Welcome to the dynamic world of currency trading! If you’re looking to navigate the financial markets with confidence, you’ve come to the right place. This guide is your complete roadmap to mastering Forex trading on the popular Olymp Trade platform. We cut through the noise and complexity to bring you clear, actionable strategies and insights. Get ready to elevate your trading game.

Olymp Trade has established itself as a leading online trading platform, providing access to the global Forex market for countless traders. Its user-friendly interface makes it an excellent choice for both new and seasoned participants. This comprehensive trading guide will show you exactly how to harness the full power of the platform and make informed decisions on major and minor currency pairs.

- Who Will Benefit From This Guide?

- What is Olymp Trade and How Does its Forex Platform Work?

- Breaking Down a Trade on the Platform

- Key Platform Features at a Glance

- Is Olymp Trade a Legit and Safe Broker for Forex Trading?

- Key Safety Features for Traders

- A Balanced View: Pros and Cons

- Understanding Olymp Trade’s Regulation and Licensing

- What FinaCom Membership Means For You

- Security Measures for Protecting Your Funds and Data

- Our Commitment to Your Safety

- Your Role in Protecting Your Account

- Key Features and Tools on the Olymp Trade Forex Platform

- An Intuitive, User-Friendly Interface

- A Full Suite of Technical Analysis Tools

- Robust Risk Management Features

- Key Trading Tools at a Glance

- Olymp Trade Forex Fees: Spreads, Commissions, and Hidden Costs

- The Spread: Your Primary Trading Cost

- What About Commissions?

- Uncovering Other Potential Costs

- Available Forex Account Types Explained

- Start with Confidence: The Demo Account

- For Careful Beginners: Micro and Cent Accounts

- The Industry Go-To: The Standard Account

- For the Pros: The ECN Account

- Account Types at a Glance

- A Note on Islamic Accounts

- How to Start Forex Trading with Olymp Trade: A Step-by-Step Guide

- Demo vs. Live Account: What’s the Difference?

- Opening and Verifying Your Trading Account

- Your Simple 3-Step Setup Guide

- Documents You’ll Typically Need

- Executing Your First Forex Trade on the Platform

- A Simple 5-Step Guide to Your First Trade

- Understanding the Order Ticket

- Understanding Leverage and Margin in Olymp Trade Forex

- So, What Exactly is Forex Leverage?

- Margin: Your “Good Faith” Deposit

- The Two Sides of Trading with Leverage

- What is a Margin Call on Olymp Trade?

- Tradable Instruments: Forex Pairs, Metals, and More

- The World of Forex Pairs

- Precious Metals: The Ultimate Safe Havens

- Expanding Your Horizons: Indices and Commodities

- Using the Olymp Trade Demo Account to Practice Your Strategy

- Key Advantages of Practicing with a Demo Account

- From Demo Novice to Live Pro: A Simple Plan

- Deposit and Withdrawal Methods: A Full Breakdown

- Common Ways to Fund Your Forex Account

- Payment Method Comparison at a Glance

- Understanding the Withdrawal Process

- What to Look For in a Broker’s Payment System

- Trading On-the-Go with the Olymp Trade Mobile App

- Full-Featured Trading in Your Pocket

- Advantages of the Olymp Trade Forex Trading App

- Get Started in 3 Easy Steps

- Pros and Cons of Forex Trading with Olymp Trade

- Advantages of Trading Forex on Olymp Trade

- Disadvantages to Consider

- At a Glance: Olymp Trade Forex

- Key Advantages for Beginners and Experienced Traders

- For the Newcomer to the Markets

- For the Seasoned Professional

- Potential Disadvantages and Risks to Consider

- A Trader’s Risk Management Checklist

- Comparing Olymp Trade with Other Popular Forex Brokers

- Final Verdict: Is Olymp Trade the Right Forex Broker for You?

- You’ll likely enjoy Olymp Trade if…

- You might want to look elsewhere if…

- A Quick Look: Pros & Cons

- Frequently Asked Questions

Who Will Benefit From This Guide?

We designed this content for anyone with a passion for trading and a desire to succeed. Whether you’re making your first deposit or you’re a veteran of the markets, you’ll find valuable information here. This guide is for:

- Aspiring Traders: Taking your first steps? We’ll guide you from understanding the basics of Forex to confidently executing your first trade on Olymp Trade.

- Intermediate Traders: You have experience but want to sharpen your skills. We’ll explore advanced analysis, platform tools, and strategies to improve your profitability.

- Expert Traders: Already a pro? Discover unique platform features and expert tips that can give you a fresh perspective and a competitive edge.

In trading, knowledge isn’t just power—it’s profit. The goal of this guide is to equip you with the practical knowledge you need to thrive.

Throughout this guide, we will cover everything from setting up your account and understanding leverage to implementing robust risk management techniques. We believe that successful traders are made, not born. With the right tools and a solid plan, you can work towards achieving your financial goals. Let’s start this journey together and unlock your full potential in the world of online trading.

What is Olymp Trade and How Does its Forex Platform Work?

So, you’ve likely heard the name Olymp Trade mentioned in trading circles. It’s a well-known online broker, but let’s cut through the noise. Think of it as your digital doorway to the global financial markets. While it offers different trading mechanics, its Forex platform is where many serious traders, like you and me, focus our energy. The platform is designed to be your command center for trading currency pairs.

The first thing that strikes you when you log in is the clean, uncluttered interface. They’ve clearly prioritized a user-friendly experience, which is a huge plus. Whether you’re a seasoned chartist or just getting your feet wet in Forex, you won’t feel overwhelmed. Everything you need is right there, without the confusing jargon or clunky menus you find on some other platforms.

Breaking Down a Trade on the Platform

Executing a trade on the Olymp Trade Forex platform is a straightforward process. Here’s how it works from start to finish:

- Pick Your Currency Pair: You start by selecting the asset you want to trade. This could be a major pair like EUR/USD, a minor like AUD/CAD, or an exotic like USD/MXN. Your choice depends on your analysis and trading strategy.

- Set Your Trade Amount: This is the amount of your own capital you’re willing to invest in this specific position. Start small and only trade what you are prepared to lose.

- Apply the Multiplier: Here’s where it gets interesting. The multiplier, also known as leverage, allows you to control a much larger position. For example, a x500 multiplier on a $100 trade means you’re controlling a $50,000 position. This magnifies potential profits, but remember, it also magnifies potential losses. Use it wisely.

