Welcome to the exciting world of online trading! If you are based in Morocco and have ever considered exploring the financial markets, you have come to the right place. The digital age has opened up incredible opportunities for individuals to participate in global markets right from their homes. This guide is designed specifically for aspiring Moroccan traders, offering a clear path to understanding and navigating the online trading landscape.

Many people find the idea of trading intimidating. They hear complex terms and see confusing charts. We are here to simplify it all. Think of this as your personal roadmap. We will walk you through the essential concepts, introduce you to a popular platform, and provide actionable tips to help you start your journey with confidence. Olymptrade Morocco provides an accessible gateway for you to tap into your trading potential.

This comprehensive guide will cover everything you need to know to get started:

- The fundamentals of how online trading works.

- Step-by-step instructions for setting up your account.

- An overview of the different assets you can trade.

- Simple strategies to help you make your first moves.

- Crucial risk management techniques to protect your capital.

Let’s unlock the doors to the financial markets together. Your trading adventure begins now.

- Olymptrade Morocco: Is It Legal and Regulated?

- Understanding Moroccan Financial Regulations

- Olymptrade’s International Licensing and Compliance

- Getting Started with Olymptrade in Morocco

- Account Registration Steps for Moroccan Users

- KYC and Verification Process

- Deposits and Withdrawals on Olymptrade Morocco

- Key Transaction Details

- Popular Payment Methods in Morocco

- Processing Times and Fees for Transactions

- A Quick Guide to Transaction Speeds

- Transaction Method Comparison

- Exploring Olymptrade’s Trading Platform and Features

- Core Platform Tools at a Glance

- Key Platform Characteristics

- User-Friendly Interface and Available Trading Tools

- Trading Instruments Available for Moroccan Traders

- Why a Diverse Portfolio Matters

- Mobile Trading Experience with Olymptrade App in Morocco

- Key Features for the Moroccan Trader

- Olymptrade Morocco Customer Support and Localized Services

- What Makes the Support Special?

- Education and Training Resources for Olymptrade Morocco Users

- Advantages and Disadvantages of Olymptrade for Moroccan Users

- The Upside: What Works in Your Favor

- The Downside: Potential Drawbacks to Consider

- A Quick Summary Table

- Olymptrade Morocco Security Measures and Data Protection

- Your Data is Your Business

- Olymptrade vs. Other Trading Platforms in Morocco

- Real User Reviews and Testimonials from Olymptrade Morocco

- Tips for Successful Trading with Olymptrade in Morocco

- Is Olymptrade Morocco the Right Choice for Your Trading Goals?

- Who Finds a Good Fit with Olymptrade?

- Frequently Asked Questions

Olymptrade Morocco: Is It Legal and Regulated?

Let’s cut straight to the chase. You’re in Morocco and you’re asking a smart question: is using Olymp Trade legal and regulated? Every trader should check this before depositing a single dirham. The answer isn’t a simple yes or no, but it is straightforward when you understand the landscape.

In Morocco, the legal framework for online trading with international brokers operates in a unique space. There are no specific laws that forbid Moroccan citizens from trading on global platforms. This is why thousands of traders from Casablanca to Marrakesh actively use international brokers to access financial markets every single day. You are not breaking any laws by using such a platform.

Now, let’s talk about regulation, which is all about your safety. While Olymp Trade is not directly regulated by the Moroccan Capital Market Authority (AMMC), it is a member of the Financial Commission (FinaCom). This is a very important detail. FinaCom is an independent international organization that resolves disputes between brokers and their clients. This membership proves the broker is committed to high standards of practice and transparency.

So what does this FinaCom membership mean for you, the trader?

- A Safety Net: Your funds are protected by FinaCom’s Compensation Fund. This means you have a layer of financial security.

- Fair Judgement: If you ever have a dispute with the broker, FinaCom acts as a neutral third party to review the case and deliver an impartial judgement.

- High Standards: To maintain its membership, the broker must adhere to strict rules regarding fair pricing, trade execution, and honest business practices.

“I started trading from Fez and was worried about security. When I learned about the international regulation through FinaCom, it gave me the confidence to focus on my charts instead of worrying about my broker.”

To make it even clearer, here is a simple breakdown of the platform’s regulatory standing for Moroccan users.

| Advantages | Disadvantages |

|---|---|

| Accessible to all traders in Morocco. | Not regulated locally by the AMMC. |

| Regulated internationally by FinaCom. | Some traders may prefer a locally regulated entity. |

| Offers dispute resolution and a compensation fund. | You rely on an international body for dispute resolution. |

The bottom line is clear. Using Olymp Trade in Morocco is legal for citizens, and the platform operates under a solid international regulatory framework. This FinaCom oversight provides crucial protection, making it a trusted and popular choice for many Moroccan traders ready to tap into the global markets.

Understanding Moroccan Financial Regulations

If you’re trading from Morocco, you need to know the local financial rules. Don’t worry, it’s not as complex as it sounds. Getting a handle on the regulations helps you trade smarter and protects your capital. It’s all about knowing who is in charge and what rules affect your trading activity.

Two main authorities oversee Morocco’s financial markets. Understanding their roles is the first step to navigating the system with confidence.

- Bank Al-Maghrib (BAM): This is Morocco’s central bank. BAM is the big boss, responsible for monetary policy, supervising banks, and managing the country’s foreign exchange reserves. Their policies directly influence the Moroccan Dirham (MAD) and rules around currency conversion.

- Autorité Marocaine du Marché des Capitaux (AMMC): Think of the AMMC as the stock market police. They regulate the capital markets, ensuring they are fair, transparent, and efficient. While their focus isn’t solely on retail Forex, their oversight protects investors and maintains market integrity.

