Welcome, fellow traders and aspiring market masters in Nigeria! You’ve likely felt the growing buzz around online trading. It presents a world of opportunity, a chance to engage with global financial markets right from your home in Lagos, Abuja, or anywhere across the country. But where do you begin? The financial world can seem complex, but breaking into it is more accessible than ever before.

This guide is your starting block. We created it specifically for you. We will walk you through the essential steps and knowledge you need to navigate the markets with confidence. Forget confusing jargon and overwhelming charts. We are here to simplify the process and show you a clear path forward. We will explore a platform designed to make your entry into trading as smooth as possible.

We will focus on Olymptrade, a popular choice for many traders in Nigeria. We will cover everything from setting up your account to understanding the tools at your disposal and developing your first trading strategies. Whether you are a complete beginner curious about Forex or an experienced trader looking for a new platform, this guide has something for you. Let’s unlock your trading potential together!

- Understanding Olymptrade’s Presence in Nigeria

- Is Olymptrade Legal for Nigerian Traders?

- How to Register an Olymptrade Account in Nigeria

- Step-by-Step Registration Guide

- Information at a Glance

- Depositing Funds to Olymptrade from Nigeria

- Popular Deposit Methods in Nigeria

- A Quick Guide to Making Your First Deposit

- Withdrawing Profits from Olymptrade in Nigeria

- Olymptrade Trading Platforms: Features for Nigerian Users

- What Makes the Platform Stand Out?

- Platform at a Glance: Web vs. Mobile

- Popular Assets Available on Olymptrade Nigeria

- Olymptrade Bonuses, Promotions, and VIP Status for Nigeria

- Olymptrade Customer Support: Help for Nigerian Traders

- Utilizing the Olymptrade Demo Account for Practice

- Olymptrade vs. Other Online Brokers in Nigeria

- Feature Showdown: A Quick Comparison

- What Really Sets Them Apart?

- Advantages and Disadvantages of Olymptrade Nigeria

- The Upside: What Makes It Attractive?

- The Downside: What to Be Cautious About?

- Quick Comparison Table

- Olymptrade Education and Market Analysis Tools

- Frequently Asked Questions

Understanding Olymptrade’s Presence in Nigeria

The landscape of online trading in Nigeria is vibrant and growing rapidly. Many Nigerians are actively seeking platforms to access global financial markets, and Olymptrade has emerged as a prominent name in this space. Its visibility and adoption rate show a deep connection with the local trading community, making it a frequent choice for both newcomers and experienced market participants.

What drives this popularity? A few key factors explain why Olymptrade resonates so well with traders in Nigeria.

- Ease of Access:

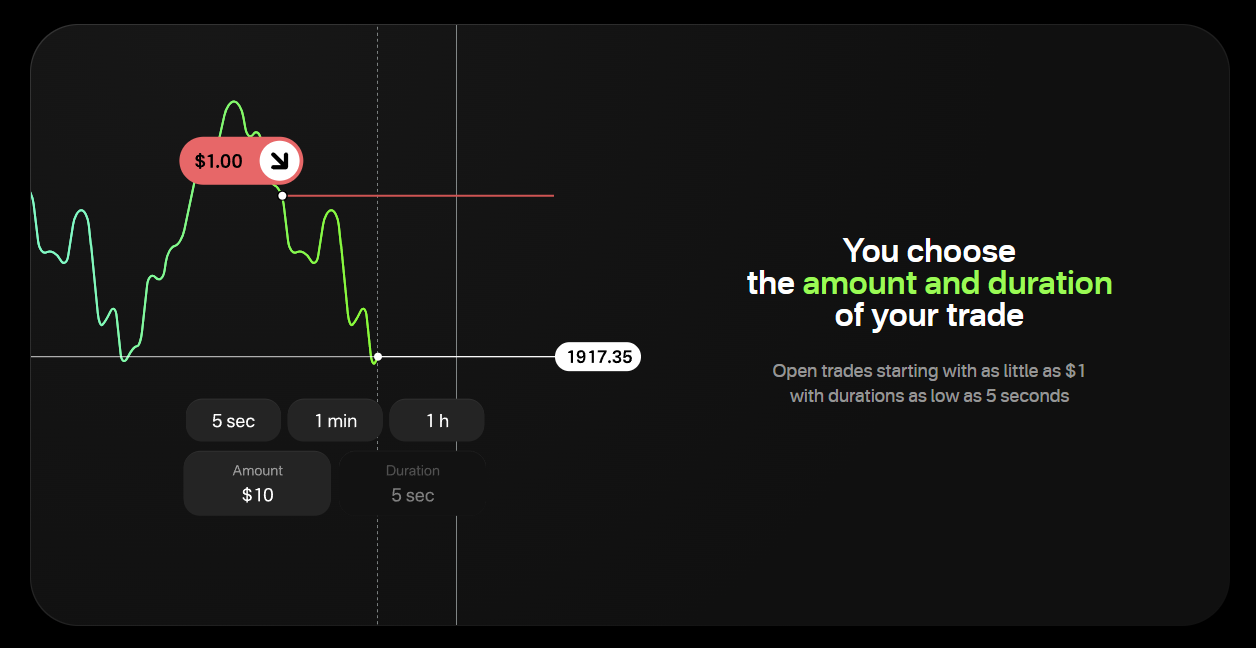

The platform significantly lowers the barrier to entry. With a small minimum deposit, it allows individuals to start their trading journey without requiring a large initial investment. This makes it a practical option for a broad audience.

- Intuitive Design: Olymptrade offers a clean, user-friendly interface. Whether you use the web platform or the mobile app, executing trades and analyzing charts is a straightforward process. This simplicity is a major advantage for those new to the trading world.

- Educational Commitment: The platform provides a rich library of free educational resources. Traders can benefit from webinars, strategy tutorials, and market insights to sharpen their skills and make more informed decisions.

Beyond its core features, Olymptrade has tailored its service to better suit the Nigerian market. It supports payment methods that are common and convenient for users in Nigeria, streamlining the process of depositing and withdrawing funds. This attention to local needs fosters a sense of trust and reliability among its user base.

Here is a quick breakdown of features particularly useful for traders in Nigeria:

| Feature | How It Helps Nigerian Traders |

|---|---|

| Demo Account | Practice trading with virtual funds to build confidence before risking real capital. |

| Mobile Trading App | Manage your trades and stay updated on market movements from anywhere. |

| Wide Range of Assets | Trade everything from currency pairs to stocks and indices on a single platform. |

| Responsive Support | Get assistance with your questions, ensuring a smoother trading experience. |

Ultimately, Olymptrade’s presence in Nigeria is built on a foundation of accessibility, education, and user-centric design. It serves as a gateway for many to participate in the financial markets, offering the tools and support needed to navigate the exciting world of online trading.

Is Olymptrade Legal for Nigerian Traders?

Let’s tackle this important question head-on. As a trader in Nigeria, you want to know that your chosen platform operates within a clear framework. The short answer is that Nigerian traders can and do actively use Olymp Trade. The platform operates internationally, which places it in a unique position regarding local regulations.

Nigeria’s Securities and Exchange Commission (SEC) primarily regulates financial entities that have a physical presence and are incorporated within the country. Since Olymp Trade is an international online broker, it doesn’t fall directly under the SEC’s local jurisdiction. This does not mean it is illegal for you to use its services. It simply means you are engaging with a global company, a common practice for traders worldwide seeking access to international markets.

So, what kind of protection do you have?

Olymp Trade is a member of the International Financial Commission (FinaCom). This is a big deal. FinaCom is an independent, third-party organization that specializes in resolving disputes within the financial markets.

Here’s what it means for you:

- Dispute Resolution: If you have an issue with the platform that you cannot solve directly, FinaCom provides a neutral body to review your case.

- Client Protection: Membership demonstrates a commitment to transparency and high standards of practice.

- Compensation Fund: FinaCom has a compensation fund that can cover judgments up to €20,000 per case, offering a safety net for traders.