- Set Your Risk Parameters: This step is non-negotiable for smart trading. You must set a Stop Loss to automatically close your trade if the market moves against you to a certain point. You also set a Take Profit to automatically lock in your gains when the price hits your target. This removes emotion from your exit strategy.

- Execute the Trade: Based on your market analysis, you decide the most likely direction of the price. If you believe it will rise, you click “Up” (Buy). If you predict it will fall, you click “Down” (Sell).

Trader’s Tip: Before you even think about trading with real funds, master the platform using the free demo account. Olymp Trade gives you replenishable virtual money to practice with. This is the perfect sandbox to test your strategies, understand market movements, and get comfortable with the platform’s tools without risking a single dollar.

Key Platform Features at a Glance

To give you a clearer picture, here is a breakdown of the essential tools you will be using on the Olymp Trade Forex platform.

| Feature | What It Does | Why It’s Important for You |

|---|---|---|

| Multiplier (Leverage) | Increases your effective trading volume. | Gives you the potential for higher returns from smaller capital investments. Must be managed carefully. |

| Stop Loss / Take Profit | Automated orders to close your position at predefined price levels. | The core of risk management. It protects your capital and helps you stick to your trading plan. |

| Fixed Commissions | Instead of a variable spread, Olymp Trade charges a small, fixed commission on trades. | This makes your trading costs predictable and transparent, so there are no surprises. |

| Analytical Tools | A suite of built-in indicators (like RSI, MACD) and charting tools. | Allows you to perform technical analysis directly on the platform without needing external software. |

In short, the Olymp Trade Forex platform successfully combines powerful features with a simple, accessible workflow. It empowers you to make informed decisions by providing the necessary tools for analysis and risk management in a clear and intuitive environment.

Is Olymp Trade a Legit and Safe Broker for Forex Trading?

This is the big question, isn’t it? Before you deposit a single dollar, you need to know if your broker is trustworthy. I’ve been in the trading world long enough to see brokers come and go, and I’ve learned to spot the red flags. So, let’s cut to the chase and look at Olymp Trade from a trader’s perspective.

First, let’s talk about legitimacy. The most crucial factor here is regulation. Olymp Trade has been a member of the Financial Commission (FinaCom) since 2016. What does this mean for you? FinaCom is an independent external dispute resolution (EDR) organization. If you ever have a dispute with the broker that you can’t solve directly, FinaCom acts as a neutral third party. They also provide a compensation fund of up to €20,000 per case, offering a safety net for your funds. This membership shows a commitment to transparency and fair practice.

Key Safety Features for Traders

Beyond formal regulation, several practical features contribute to a broker’s safety profile. Here’s what I look for and what Olymp Trade offers:

- Segregated Accounts: The broker keeps client funds in separate bank accounts from their own operational funds. This is a critical safety measure. It means they can’t use your money for their business expenses, and it protects your capital in the unlikely event of company insolvency.

- Secure Platform: The trading platform and website use SSL encryption. You can see the little padlock icon in your browser’s address bar. This protects your personal data and financial information from being intercepted.

- Regular Audits: Independent parties regularly audit the platform’s trade execution. This ensures that the prices you see and the trades you make are fair and accurate, without manipulation.

- Two-Factor Authentication (2FA): You can enable 2FA on your account for an extra layer of security, making it much harder for anyone to gain unauthorized access. I strongly recommend using this feature with any broker.

A Balanced View: Pros and Cons

No broker is perfect for everyone. It’s important to weigh the good with the bad based on your own trading style.

| Advantages | Disadvantages |

|---|---|

| Low minimum deposit ($10) makes it accessible. | Not available in some major regions like the USA or Europe. |

| Member of FinaCom, offering dispute resolution. | The range of forex pairs is more limited than some larger brokers. |

| User-friendly platform, great for beginners. | Leverage options might be lower than what some advanced traders prefer. |

| Free and unlimited demo account for practice. | Spreads can widen during high volatility news events. |

“In my experience, a broker’s legitimacy isn’t just about a license on a piece of paper. It’s about their day-to-day operations, customer support responsiveness, and how they handle withdrawals. I’ve processed multiple withdrawals from Olymp Trade without any issues, which speaks volumes about their reliability.”

So, is Olymp Trade legit and safe? Based on its FinaCom membership, security protocols, and a long track record, the evidence points to yes. It has established itself as a reliable platform, particularly for new and intermediate traders. As always, start with a demo account, test the platform, and only trade with capital you are prepared to risk. Happy trading!

Understanding Olymp Trade’s Regulation and Licensing

Let’s cut to the chase. When you’re putting your hard-earned money on the line, you need to know who is watching the broker. It’s a non-negotiable. So, how does Olymp Trade stack up when it comes to regulation and keeping your funds safe?

Olymp Trade is an A-category member of the International Financial Commission (FinaCom). This is an important detail for every trader to understand.

Think of FinaCom as an independent, third-party dispute resolution service for the forex and financial markets. They step in to ensure fair practices and protect traders. If you ever have a dispute with the broker that you can’t resolve directly, FinaCom acts as a neutral referee. This membership provides a crucial layer of security.

What FinaCom Membership Means For You

- Access to a Compensation Fund: This is a massive advantage. If a member broker violates its obligations and a ruling is made in your favor, you are protected by a compensation fund of up to €20,000 per case. This is your financial safety net.

- Impartial Dispute Resolution: You get access to an unbiased committee to review your case. This keeps the broker accountable and ensures they treat you fairly.

- Quality of Service Verification: FinaCom regularly assesses its members to ensure they meet high standards of business practice and execution quality. This means the platform is constantly under review for performance.

Here’s a simple breakdown of the key protections offered:

| FinaCom Feature | How It Protects You As a Trader |

|---|---|

| Dispute Resolution | Provides a free, fair, and transparent process to resolve complaints outside of the court system. |

| Compensation Fund | Offers financial protection up to €20,000 if the broker is found to be at fault and cannot pay. |

| Execution Certification | Ensures the broker’s trade execution speed and pricing are fair and consistent, as verified by third-party audits. |

“I never commit capital without checking for a safety net. For me, FinaCom’s oversight and especially its compensation fund are critical. It shows the broker is serious about its commitments and gives me the confidence to focus on my trading strategy, not on worrying about my broker’s integrity.”