So, what does this mean for your day-to-day trading? The most significant impact comes from currency controls. The Moroccan Dirham is not a fully convertible currency. This has direct implications for funding your trading account and withdrawing your profits.

| Regulatory Aspect | What it Means for a Trader |

|---|---|

| Currency Convertibility | You cannot freely exchange large sums of MAD for foreign currency specifically for speculative trading. This makes funding international broker accounts a key consideration. |

| Capital Outflows | Moving money out of the country to fund a trading account is regulated. Traders often use international bank accounts or e-wallets that comply with these rules. |

| Broker Choice | The regulatory landscape means you must be very selective with your broker. Look for reputable international brokers that have experience with Moroccan clients and offer suitable deposit and withdrawal methods. |

Embracing these regulations doesn’t limit you; it empowers you. By understanding the framework, you can make informed decisions, choose the right partners, and build a solid foundation for your trading journey in Morocco.

Olymptrade’s International Licensing and Compliance

As traders, we always ask the tough questions. One of the most important is: “Who holds this broker accountable?” It’s a fair question. You need to know that the platform you trust with your capital operates under strict guidelines. Let’s break down how Olymp Trade handles its international compliance.

The platform is an active member of the Financial Commission (FinaCom PLC). This isn’t just a certificate they hang on a wall. FinaCom is an independent, external dispute resolution (EDR) body. Its entire purpose is to provide a neutral third-party committee to resolve conflicts between traders and brokers.

What does this membership mean for you, the trader? It provides a crucial layer of security.

- Impartial Dispute Resolution: If you ever have an issue that you can’t resolve directly with the broker, you can file a complaint with the Financial Commission. They will review the case fairly and deliver an unbiased judgment.

- Compensation Fund: This is a massive confidence booster. FinaCom provides a compensation fund that covers its members. This means your funds are protected up to €20,000 per case if the broker fails to adhere to a judgment from the commission.

- Service Quality Guarantee: To maintain membership, a broker must demonstrate consistent transparency, honesty, and high-quality service. It’s a seal of quality that proves their commitment to fair practices.

This commitment to creating a safe trading environment shows that the platform values its clients. Knowing a regulator is watching ensures that everything from quote execution to fund withdrawals is handled correctly. This allows you to focus on your trading strategy, not on worrying about your broker’s integrity.

Getting Started with Olymptrade in Morocco

Are you in Morocco and ready to dive into the world of trading? Great choice! Getting started with Olymptrade is a straightforward process. We’ve broken it down into simple steps to help you launch your trading journey smoothly. Let’s get your account set up and ready for action.

Follow these five simple steps to begin trading on the platform from Morocco. Each step is designed to be quick, so you can move from registration to your first trade with confidence.

- Quick Registration: The first step is creating your account. It takes only a minute. All you need is a valid email address. Create a strong password, choose your currency, and you’re in.

- Account Verification: For your security and to comply with regulations, you need to verify your account. This is a standard process called KYC (Know Your Customer). You will typically need to upload a copy of your national ID card or passport and a document for proof of address.

- Fund Your Account: Now it’s time to make a deposit. Olymptrade offers a variety of payment methods convenient for traders in Morocco, including bank cards and popular e-wallets. Choose the method that works best for you and fund your trading account.

- Practice on the Demo Account: Before you risk your capital, take advantage of the free demo account. It comes with virtual funds that you can use to practice. Test your strategies, get familiar with the platform’s features, and build your confidence without any financial pressure.

- Start Live Trading: Once you feel comfortable with the platform and your strategy, it’s time to switch to your real account. Start with small amounts to manage your risk effectively as you begin your live trading journey.

Understanding the difference between practicing and trading with real money is crucial for success. Here’s a quick comparison:

| Feature | Demo Account | Real Account |

|---|---|---|

| Funds | Virtual & replenishable | Real, deposited money |

| Risk Level | Zero financial risk | Real financial risk and reward |

| Main Goal | Learning and strategy testing | Generating actual profit |

| Emotional Factor | Low, no real pressure | High, involves real trading psychology |

The journey of a thousand trades begins with a single step. Make that first step a confident one by preparing properly. Your demo account is your best friend when you’re just starting out.

Account Registration Steps for Moroccan Users

Ready to join the world of Forex trading from Morocco? Fantastic! We’ve made the sign-up process quick and simple. You are just a few moments away from accessing the global markets. Follow these easy steps to get your trading account up and running.

- Fill Out the Initial Form: Start by visiting our registration page. You’ll need to enter some basic information like your full name, email address, and a valid Moroccan phone number. Double-check your details for accuracy.

- Choose Your Account Type: Next, select the trading account that best fits your strategy. Whether you’re a beginner or an experienced trader, we have an option tailored for you. Don’t worry, you can always learn more about each type in your client area.

- Secure Your Account: Create a strong, unique password. Your account’s security is our top priority. This ensures your funds and personal information remain safe.

- Confirm Your Email: We will send a confirmation link to your email address. Click on it to verify your email and gain access to your personal client portal.

After these initial steps, you need to complete a standard verification process. This is a crucial security measure that protects all traders on our platform. It’s a one-time process and very straightforward.

You will need to upload clear copies of a couple of documents:

- Proof of Identity (POI): A valid, government-issued photo ID. This can be your Moroccan National Identity Card (CIN), passport, or driver’s license.

- Proof of Address (POA): A document that confirms where you live. You can use a recent utility bill (like water or electricity) or a bank statement. Make sure it shows your name and address clearly and is not older than six months.

Trader’s Tip: For a super-fast approval, make sure your document photos are bright and clear. All four corners of the document should be visible, and the text must be easy to read. Ensure the name on your documents exactly matches the name you registered with.

Once our team verifies your documents, you’re all set! You can then fund your account, perhaps using options convenient for Moroccan Dirham (MAD), and dive into the exciting world of trading.

KYC and Verification Process

Let’s talk about a crucial step before you place your first trade: the KYC process. You have probably heard of it. KYC stands for ‘Know Your Customer,’ and it’s a standard security check across the financial world. Think of it as the digital handshake that confirms you are who you say you are. This isn’t just about ticking boxes; it’s a vital measure that protects both you and the platform, ensuring a secure trading environment for everyone involved.

