a completely risk-free environment where you can learn the ropes, test your ideas, and build your confidence.

You get access to a live trading platform with real-time market data. The only difference? You trade with virtual funds. This means you can experience the thrill of the market without any of the financial pressure. It’s the perfect playground to make mistakes and learn from them.

What You Gain from Practice Trading

Using a demo account isn’t just about clicking buttons. It’s a strategic step toward becoming a profitable trader. Here’s what you can achieve:

- Master the Trading Platform: Learn how to open and close trades, set stop-loss and take-profit orders, and use all the platform’s features like a pro.

- Understand Market Dynamics: Watch how currency pairs move in real-time. Get a feel for market volatility and how news events impact prices.

- Develop Your Trading Strategy: This is your sandbox. Test different indicators, experiment with various trading styles, and build a strategy that works for you without risking a single cent.

- Build Trading Discipline: Practice managing your emotions. Learn to handle simulated wins and losses, helping you build the psychological resilience needed for live trading.

Demo vs. Live Trading at a Glance

It’s important to understand the key differences. While a demo account perfectly simulates the market, the emotional experience is not the same. Here’s a simple breakdown:

| Feature | Demo Account | Live Account |

|---|---|---|

| Capital | Virtual Funds (No real value) | Real Money (Your deposited capital) |

| Risk Level | Zero Financial Risk | Real Financial Risk |

| Psychology | Low-pressure, emotion-free | High-pressure, involves real emotions |

| Primary Goal | Learning and Strategy Testing | Generating Profit |

“The demo account is your gym. You don’t compete in the Olympics without training first. Treat your practice trading seriously, and it will pay dividends when you go live.”

Getting started is simple. You can open a free demo account in minutes and begin your trading journey today. Familiarize yourself with the platform, place a few trades, and start building the skills that will serve you throughout your trading career. It’s the smartest first step you can take.

Trading with a Real Account (Starter, Advanced, Expert)

You’ve spent hours on the demo, you’ve tested your strategies, and you’ve learned the rhythm of the market. Now, it’s time for the real deal. Opening a real account is the most exciting step in any trader’s journey. This is where your skills meet the live market, and where real profits and losses are made. The thrill of live trading is unmatched, but it also demands the right tools and environment for your specific needs.

We understand that not all traders are the same. A beginner’s needs are vastly different from a seasoned pro’s. That’s why we’ve designed three distinct account types, each tailored to provide the optimal trading conditions for your level of experience and capital. Let’s find the perfect fit for your forex trading career.

The Starter Account: Your Gateway to Live Trading

Are you ready to dip your toes into the real market? The Starter account is designed for you. It’s the perfect bridge from a demo environment to live trading, allowing you to experience the market’s pulse without a significant capital commitment. It’s all about building confidence and honing your strategy with real-world stakes.

- Ideal For: New traders or those with smaller investment capital.

- Key Goal: Transition smoothly to a real account and gain valuable live market experience.

- Benefits: Enjoy a low minimum deposit, standard spreads, and full access to our educational resources and trading platforms.

The Advanced Account: For the Serious Trader

You’re past the basics. You have a consistent track record and a solid trading plan. The Advanced account is built to reward your dedication with superior trading conditions. This account helps you optimize your strategy with tighter spreads and more powerful tools, giving you the edge you need to scale your forex trading efforts.

- Ideal For: Consistent and experienced traders looking to refine their performance.

- Key Goal: Maximize profitability with enhanced features and lower trading costs.

- Benefits: Benefit from significantly tighter spreads, increased leverage options, and priority customer support.

The Expert Account: Professional Grade Trading

For the elite, high-volume trader, the Expert account offers an institutional-grade experience. This is our premium offering, providing the absolute best trading conditions available. If you trade with significant size and frequency, this account ensures you operate with maximum efficiency and minimal costs, backed by our top-tier support and exclusive features.

- Ideal For: Professional traders, high-net-worth individuals, and institutional clients.

- Key Goal: Achieve peak trading performance with professional tools and pricing.

- Benefits: Get access to raw ECN spreads, the highest available leverage, a dedicated account manager, and complimentary VPS services.

“Choosing the right account is as crucial as choosing the right strategy. Align your trading environment with your ambition.”

Account Features at a Glance

Here’s a simple breakdown to help you compare our account types and see which one aligns with your trading style.

| Feature | Starter | Advanced | Expert |

|---|---|---|---|

| Best For | Beginners | Experienced Traders | Professionals |

| Minimum Deposit | Low | Medium | High |

| Spreads | Standard | Tight | Raw / From 0.0 Pips |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 (Customizable) |

| Support | Standard 24/5 | Priority 24/5 | Dedicated Manager 24/5 |

| Exclusive Perks | Full Platform Access | Advanced Analytics | Free VPS & Custom Reports |

Your journey into live trading deserves the best possible start. Choose your account, fund it, and unlock your true potential in the forex market today.

Securely Accessing Your Olymptrade Login Portal

In the world of trading, your capital is your lifeblood. Protecting it starts long before you place your first trade. It begins with the simple, yet critical, act of securely accessing your account. Your Olymptrade login is the gateway to your funds and your trading journey. Let’s walk through how to keep that gateway locked tight against any unwanted visitors, ensuring your focus remains on the charts, not on security worries.