While some traders seek brokers with regulation from bodies like CySEC or FCA, Olymp Trade’s membership with FinaCom provides a solid framework for client protection. It demonstrates a commitment to transparency and fair dealing, which is a fundamental green light for any trader doing their due diligence.

Security Measures for Protecting Your Funds and Data

Let’s talk about something every serious trader cares about: security. In the digital world of forex, protecting your capital and personal information is non-negotiable. You work hard for your money, and you deserve peace of mind. That’s why we’ve built a fortress around our trading environment, ensuring your focus remains on the charts, not on cybersecurity threats.

Our Commitment to Your Safety

We treat your security with the utmost seriousness. It’s not just a feature; it’s the foundation of our platform. We implement a multi-layered approach to ensure robust forex trading security from every angle.

- Segregated Accounts: This is a big one. We keep your funds in accounts completely separate from our company’s operational funds. This means your money is ring-fenced and protected, no matter what. It’s your capital, and it stays that way.

- State-of-the-Art Data Encryption: From the moment you log in, all data transmitted between your device and our servers is shielded by SSL (Secure Socket Layer) encryption. This technology scrambles your personal and financial details, making them unreadable to any unauthorized parties.

- Two-Factor Authentication (2FA): We strongly encourage you to enable two-factor authentication on your account. This adds a critical second layer of defense, requiring a unique code from your mobile device to log in. It’s one of the single most effective steps you can take to secure your account.

Your Role in Protecting Your Account

Security is a partnership. While we provide the secure infrastructure, your habits play a crucial role in protecting your funds. Here are some simple best practices to adopt:

| Action | Why It Matters |

|---|---|

| Use a Strong, Unique Password | Avoid common words and reuse of passwords from other sites. Mix letters, numbers, and symbols. |

| Beware of Phishing Emails | We will never ask for your password via email. Be suspicious of any urgent requests for personal info. |

| Secure Your Devices | Keep your computer and mobile’s operating systems and antivirus software up to date. |

| Log Out After Each Session | Especially on public or shared computers, always log out to prevent unauthorized access. |

“A truly secure forex broker doesn’t just build walls; they give you the keys to lock the doors. We provide the tools and transparency you need to trade with complete confidence.”

By combining our cutting-edge security measures with your vigilant practices, we create a trading environment where you can thrive. Your financial safety is our priority, allowing you to execute your strategies with confidence and clarity.

Key Features and Tools on the Olymp Trade Forex Platform

As traders, we know that our success isn’t just about strategy; it’s about the tools we use to execute it. A clunky, slow, or limited platform can be the difference between a winning and a losing trade. The Olymp Trade platform is designed by traders, for traders, giving you a powerful and intuitive environment to navigate the forex markets.

Let’s break down the core features that make this platform a standout choice.

An Intuitive, User-Friendly Interface

The first thing you’ll notice is how clean and uncluttered the workspace is. You don’t need to dig through endless menus to find what you need. Everything from placing an order to applying indicators is accessible right from the main chart window. This streamlined design means you can react to market movements faster, without getting bogged down by a complicated interface. This is a truly user-friendly interface built for quick decisions.

A Full Suite of Technical Analysis Tools

Solid market analysis is the backbone of any trading plan. The platform comes equipped with a wide array of built-in forex trading tools to help you identify trends and opportunities.

- Indicators: Access dozens of popular indicators like the RSI, MACD, Stochastic Oscillator, and Bollinger Bands. You can overlay multiple indicators on your chart to confirm your trading signals.

- Graphical Tools: Draw trend lines, support and resistance levels, and Fibonacci retracements directly on the chart to visualize your analysis.

- Multiple Timeframes: Switch between timeframes, from one minute to one month, with a single click to get both a micro and macro view of price action.

Robust Risk Management Features

Managing your capital is the most important skill in trading. Olymp Trade provides essential tools to help you protect your account and lock in profits.

- Stop Loss and Take Profit: Before you even enter a trade, you can set precise price levels where your position will automatically close. A stop loss take profit order is your non-negotiable safety net and your automated profit-taking plan. This is the cornerstone of disciplined risk management.

- Multiplier (Leverage): The platform offers a multiplier that allows you to control a larger position with a smaller amount of capital. While this amplifies potential profits, it also increases risk, making the use of a Stop Loss even more critical.

“Having integrated trading signals and one-click access to Stop Loss settings has completely changed my workflow. I spend less time on setup and more time focused on the charts, which is exactly where a trader’s attention should be.”

Key Trading Tools at a Glance

Here’s a quick summary of how these tools directly benefit your trading activity:

| Tool/Feature | Primary Benefit for Traders |

|---|---|

| Chart Indicators (e.g., Moving Averages) | Helps identify market trends, momentum, and potential entry/exit points for your technical analysis. |

| Stop Loss Order | Automatically closes your trade at a predetermined price to limit potential losses. |

| Take Profit Order | Automatically closes your trade when it reaches a specific profit target, securing your gains. |

| Built-in Market Analysis | Provides news, insights, and trading signals directly on the platform, saving you time on research. |

Ultimately, the Olymp Trade platform brings together all the essential elements for modern forex trading. It combines ease of use with powerful analytical and risk management capabilities, creating an environment where you can focus on what matters most: making smarter, more informed trading decisions.

Olymp Trade Forex Fees: Spreads, Commissions, and Hidden Costs

Let’s talk about the one thing that directly impacts our bottom line: trading costs. As traders, we know every pip counts. Understanding the fee structure of a platform isn’t just a minor detail; it’s a core part of a profitable strategy. I’ve analyzed the costs on this platform to give you a clear picture of what to expect when you trade Forex with Olymp Trade. No sugarcoating, just the facts.

The Spread: Your Primary Trading Cost

The main fee you will encounter on almost any Forex trade is the spread. Simply put, this is the small difference between the buying (Ask) price and the selling (Bid) price of a currency pair. This is how the platform makes its money on your trades. At Olymp Trade, you won’t find a fixed, one-size-fits-all spread. Instead, the spreads are dynamic, meaning they change based on market volatility and liquidity. During major trading sessions, you’ll often find the spreads on major pairs like EUR/USD are tighter, which is great for us traders.

What About Commissions?

This is where things get interesting and differ from some other brokers. Olymp Trade does not charge a traditional, separate commission per lot traded like you might see on an ECN account. Instead, a fee is integrated into the trade opening process. This fee is not hidden; you see it clearly before you confirm your trade. The size of this fee depends on a few factors:

- The specific asset you are trading.