To make it even clearer, let’s look at the situation from both sides.

| Advantages | Points to Consider |

|---|---|

| Access to a global platform with diverse financial instruments. | The platform is not directly licensed by the Nigerian SEC. |

| Protection through international bodies like FinaCom. | You are responsible for understanding your own local tax obligations. |

| Utilizes advanced technology and user-friendly trading tools. | Withdrawal and deposit methods are international, so choose one that works best for you. |

Ultimately, trading with an international broker like Olymp Trade is a legitimate activity for traders in Nigeria. Your responsibility is to be an informed participant. Understand the platform’s terms, get familiar with the deposit and withdrawal processes, and leverage the tools provided. By doing so, you can confidently and legally access the global financial markets right from Nigeria.

How to Register an Olymptrade Account in Nigeria

Ready to jump into the world of trading? Getting your Olymp Trade account set up in Nigeria is a straightforward process. You can go from thinking about trading to practicing on a demo account in just a few minutes. Let’s walk through the simple steps to get you started on your trading journey.

First, make sure you have a valid email address and a phone number handy. You will need these to secure your account. The entire process is designed to be quick and user-friendly, so you won’t get bogged down in complicated paperwork.

Step-by-Step Registration Guide

- Visit the Official Website: Navigate to the Olymp Trade platform’s main page. You will immediately see the registration form.

- Fill in Your Details: Enter your email address and create a strong password. This is your key to the platform, so keep it safe.

- Choose Your Currency: Select the currency for your account. You can typically choose between US Dollars (USD) or Euros (EUR). Think about which one works best for you.

- Agree to the Terms: Tick the box to confirm that you are of legal age and that you agree to the service agreement. It’s always a good idea to read through these terms.

- Click Register: Hit the big “Register” button. And that’s it! You’re in.

After registering, check your email inbox for a confirmation message. Clicking the link inside will verify your account and add an extra layer of security. Once confirmed, you gain instant access to both a live account and a free demo account pre-loaded with virtual funds. This is your risk-free playground to test strategies and get comfortable with the platform.

Information at a Glance

| What You Need | Why You Need It |

|---|---|

| Active Email Address | For registration, verification, and account recovery. |

| Secure Password | To protect your account and funds. |

| Choice of Currency (USD/EUR) | Sets the base currency for your trading activities. |

“The first step is always the most important. Getting registered is your entry ticket to the financial markets. Do it, and then focus on learning.”

With your account registered, the exciting part begins. You can immediately switch to the demo account to start practicing. Explore the different assets, try out indicators, and build your confidence before you ever deposit a single Naira.

Depositing Funds to Olymptrade from Nigeria

Getting your trading account ready for action is a crucial first step. We understand that for traders in Nigeria, a smooth and secure deposit process is essential. Funding your Olymptrade account is designed to be straightforward, allowing you to move from setup to trading with minimal hassle. You have several convenient options right at your fingertips, ensuring you can choose the method that best suits your needs.

Let’s explore the common payment options available to you. Each method has its own advantages, so you can select the one you are most comfortable with. The platform supports a variety of local and international systems to make depositing funds as easy as possible.

Popular Deposit Methods in Nigeria

| Payment Method | Typical Processing Time | Best For |

|---|---|---|

| Internet Banking | Near-Instant | Traders who prefer direct, secure transfers from their Nigerian bank accounts. |

| Bank Cards (Visa/Mastercard) | Instant | Quick and easy deposits using your everyday debit or credit card. |

| E-wallets (e.g., Neteller, Skrill) | Instant to a few minutes | Traders who use digital wallets for fast, international transactions. |

A Quick Guide to Making Your First Deposit

Ready to fund your account? Just follow these simple steps:

- Log in to your personal Olymptrade profile.

- Find and click on the “Payments” button, then select the “Deposit” option.

- Choose your preferred deposit method from the list provided for Nigeria.

- Enter the amount you wish to add to your account. Keep an eye out for any available deposit bonuses!

- Complete the required information for your chosen method, such as card details or bank login prompts.

- Confirm the transaction and you are all set. The funds should appear in your trading account shortly.

Remember, always use a payment method that is registered in your own name. This is a key security protocol to protect your account and your funds. With these easy-to-use options, depositing funds to Olymptrade from Nigeria is a seamless experience, getting you one step closer to the financial markets.

Withdrawing Profits from Olymptrade in Nigeria

Congratulations, trader! You’ve navigated the markets, made smart moves, and now your account is showing a healthy profit. That’s a fantastic feeling. Now comes the best part: moving those earnings from your trading account into your own bank account. Many traders worry about this step, but it’s a straightforward part of the journey. Let’s break down exactly how you can manage your Olymptrade withdrawal here in Nigeria.