The Right Way to Log In, Every Time

Consistency is key in trading, and it’s just as crucial for your login routine. Following these exact steps minimizes risk and builds good habits.

- Always Start from the Official Source: Never use a link from an email or social media message to access your account. The safest path is to type

olymptrade.comdirectly into your browser’s address bar or use the official mobile app downloaded from the Google Play Store or Apple App Store. - Verify the URL: Before entering any details, glance at the address bar. It should start with

https://and show a padlock icon. This indicates a secure, encrypted connection. If you seehttp://or any warnings, stop immediately. - Enter Your Credentials: Carefully type in your registered email address and your unique password.

- Complete 2FA (If Enabled): If you’ve activated Two-Factor Authentication (and you absolutely should), you will be prompted to enter a one-time code from your authenticator app or SMS.

Your Personal Security Checklist

Think of this as your pre-flight check before you start your trading session. A few seconds of caution can save you a world of trouble.

- Bookmark the Official Page: The first time you visit the official Olymptrade login page, bookmark it. From then on, use your bookmark to navigate there. This eliminates the risk of typos that could land you on a convincing but fake “phishing” site.

- Create an Unbreakable Password: Your password is your first line of defense. Make it strong by using a mix of upper and lowercase letters, numbers, and symbols. Avoid common words or personal information. A password manager can help you create and store complex, unique passwords for every site.

- Beware of Public Wi-Fi: Avoid accessing your trading account on public, unsecured Wi-Fi networks like those in cafes or airports. If you must, use a reputable VPN (Virtual Private Network) to encrypt your connection.

- Log Out After Every Session: When you’re done trading for the day, make a habit of logging out completely, especially if you are on a shared computer.

Two-Factor Authentication (2FA): Your Account’s Bodyguard

If you do only one thing to boost your account’s security, make it this. 2FA adds a second layer of verification, making it nearly impossible for anyone to access your account, even if they somehow steal your password. Here’s a quick breakdown:

| Advantage | The “Inconvenience” |

|---|---|

| Massively increased security. It links your account to a physical device you own (your phone). | Takes an extra 5-10 seconds to open an app or check an SMS for a code. |

| Peace of mind. You’ll receive a code anytime a login is attempted, alerting you to potential unauthorized access. | You need to have your phone with you to log in. (As a trader, you probably do anyway!) |

The choice is clear. The tiny extra step of using 2FA provides a fortress-like level of protection for your trading capital.

Treat your account security with the same discipline and rigor you apply to your trading strategy. A moment of prevention is worth more than a lifetime of regret. Secure your access, and trade with confidence.

The Essential Olymp Trade Account Verification Process (KYC)

So, you’ve created your account and you’re ready to dive into the markets. Excellent! But first, there’s one crucial step every serious trader must take: account verification. I know, I know—paperwork can seem like a drag when all you want to do is trade. But trust me on this, the Olymp Trade account verification, also known as KYC (Know Your Customer), is your best friend when it comes to security and unlocking the platform’s full potential.

Think of it this way: KYC is not a hurdle. It’s a hallmark of a legitimate and regulated broker. This process is a standard requirement across the financial industry to protect you, the trader, and to prevent illegal activities. Completing it ensures that your funds are safe and that your withdrawal requests are processed smoothly and without delay.

Why Completing KYC is a Non-Negotiable Step

Let’s break down exactly why this verification process is so important for your trading journey:

- Secures Your Account: First and foremost, it proves you are who you say you are. This protects your account from any unauthorized access and ensures that only you can withdraw your hard-earned profits.

- Enables Seamless Withdrawals: This is a big one. An unverified account often faces restrictions, especially when it comes to withdrawing funds. A fully verified account clears the path for fast and hassle-free withdrawals.

- Compliance with Regulations: Reputable brokers like Olymp Trade adhere to international Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws. Your verification helps them, and you, stay on the right side of these regulations.

- Unlocks Full Platform Features: Some features, higher limits, and promotional offers may only be available to fully verified users. Verification is your ticket to the complete trading experience.

A Trader’s Guide to Required Documents

The process is straightforward. You’ll typically need to provide clear copies of a few standard documents. To make it simple, here’s a table outlining what you’ll need and some pro tips to get it right the first time.

| Document Category | Accepted Documents | Key Requirements |

|---|---|---|

| Proof of Identity (POI) | Passport, National ID Card, Driver’s License | Must be a government-issued photo ID. Ensure it is not expired and all four corners are visible in the photo. The image must be clear and high-resolution. |

| Proof of Address (POA) | Utility Bill (electricity, water, gas), Bank Statement, Credit Card Statement | The document must be recent (usually within the last 3-6 months). Your full name and address must be clearly visible and must match the details you used to register your Olymp Trade account. |

| Proof of Payment (POP) | Photo of your bank card, screenshot of e-wallet transaction history | For cards, show your name and the first 6 and last 4 digits (cover the middle digits and the CVV). For e-wallets, the screenshot must show your name, the transaction details, and the broker’s name. |

Common Mistakes vs. Pro Trader Tips

Getting your verification approved quickly means avoiding common errors. Here’s a quick rundown to help you succeed.