Getting verified is usually quick and straightforward. Here’s a typical rundown of what to expect:

- Initial Sign-Up: You start by creating your trading account with basic information like your email and a password.

- Provide Personal Details: Next, you will fill in your full name, date of birth, and residential address. Pro tip: make sure these details match your official documents exactly to avoid any delays.

- Upload Your Documents: This is the core of the verification. You will need to upload clear, readable copies of a couple of documents to confirm your identity and address.

- Wait for a Quick Review: Once you’ve submitted everything, a compliance team reviews your documents. This process is often completed very quickly, sometimes in just a few hours.

- Get Fully Activated: That’s it! Once your documents are approved, your account is fully unlocked. You are now ready to fund it and dive into the markets.

To make the process even smoother, have your documents ready before you start. It will save you time and get you trading faster.

| Document Type | Common Examples | What to Check |

|---|---|---|

| Proof of Identity | Passport, Driver’s License, or National ID Card | Ensure it is valid (not expired) and all four corners are visible in the photo. |

| Proof of Address | Utility Bill (electricity, water, gas) or a Bank Statement | It must be recent (usually within the last 3 months) and clearly show your name and address. |

Completing the KYC and verification process is a simple, one-time task. It builds a foundation of trust and security, allowing you to focus on what truly matters: your trading strategy and market analysis.

Deposits and Withdrawals on Olymptrade Morocco

Getting your money in and out of your trading account should be the easiest part of your journey. As a trader in Morocco, you need a platform that makes this process fast and simple. Let’s break down how deposits and withdrawals work on Olymp Trade, so you can focus on what really matters: making smart trades.

Funding your account is your first step into the live markets. The platform offers several convenient payment methods tailored for users in Morocco. You can choose the one that works best for you.

- Bank Cards: A straightforward and popular option. You can use your Visa or Mastercard to make a deposit directly into your trading account. It’s quick and secure.

- E-Wallets: Digital wallets like Skrill and Neteller offer another layer of convenience and speed. Many traders prefer this method for its fast processing times, both for adding funds and for withdrawals.

- Bank Transfers: For those who prefer traditional banking, a direct bank transfer is also an available option, though it might take a bit longer to process compared to other methods.

When it’s time to enjoy your profits, the withdrawal process is just as important. A key rule to remember is that you typically withdraw funds using the same method you used for your deposit. This is a standard security measure to protect your money. Before you request your first withdrawal, make sure you complete the account verification process. This involves submitting some identification documents and is a one-time step to secure your account and comply with regulations.

Key Transaction Details

| Feature | What You Should Know |

|---|---|

| Processing Speed | Deposits are usually instant. Withdrawals are processed quickly by Olymp Trade, but the final arrival time depends on your chosen payment method. E-wallets are often the fastest. |

| Transaction Fees | Olymp Trade does not charge any commission on deposits or withdrawals. However, your bank or e-wallet provider might have its own fees, so it’s wise to check with them. |

| Minimum Amounts | The platform has very accessible minimum deposit and withdrawal amounts, making it easy for traders of all levels to get started and manage their capital effectively. |

| Security | All transactions are protected with encryption. The policy of withdrawing to the source of the deposit adds an extra layer of security to your funds. |

Having reliable and diverse payment methods is a massive advantage. It gives you the flexibility to manage your trading capital without hassle. The system is designed to be user-friendly, ensuring that whether you are making a deposit to catch a market opportunity or a withdrawal to access your earnings, the experience is smooth.

Popular Payment Methods in Morocco

Funding your trading account is your first step into the live markets. It’s an exciting moment! In Morocco, you have a solid mix of both traditional and modern ways to get your capital ready for action. Choosing the right method depends on your needs for speed, cost, and convenience. Let’s break down the most common options available to traders here.

Most brokers operating in the region understand the need for flexibility. They typically offer a variety of choices to ensure you can deposit and withdraw funds smoothly. Here are the methods you’ll most likely encounter:

- Credit and Debit Cards: This is often the fastest and most straightforward way to fund an account. Major cards like Visa and Mastercard are widely accepted. Deposits are usually instant, allowing you to seize a trading opportunity without delay.

- Bank Wire Transfers: A classic and highly secure method. While it might take a few business days for the funds to reflect in your trading account, it’s a reliable option, especially for larger deposit amounts. Many traders prefer it for its security and direct link to their bank.

- E-Wallets (Digital Wallets): Services like Skrill and Neteller have become incredibly popular among traders. They offer a great balance of speed and security. E-wallets act as a middleman between your bank and your broker, which can be great for managing your trading funds separately. Transactions are often processed very quickly.

To make your decision easier, here is a quick comparison of the most popular funding options:

| Payment Method | Transaction Speed | Common Use Case |

|---|---|---|

| Credit/Debit Card | Instant | Quickly funding an account to start trading right away. |

| Bank Wire Transfer | 1-5 Business Days | Making large, secure deposits or withdrawals. |

| E-Wallets | Near-Instant | Fast deposits and quick access to withdrawn profits. |

Before you commit, always check the “deposits and withdrawals” section of your chosen broker. Look for any potential fees and processing times associated with each method. A little research upfront ensures a smooth and hassle-free funding experience, letting you focus on what really matters: trading the markets.

Processing Times and Fees for Transactions

In the world of trading, timing is everything. This applies not just to your trades, but also to your funds. Quick and cost-effective access to your capital is essential for seizing market opportunities. Let’s look at how processing times and fees can impact your trading journey.

Deposits and withdrawals have different timelines. We process deposits rapidly so you can start trading immediately. Withdrawals require a bit more time for security and verification, ensuring your money reaches you safely. The method you choose plays a big role.

A Quick Guide to Transaction Speeds

- E-Wallets: These are often the fastest option, with deposits hitting your account almost instantly and withdrawals typically processed within 24 hours.

- Credit/Debit Cards: Deposits are usually instant. Withdrawals are sent back to your card, which can take a few business days to reflect on your statement.

- Bank Wire Transfers: This is the most traditional method. It’s reliable and secure but also the slowest, often taking several business days for both deposits and withdrawals.