The entire withdrawal process is designed to be secure and efficient. The key is to have your account details in order and to understand the options available to you. Once you get the hang of it, requesting your profits becomes a simple, routine task.

A Quick Guide to the Withdrawal Steps

- Access Your Account: Log in to your personal profile on the platform.

- Find the Withdrawal Page: Navigate to the main menu and select the “Withdraw” option. It’s usually located right next to the deposit button.

- Select Your Method and Amount: You’ll see a list of available payment methods. Choose the one you prefer, enter the amount you wish to withdraw, and fill in any required payment details. Always double-check your information.

- Submit Your Request: Once you confirm the details, submit your request. You will receive a notification that your request is being processed.

To give you a clearer picture, here are the common payment methods you can use to get your funds in Naira and other currencies.

| Payment Method | Typical Processing Time | Things to Note |

|---|---|---|

| Local Internet Banking | 1-3 business days | Direct and convenient for getting funds into your Nigerian bank account. |

| E-wallets (Neteller, Skrill) | Often within 24 hours | Very fast processing times after approval. Great for traders who use e-wallets frequently. |

| Cryptocurrency (USDT TRC-20) | Usually very fast | A modern and swift option, but ensure your wallet address is 100% correct. |

Tips for a Smooth Experience

To ensure your withdrawal is fast and hassle-free, keep these pro tips in mind:

- Complete Your Verification: This is the most important step. Make sure your account is fully verified before you even attempt to withdraw profits. An unverified account is the number one cause of delays.

- Consistency is Key: For security reasons, you should withdraw funds using the same payment method you used for your deposit. If you used multiple methods, you’ll need to withdraw proportionally to each one.

- Be Aware of Limits: Check the minimum and maximum withdrawal limits for your chosen method. This helps you plan your withdrawals effectively.

- Patience During Holidays: Remember that bank transfers can be delayed during public holidays and weekends. Plan accordingly if you need the funds by a specific date.

Ultimately, securing your profits is the goal of every trader. Following these steps and tips will help you enjoy the fruits of your successful trading with confidence and ease.

Olymptrade Trading Platforms: Features for Nigerian Users

As a trader in Nigeria, your choice of platform can make or break your success. You need a tool that is not only powerful but also intuitive and accessible. The Olymptrade platform delivers a robust trading environment perfectly suited for both new and experienced traders across the country, from the bustling markets of Lagos to the calm of Calabar.

You get the flexibility to trade however you want. Olymptrade ensures a smooth experience whether you use their browser-based Web platform, the full-featured Desktop app, or the convenient Mobile app for trading on the move.

What Makes the Platform Stand Out?

- User-Friendly Design: You don’t need to be a tech guru to find your way around. The interface is clean and simple, helping you focus on what truly matters: your trades.

- Risk-Free Demo Account: Practice your strategies without spending a single Naira. The platform gives you virtual funds to test your skills and build confidence in a live market environment.

- Free Education Centre: Sharpen your trading axe with a wealth of knowledge. Gain access to webinars, video tutorials, and market analysis that can help you make smarter decisions.

- Diverse Asset Selection: Why limit yourself? You can trade a wide variety of instruments, including popular Forex pairs, stocks from major global companies, and commodities, all from a single account.

- Advanced Analysis Tools: Spot opportunities like a professional. The platform comes equipped with a suite of technical indicators and charting tools to help you analyze market trends effectively.

_

Platform at a Glance: Web vs. Mobile

| Feature | Web Platform | Mobile App |

|---|---|---|

| Best For | In-depth analysis on a larger screen | Trading on the go, anytime |

| Full Charting Tools | Yes, with multi-chart layout | Yes, optimized for touchscreens |

| Accessibility | Any modern web browser | Android and iOS devices |

| Key Advantage | Ideal for complex strategy development | Convenience and instant trade alerts |

“I started on my phone during my daily commute. The app is light on data, which is great, and incredibly easy to use. Moving to the web platform for deeper analysis was a seamless transition.”

