Hello, fellow traders! Welcome to your go-to resource for navigating the world of online trading in South Korea. If you’re looking for a dynamic and accessible platform, you’ve likely heard about Olymptrade. This guide is built specifically for Korean traders, whether you are just starting your journey or looking to refine your existing skills.

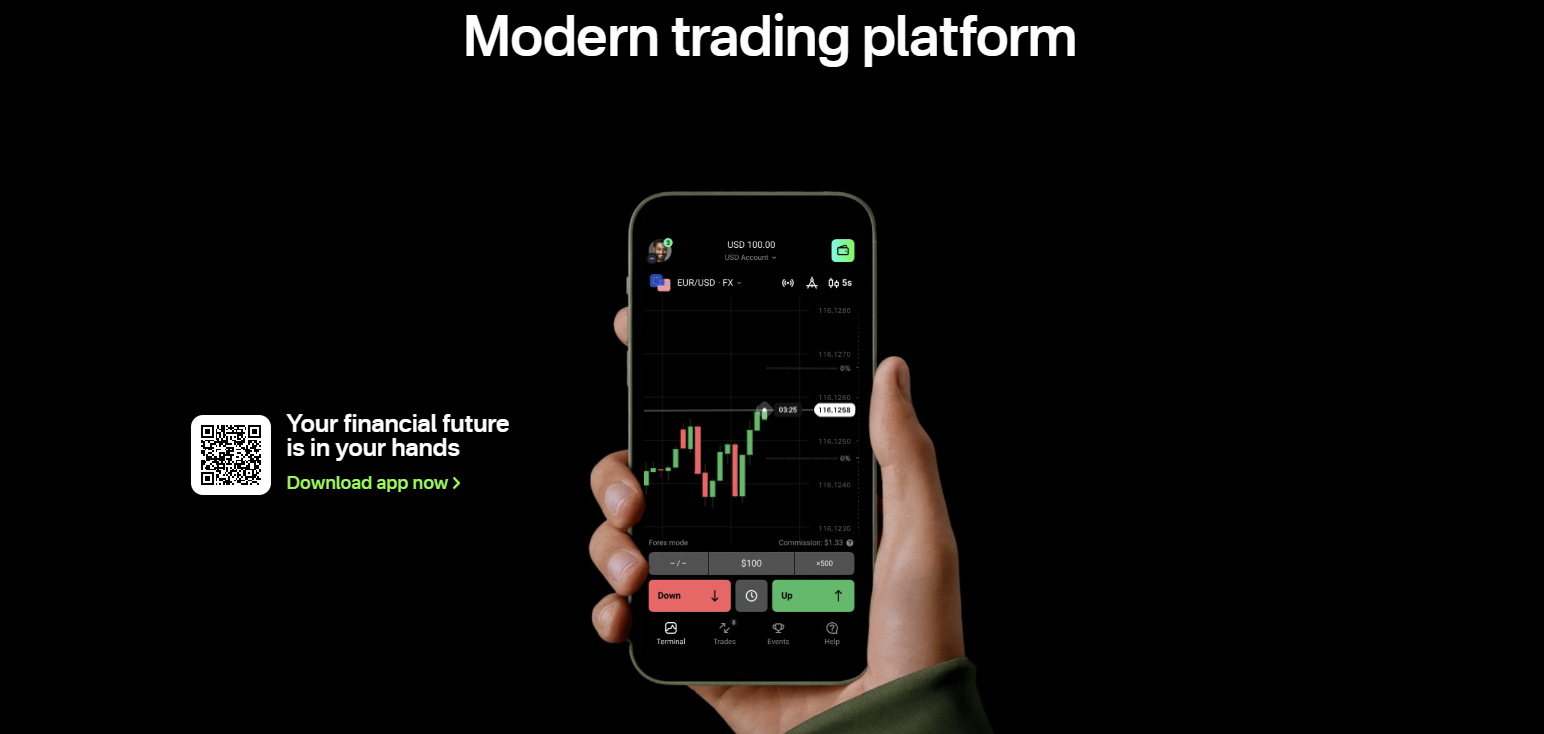

Olymptrade offers a gateway to global financial markets right from your screen. You can trade a wide variety of assets, from currency pairs in the Forex market to stocks of major international companies. We created this comprehensive guide to help you unlock the platform’s full potential. We cut through the noise and give you clear, actionable information.

Inside this guide, you will discover:

- How to easily set up and verify your trading account.

- A deep dive into the different trading modes, including Forex and Fixed Time Trades.

- Tips for using the platform’s tools and indicators to your advantage.

- Practical strategies to help you make informed trading decisions.

Let’s get started and explore how you can leverage Olymptrade Korea to achieve your financial goals. Your trading adventure begins now.

- Understanding Olymp Trade’s Presence in Korea

- Is Olymptrade Legal in Korea? Navigating Regulations

- How to Sign Up for Olymptrade Korea: Step-by-Step

- Olymptrade Account Types and Features for Korean Users

- Available Trading Instruments on Olymptrade Korea

- Deposits and Withdrawals: Payment Methods for Olymptrade Korea

- Popular Deposit Options

- The Olymptrade Platform: User Experience and Tools

- Desktop vs. Mobile App Experience

- Essential Trading Indicators and Analysis Tools

- Bonuses, Promotions, and Special Offers for Korean Traders

- Advantages of Using Forex Bonuses

- Disadvantages to Watch Out For

- Customer Support for Olymptrade Korea Users

- Pros and Cons of Using Olymptrade in Korea

- Risk Management Strategies for Olymptrade Korea Trading

- Key Pillars of Trading Defense

- Risk Management in Action: A Tale of Two Traders

- Comparing Olymptrade with Other Trading Platforms in Korea

- Feature-by-Feature Showdown

- The Core Differences

- Advantages of the Olymptrade Approach:

- Frequently Asked Questions About Olymptrade Korea

- Final Thoughts on Olymptrade for Korean Investors

- Frequently Asked Questions

Understanding Olymp Trade’s Presence in Korea

The world of online trading is truly global. Platforms are constantly expanding, reaching traders in every corner of the planet. South Korea, with its tech-savvy population and dynamic economy, is a fascinating market for any trading platform. But how does a global broker like Olymp Trade fit into the local trading scene? It’s not just about translating a website; it’s about understanding the culture, the regulations, and what Korean traders truly value.