- The current market situation and volatility.

- The multiplier (leverage) you choose for your position.

- The amount of your investment in the trade.

This model simplifies the cost calculation, as you know the total upfront cost before entering a position, combining the spread and the fee into one clear picture.

Uncovering Other Potential Costs

A smart trader always looks for the hidden costs. So, what else do you need to be aware of? Here’s a breakdown of other potential fees you might encounter on your trading journey.

| Fee Type | Olymp Trade’s Approach |

|---|---|

| Overnight Fees (Swaps) | If you hold a Forex position open overnight, an overnight fee is applied. Unlike traditional swaps that fluctuate, Olymp Trade uses a fixed, pre-calculated fee. You can see this fee amount before you open the trade, which helps immensely with planning longer-term positions. |

| Inactivity Fees | Yes, there is an inactivity fee, but it’s quite reasonable. If your account has a balance but you don’t make any trades or non-trading operations for 180 consecutive days, a fee of $10 per month is charged. Simply making one trade resets this timer. |

| Deposit/Withdrawal Fees | This is a major advantage. Olymp Trade does not charge fees for depositing or withdrawing funds. However, be aware that your bank or payment system provider might charge its own transaction fees, so always check with them. |

From my perspective, the transparency is key. When I set up a trade, the platform shows me the potential outcome including all the fees. I know my spread, I see the opening fee, and if I plan to hold it overnight, that cost is also clear. This allows me to manage my risk and profit targets with much greater precision, which is essential for consistent trading.

– A Trader’s View on Cost Management

Available Forex Account Types Explained

Stepping into the forex market is an exciting journey. But before you can execute your first trade, you face a critical decision: choosing the right trading account. This isn’t just a technicality; the account you select shapes your entire trading experience. It influences your costs, your risk, and the strategies available to you. Think of it as choosing the right gear for an expedition. Let’s break down the common forex account types so you can pick the one that fits you perfectly.

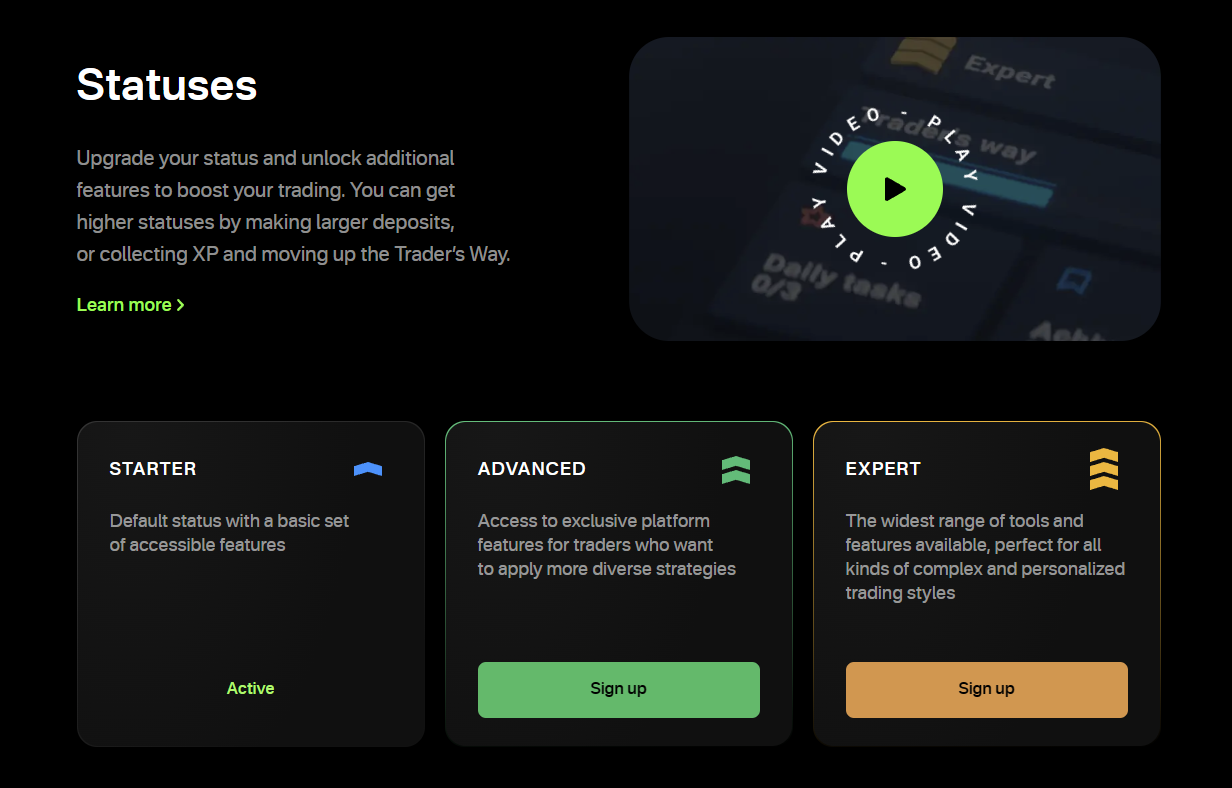

Start with Confidence: The Demo Account

Every single trader, from novice to seasoned pro, should start with a demo account. It’s your personal trading simulator. You get to trade with virtual money in real market conditions. Why is this essential?

- Zero Risk: Learn the ropes without risking a single cent of your hard-earned capital.

- Platform Mastery: Get comfortable with the trading platform, its tools, and how to place orders.

- Strategy Testing: Test and refine your trading strategies until you find what works for you.

A demo account is your free pass to build confidence and skill before you go live.

For Careful Beginners: Micro and Cent Accounts

Ready to trade with real money but want to keep the stakes low? A micro account or cent account is your best friend. These accounts are designed for traders transitioning from a demo environment. They allow you to trade with much smaller contract sizes (micro-lots or cent-lots) than a standard account. This means your potential profits and losses are smaller, making it an ideal way to manage risk while gaining invaluable live market experience. The minimum deposit is often very low, making it highly accessible.

The Industry Go-To: The Standard Account

The standard account is the most popular choice for a reason. It’s the all-rounder, suitable for most retail traders who have some experience under their belt. With a standard account, you trade in standard lots (100,000 units of currency). The key features usually include:

- Competitive spreads where the broker’s fee is included.

- Often zero commission on trades.

- Access to standard leverage levels.

This account provides a complete trading experience and is the benchmark against which other accounts are measured.