Common Rejection Reasons

- Submitting blurry or low-quality photos.

- Using an expired ID or an old utility bill.

- Cropping the document so the edges are not visible.

- Details on the document (name, address) do not match your account profile.

Pro Tips for First-Time Approval

- Place documents on a flat, contrasting background.

- Use your phone’s camera in good, natural light. Avoid flash.

- Double-check all details for consistency before you upload.

- Ensure the file format is accepted (usually JPG or PNG).

“View the Olymp Trade account verification not as a chore, but as the final step in fortifying your trading fortress. It’s the key that confirms your ownership and secures your future profits.”

Take a few minutes to complete the KYC process correctly. It’s a small investment of time that pays huge dividends in security, peace of mind, and your ability to operate as a professional trader on the platform.

Why Verification is Mandatory for Withdrawals

You’ve traded smart, made some great calls, and now you see those profits sitting in your account. The next logical step? Withdrawing your hard-earned cash. But then you hit a roadblock: a request for documents. We get it, it can feel like an unnecessary delay when you’re ready to enjoy your winnings. So, why is this step non-negotiable? Let’s break it down.

Think of it this way: verification is the digital lock on your trading account’s vault. It’s not about making things difficult for you; it’s about making things impossible for anyone else. This process is a cornerstone of our commitment to your security and our compliance with global financial regulations.

The Core Reasons for Verification

Every legitimate broker operates under strict rules. These aren’t just company policies; they are international standards designed to create a safe financial environment for everyone. Here’s exactly why we ask for your documents:

- To Protect Your Funds: First and foremost, we need to confirm that you are the person requesting the withdrawal. This prevents any unauthorized access to your account and ensures your profits go directly to you, and no one else.

- To Comply with Regulations (KYC & AML): We are legally required to follow “Know Your Customer” (KYC) and “Anti-Money Laundering” (AML) laws. These global mandates help combat financial crime by ensuring all funds are tracked and legitimate. Verification is our way of playing by the rules and keeping the trading space clean.

- To Prevent Fraud and Identity Theft: By matching your documents to your account details, we create a secure link that is incredibly difficult for fraudsters to break. This simple check protects your identity and your financial well-being.

What We Ask For and Why

The documents requested are standard across the industry. Here is a quick look at what we typically need and the simple reason behind each request.

| Document Type | The Purpose |

|---|---|

| Proof of Identity (POI) (e.g., Passport, Driver’s License) | To confirm your name, photo, and date of birth match the details you registered with. |

| Proof of Address (POA) (e.g., Utility Bill, Bank Statement) | To verify your country of residence and ensure we are complying with regional financial laws. |

“Completing verification isn’t a hurdle; it’s your express lane to secure and fast withdrawals. It’s a one-time setup for a lifetime of peace of mind.”

Ultimately, a broker that enforces strict verification is a broker you can trust. It shows they are serious about security and operating within the law. So, view it not as a delay, but as a hallmark of a professional and safe trading environment. Get it done once, and you’ll be set for smooth, secure withdrawals whenever you need them.

Funding Your Account: Popular Deposit Methods

You’ve got your strategy polished and you’re ready to hit the live markets. The final step? Funding your trading account. This process should be seamless, secure, and fast. After all, you don’t want to miss a market opportunity waiting for a deposit to clear. Let’s dive into the most popular and trusted deposit methods available to traders today, so you can choose the one that fits you best.

The Go-To Classics: Credit & Debit Cards

For most traders, this is the quickest way to get started. Using your Visa or MasterCard is just like making any other online purchase. It’s familiar, incredibly fast, and highly secure.

- Instant Deposits: Your funds usually appear in your trading account within minutes.

- High Security: Transactions are protected by multiple layers of security from your bank and card provider.

- Convenience: You already have the card in your wallet. No need to set up a new service.

For Larger Sums: Bank Wire Transfers

Bank transfers are the workhorse of account funding. While not as instant as card deposits, they are exceptionally reliable, especially for moving larger amounts of capital. This is a trusted method for serious traders who prioritize security and have higher deposit needs. It’s a direct link between your bank and your trading account, offering a clear paper trail and peace of mind.

The Digital Age: E-Wallets & Crypto

Modern traders often demand modern solutions. E-wallets and cryptocurrencies offer speed and flexibility that traditional methods sometimes lack.

E-Wallets (like Skrill, Neteller, PayPal):

These digital wallets act as an intermediary, providing an extra layer of privacy and speed. You can fund your e-wallet using various methods and then instantly transfer the funds to your trading account. They are especially popular for making quick withdrawals too!

Cryptocurrency (like Bitcoin, Ethereum, USDT):

For the tech-savvy trader, crypto deposits offer a decentralized and often faster way to fund an account. With stablecoins like USDT, you can also avoid the volatility of other cryptocurrencies during the transfer process. This method is gaining traction for its global accessibility and low transaction fees.