For any platform to succeed in Korea, localization is key. This goes beyond simply offering the platform in the Korean language. It involves providing dedicated customer support that understands local nuances and offering payment methods that are popular and trusted within the country. Traders in Seoul or Busan expect the same level of seamless digital experience in their trading app as they do in their everyday life. Successful platforms focus on several key areas to appeal to the local market:

A powerful, intuitive, and fast mobile trading app is not just a feature; it’s a necessity.

- Mobile-First Approach: South Korea has one of the highest smartphone penetration rates globally.

- Speed and Technology: Traders here appreciate cutting-edge technology. Fast order execution, minimal lag, and a stable platform are critical factors for building trust.

- Educational Content: There’s a strong desire for learning and self-improvement. Access to high-quality webinars, tutorials, and market analysis in Korean can be a major draw.

- Diverse Assets: While major currency pairs are always popular, access to a wide range of assets, including international stocks, indices, and commodities, is highly valued.

Navigating the local financial environment is also a crucial piece of the puzzle. Every country has its own set of rules for financial services. While international brokers operate in a global space, traders should always be aware of the local regulatory landscape. This ensures a safer and more transparent trading journey for everyone involved.

| Advantages | Potential Challenges |

|---|---|

| Access to global markets and diverse assets. | Navigating international payment methods. |

| Often features advanced trading tools and platforms. | Customer support hours may not align with the local time zone. |

| Competitive spreads and leverage options. | Understanding local regulatory nuances. |

“A platform’s success in a new market isn’t just about the technology it offers, but how well it listens to and serves the local community of traders.”

Ultimately, a platform’s presence in Korea is defined by its commitment to the local traders. It’s about building a community, providing reliable support, and offering a service that feels both global in its opportunities and local in its execution. For traders in Korea, choosing a platform means finding one that respects their needs and empowers their financial goals.

Is Olymptrade Legal in Korea? Navigating Regulations

That’s a crucial question for any trader looking to operate in South Korea. The answer isn’t a simple yes or no, as it involves understanding the local financial environment. South Korea has its own robust financial regulations, primarily overseeing domestically licensed companies. International online trading platforms often operate in a different category.

For platforms like Olymptrade, their legality can be viewed from a different angle. They are typically not licensed directly by South Korean financial authorities. However, this does not mean they are explicitly illegal or banned. Many global brokers offer services to clients in various countries under international regulation. This creates a space where Korean traders can access these platforms, but the responsibility shifts more towards the individual.

As a trader in Korea, here’s what you should focus on:

- International Regulation: Check the platform’s credentials. Olymptrade is regulated by an international financial commission, which provides a standard of conduct and a dispute resolution framework.

- Personal Due Diligence: The duty falls on you to understand the platform you are using. Research its reputation, security measures, and the terms of service.

- Understanding the Risks: Trading always involves risk. Part of managing that risk is choosing a platform you trust, regardless of where it is based.

- Local Reporting: Remember that you are responsible for any tax reporting on profits according to South Korean law.

In short, while Olymptrade may not hold a local Korean license, it provides an accessible gateway to the financial markets for traders in the country. Your priority should be to ensure you are comfortable with the platform’s international regulatory status and take personal responsibility for your trading activities.

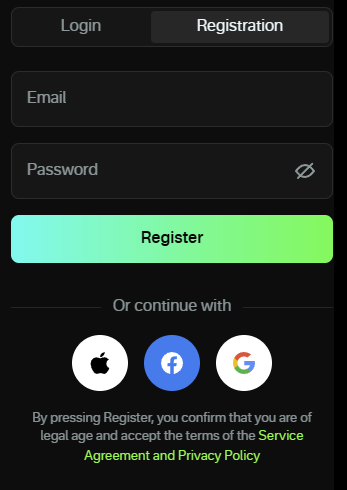

How to Sign Up for Olymptrade Korea: Step-by-Step

Ready to jump into the trading world? Getting your account set up is a quick and straightforward process. You don’t need any special skills to get started. Just follow these simple steps, and you’ll be ready to explore the platform in minutes. Let’s walk through it together.

- Visit the Official Website: The first step is to navigate to the official Olymptrade platform for Korea. Ensure you are on the correct site to protect your information.

- Locate the Registration Form: Look for a button that says “Registration” or “Start Trading.” It’s usually in a prominent spot at the top of the page. Click it to open the sign-up form.

- Enter Your Details: The form will ask for some basic information. You will need to provide a valid email address and create a secure password. Make sure the email is one you can access easily, as you’ll need it for verification.

- Select Your Currency: You’ll be asked to choose the currency for your trading account, typically between USD and EUR. Think carefully about this choice, as it may not be easy to change later.

- Agree to the Terms: Read through the service agreement and privacy policy. If you agree, check the box to confirm you are of legal age and accept the terms.

- Complete Your Registration: Click the final registration button. A confirmation link will be sent to the email address you provided. Open your email, find the message from Olymptrade, and click the link to verify your account.