Ultimately, the Olymptrade ecosystem provides a reliable and feature-rich foundation for your trading journey. It strips away unnecessary complexity, allowing you to concentrate on spotting opportunities and managing your portfolio with confidence.

Popular Assets Available on Olymptrade Nigeria

As a trader, your power lies in having choices. A diverse trading portfolio is your best tool for navigating the markets, seizing opportunities, and managing risk. On the Olymptrade platform in Nigeria, you get access to a fantastic range of assets. This means you can build a strategy that truly fits your style, whether you love the fast pace of currencies or the steady growth of major companies.

Let’s break down the exciting world of instruments you can trade. Having this variety at your fingertips allows you to pivot your strategy based on global news, economic reports, or market sentiment. One day you might be trading the volatility of tech stocks, and the next you could be hedging with a safe-haven asset like gold.

| Asset Class | Description | Popular Examples |

|---|---|---|

| Forex | The foreign exchange market is the largest financial market in the world. You trade the value of one currency against another, speculating on their price movements. It’s known for its high liquidity and round-the-clock trading hours on weekdays. | EUR/USD, GBP/JPY, USD/CAD, AUD/USD |

| Stocks | Trade on the price movements of shares from some of the world’s biggest and most influential companies. This allows you to tap into the performance of giants in technology, finance, and consumer goods without owning the actual stock. | Apple, Tesla, Microsoft, Amazon |

| Indices | Instead of trading a single company, you can trade the performance of an entire stock market or a sector. An index is a basket of top stocks, offering a broader view of market health. | S&P 500, NASDAQ 100, Dow Jones, FTSE 100 |

| Commodities | Trade raw materials that are essential to the global economy. These include precious metals, which often act as safe-haven assets during uncertain times, and energies that react to global supply and demand. | Gold, Silver, Brent Crude Oil, Natural Gas |

| Cryptocurrencies | Dive into the dynamic and innovative world of digital currencies. Known for their volatility, cryptocurrencies can present unique trading opportunities for those who understand their market drivers. | Bitcoin, Ethereum, Litecoin, Ripple (XRP) |

This wide selection ensures that no matter what is moving the global markets, you can find a trading opportunity. It gives you the flexibility to diversify your portfolio and not put all your eggs in one basket. Mastering different asset classes can significantly elevate your trading game and open up new avenues for potential profit.

Olymptrade Bonuses, Promotions, and VIP Status for Nigeria

As a trader here in Nigeria, I’m always looking for ways to maximize my capital and get an edge in the market. One of the best ways to do this is by taking full advantage of the offers a trading platform provides. Let’s talk about how you can boost your trading journey with Olymptrade promotions and unlock exclusive perks.

The platform frequently rolls out offers that can give you more firepower for your trades. These aren’t just gimmicks; they are real tools that can enhance your trading experience. Here are some of the common types of bonuses you might find:

- Deposit Bonus: This is a fantastic way to increase your initial investment. When you fund your account, you can receive a percentage of your deposit as extra trading funds. More capital means more trading opportunities.

- Promo Codes: Keep your eyes peeled for special promo codes. You can often find these during special events or campaigns. Entering a code can unlock anything from a deposit match to other unique trading advantages.

- Risk-Free Trades: This is a personal favorite. It allows you to open a position for a certain amount, and if your forecast is wrong, your investment amount is returned to your account. It’s a great way to test a new strategy without the stress.

Moving beyond one-time promotions, there’s a whole other level of benefits for dedicated traders. This is where the VIP status comes into play, and it truly separates the casual traders from the serious ones.

A quick tip for my fellow Nigerian traders: Always understand the terms attached to any bonus. Knowing the rules helps you use these promotions effectively and turn them into real profit without any hitches.

Achieving VIP status on the Olymptrade platform is a goal worth aiming for. It transforms your standard trading account into a powerhouse of premium features designed to improve your results. The difference is clear when you see the benefits side-by-side.

| Feature | Standard Account | VIP Status |

|---|---|---|

| Higher Profitability | Standard asset returns | Increased percentage of profit on trades |

| Personal Support | General customer service | A dedicated personal analyst for consultations |

| Withdrawal Speed | Standard processing time | Priority, high-speed withdrawals |

| Exclusive Strategies | Access to public webinars | Private webinars and exclusive trading strategies |

| Special Tools | Basic indicators | Advanced tools and private trading signals |

For traders in Nigeria, these advantages provide a tangible boost. Faster access to your funds, expert guidance, and higher potential returns on your trades are exactly the kind of perks that help you navigate the markets with more confidence and skill.