At a Glance: Comparing Your Options

Feeling overwhelmed? This table breaks it down for you.

| Deposit Method | Typical Speed | Best For | Things to Consider |

|---|---|---|---|

| Credit/Debit Card | Instant / Minutes | Quick, small to medium deposits. | Some banks may have restrictions on international transactions. |

| Bank Wire Transfer | 1-5 Business Days | Large, secure deposits. | Can be slower and may involve fees from your bank. |

| E-Wallets | Instant / Minutes | Fast deposits and withdrawals; added privacy. | You’ll need to set up and fund the e-wallet account first. |

| Cryptocurrency | Minutes to Hours | Global access, low fees, tech-focused traders. | Ensure you’re sending to the correct wallet address. Transactions are irreversible. |

“Your chosen funding method should complement your trading style. If you’re an agile day trader, you need instant deposits. If you’re a long-term position trader making a large initial deposit, the security of a wire transfer might be more appealing.”

Ultimately, the right choice is yours. We believe in providing you with a variety of secure and efficient funding options. This way, you can spend less time on logistics and more time analyzing the charts and executing your strategy. Check your client area to see the available methods and get your account funded today!

How to Withdraw Funds from Your Olymp Trade Account

You’ve traded successfully, and now it’s time to enjoy your profits. This is the most rewarding part of trading! Accessing your money should be simple and secure. Let’s walk through the exact steps to withdraw funds from your Olymp Trade account, so you know precisely what to expect.

Your Step-by-Step Withdrawal Guide

Getting your money out is a straightforward process. We designed the platform to be intuitive for traders. Just follow these simple steps:

- Log In: Access your personal Olymp Trade account.

- Navigate to Payments: Find and click on the “Payments” button in the menu, then select the “Withdraw” option.

- Specify the Amount: Enter the amount of money you wish to withdraw. Make sure it’s within your available balance.

- Choose Your Method: Select the payment method for your withdrawal. This is a crucial step we will discuss below.

- Submit Your Request: Review the details one last time and click the “Send a request” button. You will receive a confirmation that your request is being processed.

Available Withdrawal Methods and Rules

For security and compliance reasons, there’s a golden rule you need to remember: you must withdraw funds using the same payment method you used to make a deposit. If you used multiple methods to fund your account, you can withdraw to them in proportion to the deposited amounts.

Here are the common methods available:

- Bank Cards (Visa/Mastercard): A popular and direct way to get funds back to your bank account.

- Electronic Wallets (E-wallets): Options like Skrill and Neteller are often the fastest for processing withdrawals.

- Bank Transfer: A reliable method for larger sums, though it might take a bit longer.

Important Factors for a Smooth Withdrawal

Keep these points in mind to ensure your withdrawal process is quick and hassle-free.

| Factor | Description |

|---|---|

| Account Verification (KYC) | Before your first withdrawal, you must complete the identity verification process. This is a standard security measure to protect your funds and prevent fraud. It’s a one-time process, so get it done early! |

| Processing Time | We process most requests within 24 hours. However, the final time it takes for money to reach you depends on your payment provider. E-wallets are typically instant or take a few hours, while bank transfers can take several business days. |

| Fees and Limits | Olymp Trade does not charge a fee for withdrawals. However, your bank or payment system might have its own transaction fees. Always check with them. Also, be aware of any minimum or maximum withdrawal limits for your chosen method. |

Pro Tip: Always double-check your withdrawal details, especially your bank account or e-wallet number, before you confirm the request. A small typo is the most common reason for delays.

Withdrawing your profits is a sign of your success as a trader. By following these guidelines, you can ensure the process is as smooth as your trading strategy.

Navigating the Olymp Trade Platform Interface

First impressions matter, especially in trading. When you log in, the last thing you want is a confusing screen. The Olymp Trade platform immediately stands out with its clean and intuitive design. It’s clear that this trading interface was built with the trader in mind, stripping away the clutter so you can focus on what’s important: the market.

Whether you’re a seasoned pro or just starting, a user-friendly interface helps you make faster, more confident decisions. Let’s break down the main components so you can navigate it like an expert from day one.

The Main Chart: Your Trading Arena

The large chart is the centerpiece of the platform. This is where you’ll spend most of your time analyzing price movements. You have full control over what you see:

- Chart Type: Switch between different chart styles with a single click. While the Area Chart is the default, most traders prefer Japanese Candlesticks for their detailed market insights.

- Timeframe: Adjust the timeframe from as little as a few seconds to several hours or even a month. This flexibility is crucial for matching the chart to your trading strategy, whether you’re a scalper or a long-term position trader.

- Zoom and Pan: Easily zoom in to examine recent price action or zoom out to see the bigger picture.

Asset Selection and Management

At the top of your screen, you’ll find the current asset you’re viewing. Clicking on it opens a menu showcasing all available financial instruments. The platform offers a wide variety of assets to trade, including:

- Currency Pairs (e.g., EUR/USD, GBP/JPY)

- Stocks (e.g., Apple, Tesla)

- Indices (e.g., S&P 500)

- Commodities (e.g., Gold, Oil)

- Cryptocurrencies

This menu makes it simple to switch between markets without losing your place. You can also “favorite” assets you trade often for quick access.