For the Pros: The ECN Account

If you’re an experienced, high-volume trader or scalper, an ECN account offers a significant edge. ECN stands for Electronic Communication Network. Instead of trading with the broker, you get direct access to a network of liquidity providers (banks, institutions). This results in:

- Ultra-Tight Spreads: Spreads can go as low as zero on major pairs.

- Transparent Pricing: You see the raw market prices.

- Lightning-Fast Execution: Orders are filled instantly at the best available price.

Instead of a wider spread, you pay a small, fixed commission on each trade. This model is preferred by professionals who need the best possible trading conditions.

Account Types at a Glance

Here’s a simple table to help you compare the main options:

| Account Type | Best For | Spreads | Commission | Key Feature |

|---|---|---|---|---|

| Demo | Everyone | Market Simulation | None | Risk-Free Practice |

| Micro/Cent | Beginners | Standard | Usually None | Low Risk, Small Lot Sizes |

| Standard | Intermediate Traders | Competitive | Usually None | Industry Standard |

| ECN | Advanced/Pro Traders | Raw / Very Tight | Fixed Fee per Trade | Direct Market Access |

A Note on Islamic Accounts

For traders of the Islamic faith, most brokers offer an Islamic account, also known as a swap-free account. These accounts comply with Sharia law by not charging or crediting interest on positions held overnight. Instead, a fixed administration fee may be charged for positions held for more than a day. This option is available across different account bases, such as a Standard or ECN account.

Choosing from the available forex account types sets the foundation for your success. Match the account to your capital, experience, and trading style, and you’ll be starting your trading journey on the right foot.

How to Start Forex Trading with Olymp Trade: A Step-by-Step Guide

Ready to jump into the world’s largest financial market? Getting started with forex trading on Olymp Trade is more straightforward than you might think. I’ve been in your shoes, and I can tell you that a clear path makes all the difference. Let’s walk through the exact steps to get you from sign-up to your first trade, turning market movements into potential opportunities.

- Create Your Account

First things first, you need a trading account. The registration process on the Olymp Trade platform is quick and simple. You’ll just need an email address to create your login. In a few minutes, you’ll have access to both a live and a demo account. No lengthy paperwork, just a fast track to the trading terminal. - Explore with the Demo Account

This is a step you should never skip! Before you risk a single dollar of your own money, get comfortable with the platform using the free demo account. It comes pre-loaded with virtual funds. Use it to:- Navigate the trading interface.

- Practice opening and closing trades on different currency pairs.

- Experiment with tools like Stop Loss and Take Profit.

- Test a basic trading strategy without any financial pressure.

Think of the demo account as your personal trading gym. It’s where you build your skills and confidence before stepping into the main arena.

- Fund Your Live Account

Once you feel confident and ready to trade with real capital, it’s time to make your first deposit. Olymp Trade offers a variety of convenient payment methods, including bank cards, e-wallets, and other local options. The process is secure and designed to get you funded quickly so you don’t miss a market opportunity. Choose the method that works best for you and fund your account. - Choose Your Asset and Place a Trade

Now for the exciting part. Head to the forex section of the platform. You’ll see a list of available currency pairs like EUR/USD, GBP/JPY, and many others. Pick one you’ve been watching. Based on your analysis, decide if you think its value will go up (a “Buy” or “Long” position) or down (a “Sell” or “Short” position). Enter the amount you want to invest, set your Stop Loss to manage risk, and click the corresponding button to open your trade. You are now officially forex trading!

Demo vs. Live Account: What’s the Difference?

While the interface is identical, the mindset and outcomes are different. Here’s a quick breakdown to help you understand the purpose of each.

| Feature | Demo Account | Live Account |

|---|---|---|

| Capital | Virtual, replenishable funds | Real, deposited money |

| Risk | Zero financial risk | Real risk of capital loss |

| Psychology | No emotional pressure | Real trading emotions (fear, greed) |

| Purpose | Practice, strategy testing, platform learning | Earning potential from market movements |

Following these steps provides a structured approach to begin your journey in forex trading. Start with education on the demo account, transition smoothly to a live environment, and always prioritize managing your risk. Welcome to the market!

Opening and Verifying Your Trading Account

So, you’re ready to dive into the markets. Fantastic! Before you can place your first trade, there’s one quick but essential step: setting up and verifying your trading account. Think of it as getting your official keys to the trading floor. It’s a straightforward process that every serious trader completes.

Why the paperwork? It’s all about security and regulation. Reputable brokers follow Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines. This process protects both you and the broker from fraud and ensures a secure trading environment for everyone. It’s a sign you’re dealing with a professional outfit.

Your Simple 3-Step Setup Guide

- Choose Your Account Type: First, you’ll select the account that best fits your trading style. Are you a beginner needing a standard account, or an experienced trader looking for ECN execution? Make your choice and move to the application.

- Complete the Application Form: This is the standard stuff – your name, address, and contact details. You will also answer a few questions about your trading experience and financial standing. Be honest here; it helps the broker understand your needs.

- Submit Your Documents for Verification: This is the final and most important part. You will need to prove who you are and where you live. This is what gets most new traders stuck, but it’s simple if you have the right documents ready.

Documents You’ll Typically Need

To make the verification process a breeze, have these documents scanned or photographed clearly on your device. Blurry images are the number one cause of delays.

| Document Type | Acceptable Examples | Key Requirements |

|---|---|---|

| Proof of Identity (POI) | Passport, Driver’s License, National ID Card | Must be a valid, government-issued photo ID. All four corners should be visible. |

| Proof of Address (POA) | Utility Bill (gas, electric, water), Bank Statement, Credit Card Statement | Must be recent (usually within the last 3-6 months) and clearly show your name and the same address used in your application. |

A quick tip from one trader to another: Make sure the name and address on your Proof of Address document exactly match what you entered in the application form. Even a small difference can trigger a rejection and slow you down. Double-check it before you upload!

Once you receive that confirmation email, you are officially ready to go. The next step is funding your account and scouting for those high-probability setups. The verification process is the final checkpoint before your trading journey truly begins.

Executing Your First Forex Trade on the Platform

This is the moment you’ve been working towards. You’ve done your analysis, you’ve funded your account, and now it’s time to pull the trigger. Placing your first forex trade is a huge milestone! Don’t worry, our platform makes it incredibly straightforward. Let’s walk through the process together, step-by-step.