You’ll immediately get access to a demo account, which is a fantastic way to practice your trading strategies with virtual funds before you decide to deposit real money.

| Required Information | Pro Tip |

|---|---|

| Active Email Address | Use your primary email to ensure you receive important account notifications. |

| Strong Password | Create a unique password with a mix of letters, numbers, and symbols for better security. |

| Account Currency Choice | Choose the currency you are most comfortable with for managing deposits and withdrawals. |

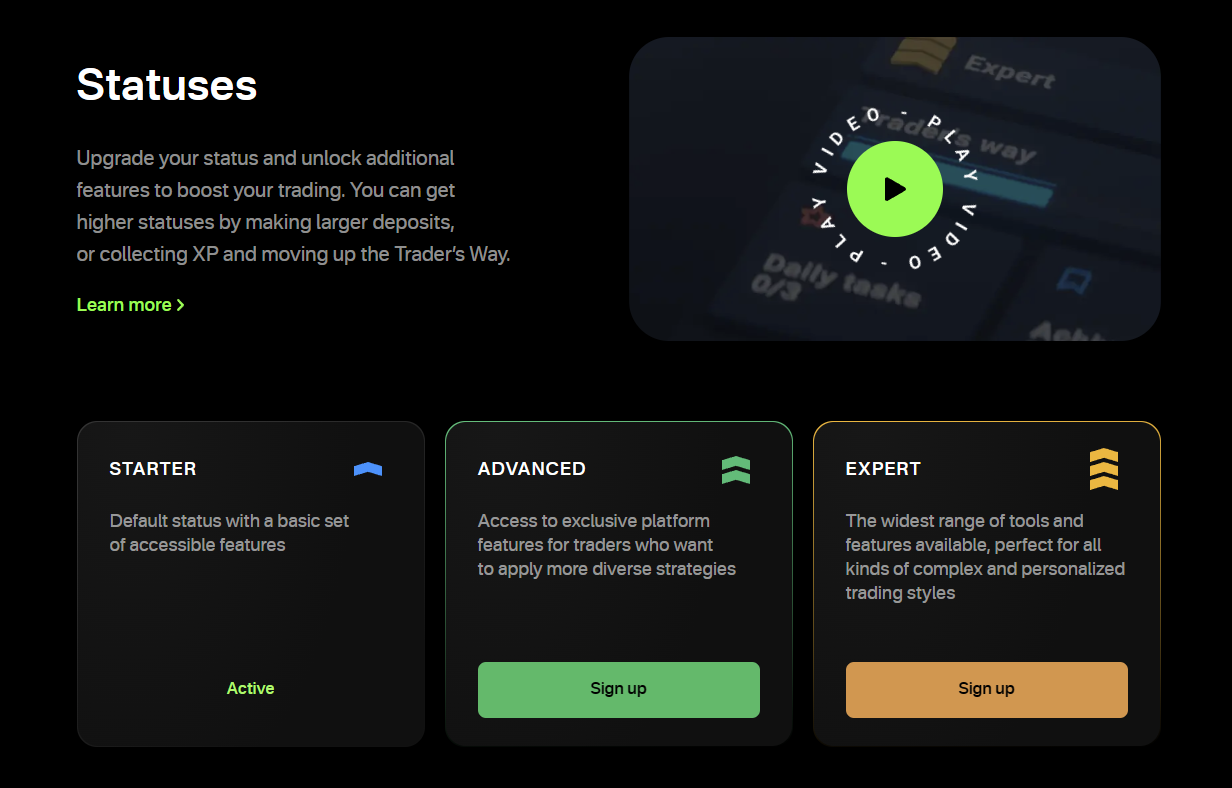

Olymptrade Account Types and Features for Korean Users

Choosing the right trading account is a crucial first step on your journey in the financial markets. It sets the foundation for your entire trading experience. Olymptrade offers several distinct account types, each designed to match the needs of different traders, from absolute beginners to seasoned professionals in Korea. Let’s explore which one fits your trading style best.

The platform structures its accounts into three main levels, or statuses. Each level unlocks new tools and better trading conditions, allowing you to grow as a trader without switching platforms. Your status level depends on your deposit amount, and you can upgrade at any time to access more benefits.

- Starter Status: This is the perfect entry point. It gives you full access to the trading platform and all standard features, making it ideal for learning the ropes and testing your first trading strategy.

- Advanced Status: For traders who are ready to get more serious. This level offers better profitability rates, more open trade slots, and access to exclusive educational materials to sharpen your skills.

- Expert Status: The premium choice for dedicated traders. Expert status provides the best possible trading conditions, including the highest profitability, risk-free trades, personal consultations, and lightning-fast withdrawals.

To make the choice clearer, here is a direct comparison of the key features available with each Olymptrade account status.

| Feature | Starter | Advanced | Expert |

|---|---|---|---|

| Maximum Profitability Rate | Up to 82% | Up to 84% | Up to 92% |

| Withdrawal Speed | Standard (up to 24 hrs) | Faster (within hours) | Priority (within minutes) |

| Maximum Open Trades | 10 | 20 | 30 |

| Private Webinars | No | Yes | Yes |

| Risk-Free Trades | No | Upon reaching status | Yes, with exclusive signals |

| Personal Analyst | No | No | Yes |

As you can see, each Olymptrade account status offers a clear progression. You start with a solid foundation and can unlock powerful trading features as you gain confidence and experience. For Korean traders, this flexible system means you only pay for the tools you need, when you need them. Whether you are making your first deposit or managing a large portfolio, there is an account designed to help you reach your financial goals.

Available Trading Instruments on Olymptrade Korea

A trader is only as good as the opportunities they can seize. That’s why having a diverse portfolio of trading instruments is crucial. On Olymptrade Korea, you gain access to a wide array of global markets, allowing you to switch strategies and find opportunities no matter the economic climate. You are not locked into a single market; you have the freedom to explore.

Let’s break down the exciting assets you can trade. This variety ensures that whether you follow long-term trends or prefer short-term volatility, there is always a market ready for you.

- Forex Pairs: Dive into the world’s largest financial market. Trade major pairs like EUR/USD, popular crosses like GBP/JPY, and even exotic pairs for unique trading opportunities. The forex market is open 24/5, offering constant action.

- Stocks: Take a position on the performance of global giants. You can trade stocks of leading companies in tech, finance, and consumer goods. This allows you to capitalize on earnings reports and industry news.