The Trade Execution Panel

On the right side of the chart, you’ll find the control panel for trade execution. This is where you set the parameters for your position before entering the market. It’s designed for speed and precision.

| Parameter | Description |

|---|---|

| Amount | This is where you set your investment amount for the trade. Always manage your risk responsibly! |

| Multiplier (Forex) | This tool increases your potential profit (and risk) by multiplying your investment volume. Use it wisely. |

| Take Profit & Stop Loss | Essential risk management tools. Set these levels to automatically close your trade at a desired profit or an acceptable loss. |

| Up / Down Buttons | The final step. Click \”Up\” if you predict the price will rise, or \”Down\” if you predict it will fall. |

Adding Technical Indicators and Trading Tools

No technical analysis is complete without indicators. The Olymp Trade platform has a dedicated menu for all your analytical needs. You can access it via a small icon, usually resembling a compass or chart symbol. Here, you’ll find a comprehensive list of popular technical indicators like Moving Averages, RSI, MACD, and Bollinger Bands. Adding them to your chart is as simple as clicking the name and adjusting the settings.

I highly recommend spending time on your demo account to master the interface. Practice changing chart settings, applying different indicators, and placing trades. Getting comfortable with the platform is the first step toward building a solid trading routine.

Is Your Olymp Trade Online Account Safe? Key Security Features

Let’s talk about something every trader thinks about but doesn’t always discuss: security. When you deposit your money into an online trading platform, you need absolute confidence that your funds and personal data are protected. It’s a non-negotiable part of trading. So, how does your Olymp Trade online account stack up? The platform takes security seriously, implementing several layers of protection to create a secure trading environment for you.

Think of it like securing your home. You don’t just rely on one lock. You have a strong front door, window locks, and maybe even an alarm system. Your online trading account deserves the same multi-layered approach. Here are the core security features Olymp Trade uses to protect you:

- Two-Factor Authentication (2FA): This is one of your strongest defenses. When you enable 2FA, logging in requires not just your password but also a unique, time-sensitive code sent to your phone or authentication app. This simple step makes it incredibly difficult for anyone else to access your account, even if they somehow get your password.

- SSL/TLS Encryption: Ever notice the little padlock icon in your browser’s address bar? That means the connection is secure. Olymp Trade uses robust SSL/TLS encryption protocols. This scrambles all the data traveling between your device and their servers, making your personal information and financial transactions unreadable to any potential eavesdroppers.

- KYC Verification: While it might seem like just another step, the \”Know Your Customer\” (KYC) process is a vital security measure. By verifying your identity, the platform helps prevent fraud, money laundering, and the creation of fake accounts, ensuring a safer ecosystem for all legitimate traders.

- Segregated Accounts: This is a crucial feature that many new traders overlook. Olymp Trade keeps client funds in segregated bank accounts, completely separate from the company’s own operational funds. This means your capital is ring-fenced and protected, not used for company expenses.

A Quick Look at How You’re Protected

To make it even clearer, here’s a simple breakdown of these features and what they do for you:

| Security Measure | How It Safeguards Your Account |

|---|---|

| Two-Factor Authentication (2FA) | Adds a second layer of login security, acting as a digital deadbolt. |

| SSL/TLS Encryption | Protects your data while it’s in transit, like sending cash in an armored truck. |

| KYC Verification | Confirms you are who you say you are, preventing identity theft and fraud. |

| Segregated Funds | Ensures your trading capital is kept safe and separate from company finances. |

“A platform’s security is a partnership. They provide the tools, but you have to use them. Always enable 2FA and use a unique, strong password—it’s the best habit a trader can build.”

Ultimately, a secure platform gives you the peace of mind to focus on what really matters: analyzing the markets and making smart trading decisions. By understanding and utilizing these key features, you can trade with confidence, knowing your Olymp Trade online account has a robust security framework behind it.