A Simple 5-Step Guide to Your First Trade

- Choose Your Currency Pair: Navigate to the market watch window. Here you will see a list of available pairs like EUR/USD, GBP/JPY, or AUD/CAD. Click on the pair you want to trade to bring up the order ticket.

- Decide on Your Direction: Based on your strategy, will the price go up or down? If you think it will rise, you will place a ‘Buy’ order. If you believe it will fall, you will place a ‘Sell’ order. It’s that simple.

- Select Your Trade Size (Volume): This determines how much money you are committing to the trade. It’s measured in lots. We strongly recommend starting with a very small lot size, like 0.01, for your first few trades to manage risk effectively.

- Set Your Safety Nets: This is crucial. Always set a Stop Loss and a Take Profit level.

- A Stop Loss (SL) is an order that automatically closes your trade if the market moves against you by a certain amount. It protects you from large losses.

- A Take Profit (TP) automatically closes your trade when it reaches a specific profit target. It helps you lock in your gains.

- Execute the Trade: Double-check all the parameters on your order ticket. Is the pair correct? Is the trade size right? Are your SL and TP levels set? If everything looks good, click the ‘Buy’ or ‘Sell’ button. Congratulations, you are now in a live trade!

Understanding the Order Ticket

The order ticket can seem a bit intimidating at first, but it’s just a few key inputs. Here’s a quick breakdown of the main components:

| Term | What It Means | Why It’s Important |

|---|---|---|

| Currency Pair | The two currencies you are trading against each other. | This is the asset you are speculating on. |

| Volume / Lot Size | The size of your trading position. | Directly impacts your potential profit or loss. Start small! |

| Stop Loss | The price at which your trade will automatically close at a loss. | Your most important risk management tool. Never trade without it. |

| Take Profit | The price at which your trade will automatically close at a profit. | Ensures you exit with your target profit, even if you’re not watching the screen. |

Trader’s Tip: Before you execute your first live trade, practice everything on a demo account. Open and close a dozen trades. Get comfortable with the platform and the process. This builds muscle memory and confidence without risking any real capital. Treat your demo trading as seriously as you would live trading.

Once you execute your trade, you can monitor its progress in the ‘Trade’ or ‘Terminal’ window of the platform. You’ll see your position floating in real-time profit or loss. Now, you just need to let your strategy play out and manage the trade according to your plan. You’ve officially made the leap from observer to active trader!

Understanding Leverage and Margin in Olymp Trade Forex

As traders, we’re always looking for an edge. We want to maximize our potential from every market move. Two of the most powerful, and often misunderstood, tools at our disposal are leverage and margin. Getting a firm grip on these concepts is fundamental to your success on the Olymp Trade platform. Let’s break them down in a way that makes sense, trader to trader.

So, What Exactly is Forex Leverage?

Think of leverage as a temporary loan provided by your broker, in this case, Olymp Trade. It allows you to control a much larger position in the market than your own capital would normally permit. It’s expressed as a ratio, like 1:100, 1:200, or even 1:500. This is how leverage trading works in practice:

- If you have $100 in your account and use 1:100 leverage, you can open a position worth $10,000 ($100 x 100).

- With the same $100 but using the Olymp Trade leverage of 1:500, you could control a position worth $50,000 ($100 x 500).

This amplification means that even small price movements in your favor can result in significant profits relative to your initial investment. But remember, this is a double-edged sword.

Margin: Your “Good Faith” Deposit

If leverage is the loan, then margin is your down payment or collateral. It’s not a fee; it’s a portion of your account funds that Olymp Trade sets aside to open and maintain your leveraged position. It’s your skin in the game, ensuring you can cover potential losses.

The amount of margin required is directly linked to the leverage you choose. It’s a simple inverse relationship:

- Higher Leverage = Lower Margin Required

- Lower Leverage = Higher Margin Required

When you set up a trade on Olymp Trade, the platform will clearly show you the margin needed to open that specific position. This transparency helps you manage your account equity effectively.

The Two Sides of Trading with Leverage

Leverage is a powerful tool, but it demands respect. Understanding its advantages and disadvantages is a core part of sound risk management forex strategy.

| Advantages | Disadvantages |

|---|---|

| Magnified Profits: You can achieve substantial returns from a relatively small initial capital investment. | Magnified Losses: Losses are amplified in the same way as profits. A small market move against you can deplete your capital quickly. |

| Capital Efficiency: Frees up your capital to be used for other trades, diversifying your portfolio. | Risk of Margin Call: If your losses bring your account equity below the required margin, you’ll face a margin call. |

| Trading Opportunities: Allows you to trade in markets that might otherwise require a very large capital outlay. | Psychological Pressure: Managing a large position can be stressful and may lead to emotional trading decisions. |

What is a Margin Call on Olymp Trade?

A margin call isn’t something to fear; it’s a safety mechanism. A margin call Olymp Trade feature is designed to protect you from falling into debt. It happens when your floating losses cause your account equity to drop below the maintenance margin level. When this occurs, the platform will automatically start closing your open positions, beginning with the least profitable one, to free up margin and protect your account from further loss. Knowing how this works helps you understand the importance of not over-leveraging your account.

“My first rule of leverage is simple: treat it like a sharp knife. In the hands of a skilled chef, it creates a masterpiece. In the hands of a novice, it can cause a lot of damage. Start small, understand the mechanics of how leverage works forex, and always, always use a stop loss. That’s how you stay in the game long enough to win.”

Tradable Instruments: Forex Pairs, Metals, and More

As a trader, your power comes from opportunity. Limiting yourself to just one or two assets is like fishing in a small pond. The real action happens when you have access to a wide ocean of financial markets. Having a diverse range of tradable instruments at your fingertips means you can adapt to any market condition, capitalize on global news, and build a truly resilient trading strategy. Let’s explore the powerful options you can command.

The World of Forex Pairs

The foreign exchange market is the biggest and most liquid market in the world, and it’s our primary playground. But not all currency pairs are created equal. Understanding the different categories helps you pinpoint the right opportunities for your style.

- The Majors: These are the titans of the Forex market. They involve the US Dollar (USD) paired with other major currencies like the Euro, Japanese Yen, or British Pound (think EUR/USD, USD/JPY). They offer high liquidity and typically lower spreads, making them ideal for both new and experienced traders.

- The Minors (Crosses): These pairs don’t involve the US Dollar. Instead, they feature other major currencies traded against each other, such as EUR/GBP or AUD/JPY. They can offer unique trading opportunities based on the economic relationship between two specific countries, often with excellent volatility.