- Indices: Instead of trading a single company, you can trade the performance of an entire stock market. Indices like the S&P 500 or the NASDAQ bundle top stocks, providing a broader view of market health.

- Commodities: Trade timeless and essential assets. This includes precious metals like gold and silver, which are often seen as safe havens, as well as energy resources like oil.

- Cryptocurrencies: Engage with the dynamic and fast-moving world of digital assets. Trade popular cryptocurrencies like Bitcoin and Ethereum to take advantage of their significant price swings.

To help you decide where to start, here is a simple guide to what each asset class offers:

| Asset Class | Common Examples | Ideal for Traders Who… |

|---|---|---|

| Forex | EUR/USD, USD/JPY | Enjoy high liquidity and are interested in global economics. |

| Stocks | Apple, Microsoft, Tesla | Follow corporate news and enjoy analyzing individual companies. |

| Indices | S&P 500, Dow Jones | Prefer trading on overall market sentiment and economic data. |

| Commodities | Gold, Silver, Oil | Trade based on supply/demand dynamics and global events. |

| Crypto | Bitcoin, Ethereum | Seek high volatility and are passionate about new technology. |

With such a rich selection, Olymptrade Korea empowers you to build a robust and diversified trading strategy. You can easily pivot from one market to another, ensuring you are always positioned to find the next great trading opportunity. Explore these instruments and discover which markets best suit your personal trading style.

Deposits and Withdrawals: Payment Methods for Olymptrade Korea

As a trader, you need two things to be fast and reliable: your trades and your transactions. Getting money into your account to seize an opportunity is crucial. Getting your profits out is even more important. Let’s dive into how Olymptrade makes managing your funds in Korea simple and efficient, so you can focus on what you do best—trading.

Funding your Olymptrade account is a breeze. The platform supports a variety of payment methods popular in Korea, ensuring you can start trading without delay. The process is designed to be intuitive, even for complete beginners. You simply choose your preferred method, enter the amount, and follow the clear on-screen instructions.

Popular Deposit Options

- Bank Cards (Visa/Mastercard): This is one of the fastest ways to fund your account. Using your credit or debit card is secure and works just like any other online payment you’re used to making. The funds typically appear in your trading account almost instantly.

- E-Wallets: Digital wallets provide an excellent combination of speed and security. They act as a quick link between your bank and your trading account. These systems are perfect for traders who need to move funds quickly for both deposits and withdrawals.

- Bank Transfers: For those who prefer traditional methods, direct bank transfers are a solid choice. This method is highly secure and ideal for moving larger sums of money into your trading account.

Withdrawing your hard-earned profits is just as straightforward. Olymptrade ensures the process is smooth and secure. For your protection, it’s standard practice to withdraw funds using the same payment method you used for the deposit. This helps prevent unauthorized access and ensures the money goes directly back to you.

| Payment Method | Typical Use Case | Key Advantage |

|---|---|---|

| Credit/Debit Card | Instant account funding | Speed and Convenience |

| E-Wallets | Frequent deposits & withdrawals | Fastest transaction times |

| Bank Transfer | Larger, secure transactions | High level of security |

To ensure the smoothest experience, always make sure your account is fully verified. Completing the verification process early on will significantly speed up your withdrawal requests. By providing a range of convenient and trusted payment methods, Olymptrade removes the friction from financial management, letting you stay focused on the charts.

The Olymptrade Platform: User Experience and Tools

When you spend hours analyzing charts, the platform you use becomes your digital office. It needs to be clean, fast, and intuitive. My first impression of the Olymptrade platform was its simplicity. It avoids the clutter that overwhelms many new traders, yet it hides a surprising amount of power just beneath the surface. Executing a trade feels seamless, and finding your preferred assets is a breeze. The entire interface is designed to keep your focus where it matters most: on the market’s movement.

The user experience is clearly a top priority. Whether you trade on a large monitor or your mobile phone on the go, the transition feels natural. Here is what stands out from a daily user’s perspective:

- Intuitive Navigation: You won’t get lost searching for essential functions. Asset selection, trade execution, and account management are exactly where you expect them to be.

- Clean Workspace: The charts are front and center. You can easily customize the layout, hiding panels you don’t need to maximize your charting area.

- Responsive Performance: The platform reacts instantly to your commands. In fast-moving markets, this responsiveness is not just a luxury; it’s a necessity for good execution.

- Effortless Customization: You can quickly switch between chart types like Candlesticks or Heikin Ashi, change color schemes, and adjust timeframes with a couple of clicks.

Of course, a sleek design means little without the right analytical firepower. The platform equips you with a robust set of tools for proper technical analysis. You have everything you need to build and test a trading strategy, from basic trend identification to complex market analysis.

| Tool Category | Examples Available |

|---|---|

| Charting Tools | Trend lines, horizontal lines, Fibonacci levels, support and resistance channels. |

| Technical Indicators | Moving Averages (SMA, EMA), RSI, MACD, Bollinger Bands, Stochastic Oscillator. |

| Order Management | Stop Loss and Take Profit for risk control on every position. |

The best trading platform is the one that gets out of your way and lets you trade. It should feel like an extension of your strategy, not a barrier to it. This platform achieves that balance remarkably well.

Ultimately, the combination of a user-friendly interface and a comprehensive toolkit makes the Olymptrade platform a strong contender. It supports traders by providing the necessary instruments for analysis without a steep learning curve. This allows you to spend less time fighting with the software and more time analyzing the market and making informed trading decisions.