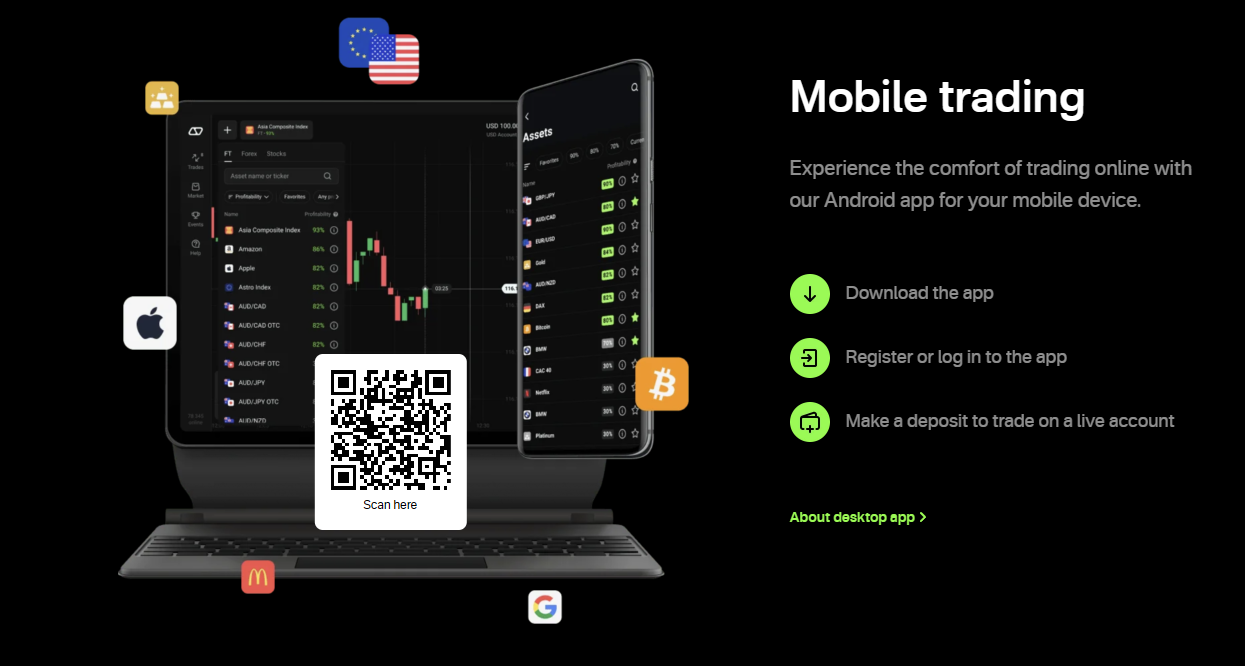

Trading on the Go with the Olymp Trade Mobile App

The financial markets never sleep, and as a trader, you know that opportunities can appear in a flash. You can’t be chained to your desk all day. That’s where the power of mobile trading comes in. The Olymp Trade mobile app puts the full potential of the financial markets right into the palm of your hand, allowing you to react instantly, no matter where you are.

This isn’t just a scaled-down version of the desktop platform. It’s a fully-featured trading app designed for speed, efficiency, and a seamless user experience. You get everything you need to analyze charts, manage your positions, and execute trades with precision.

Key Features at Your Fingertips

The development team packed a ton of power into this intuitive application. Here is what makes it stand out:

- Full Asset Access: Trade all your favorite instruments, from currency pairs and stocks to indices and commodities, directly from your phone.

- Advanced Charting Tools: Use a wide range of indicators and analytical tools to perform technical analysis on the go. The charts are responsive and easy to navigate on a smaller screen.

- Intuitive Interface: The layout is clean and user-friendly. Placing a trade, setting up Stop Loss/Take Profit, or checking your history takes just a few taps.

- Instant Notifications: Get real-time alerts on price movements, market news, and the status of your trades. Never miss a critical moment again.

- Integrated Education: Access a wealth of educational materials and market insights directly within the app to sharpen your skills.

The Freedom to Trade Your Way

Imagine catching a perfect entry point on EUR/USD during your lunch break or managing an open position while commuting home. This is the freedom the Olymp Trade mobile app delivers. It untethers you from your trading station and integrates trading into your daily life. You decide when and where you engage with the markets, giving you an edge in today’s dynamic environment.

| Advantages of Mobile Trading | Potential Considerations |

|---|---|

| Flexibility: Trade from anywhere with an internet connection. | Distractions: The mobile environment can be full of notifications and interruptions. |

| Speed: React instantly to market news and price action. | Screen Size: Detailed technical analysis can be more challenging on a smaller screen. |

| Convenience: Check your portfolio and open positions in seconds. | Connectivity: A stable internet connection is crucial for execution. |

Get Started in 3 Simple Steps

Ready to trade on the go? Setting up your mobile trading hub is quick and easy.

- Download the App: Head to the Apple App Store for iOS trading or the Google Play Store for Android trading. Search for “Olymp Trade” and download the official application.

- Log In or Register: If you already have an account, simply log in with your credentials. New traders can register a new account directly through the app in just a few minutes.

- Start Trading: Fund your account, explore the platform with the demo account, and start seizing opportunities in the global markets.

“I used to worry about missing moves when I was away from my PC. The Olymp Trade mobile app changed everything. It’s stable, fast, and has all the tools I need. Last week, I closed a profitable trade on Gold while waiting in line for coffee. It’s a true game-changer for any active trader.”

Managing Your Account Profile and Settings

Think of your trading account as the cockpit of your own personal fighter jet. Before you take to the skies of the market, you need to ensure every dial is calibrated, every switch is in the right place, and your seat is perfectly adjusted. Managing your account profile and settings isn’t just tedious admin work; it’s about fine-tuning your command center for peak performance, security, and efficiency. Let’s get your setup mission-ready.

Your Profile: More Than Just a Name

Keeping your personal information up-to-date is crucial. It ensures smooth operations, especially when it comes to funding and withdrawals. Regulators require us to verify who you are, and accurate details prevent any unnecessary delays when you want to access your profits. A quick check now saves you a headache later.

Fortify Your Defenses: Security Settings

In the world of trading, your capital is your ammo. Protecting it is non-negotiable. Your account security is the first line of defense against threats. Don’t take it lightly.

- Password Strength: Ditch \”Password123\”. Create a complex, unique password combining letters, numbers, and symbols. A password manager can be your best friend here.

- Two-Factor Authentication (2FA): This is your single most important security feature. Enabling 2FA means that even if someone gets your password, they can’t access your account without your phone. Turn it on. Right now.

- Device Management: Regularly review the list of devices authorized to access your account. See a device you don’t recognize? Revoke its access immediately.