Fees are another critical factor. Unseen costs can eat into your profits over time. While we aim to keep our fees minimal, some payment processors may apply their own charges. Always be aware of the total cost of moving your money.

Transaction Method Comparison

| Payment Method | Average Deposit Time | Average Withdrawal Time | Potential Fees |

|---|---|---|---|

| Credit/Debit Card | Instant | 1-3 Business Days | Check with your card issuer. |

| E-Wallets | Instant | Under 24 Hours | Low fees, if any, from the provider. |

| Bank Wire Transfer | 1-3 Business Days | 2-5 Business Days | Your bank may charge a fee. |

Ultimately, the best choice depends on your personal needs. Do you prioritize speed or the lowest possible cost? Answering that question will help you manage your funds as effectively as you manage your trades.

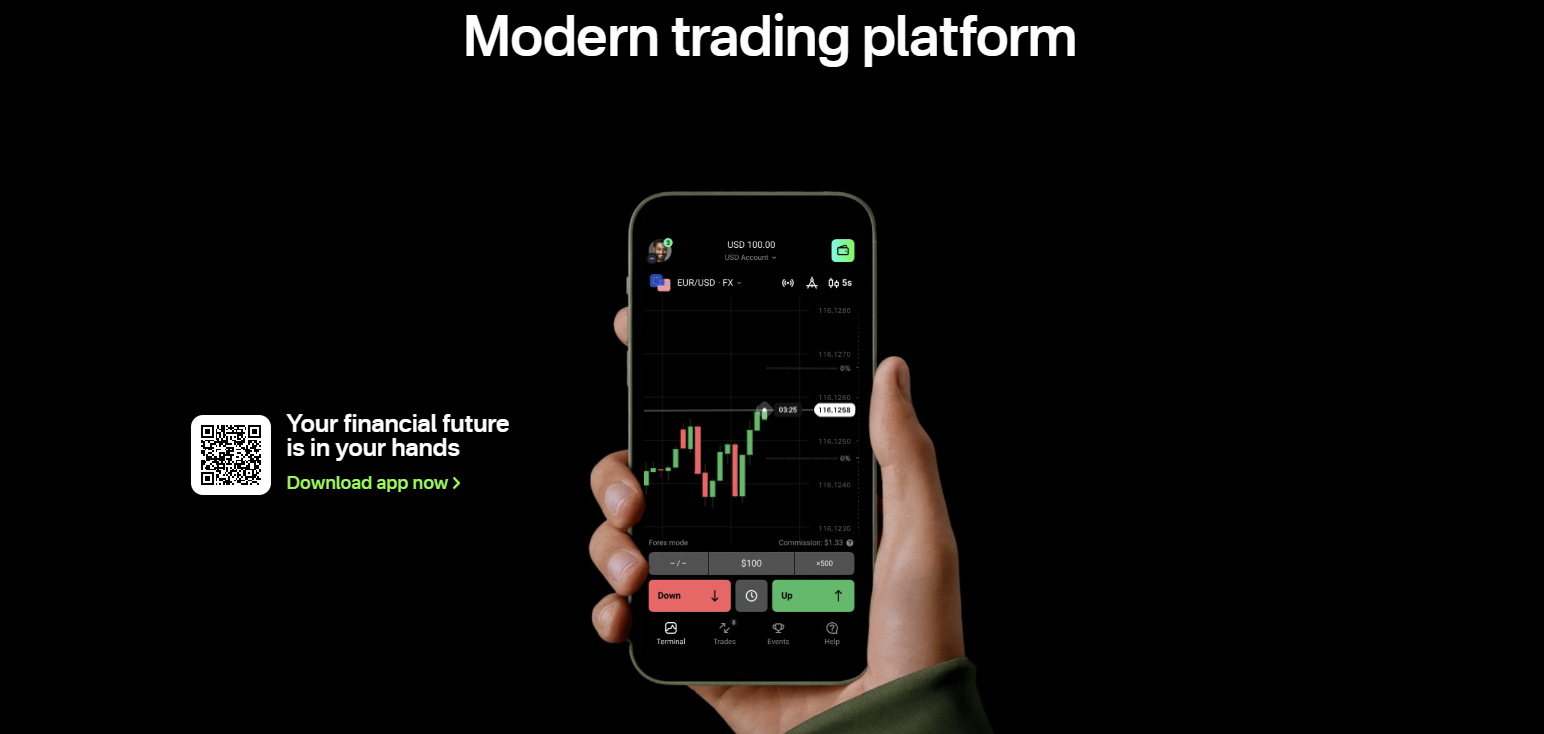

Exploring Olymptrade’s Trading Platform and Features

Let’s talk about the cockpit of your trading journey: the platform. When you’re in the heat of the market, you need a platform that’s fast, reliable, and intuitive. A clunky interface can cost you a perfect entry point. This is where the Olymptrade platform really shines. It’s designed from the ground up to feel clean and straightforward, whether you’re on your desktop or trading on the go with your phone.

The first thing you’ll notice is the minimalist design. There’s no clutter. Everything you need, from your charts to your trade history, is exactly where you expect it to be. You can customize the layout, switch between dark and light themes, and set up your charts with the tools that matter most to you. It’s a workspace built for focus.

Core Platform Tools at a Glance

Every trader needs a solid toolkit. The platform equips you with everything necessary to analyze the markets and execute your strategy. You are not just getting a “buy” and “sell” button; you are getting a full analytical suite.

- Advanced Charting: Choose from Area Charts, Japanese Candlesticks, Heikin-Ashi, and Bars to visualize price action in a way that suits your style.

- Technical Indicators: Access a wide array of popular indicators like RSI, MACD, Bollinger Bands, and Moving Averages. Applying them to your chart is a simple, one-click process.

- Analytical Tools: Draw trend lines, support and resistance levels, and Fibonacci retracements directly on your charts to build a complete technical picture.

- One-Click Trading: When timing is critical, this feature allows for instant trade execution without extra confirmations, helping you seize opportunities as they arise.