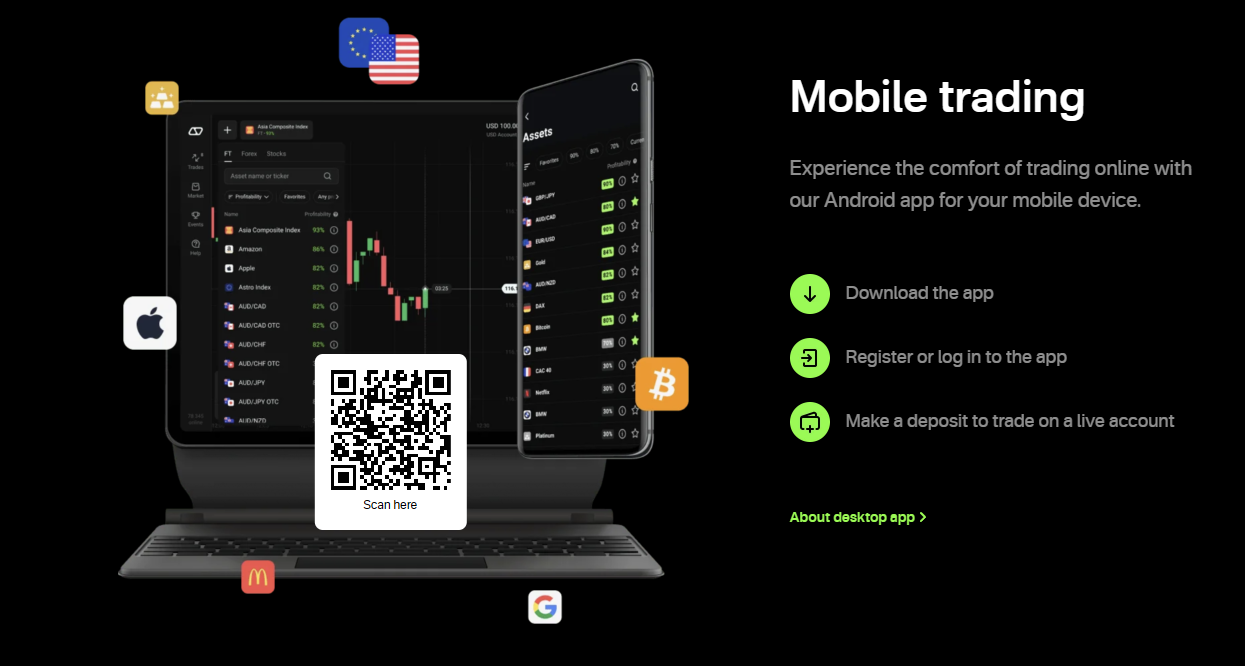

Desktop vs. Mobile App Experience

The old debate: a powerful desktop rig versus a sleek mobile app. Which one is better for trading? The real answer is that they are not competitors; they are partners. A smart trader leverages the unique strengths of both to create a seamless trading workflow, whether at their desk or on the move.

Your desktop platform is your command center. It’s where the deep, analytical work happens. Here’s what makes it indispensable:

- Unmatched Visual Real Estate: With multiple large monitors, you can view several currency pairs, different timeframes, and economic calendars all at once. No more squinting or switching between tabs.

- Powerful Charting Tools: Desktops handle complex custom indicators, drawing tools, and automated trading scripts (Expert Advisors) without breaking a sweat. This is where you conduct serious technical analysis.

- Focused Environment: When you sit at your trading desk, you are there to trade. It creates a psychological boundary that helps minimize distractions and encourages disciplined decision-making.

The mobile app, on the other hand, is your tactical unit on the go. It’s all about speed, access, and management.

Think of your mobile app not for detailed analysis, but for monitoring and managing. It grants you the freedom to step away from your screen without disconnecting from the market.

Its primary advantages are flexibility and immediacy. You can check your open positions while grabbing coffee, adjust a stop-loss order during your lunch break, or close a trade to lock in profits when you receive a critical news alert. It’s perfect for managing trades that you’ve already planned and placed on your desktop.

| Aspect | Desktop Experience | Mobile App Experience |

|---|---|---|

| Primary Use | In-depth analysis, strategy planning, precise trade execution. | Position monitoring, risk management, quick entry/exit on the go. |

| Charting | Full-featured, complex, and highly customizable. | Simplified, essential tools for quick checks. |

| Accessibility | Fixed to one location (your desk). | Available anywhere with an internet connection. |

| Risk Factor | Lower risk of execution errors. | Higher risk of “fat-finger” mistakes due to small screen. |

The winning strategy is a hybrid one. Use your desktop for the heavy lifting—research, analysis, and placing your core trades. Then, use the mobile app as your trusted companion to manage those trades, ensuring you’re always in control, no matter where life takes you.

Essential Trading Indicators and Analysis Tools

Navigating the forex market without the right tools is like sailing a ship without a compass. You might stay afloat, but you won’t know where you’re going. Trading indicators and analysis tools are your compass and map. They help you translate the chaotic price movements on your chart into actionable insights. These tools don’t predict the future, but they give you a high-probability glimpse into what might happen next.

Learning to use a few key indicators effectively is far better than cluttering your chart with dozens you barely understand. Here are some of the most trusted tools that traders rely on daily:

- Moving Averages (MA): This is the cornerstone of trend analysis. MAs smooth out price data to create a single flowing line, making it easier to identify the direction of the trend. The Simple Moving Average (SMA) and Exponential Moving Average (EMA) are the two most common types.

- Relative Strength Index (RSI): A fantastic momentum oscillator that helps you gauge whether a currency pair is overbought or oversold. It measures the speed and change of price movements on a scale of 0 to 100.

- MACD (Moving Average Convergence Divergence): This versatile tool helps traders spot changes in the strength, direction, momentum, and duration of a trend. It consists of two lines and a histogram that signal potential buying or selling opportunities.

- Bollinger Bands: These are all about volatility. The bands expand when the market is volatile and contract when it’s quiet. The price tends to stay within these bands, making them useful for identifying potential price targets and reversals.