Olymptrade Customer Support: Help for Nigerian Traders

Ever been in the middle of a trade when a question pops into your head? It happens to all of us. In the fast-moving world of online trading, quick and reliable help is not just a bonus—it’s essential. For traders in Nigeria, knowing you have a dedicated support team ready to assist can make all the difference. This lets you focus on your strategy, not on technical glitches or account queries. Olymptrade customer support is designed to be your trading partner, providing the backup you need, when you need it.

Getting in touch is straightforward. You have several options available, so you can choose the one that best fits your situation. No more waiting days for a simple answer!

| Support Channel | Best Use Case | Typical Response Time |

|---|---|---|

| Live Chat | Immediate questions, platform navigation help, and quick clarifications. | Instant / Within minutes |

| Detailed inquiries, sending documents, or non-urgent technical issues. | Within 24 hours | |

| Online Contact Form | Submitting a formal request directly through the platform or website. | Within 24 hours |

| Help Center (FAQ) | Finding answers to common questions about deposits, withdrawals, and verification. | Available 24/7 for self-help |

Why is responsive support so critical for your trading success? Think about it this way. A strong support system offers several key advantages:

- Peace of Mind: Knowing that a professional is available to help reduces trading anxiety.

- Problem Resolution: Quickly solve any deposit or withdrawal issues that might arise.

- Technical Guidance: Get help with platform features or troubleshooting so you don’t miss a trading opportunity.

- Account Security: Receive assistance with account verification and security questions to protect your funds.

Ultimately, your trading journey is your own, but you don’t have to walk it alone. Having access to a responsive and helpful customer support team builds confidence. It shows that the platform values its Nigerian traders and is invested in their success. So, the next time you have a question, remember that help is just a click or a message away.

Utilizing the Olymptrade Demo Account for Practice

Jumping into the world of trading feels exciting. The potential is huge, but let’s be real, so are the risks. This is where a smart trader starts. Before you put any real money on the line, you need a safe place to practice. Think of the demo account as your personal trading gym. It’s a powerful tool that mirrors the live market, giving you a realistic experience without any of the financial pressure. You get to learn the ropes, make mistakes, and find your footing, all with virtual funds.

So, what exactly can you achieve with this practice account? It’s more than just a game. It’s a crucial step in your trading journey.

- Learn the Platform Inside Out: Get comfortable with the trading interface. Learn how to place orders, use indicators, and analyze charts before it really counts.

- Develop and Test Strategies: Have a trading idea? The demo account is your laboratory. You can test your strategies against live market data, refine your approach, and see what works without any financial backlash.

- Master Your Emotions: Trading psychology is key. Practice managing the feelings of a losing or winning streak. Build the discipline needed to stick to your plan when real money is involved.

- Understand Market Flow: Get a genuine feel for how different assets move. Watch market volatility and learn to spot potential opportunities in a completely risk-free setting.

To put it clearly, here is how the demo and live environments stack up:

| Feature | Demo Account | Live Account |

|---|---|---|

| Capital | Virtual Funds | Real Money |

| Market Conditions | Real-Time Data | Real-Time Data |

| Primary Purpose | Education & Practice | Profit Generation |

| Psychological Impact | Low to None | High |

“My best advice for anyone starting out is simple. Trade on the demo account as if it’s your own money. Don’t take huge, unrealistic risks just because you can. The habits you form during practice are the same habits you’ll carry into live trading.”

The demo account isn’t just for newcomers. Seasoned traders often return to it to test new theories or get the hang of a new asset. Think of it as your ongoing training ground. Spend quality time there. Build your confidence. When you are consistently successful in your practice account, you’ll be much better prepared to step into the live market.

Olymptrade vs. Other Online Brokers in Nigeria

Choosing the right online broker in Nigeria can feel overwhelming. With so many options available, how do you know which one fits your trading style and budget? Let’s break down how Olymptrade compares to other popular online brokers you might encounter. We’ll look at the key features that matter most to Nigerian traders.