Key Platform Characteristics

To give you a clearer picture, here’s a breakdown of what makes the platform tick. It’s more than just looks; the underlying functionality is what truly empowers your trading.

| Feature | What It Means for You |

|---|---|

| Intuitive User Interface | Spend less time figuring out the platform and more time analyzing the market. Perfect for both new and seasoned traders. |

| Cross-Platform Sync | Start your analysis on a desktop and place a trade from your mobile. Your account is seamlessly synced across all devices. |

| Free Demo Account | Practice your strategies with virtual funds in a real-market environment. It’s the perfect risk-free training ground. |

| Risk Management Tools | Utilize features like Stop Loss and Take Profit to manage your risk and protect your capital automatically. |

“A great platform doesn’t just show you the market; it helps you understand it. The integration of educational resources and analytical tools right into the interface is a game-changer for developing traders.”

Ultimately, the platform feels like a reliable partner. It combines the power needed for serious analysis with the simplicity required for quick, decisive action. It removes technical barriers, allowing you to concentrate fully on your trading strategy and market movements.

User-Friendly Interface and Available Trading Tools

Let’s be honest. A clunky, confusing trading platform is a recipe for disaster. When you’re in the heat of a trade, the last thing you need is to fight with your software. That’s why a clean and intuitive interface isn’t just a “nice-to-have”—it’s a critical part of your trading toolkit. We designed our platform with traders in mind. You can find everything you need quickly, place orders without a hassle, and customize your workspace to fit your unique style.

A great interface is your command center, but you still need the right weapons. We equip you with a full arsenal of professional-grade trading tools directly within the platform. You get everything you need to analyze the market and execute your strategy with precision. Here are some of the key tools at your fingertips:

- Advanced Charting Suite: Dive deep into price action with multiple chart types, timeframes, and customizable layouts.

- Dozens of Technical Indicators: From RSI and MACD to Bollinger Bands and Ichimoku Clouds, apply popular indicators to spot trends and opportunities.

- Comprehensive Drawing Tools: Map out your analysis with trend lines, Fibonacci retracements, support/resistance levels, and more.

- Integrated Economic Calendar: Stay ahead of market-moving news events without ever leaving your trading screen.

- One-Click Trading: Seize opportunities the moment they arise with ultra-fast order execution.

- Essential Risk Management: Easily set stop-loss and take-profit orders to protect your capital and lock in gains.

| Feature | How It Improves Your Trading |

|---|---|

| Customizable Workspace | Arrange charts and tools the way you want, reducing clutter and improving focus. |

| Real-Time Data Feeds | Make decisions based on the most current price information, eliminating lag. |

| Multi-Chart Layouts | Monitor multiple currency pairs or timeframes simultaneously on a single screen. |

Ultimately, our goal is simple. We provide a powerful, yet easy-to-use platform so you can stop wrestling with technology and start focusing on what truly matters: your trading strategy.

Trading Instruments Available for Moroccan Traders

As a trader in Morocco, you have a universe of financial markets at your fingertips. Gone are the days of being limited to just one asset. Today, you can build a diverse portfolio and tailor your trading strategy to different market conditions. The key is to understand the variety of instruments available and choose the ones that align with your goals, trading style, and risk tolerance. Let’s explore the exciting options you can access.

From the fast-paced world of currency exchange to the steady value of precious metals, each instrument offers unique opportunities. Diversifying across these markets can be a powerful way to manage risk and unlock new potential for profit. Below is a quick breakdown of the primary asset classes you can trade.

| Instrument Category | What It Represents | Popular Examples |

|---|---|---|

| Forex Pairs | Trading one currency against another. This market operates 24/5, offering high liquidity. | EUR/USD, GBP/USD, USD/JPY |

| Commodities | Raw materials or agricultural products. Includes precious metals, energies, and softs. | Gold (XAU/USD), Crude Oil (WTI), Silver |

| Indices | A basket of top-performing stocks from a specific stock exchange, representing an economy’s health. | S&P 500, NASDAQ 100, DAX 40 |

| Stocks (via CFDs) | Speculating on the price movements of individual company shares without owning the underlying asset. | Apple (AAPL), Tesla (TSLA), Microsoft (MSFT) |

| Cryptocurrencies | Digital or virtual tokens that use cryptography for security. Known for high volatility. | Bitcoin (BTC), Ethereum (ETH), Ripple (XRP) |

Why a Diverse Portfolio Matters

Many successful traders don’t just stick to one thing. They understand the power of diversification. Here’s why exploring different trading instruments can be a game-changer for your strategy:

- Risk Management: When one market is down, another might be up. Spreading your capital across different assets helps cushion your portfolio against volatility in a single sector.

- More Opportunities: Different markets are active at different times and react to different global events. Having access to forex, commodities, and indices means you can almost always find a trading opportunity.

- Strategy Flexibility: Some strategies work better in volatile markets like crypto, while others are suited for stable trends in major forex pairs. A wider choice of instruments lets you apply the right strategy at the right time.

- Adapt to Market Conditions: During times of economic uncertainty, traders often flock to safe-haven assets like gold. In a booming economy, stock indices might present better opportunities. A diverse toolkit allows you to adapt.

Ultimately, the best instruments for you depend on your personal approach. Start by mastering one or two, understand their behavior, and then gradually expand your horizons. The global markets are full of potential, waiting for you to tap into them.

Mobile Trading Experience with Olymptrade App in Morocco

In today’s fast-moving world, especially within the vibrant cities of Morocco, you cannot afford to be tied to a desktop. The financial markets wait for no one. This is where trading on the go becomes essential. Having a robust mobile platform isn’t just a convenience; it’s a critical tool for success. The Olymptrade app delivers a complete trading terminal right into your pocket, allowing you to seize opportunities wherever you are.

The experience is designed to be seamless. Imagine analyzing a currency pair while sipping mint tea at a riad or executing a trade while on the move. This is the flexibility modern traders in Morocco demand. The app provides instant access to your portfolio, real-time quotes, and charting tools, ensuring you never miss a market beat.