To simplify, here’s a quick breakdown of what each tool helps you achieve:

| Tool | Main Purpose | What It Helps You Spot |

|---|---|---|

| Moving Averages | Trend Identification | The overall market direction and potential support/resistance. |

| RSI | Momentum Analysis | Overbought and oversold conditions, signaling a possible reversal. |

| MACD | Trend & Momentum | Shifts in momentum and potential new trend formations. |

| Bollinger Bands | Volatility Measurement | Periods of high/low volatility and potential price breakouts. |

Beyond indicators, don’t forget the power of manual chart analysis. Drawing simple support and resistance levels shows you where the market has struggled to break through in the past. Trend lines give you a clear visual on the market’s current path. Combining these manual tools with a couple of indicators creates a robust analysis framework. The key is to find a combination that suits your personal trading style and helps you make decisions with clarity and confidence.

Bonuses, Promotions, and Special Offers for Korean Traders

The forex market is fiercely competitive. Brokers constantly find new ways to attract traders and keep them active. For traders in Korea, this competition is fantastic news! It means a rich variety of bonuses, promotions, and special offers are always available. These incentives can give your trading capital a significant boost and open up new opportunities. Let’s explore what kind of perks you can find.

Many brokers design their offers specifically to appeal to the dynamic Korean trading community. Here are some of the most common promotions you’ll encounter:

- Welcome Bonus: This is a one-time offer for new clients. You receive this bonus simply for signing up and making your first deposit. It’s a great way to start your trading with extra leverage.

- Deposit Bonus: The broker matches a percentage of your deposit amount. For example, a 50% bonus on a ₩1,000,000 deposit gives you an extra ₩500,000 in trading funds.

- No-Deposit Bonus: This is a small amount of trading credit given to you without any deposit required. It offers a completely risk-free way to test a broker’s live platform and execution speed.

- Rebate or Cashback Programs: You earn back a portion of the spread or commission on every single trade you make, whether you win or lose. This is a huge favorite among active day traders and scalpers.

- Trading Contests and Competitions: Pit your skills against other traders for cash prizes, gadgets, or other exclusive rewards. These events add a fun, competitive edge to your daily trading routine.

Trading bonuses sound amazing, but it’s crucial to understand both sides of the coin. Knowing the full picture helps you make smarter decisions for your trading account.

Advantages of Using Forex Bonuses

- Increased Trading Capital: More funds in your account mean you can take on larger positions or better diversify your trades across different currency pairs.

- Reduced Personal Risk: A bonus can act as a cushion, allowing you to absorb some initial losses without impacting your own deposited funds.

- Freedom to Test New Strategies: Extra capital gives you the confidence to test new trading strategies or expert advisors with less personal financial risk.

Disadvantages to Watch Out For

- Trading Volume Requirements: Most bonuses come with strings attached. You often need to trade a specific volume before you can withdraw the bonus funds or any profits made from them.

- Withdrawal Restrictions: Some brokers may lock your initial deposit until you meet the bonus turnover requirements. Always read the terms and conditions very carefully.

- Encourages Over-trading: The pressure to meet a volume requirement might lead you to take unnecessary risks or trade more frequently than your strategy dictates.

| Bonus Type | Best For | Key Consideration |

|---|---|---|

| Welcome Bonus | New Traders | Often has a high percentage match but is a one-time offer. |

| Deposit Bonus | All Traders | Check the terms for minimum deposit and withdrawal rules. |

| No-Deposit Bonus | Complete Beginners | Usually a small amount with very strict profit withdrawal conditions. |

| Rebates/Cashback | Active/High-Volume Traders | Rewards consistent trading activity and lowers your overall costs. |

A veteran trader once said, “A bonus is a tool, not a treasure. Use it to build your strategy, not to chase a quick profit.” Always prioritize a broker’s regulation and trading conditions over the size of its promotion.

Ultimately, the right bonus for you depends entirely on your trading style and long-term goals. For Korean traders, the options are plentiful. Take your time, read the fine print, and choose offers that genuinely support your trading journey. A good promotion should enhance your strategy, not dictate it. Trade smart!

Customer Support for Olymptrade Korea Users

In the fast-paced world of trading, quick and effective support is not just a luxury—it’s a necessity. When your capital is on the line, you need to know that a professional team is ready to help you solve any issue. For our traders in Korea, we provide a dedicated support system designed to answer your questions and resolve problems without delay, letting you focus on what truly matters: your trading.

Our team understands the unique needs of the Korean market. We train them to handle a wide range of topics, so you never feel stuck. You can get help with many common concerns, including:

- Navigating the trading platform and using its features.

- Questions regarding deposits or withdrawal processes.

- Assistance with the account verification (KYC) procedure.

- Troubleshooting any technical glitches or platform errors.

- Understanding your trading history and financial statements.

We make reaching out for help simple and accessible. You can choose the method that works best for you, ensuring you get a timely and helpful response. Clear communication is key, which is why our support is available in Korean, removing any language barriers.

| Contact Method | Best For | Availability |

|---|---|---|

| Live Chat | Instant answers to urgent questions | 24/7 |

| Email Support | Detailed inquiries or issues requiring attachments | Responds within one business day |

| Online Help Center | Finding answers to frequently asked questions | Always accessible |

Before contacting support, having your account ID and a clear description of your issue ready can speed up the process. A reliable customer support system is our commitment to you, ensuring a smooth and confident trading experience from start to finish.