- The Exotics: Ready for a walk on the wild side? Exotic pairs match a major currency with one from an emerging or smaller economy, like USD/MXN (US Dollar/Mexican Peso). These pairs can be more volatile and have wider spreads, but they offer the potential for significant moves if you time your entry right.

Precious Metals: The Ultimate Safe Havens

When market uncertainty strikes, many traders flock to the stability of precious metals. Trading gold (XAU/USD) and silver (XAG/USD) isn’t just about hedging; it’s about capitalizing on fundamental market sentiment. These metals often move based on global economic health, inflation fears, and geopolitical tensions, providing clear and powerful trends to follow.

| Instrument | Key Characteristics | Best For… |

|---|---|---|

| Gold (XAU/USD) | Often seen as the primary “safe-haven” asset. Tends to have strong, sustained trends. Less volatile on an intraday basis compared to some forex pairs. | Long-term position traders and those looking to hedge against inflation or market instability. |

| Silver (XAG/USD) | Known as “gold’s volatile cousin.” It has both industrial and monetary value, making its price movements more dynamic. Can experience larger percentage moves than gold. | Traders looking for higher volatility and shorter-term opportunities within the metals market. |

Expanding Your Horizons: Indices and Commodities

The best traders never stop looking for an edge. Why limit yourself? Expanding into other CFD instruments opens up a whole new world of possibilities.

- Stock Indices: Instead of picking individual stocks, you can trade the overall performance of an entire stock market. Think of the S&P 500 (US500) or the NASDAQ (NAS100). This allows you to trade based on the sentiment of an entire economy.

- Energy Commodities: Trade the lifeblood of the global economy with instruments like Crude Oil (WTI). Energy prices are driven by supply, demand, and major geopolitical events, creating powerful and predictable trading setups for those who do their homework.

“Never put all your eggs in one basket. The same is true for trading. By mastering different tradable instruments, you’re not just diversifying your portfolio; you’re multiplying your chances of success. When one market is quiet, another is always moving. Be ready for it.”

Using the Olymp Trade Demo Account to Practice Your Strategy

Every professional trader will tell you the same thing: success isn’t about luck, it’s about skill, discipline, and a proven strategy. But how do you develop those without losing your shirt in the process? Pilots use flight simulators, and elite athletes have practice sessions. For a trader, the ultimate training ground is a demo account.

The Olymp Trade demo account is your personal, risk-free market simulator. It’s not a simplified game; it’s a fully functional version of the live trading platform. You get access to the same currency pairs, stocks, and commodities with real-time price movements. The only difference is that you trade with $10,000 in replenishable virtual funds. This allows you to experience the real thrill of trading without any of the real financial risk.

Key Advantages of Practicing with a Demo Account

- Master the Platform: Before you put real money on the line, you must know the platform inside and out. Practice placing trades, setting Stop Loss and Take Profit levels, and applying technical indicators until it becomes second nature.

- Strategy Forging: Have a new idea based on the RSI and MACD indicators? Want to test a scalping strategy during the London session? The demo account is your laboratory. Test, refine, and validate your strategies against live market data until you have confidence in their effectiveness.

- Build Emotional Resilience: Trading psychology is a huge part of the game. Practicing on a demo account helps you learn to handle the feeling of a trade going against you and to stick to your plan without panic. It builds the discipline you need to succeed in the live market.

- Risk Management Practice: Learn how to properly calculate position sizes and apply the 1% rule. Understanding how to manage your capital is arguably more important than finding the perfect entry point, and the demo account is the perfect place to learn it.

From Demo Novice to Live Pro: A Simple Plan

To get the most out of your demo experience, don’t treat it like a video game. Treat every virtual dollar as if it were real. Follow these steps to build a solid foundation:

- Set a Realistic Balance: If you plan to start live trading with $200, reset your demo account to that amount. This forces you to practice with realistic position sizes from day one.

- Follow a Trading Plan: Define your rules before you trade. What are your entry signals? When will you take profit? Where will you place your stop loss? Write it down and stick to it.

- Keep a Journal: Log every single trade. Note your reasons for entry, the outcome, and what you could have done better. Your journal will become your most valuable learning tool.

- Aim for Consistency: Don’t focus on hitting one huge, lucky trade. Aim for a consistent, positive return over a period of weeks. Profitability in trading is a marathon, not a sprint.

Understanding the psychological shift from a demo to a live environment is crucial for your success.

| Aspect | Demo Account Mindset | Live Account Mindset |

|---|---|---|

| Risk | Non-existent, which can lead to over-trading or risky behavior. | Real and tangible, requiring strict discipline and risk management. |

| Emotions | Detached and analytical. Decisions are easy to make. | Fear and greed become major factors. Sticking to a plan is harder. |

| Goal | To learn a process and test a system. | To execute the proven process and protect capital. |

“Your demo account is your trading dojo. It’s where you practice your moves, condition your mind, and forge your discipline. Never step into the real fight without first mastering the training.”

Take your time in the demo environment. There is no rush to go live. Use the tools available on the Olymp Trade platform to build a solid, repeatable strategy. When you can consistently follow your plan and generate positive results in your demo account, you’ll be ready to take on the live markets with genuine confidence.

Deposit and Withdrawal Methods: A Full Breakdown

Alright, let’s talk about the plumbing of your trading career: getting money in and out of your brokerage account. It might not be as thrilling as nailing a perfect trade, but trust me, understanding your deposit and withdrawal options is fundamental. A great trading strategy means nothing if you can’t fund your account efficiently or, more importantly, access your profits when you need them. The speed, security, and cost of your transactions can significantly impact your overall trading experience. So, let’s break down what you need to know to keep your capital flowing smoothly.

Common Ways to Fund Your Forex Account

Every forex broker offers a variety of ways to manage your money. While the specific options can vary, you’ll almost always find a core set of methods available. Choosing the right one depends on your priorities—are you looking for speed, low costs, or the convenience of using a method you already trust?

- Bank Wire Transfers: The old-school, reliable workhorse. Great for large sums, but often the slowest and most expensive option.

- Credit/Debit Cards: Visa and MasterCard are nearly universal. Deposits are typically instant, making them perfect for jumping on a market opportunity quickly.

- E-Wallets (Digital Wallets): Services like PayPal, Skrill, and Neteller have become incredibly popular. They offer a great balance of speed and security for both deposits and withdrawals.