Key Features for the Moroccan Trader

- Total Accessibility: Whether you use Android or iOS, the application provides a consistent and powerful experience. Trade forex, stocks, and other assets directly from your device.

- Intuitive Interface: The platform is clean and easy to navigate. You don’t need to be a tech wizard to find what you’re looking for. Placing orders, setting stop-loss levels, and monitoring open positions is straightforward.

- Full-Featured Charting: Don’t compromise on analysis. The mobile platform includes a wide range of indicators and graphical tools to help you make informed decisions directly from your phone’s screen.

- Instant Alerts: Set up price alerts and notifications for key market events. The app keeps you informed, so you can react quickly to volatility and trading signals.

Let’s look at a balanced view of using a dedicated forex app for your daily trading activities.

| Advantages of Mobile Trading | Potential Drawbacks |

|---|---|

| Complete freedom to trade from anywhere with an internet connection. | The smaller screen can make complex technical analysis less comfortable. |

| Fast execution for capturing quick market movements. | A stable mobile internet connection is crucial for uninterrupted trading. |

| Full account management, including deposits and withdrawals. | The potential for distractions in a mobile environment is higher. |

The real power of the Olymptrade app is that it puts you in control. It transforms your smartphone into a powerful tool, giving you the freedom to integrate trading into your lifestyle, not the other way around. For any active trader in Morocco, this flexibility is a true game-changer.

Olymptrade Morocco Customer Support and Localized Services

When you trade, you need a partner who understands you. For traders in Morocco, having access to fast, reliable, and localized support is not just a luxury—it’s essential. You need a team that speaks your language and understands your unique needs. This is where Olymptrade truly shines, by providing dedicated services specifically for the Moroccan market.

Imagine having a question about a deposit or a specific market movement. Getting a clear answer quickly can make all the difference. Olymptrade removes the barriers, ensuring you get the help you need without confusion or delay. This focus on local traders builds a foundation of trust and confidence.

What Makes the Support Special?

- Language Accessibility: Communicate with the support team in languages you are comfortable with, including Arabic and French. This eliminates misunderstandings and gets you solutions faster.

- Local Payment Expertise: Get assistance with deposit and withdrawal methods that are popular and convenient within Morocco. No more struggling with unfamiliar international payment systems.

- Culturally Aware Team: The support staff understands local customs and business hours, providing a more personalized and effective service experience.

- Relevant Educational Content: Access resources and market analysis that consider the interests and perspectives of traders in the region.

Let’s compare the difference between standard support and the tailored assistance you receive as a trader in Morocco.

| Feature | Generic Global Support | Olymptrade’s Localized Service |

|---|---|---|

| Communication | Often limited to English | Multi-language support (Arabic, French) |

| Response Time | May be delayed due to time zone differences | Aligned with local Moroccan hours for faster replies |

| Problem Solving | General solutions for a global audience | Specific solutions for local payment and access issues |

Ultimately, trading is about making smart decisions. Choosing a platform that invests in its Moroccan community with top-tier customer support is one of the smartest decisions you can make. It means you can focus more on your strategy and less on troubleshooting, knowing that a capable team has your back every step of the way.

Education and Training Resources for Olymptrade Morocco Users

Success in the trading arena doesn’t come from luck; it comes from knowledge and a sharp strategy. Many aspiring traders in Morocco jump in without a plan, but the most profitable ones invest in their education first. Olymptrade provides a complete ecosystem of learning tools designed to build your skills from the ground up. You get everything you need to transform from a curious beginner into a confident trader.

Let’s explore the powerful training resources available right on the platform:

- In-Depth Webinars: Join live sessions with professional analysts who break down market trends and trading strategies in real-time. This is your chance to ask questions and see how experts navigate the markets.

- Step-by-Step Tutorials: A vast library of video guides covers everything. Learn how to use the platform’s features, understand technical indicators, and master chart analysis at your own pace.

- Strategy Guides: Don’t just trade blindly. The platform offers detailed articles on various trading strategies, from simple trend-following to more complex patterns, helping you find a style that fits your goals.

- Market Insights and Analytics: Get a daily dose of professional analysis. Understand what’s moving the markets, from major economic news to subtle shifts in sentiment, giving you an edge before you even open a trade.

Choosing the right tool depends on your current skill level. This simple table can help guide you on where to start your learning journey.

| Learning Resource | Ideal For | Primary Benefit |

|---|---|---|

| Demo Account | Absolute Beginners | Practice trading with virtual funds in a risk-free environment. |

| Video Tutorials | Beginners & Intermediates | Build a strong foundation of core trading concepts visually. |

| Strategy Articles | Intermediates | Move beyond the basics and develop a structured trading plan. |

| Live Webinars | Intermediate & Advanced | Gain deep insights and interact directly with market experts. |

A trader’s most valuable asset isn’t a secret indicator; it’s a solid education. Master the fundamentals, and you equip yourself to handle any market condition with confidence.

For traders in Morocco, this collection of resources offers a clear and structured path to improvement. Instead of searching for scattered information online, you have a professional, curated learning center at your fingertips. Take advantage of these tools to build your knowledge, refine your strategy, and trade with the skill your financial goals deserve.

Advantages and Disadvantages of Olymptrade for Moroccan Users

Choosing the right trading platform is a crucial first step for any trader in Morocco. Olymptrade has gained significant attention, but it’s important to look at both sides of the coin before you commit. Let’s break down what makes it appealing and where it might fall short for Moroccan users.

The Upside: What Works in Your Favor

Many traders find the platform’s entry point very attractive. You don’t need a large amount of capital to get started, which lowers the barrier for new traders wanting to test the waters. Here are some key benefits:

- Low Minimum Deposit: You can begin your trading journey with a very small initial investment. This makes it accessible for almost everyone.

- User-Friendly Interface: The platform is clean, intuitive, and easy to navigate. You won’t get lost in complex charts and tools, which is perfect for beginners.