Pros and Cons of Using Olymptrade in Korea

Are you a trader in Korea exploring different platforms? You’ve likely come across Olymptrade. It’s a popular name, but popularity doesn’t always equal a perfect fit. Every trading platform has its unique strengths and weaknesses. Before you commit your capital, it’s crucial to weigh both sides of the coin. Let’s break down what Olymptrade offers to traders in the Korean market, giving you a clear, unbiased view to inform your decision.

| Advantages of Olymptrade | Disadvantages of Olymptrade |

|---|---|

| Low Barrier to Entry: You can start trading with a very small initial deposit. This makes it incredibly accessible for new traders who want to test the waters without significant financial risk. | Limited Advanced Tools: Seasoned traders may find the platform lacking in sophisticated analytical tools, custom indicators, and the robust features found on platforms like MetaTrader. |

| User-Friendly Interface: The platform is designed with simplicity in mind. Its clean layout and intuitive navigation make it easy for beginners to execute trades and manage their accounts without feeling overwhelmed. | Withdrawal Processing Times: While deposits are often instant, withdrawals can sometimes take longer to process compared to other brokers. This is a common point of frustration for some users. |

| Free Demo Account: Olymptrade provides a replenishable demo account. This is a fantastic feature for practicing strategies and getting familiar with the platform’s mechanics using virtual funds. | Spreads Can Be Wider: For certain assets, particularly during volatile market conditions, the spreads might not be as competitive as those offered by some ECN brokers, impacting profitability for scalpers. |

| Educational Resources: The platform offers a decent library of educational materials, including webinars, tutorials, and strategy guides, which is a great help for traders just starting their journey. | Asset Selection is Moderate: While it covers major currency pairs, stocks, and commodities, the overall selection of tradable assets is not as extensive as what some larger, more established brokers provide. |

Choosing a broker is a personal decision. For a new trader in Korea, Olymptrade’s simplicity and low entry cost are major draws. However, an experienced professional might feel constrained by its limitations. The key is to match the platform’s features with your own trading style and goals.

Risk Management Strategies for Olymptrade Korea Trading

Every successful trader knows a secret. It’s not about having a crystal ball to predict every market move. The real secret to long-term success, especially when trading with Olymptrade in Korea, is rock-solid risk management. Think of it as your shield. It protects your capital from devastating blows and keeps you in the game long enough to seize profitable opportunities. Without it, even the best trading strategy can fail. Let’s dive into the core strategies that will protect your account and help you trade with confidence.

Protecting your capital is your number one job as a trader. Profits come second. By implementing a clear set of rules, you remove emotion from your decisions and treat trading like a business. This disciplined approach separates amateurs from professionals.

Key Pillars of Trading Defense

- The Power of the Stop-Loss: This is your ultimate safety net. A stop-loss order automatically closes your position when the price hits a predetermined level. This prevents a single bad trade from wiping out a significant portion of your account. Always set a stop-loss based on technical analysis, not just an arbitrary number.

- Secure Your Gains with Take-Profit: Greed is a trader’s enemy. A take-profit order does the opposite of a stop-loss; it automatically closes your trade when it reaches a specific profit target. This locks in your winnings and prevents a profitable trade from reversing and turning into a loss.

- Smart Position Sizing: Never risk too much on a single trade. A popular rule of thumb is to risk only 1-2% of your total trading capital on any one position. This means you can endure a string of losses without blowing up your account. Your survival in the market depends on it.

- Use Leverage Wisely: Olymptrade offers leverage, which can magnify your profits. However, it also magnifies your losses. Treat leverage as a powerful tool, not a toy. Using excessive leverage is one of the fastest ways for new traders to lose their capital. Start small and understand the risks involved.

Risk Management in Action: A Tale of Two Traders

Let’s see how this plays out. Imagine two traders in Korea, both starting with a $1,000 account on Olymptrade. Their approaches to risk are vastly different.

| Metric | Trader A (Smart Risk) | Trader B (Reckless Risk) |

|---|---|---|

| Starting Capital | $1,000 | $1,000 |

| Risk per Trade | 2% ($20) | 20% ($200) |

| Result after 3 Losses | $940 | $400 |

| Mental State | Calm, still in the game | Panicked, making emotional decisions |

As you can see, Trader A can easily recover from a few losses. Trader B, however, has lost more than half their account and is now in a desperate situation. Which trader do you want to be?

The goal of a successful trader is to make the best trades. Money is secondary.

By mastering these risk management strategies, you build a durable trading career. You shift your focus from chasing quick profits to preserving your capital and growing it steadily over time. Make these principles the foundation of your trading plan on Olymptrade, and you’ll be on the right path to consistent success.

Comparing Olymptrade with Other Trading Platforms in Korea

As a trader in Korea, you have a sea of options. Every platform promises the moon, but which one actually delivers for your specific needs? Choosing the right broker is a critical first step. It can define your entire trading experience, from the first deposit to your final withdrawal. Let’s break down how Olymptrade stacks up against other popular trading platforms available in the Korean market.

Many traders get lost in complex charts and overwhelming interfaces offered by traditional brokers. The key is finding a balance between powerful tools and a platform that doesn’t make you feel like you need a degree in finance to place a simple trade. We need to look at what truly matters: accessibility, asset variety, and support.

Feature-by-Feature Showdown

To give you a clearer picture, let’s put Olymptrade side-by-side with what you might call “typical” trading platforms you’ll find in Korea. This isn’t about one being definitively better, but about which one fits your style.

| Feature | Olymptrade | Other Common Platforms in Korea |

|---|---|---|

| Minimum Deposit | Very low, often around $10 | Typically higher, can range from $100 to $1000+ |

| Platform Simplicity | Clean, intuitive, and beginner-friendly | Often complex with a steep learning curve |

| Demo Account | Free and easily accessible with virtual funds | Available, but sometimes with time limits or fewer features |

| Educational Content | Extensive library of webinars, tutorials, and strategies | Varies greatly; some are excellent, others are lacking |

| Asset Diversity | Good mix of forex, stocks, indices, and commodities | Some specialize heavily (e.g., only stocks or only forex) |

The Core Differences

What does that table really tell us? It highlights a fundamental difference in philosophy. Olymptrade focuses heavily on making trading accessible to everyone. The low entry barrier means you can test the waters with minimal risk. This is a huge advantage for new traders who are still learning the ropes.

For traders just starting out, a simple interface and a small initial deposit can make all the difference. It removes the fear factor and lets you focus on learning to trade effectively.

On the other hand, many established platforms in Korea are built for seasoned professionals. They might offer more niche analytical tools but often at the cost of usability. Navigating these platforms can feel like a full-time job in itself, which isn’t ideal if you’re trading part-time or just beginning your journey.