\”A trader who neglects account security is like a soldier who goes into battle without a helmet. It’s an unnecessary risk that professionals simply do not take.\”

Fine-Tune Your Experience: Trading & Notification Preferences

Every trader is different. Your platform should adapt to your style, not the other way around. Customizing your preferences saves you precious seconds when volatility spikes and helps you stay focused on what matters: the charts.

Here are a few settings you should dial in immediately:

| Setting to Customize | Why It’s a Game-Changer |

|---|---|

| Default Trade Size & Leverage | Prevents costly fat-finger errors and ensures you stick to your risk management plan on every trade. |

| Chart Templates | Save your favorite indicator setups, colors, and timeframes. Apply your proven analysis framework to any chart in one click. |

| Notification Alerts | Get alerts for price levels, margin calls, or major news without being glued to your screen. Customize them to avoid information overload. |

| One-Click Trading | For scalpers and day traders, this can be essential for rapid execution. Use with caution and a clear understanding of your risk. |

Your Quarterly Account Health Checklist

Just like you review your trading strategy, you should review your account settings regularly. Take five minutes every quarter to run through this simple checklist.

- Is my personal contact information (email, phone number) correct?

- Is my password still strong and unique? Time for a change?

- Is Two-Factor Authentication (2FA) active on my account?

- Have I reviewed the list of authorized devices and sessions?

- Are my notification settings optimized to inform, not annoy, me?

Taking control of your account profile and settings is a mark of a disciplined trader. It demonstrates that you care about security, efficiency, and professionalism. Get these settings right, and you can focus all your energy on what you do best: analyzing the markets and executing winning trades.

Troubleshooting Common Olymptrade Account Issues

Hit a snag with your Olymptrade account? Don’t worry, it happens to every trader at some point. Whether it’s a login hiccup or a verification delay, most problems have a simple fix. Getting locked out right before a big market move is frustrating, but panicking won’t help. Let’s walk through the most common account issues and get you back to charting and trading in no time.

Can’t Log In? Let’s Fix It.

The classic login problem is usually the easiest to solve. Before you contact support, run through this quick checklist. Often, the solution is just a click away.

- Forgot Your Password? This is the most frequent culprit. Use the \”Forgot Password\” link on the login page. You’ll receive an email with instructions to reset it. Make sure to check your spam folder if you don’t see it.

- Two-Factor Authentication (2FA) Issues: If you use an authenticator app, ensure the time on your phone is synced correctly with internet time. An out-of-sync clock is a common reason for 2FA codes to fail.

- Incorrect Email/Phone: Double-check that you are using the exact email address or phone number you registered with. A simple typo can be the source of the entire problem.

The Verification Voyage: Navigating KYC

The \”Know Your Customer\” (KYC) process is a standard security measure, but it can sometimes feel like a roadblock. Olymptrade requires verification to protect your account and comply with financial regulations. If your verification is delayed, it’s often due to document issues.

Avoid these common mistakes for a smoother verification process:

- Blurry or cropped images.

- Expired documents.

- Information on the document not matching your account details.

- Using a document type that isn’t accepted.

Always submit clear, full-sized photos of valid documents where all four corners are visible. This simple step can turn a week-long delay into a ten-minute approval.

Deposit and Withdrawal Glitches

Money matters are critical. When a deposit doesn’t appear or a withdrawal is pending for too long, it’s easy to get concerned. Here’s a quick troubleshooting table for these financial snags.

| The Problem | What to Check First |

|---|---|

| Deposit Not Reflected | Check your bank or e-wallet statement to confirm the transaction was successful. Some payment methods can take a few hours to process. Be patient before raising a ticket. |

| Withdrawal Rejected | This often happens if you try to withdraw to a different payment method than the one you used for depositing. For security, you must usually withdraw via the same system. |

| Withdrawal Pending | Ensure your account is fully verified. Withdrawals cannot be processed without completing the KYC procedure. Also, check if you have any active trading bonuses that have specific withdrawal conditions. |

A Trader’s Pro-Tip: When you do need to contact customer support, be prepared. Have your account ID, relevant transaction numbers, and clear screenshots of the issue ready. The more information you provide upfront, the faster the support team can resolve your case and get you back in the market.

How to Deactivate or Delete Your Olymp Trade Account

Every trader’s journey has its twists and turns. Sometimes, taking a step back is the smartest move you can make. Whether you’re looking to take a temporary break from the markets or have decided to stop trading for good, it’s important to know how to manage your account properly. Let’s walk through the process of deactivating or permanently deleting your Olymp Trade account.

Understanding the Difference: Deactivate vs. Delete

First, it’s crucial to understand the two options you have. They are not the same, and choosing the right one depends on your long-term plans.

- Deactivation is like putting your account on pause. Your data remains saved, and you can reactivate it later if you decide to return to trading. It’s the best option for taking a break.

- Deletion is a permanent action. Your account, along with all its associated data and trading history, will be erased forever. You will not be able to recover it.

Step-by-Step: How to Deactivate Your Account

If you just need a timeout to reassess your strategy or manage risk, deactivation is your best bet. It’s a simple process you can do yourself directly from the platform.

- Log in to your Olymp Trade account.

- Navigate to your user profile section.