- Free Demo Account: You get access to a free practice account with virtual funds. This allows you to hone your strategy and get comfortable with the platform without risking real money.

- Educational Resources: Olymptrade provides a decent library of webinars, tutorials, and articles to help you learn the basics of trading.

- Convenient Payment Options: The platform often supports various e-wallets and other payment methods that are popular and accessible in Morocco, simplifying the deposit and withdrawal process.

The Downside: Potential Drawbacks to Consider

No platform is perfect, and there are several points you should carefully consider. These potential disadvantages could impact your trading experience.

- Limited Asset Variety: Compared to larger, more established brokers, the range of available assets like forex pairs, stocks, or commodities might be more limited.

- High-Risk Trading Modes: The primary trading mode, Fixed Time Trades, carries a very high level of risk. It is possible to lose your entire investment on a single trade very quickly.

- Withdrawal Scrutiny: Like many brokers, Olymptrade requires strict identity verification before processing withdrawals. This process can sometimes be slow or require extensive documentation, which can be a point of frustration for some users.

A Quick Summary Table

| Advantages | Disadvantages |

|---|---|

| Very low entry barrier for new traders. | Fewer trading instruments than competitors. |

| Simple and intuitive platform design. | Fixed Time Trades are inherently high-risk. |

| Unlimited and free demo account for practice. | Withdrawal verification can sometimes be slow. |

| Accessible educational content for learning. | Regulatory oversight may not be as strong as other brokers. |

Olymptrade Morocco Security Measures and Data Protection

As a trader in Morocco, your first concern should always be the safety of your capital and personal information. When you place a trade, you need complete confidence that your platform has your back. Let’s break down the robust security framework that protects you every step of the way, so you can focus on what truly matters: analyzing the markets.

We understand that trust is earned, not given. That’s why multiple layers of security are in place to safeguard your trading account and activities. These aren’t just features; they are essential pillars of a secure trading environment.

- Advanced Encryption: Every piece of data you send, from your login details to your transaction requests, is protected by modern SSL (Secure Socket Layer) encryption. This creates a secure tunnel, making your information unreadable to any unauthorized parties.

- Two-Factor Authentication (2FA): Add an extra wall of defense to your account. By enabling 2FA, you ensure that even if someone gets your password, they can’t access your account without a second verification code from your personal device.

- Segregated Funds: Your trading capital is held in accounts completely separate from the company’s operational funds. This is a critical measure that ensures your money is protected and available for withdrawal at all times.

- Vulnerability Scans: The platform undergoes regular checks and security audits to proactively identify and fix any potential vulnerabilities, keeping it resilient against emerging threats.

Your Data is Your Business

Protecting your personal data is a top priority. Your information is managed according to strict privacy policies. This means your identity documents, contact details, and transaction history are stored securely and are never shared with third parties without your explicit consent. The verification process, often called KYC (Know Your Customer), is a key part of this protection.

| Verification Step | Benefit to You, the Trader |

|---|---|

| Identity Confirmation | Prevents identity theft and ensures only you can operate your account. |

| Address Verification | Complies with international financial regulations, adding legitimacy and security. |

| Payment Method Confirmation | Secures your deposits and withdrawals, guaranteeing funds go to and from your own accounts. |

A successful trading strategy is built on a foundation of confidence. If you’re constantly worried about platform security, you’re already at a disadvantage. Choosing a broker that prioritizes data protection and fund safety is the first winning trade you’ll ever make.

Olymptrade vs. Other Trading Platforms in Morocco

Navigating the world of online trading in Morocco can feel overwhelming. With so many options available, how do you pick the right partner for your forex trading journey? It’s crucial to compare brokers based on what truly matters to you as a trader. Let’s look at how Olymptrade stacks up against other typical platforms you might encounter.

Choosing a trading platform is more than just looking at spreads. It’s about finding a system that fits your style, budget, and local needs. For many traders in Morocco, accessibility and ease of use are top priorities.

| Feature | Olymptrade | Typical International Broker |

|---|---|---|

| Minimum Deposit | Generally low, accessible for beginners | Often higher, can be a barrier to entry |

| Platform Simplicity | User-friendly interface, designed for clarity | Can be complex (e.g., MT4/MT5), steep learning curve |

| Local Deposit Methods | Often supports local payment options | Limited to wire transfers or international e-wallets |

| Educational Resources | Integrated webinars, tutorials, and market analysis | Varies, may require separate research |

What makes a trading platform stand out for the local market? Here are a few points to consider:

- Ease of Getting Started: A platform with a low entry barrier allows new traders to test the waters without risking significant capital.

- Mobile Experience: The quality of the trading app is critical. A smooth, reliable app lets you manage trades on the go, which is essential in today’s fast-paced world.

- Fixed Time Trades: The availability of different trading modes, like Fixed Time Trades, provides more ways to engage with the market beyond traditional forex trading.

- Support and Community: Access to support in your language and a community of fellow traders can make a huge difference in your learning curve.

The best trading platform isn’t just about having the most features; it’s about having the right features that empower your trading strategy and make your life easier.

Real User Reviews and Testimonials from Olymptrade Morocco

Wondering what it’s really like to trade on Olymptrade in Morocco? Forget the flashy ads for a moment. The best insights come directly from traders on the ground, people just like you navigating the markets from Casablanca to Marrakech. We’ve listened to the local trading community to give you a clear, unfiltered look at their real experiences with the platform.

“I started with a small amount just to test the platform. The verification process was smooth, and I found the educational materials very helpful. What I appreciate most is the quick response from their support team when I had a question about a withdrawal. It feels good knowing there’s reliable help available.”

– Youssef, a trader from Agadir

Of course, no platform is perfect for everyone. Let’s break down the common feedback into a simple overview to see what Moroccan traders highlight most often.

| Feature | What Traders in Morocco Appreciate | Points for Improvement Noted |

|---|---|---|

| Platform Usability | Clean, intuitive interface great for beginners. | Some advanced traders wish for more complex charting tools. |

| Deposits & Withdrawals | Multiple local payment options are a huge plus. | Withdrawal times can vary depending on the method used. |

| Customer Support | Helpful and responsive support in multiple languages. | Peak hour wait times can sometimes be longer. |

| Mobile App | Full functionality for trading on the go. | Occasional updates can cause minor, temporary lags. |

So, what are the key themes we see from user testimonials?