Advantages of the Olymptrade Approach:

- Low Financial Barrier: You don’t need a large capital to start.

- Focus on Education: The platform actively helps you become a better trader.

- User-Friendly Experience: Spend more time analyzing the market, not figuring out the software.

- Risk-Free Practice: The demo account is a perfect sandbox to test strategies without pressure.

Ultimately, the best platform is the one that aligns with your goals. If you’re looking for a straightforward, supportive, and accessible entry into the trading world, Olymptrade presents a very compelling case compared to many of the more traditional and complex options available to Korean traders.

Frequently Asked Questions About Olymptrade Korea

Diving into the world of online trading brings up many questions. You’re smart to do your research! We’ve gathered the most common queries we hear from traders in Korea to give you clear, direct answers. Let’s tackle them one by one so you can get started with confidence.

- Is Olymptrade a good starting point for new traders in Korea?

- Absolutely. The trading platform is designed with a user-friendly interface that makes navigation simple. You don’t need years of experience to understand the layout. Plus, there’s a free demo account loaded with virtual funds. This lets you practice your strategies and get comfortable with the platform’s features without risking any real capital. It’s a perfect training ground.

- What can I actually trade on the platform?

- You get access to a wide variety of financial markets, allowing you to diversify your trading activities. This means you aren’t stuck with just one type of asset. You can explore:

- Currency Pairs (Forex Trading)

- Stocks of major international companies

- Market Indices

- Commodities like gold and oil

- Cryptocurrencies

- How do deposits and withdrawals work?

- Moving your money should be hassle-free, and Olymptrade Korea offers several convenient methods. The process is streamlined to be as quick as possible. While times can vary, here’s a general idea of what to expect.

| Method | Commonly Used For | Typical Processing Speed |

|---|---|---|

| Bank Cards (Visa/Mastercard) | Deposit & Withdrawal | Deposits are often instant; withdrawals can take 1-5 business days. |

| E-Wallets (e.g., Skrill, Neteller) | Deposit & Withdrawal | Often the fastest option, with many transactions processed within 24 hours. |

| Bank Transfer | Deposit & Withdrawal | Can be slower, typically taking several business days to complete. |

- Is customer support available when I need it?

- Yes, and this is crucial. The support team is available 24/7. Whether you have a question about a trade, a deposit, or just need help with a feature, you can reach out via live chat, email, or phone. Getting timely help is a key part of a good trading experience.

Final Thoughts on Olymptrade for Korean Investors

So, what is the final verdict on this platform for traders in Korea? Choosing a broker is a deeply personal decision, tied directly to your trading style and financial goals. Olymptrade presents a compelling case, especially for those who value simplicity and a low barrier to entry. It strips away much of the complexity found on other platforms, offering a clean interface that lets you focus on the market.

The platform isn’t trying to be everything to everyone. Instead, it carves out a niche for traders who want a straightforward experience. For a Korean investor just starting out or a seasoned trader looking for a no-fuss platform to test strategies, it has significant appeal. However, it’s crucial to weigh both the strengths and weaknesses before committing your capital.

| Advantages for Korean Traders | Points to Consider |

|---|---|

| Low minimum deposit makes it highly accessible for beginners. | The range of available assets might be more limited than larger brokers. |

| An intuitive and user-friendly interface that is easy to navigate. | Advanced analytical tools are less extensive compared to some professional platforms. |

| A free and unlimited demo account is perfect for practice. | Withdrawal processing times can vary and should be checked. |

| Excellent educational materials to help build your trading knowledge. | Regulation status is a key factor every trader must research for themselves. |

Ultimately, a trading platform is just a tool. Your success in the markets will always depend more on your discipline, market analysis, and risk management strategy than on the broker you choose. Olymptrade provides the tools to get started effectively, but the responsibility to use them wisely rests on your shoulders.

The best trading platform isn’t the one with the most features. It’s the one that fits your personal trading style and helps you execute your strategy flawlessly.

For a Korean investor just starting out or a seasoned trader looking for a no-fuss platform to test strategies, it has significant appeal.

For Korean investors seeking a streamlined entry into the world of online trading, Olymptrade is a strong contender worth exploring. The key is to leverage its educational resources, spend ample time on the demo account, and determine if its workflow aligns with your ambitions. Start small, learn continuously, and trade responsibly.

Frequently Asked Questions

What is Olymptrade Korea and why is it popular among Korean traders?

Olymptrade Korea is an online trading platform offering access to global financial markets, including Forex, stocks, indices, commodities, and cryptocurrencies. Its popularity in South Korea stems from its user-friendly interface, low barrier to entry, powerful mobile app, and comprehensive educational resources, tailored to the tech-savvy Korean population.

Is Olymptrade regulated for trading in South Korea?

While Olymptrade does not hold a direct local Korean financial license, it is regulated by an international financial commission. This means it operates under international standards, and Korean traders can access its services, though personal due diligence regarding international regulations and local tax reporting is recommended.

What are the different account types available on Olymptrade for Korean users?

Olymptrade offers three main account statuses: Starter, Advanced, and Expert. Each status provides progressively better trading conditions, higher profitability rates, faster withdrawals, and access to exclusive features like private webinars, risk-free trades, and personal analyst consultations, based on your deposit amount.

How can I deposit and withdraw funds on Olymptrade Korea?

Olymptrade provides convenient payment methods for Korean traders, including bank cards (Visa/Mastercard), e-wallets (for faster transactions), and traditional bank transfers for larger sums. Deposits are often instant, while withdrawals are processed securely, typically using the same method as the deposit, with varying speeds depending on your account status and method chosen.

Does Olymptrade Korea offer a demo account for practice?

Yes, Olymptrade provides a free and replenishable demo account upon registration. This is an excellent feature for new traders to practice strategies, get familiar with the platform’s interface, and explore different assets using virtual funds without any financial risk before committing real capital.