- Find the account settings or security options.

- Look for an option labeled \”Deactivate Account\” or \”Block Account.\” The platform may ask you for a reason for your decision.

- Confirm your choice. Your account will now be inactive, but you can restore it later by contacting support.

For a Permanent Break: How to Delete Your Account

If you’re certain you won’t be returning to the platform, you can request a permanent deletion. This process is more final and requires you to contact the support team directly. This ensures you understand the permanent nature of the action.

Here’s the typical procedure:

- Withdraw Your Funds: Make sure your account balance is zero. Withdraw all your remaining money before starting the deletion process.

- Contact Customer Support: Reach out to the Olymp Trade support team via live chat or email.

- State Your Request: Clearly state that you wish to permanently delete your account. Be prepared to provide your account details and answer a few security questions to verify your identity.

- Follow Instructions: The support agent will guide you through the final steps and confirm once the deletion is complete.

Deactivation vs. Deletion: A Quick Comparison

Still unsure which path to take? This table breaks it down for you.

| Feature | Deactivation | Permanent Deletion |

|---|---|---|

| Reversibility | Fully reversible | Permanent and irreversible |

| Data Retention | Your profile and history are saved | All data is permanently erased |

| Best For | Taking a break, risk management | Quitting trading for good |

| How to Do It | Via user profile settings | By contacting customer support |

A Final Thought Before You Go

Closing an account is a big decision. Before you proceed, ask yourself why you’re leaving. Was it a series of losses? A lack of a solid strategy? Or just burnout from watching the charts all day?

\”Sometimes, the most profitable trade is the one you don’t take. Taking a break to study, practice on a demo account, or simply clear your head isn’t quitting—it’s sharpening your axe for the next challenge.\”

Whatever your reason, make sure the decision serves your long-term goals. The market will always be here if you choose to return with a clearer mind and a stronger plan.

Final Verdict: Is an Olymptrade Account Right for You?

So, we’ve explored the platform, analyzed its features, and discussed its potential. Now we arrive at the most important question: should you trade with an Olymp Trade account? The answer truly depends on who you are as a trader and what you need from a broker.

This isn’t a one-size-fits-all solution. For some traders, it’s a perfect match. For others, different platforms might be a better fit. Let’s break it down to help you decide.

Who is Olymp Trade Best For?

To give you a clearer picture, we’ve created a simple table outlining the ideal user for the platform versus who might want to consider other options.

| Trader Profile | Why It’s a Great Fit | Who Might Reconsider |

|---|---|---|

| The Newcomer | The low minimum deposit, free demo account, and extensive educational resources make it an ideal starting point. | Traders who feel overwhelmed and prefer to stick with paper trading for an extended period. |

| The Small-Capital Trader | You can start trading with a very small initial investment, allowing you to manage risk effectively without a large bankroll. | High-volume professional traders who require institutional-grade liquidity and deep order books. |

| The Mobile Trader | Their mobile app is robust and intuitive. It allows you to manage your trades and analyze charts from anywhere. | Traders who rely exclusively on complex, multi-monitor desktop setups with custom plugins. |

Our Final Thoughts

Here are the key takeaways to remember:

- Accessibility is Key: Olymp Trade excels at lowering the barrier to entry. If you’ve felt intimidated by trading before, this platform provides a welcoming environment.

- Learning and Growth: The focus on education is a significant advantage. It’s not just a platform to place trades, but a place to learn how to trade better.

- Simplicity Over Complexity: The proprietary platform is clean and straightforward. It has what you need to execute trades effectively without the clutter of more complex professional software like MT5.

Ultimately, if you’re a new or intermediate trader looking for a reliable, user-friendly platform with a low financial commitment, an Olymp Trade account is a strong contender. It gives you the tools to get started and the resources to grow your skills.

The best way to know for sure is to see it for yourself. We recommend opening a free demo account. You get to test the platform with virtual funds, follow the market, and see if its trading style aligns with your personal goals. It’s a completely risk-free way to make a final, informed decision.

Frequently Asked Questions

What is the difference between a Demo and a Live account on Olymptrade?

A Demo account uses virtual, replenishable funds for risk-free practice and strategy testing in a real market environment. A Live account uses your own deposited money for real trading, involving actual financial risk and the potential for profit.

Why is account verification (KYC) required on Olymptrade?

Account verification is a mandatory security measure to protect your funds from unauthorized access, prevent fraud, and comply with international financial regulations (KYC & AML). It is essential for enabling secure and smooth withdrawals.

How can I withdraw my profits from Olymptrade?

To withdraw funds, navigate to the “Withdraw” section in your account, enter the amount, and choose a withdrawal method. For security, you must withdraw funds using the same payment method you used for your deposit.

Is trading on Olymptrade safe?

Yes, Olymptrade employs several security features to protect users, including Two-Factor Authentication (2FA), SSL/TLS data encryption, mandatory KYC verification, and keeping client funds in segregated bank accounts separate from company funds.

Can I trade on Olymptrade using my smartphone?

Absolutely. Olymptrade offers a full-featured mobile app for both iOS and Android devices. It allows you to analyze charts, manage your portfolio, and execute trades from anywhere, providing complete flexibility for trading on the go.