- Accessibility: Many users find the low minimum deposit makes it easy for anyone in Morocco to start trading without a huge initial investment.

- Education First: The free demo account and learning resources get consistent praise for helping new traders build confidence before risking real capital.

- Community Feel: Traders often discuss strategies and share tips, creating a sense of community around the platform and its features.

- Localized Experience: Having support and payment methods that work well within Morocco is a major advantage mentioned frequently in reviews.

Hearing directly from the Olymptrade Morocco community paints a vivid picture. The platform offers a strong entry point for new traders with its user-friendly design and solid local support. While every trader’s journey is unique, these shared experiences provide valuable insights as you consider your next move in the financial markets.

Tips for Successful Trading with Olymptrade in Morocco

Embarking on your trading journey from Morocco with Olymp Trade is an exciting prospect. To turn that excitement into consistent results, you need a smart approach. Success in the markets isn’t about luck; it’s about discipline, knowledge, and a solid plan. Let’s explore some crucial tips that can help Moroccan traders navigate the platform and the markets with confidence.

First and foremost, prioritize your education. Before you even think about trading with real money, immerse yourself in the learning materials available. The Olymp Trade platform offers a wealth of information to get you started. Once you’ve grasped the basics, open a demo account. This is your risk-free sandbox. Use it to test strategies, learn the platform’s features, and get a feel for market movements without risking a single dirham. Treat your demo trading seriously to build good habits from day one.

Next, every trader needs a strategy. Trading without one is simply gambling. Your trading plan doesn’t have to be complicated. It should clearly define what you will trade, when you will trade, and what signals you will use to enter or exit a position. The real challenge is sticking to your plan, especially when emotions run high. Discipline is what separates successful traders from the rest.

Finally, master the art of risk management. Your primary goal should always be to protect your capital. A simple but powerful rule is to never risk more than a small percentage, like 1-2%, of your total account balance on any single trade. Use tools like Stop Loss to automatically exit a losing trade at a price you’ve decided on beforehand. This prevents one bad trade from wiping out your account.

| Golden Rules for Success | Common Mistakes to Avoid |

|---|---|

| Keep a trading journal to analyze your performance. | Making trading decisions based on fear or greed. |

| Stay patient and wait for high-probability setups. | Chasing losses by immediately opening another trade. |

| Start with a small amount of capital you can afford to lose. | Ignoring your pre-defined trading plan. |

| Continuously learn and adapt to changing market conditions. | Trading without a clear stop loss in place. |

By combining these principles of education, strategic planning, and careful risk management, traders in Morocco can build a strong foundation for a long and potentially rewarding trading career. Remember, consistency is more valuable than a single big win.

Is Olymptrade Morocco the Right Choice for Your Trading Goals?

Picking the right trading platform is a huge decision. It’s like a mechanic choosing their primary set of tools. For traders in Morocco, the name Olymptrade often comes up. But is it the perfect fit for what you want to achieve in the financial markets? The answer isn’t a simple yes or no. It really depends on your personal trading style, experience level, and ultimate goals.

What works for a trader focused on long-term currency trends might not be ideal for someone executing rapid-fire trades during market news. To help you decide, let’s look at what kind of trader typically finds success with this platform. Think about where you fit in.

Who Finds a Good Fit with Olymptrade?

- The Beginner Trader: If your goal is to learn the ropes without feeling overwhelmed, the platform’s simplicity is a major plus. The availability of a demo account allows you to practice strategies with virtual funds, which is essential for building confidence.

- The Mobile-First Trader: Do you check your trades on the go? If your trading happens more on your phone than on a desktop, the platform’s mobile app performance is a critical factor. It’s designed for quick access and clean execution from anywhere.

- The Fixed-Time Trades Enthusiast: If your strategy revolves around predicting price movements over short, set durations, then the platform is tailored specifically for this style of trading.

- The Trader Seeking Simplicity: Some traders want a powerful, yet straightforward interface. They don’t want to get lost in overly complex menus. The goal here is a clean path from analysis to trade execution.

To put it another way, matching your trading goals to a platform’s strengths is the key to success. Let’s break it down in a simple table.

| Consider This Platform If Your Goal Is… | You Might Need a Different Tool If… |

|---|---|

| To learn trading with a low barrier to entry and educational support. | You require highly complex analytical tools and custom indicators. |

| To execute trades quickly from a user-friendly mobile or web interface. | Your strategy depends on integrating with third-party software like MetaTrader 4/5. |

| To focus primarily on fixed-time trades and major forex pairs. | You want access to an exhaustive list of exotic stocks or niche commodities. |

Ultimately, the best platform is the one that feels like an extension of your own strategy. Your trading goals should always be the deciding factor. Take the time to assess what you truly need from a broker to navigate the markets effectively from Morocco.

Frequently Asked Questions

What is the Exness Rebate, and how does it work?

The Exness Rebate is a program that offers cashback on each trade. Every time you make a trade, a portion of the trading fees returns to your account as a rebate, helping reduce overall costs.

Who is eligible for Exness Cashback?

Most Exness accounts qualify for rebates, but eligibility may vary by account type.

How can I maximize my Exness Rebate?

To maximize Exness Cashback, focus on high-volume trading, choose low-spread pairs, and trade during high-liquidity sessions. Additionally, check that your account type qualifies for rebates.

Do rebates impact my trading performance?

No, Exness Rebates do not affect your trading performance, spreads, or execution speed. Rebates only reduce your costs by returning part of the fees on completed trades.

Are there any risks associated with the Exness Rebate program?

The main risk is over-trading in an attempt to earn more rebates. It’s essential to stick to a disciplined strategy and avoid taking unnecessary risks solely to increase rebates.