Many traders start by looking at the cost to get started. While some brokers require a significant initial investment, others offer a much lower entry point. It’s crucial to find a platform that not only fits your budget but also provides the tools you need to trade effectively. Think about what you value most: a simple interface, a wide range of assets, or easy local payment options?

Feature Showdown: A Quick Comparison

To give you a clear picture, let’s compare some essential features side-by-side. This table simplifies what you can generally expect.

| Feature | Olymptrade | Other Online Brokers |

|---|---|---|

| Minimum Deposit | Typically very low, accessible for beginners. | Varies widely, from moderate to very high. |

| Platform Simplicity | Custom platform designed to be user-friendly and intuitive. | Often use complex platforms like MT4/MT5, which have a steeper learning curve. |

| Local Payment Methods (Naira) | Yes, offers deposits and withdrawals via local Nigerian banks. | Hit or miss; many only offer wire transfers or e-wallets, often with high fees. |

| Demo Account | Free, unlimited, and easily reloadable demo account. | Usually available, but can sometimes be time-limited or have fewer features. |

| Educational Support | Extensive library of webinars, tutorials, and articles built into the platform. | Varies greatly; some have excellent resources, others have very little. |

What Really Sets Them Apart?

The biggest advantage for many Nigerian traders using Olymptrade is the focus on accessibility. The low minimum deposit removes a major barrier, allowing you to start trading with a smaller amount of capital. You don’t need a fortune to enter the market. This is a sharp contrast to many international brokers whose high deposit requirements can be discouraging.

Furthermore, the convenience of using local payment methods cannot be overstated. Managing currency conversions and international transfer fees can eat into your profits before you even place a trade. Being able to deposit and withdraw directly in Naira simplifies the entire process and saves you money.

For me, trading is about focus. I don’t want to worry about high fees or how to get my money out. I want a platform that just works, so I can concentrate on the charts.

While some advanced traders might prefer the complex analytical tools of platforms like MetaTrader, beginners and intermediate traders often find them confusing. Olymptrade offers a clean, straightforward interface where you can execute trades, manage your account, and access learning materials all in one place. This integrated approach makes the learning curve much smoother, helping you build confidence as you trade.

Advantages and Disadvantages of Olymptrade Nigeria

Thinking about jumping into the financial markets with Olymptrade in Nigeria? It’s a popular choice, but like any trading platform, it has its bright spots and its shadows. Every trader has a unique style and risk appetite, so what works wonders for one person might be a deal-breaker for another. Let’s cut through the noise and look at the real pros and cons of using this platform from a trader’s perspective.

The Upside: What Makes It Attractive?

Many traders in Nigeria get their start here, and for good reason. The platform makes a solid effort to be accessible.

- Low Entry Barrier: You don’t need a huge bankroll to get started. The minimum deposit is quite low, which allows new traders to get a feel for live trading without risking significant capital. This is a huge confidence booster.

- Intuitive Trading Platform: The interface is clean, modern, and easy to navigate. You won’t get lost in complicated menus. Placing a trade is a straightforward process, whether you are on a desktop or using their mobile app.

- Excellent Demo Account: Before you risk a single Naira, you can use their free demo account. It comes with virtual funds that you can replenish anytime. This is the perfect training ground to test your forex trading strategies and get comfortable with the platform’s features.

- Accessible Education: Olymptrade provides a good range of educational materials. You can find webinars, video tutorials, and strategy guides right on the platform, helping you build your knowledge base as you trade.

- Convenient Local Payments: For traders in Nigeria, funding your account is simple. The platform supports various local payment methods, including direct bank transfers, which makes the deposit and withdrawal process much smoother.

The Downside: What to Be Cautious About?

No platform is without its drawbacks. It’s crucial to be aware of the potential challenges before you commit your funds.

- Limited Range of Assets: If you are an experienced trader looking for exotic currency pairs or a vast selection of stocks, you might find the asset list a bit restrictive compared to other international brokers.

- High-Risk Trading Instruments: The platform is well-known for fixed time trades. While they offer simplicity, they are inherently high-risk. A wrong prediction, even by a small margin, can result in the loss of your entire stake for that trade.

- Withdrawal Timeframes: While deposits are often instant, some traders report that withdrawals can take a few business days to be fully processed and reflect in their accounts. This requires a bit of patience.

- Regulatory Oversight: The regulatory status of the broker is a point of discussion in the trading community. You should always research and understand the level of investor protection offered by any broker you choose.

Quick Comparison Table

Here’s a simple breakdown to help you weigh your options at a glance.

| Advantages | Disadvantages |

|---|---|

| Very low minimum deposit to start. | Fewer tradable assets than competitors. |

| Clean and user-friendly interface. | Fixed Time Trades carry high risk. |

| Free and replenishable demo account. | Withdrawals can sometimes be slow. |

Ultimately, Olymptrade Nigeria can be a solid entry point for beginners due to its simplicity and low startup cost. The key is to manage your risk carefully and never invest more than you are willing to lose. My advice? Spend quality time on the demo account. See how it feels, test your strategies, and then decide if it’s the right fit for your journey into the world of trading.

Olymptrade Education and Market Analysis Tools

Jumping into the trading world without the right knowledge is like sailing without a compass. You might get lucky, but you’re more likely to get lost. That’s why having access to powerful educational resources and sharp analysis tools directly on your trading platform is a game-changer. It transforms guessing into a calculated strategy. We believe every trader, new or experienced, deserves the best resources to sharpen their skills and make informed decisions.

We pack our platform with a comprehensive learning center designed to build your trading confidence from the ground up. You are not alone on this journey. You get access to a wealth of materials that cater to every learning style. Forget sifting through endless websites for reliable information; it’s all right here.

- Webinars with Experts: Join live sessions with professional analysts. Ask questions and learn trading strategies in real-time.

- Step-by-Step Tutorials: Watch easy-to-follow video guides on how to use platform features, indicators, and chart patterns.

- In-Depth Articles: Read up on everything from basic trading concepts to advanced market analysis techniques.

- Strategy Breakdowns: Discover and understand popular trading strategies that you can test and adapt for yourself.

Of course, education is only half the battle. You need the right tools to put that knowledge into action. Our platform is equipped with a full suite of technical analysis instruments. You can analyze price charts, identify trends, and spot potential entry and exit points directly from your trading interface. No need for third-party software or cluttered screens.

| Tool Type | Primary Use |

|---|---|

| Technical Indicators | Analyze momentum, volatility, and trend strength (e.g., RSI, MACD, Bollinger Bands). |

| Charting Tools | Draw trend lines, support/resistance levels, and Fibonacci retracements to map out the market. |

| Economic Calendar | Stay ahead of major news events and market-moving announcements that can impact asset prices. |

The real power comes from combining these two elements. You can learn about the Relative Strength Index (RSI) in an article, then immediately apply it to a live chart to see how it works. This seamless integration of learning and doing accelerates your growth as a trader. It builds a strong foundation based on practical experience, not just theory.

An investment in knowledge pays the best interest. In trading, that knowledge is your most valuable asset.

Frequently Asked Questions

Is Olymptrade open to traders in Nigeria?

Yes, absolutely. Olymptrade fully welcomes traders from Nigeria. You can easily create an account, complete verification, and access all trading features without restrictions, as the platform and support are well-suited for the Nigerian market.

What is the minimum deposit to start trading on Olymptrade?

You don’t need a large amount of capital to begin. The minimum deposit on Olymptrade is very low, making it highly accessible for new traders to start trading with real money without taking a huge initial risk.

What methods can I use to fund and withdraw from Olymptrade in Nigeria?

Olymptrade offers several convenient options for funding and withdrawing in Nigeria, including direct transfers from major Nigerian banks via Internet Banking, standard debit/credit cards (Visa/Mastercard), and popular international e-wallets like Neteller and Skrill.

Is Olymptrade suitable for beginner traders?

Yes, Olymptrade is designed to be user-friendly and is highly recommended for beginners. Its most valuable feature for new traders is the free demo account, which provides replenishable virtual funds to practice strategies and get comfortable with the platform risk-free before trading with real money.

What assets can I trade on Olymptrade?

Olymptrade offers a diverse range of assets to help you diversify your portfolio. You can trade currency pairs (Forex), stocks of global companies, major market indices, and popular commodities like gold and silver, all from a single account.