- Cryptocurrency: A growing number of brokers now accept crypto like Bitcoin (BTC) and Tether (USDT). This can offer fast transactions and a degree of anonymity.

Payment Method Comparison at a Glance

To make it even clearer, here’s a table comparing the most common funding methods. Keep in mind that times and fees are typical estimates and can vary between brokers.

| Method | Typical Deposit Time | Typical Withdrawal Time | Potential Fees |

|---|---|---|---|

| Bank Wire Transfer | 2-5 Business Days | 3-7 Business Days | High (often $25-$50 per transaction) |

| Credit/Debit Card | Instant | 1-3 Business Days | Low to none for deposits; some brokers charge for withdrawals |

| E-Wallets (Skrill, Neteller, etc.) | Instant | Usually within 24 Hours | Low; fees may apply when moving money out of the e-wallet |

| Cryptocurrency | Minutes to an Hour | Minutes to a few Hours | Network fees (can vary greatly) |

Understanding the Withdrawal Process

Getting your profits out should be a happy occasion, not a stressful one. Know that virtually every regulated forex broker requires you to complete a Know Your Customer (KYC) verification before processing your first withdrawal. This involves submitting proof of identity and address. It’s not the broker being difficult; it’s a standard anti-money laundering (AML) requirement. Plan for this and get your documents verified right after you open your account to avoid delays later. Also, many brokers insist that you withdraw funds using the same method you used for the deposit, at least up to the initial deposit amount. This is another security measure to protect your account.

A quick tip from my own experience: I always make a small test withdrawal soon after funding a new account with a broker. It costs me little, but it gives me complete peace of mind that the process works as expected. Don’t wait until you have a large profit to find out there’s a problem.

What to Look For in a Broker’s Payment System

When you’re choosing a new broker, don’t just look at spreads and leverage. Dig into their banking options. Here’s your checklist:

- Variety of Methods: Do they offer a method that is convenient and low-cost for you?

- Clear Fee Structure: Are all deposit and withdrawal fees clearly stated? Beware of hidden charges.

- Processing Times: Does the broker commit to reasonable processing times for withdrawals? Look for specifics, not vague promises.

- Security: Does the broker use SSL encryption and other security measures to protect your financial data during transactions?

- Minimum Amounts: Check the minimum deposit and withdrawal amounts. Ensure they align with your trading capital and strategy.

Choosing a broker with a transparent, efficient, and secure system for handling your funds is a non-negotiable part of setting yourself up for success in the forex market. It ensures your focus stays where it should be: on the charts.

Trading On-the-Go with the Olymp Trade Mobile App

The financial markets wait for no one. A perfect trading opportunity can appear while you’re commuting, waiting for a coffee, or away from your computer. In today’s fast-paced world, being tied to a desktop means you’re leaving money on the table. That’s why powerful mobile trading is not just a luxury; it’s a necessity for any serious trader. The Olymp Trade mobile app puts the full power of our platform directly into your hands.

We designed our trading app from the ground up to provide a seamless and intuitive experience. It isn’t a stripped-down version of the desktop platform. It’s a robust trading terminal that gives you the freedom to analyze charts, execute trades, and manage your portfolio from anywhere with an internet connection.

Full-Featured Trading in Your Pocket

Don’t think for a second that trading on a smaller screen means sacrificing functionality. The Olymp Trade app is packed with the tools you need to make informed decisions. Here’s a glimpse of what you get:

- Interactive Charts: Switch between chart types, zoom in on price action, and apply a wide range of technical indicators and drawing tools to conduct your analysis.

- Instant Trade Execution: Open and close trades with a single tap. The app is optimized for speed, ensuring you get the entry price you want.

- Complete Account Management: Deposit funds, withdraw your profits, and view your entire trading history securely within the app.

- Price Alerts: Set up custom notifications for specific asset prices. Let the app watch the market for you and alert you when your target is reached.

- Built-in Education: Access our library of tutorials, webinars, and market analysis directly on your mobile device to sharpen your skills.

“I used to worry about open positions when I left the house. Now, with the mobile app, I have total peace of mind. I can check my trades and react to news in seconds. It’s a complete game-changer for my trading style.”

Advantages of the Olymp Trade Forex Trading App

Integrating our mobile platform into your trading routine gives you a distinct edge. Here’s how it benefits you:

| Feature | Benefit for You |

|---|---|

| Ultimate Flexibility | Trade on your own terms, whether you have five minutes or five hours. You are no longer chained to your desk. |

| Increased Responsiveness | React instantly to breaking news or sudden market volatility. Seize opportunities the moment they arise. |

| Intuitive User Interface | Enjoy a clean, user-friendly layout designed for touchscreens, making navigation and trading effortless. |

| Synchronization | Your trades, settings, and account information are perfectly synced between your mobile and desktop platforms. |

Get Started in 3 Easy Steps

Ready to unlock the freedom of mobile trading? Joining the thousands of traders who use the Olymp Trade for Android and iOS devices is simple. The official app is available on both the Google Play Store and the Apple App Store, ensuring a secure and optimized experience for your device.

- Visit your device’s app store (Google Play or Apple App Store).

- Search for the official Olymp Trade app and tap to download it.

- Log in with your existing account or create a new one in just a few minutes.

That’s it! You now have a world of trading opportunities at your fingertips. Download Olymp Trade today and discover the power and convenience of having the market in your pocket.

Pros and Cons of Forex Trading with Olymp Trade

Thinking about jumping into the forex market with Olymp Trade? Smart move to do your research first. Like any trading platform, it has its brilliant moments and its drawbacks. As a trader who has spent countless hours on various platforms, I can tell you that the \”best\” platform often depends on your personal trading style and goals. Let’s break down what you can expect from forex trading with Olymp Trade, with no fluff.

Advantages of Trading Forex on Olymp Trade

For many traders, especially those getting their feet wet, Olymp Trade offers some compelling benefits that make it an attractive choice.

- Low Barrier to Entry: You don’t need a massive bankroll to start. With a very low minimum deposit, it opens the door for traders who want to start small, test strategies with real money, and build their confidence without significant financial risk.

- User-Friendly Interface: The platform is clean, intuitive, and easy to navigate. You won’t be overwhelmed by a complex layout. Charts are clear, placing trades is straightforward, and finding the tools you need is simple. This is a huge plus when you’re trying to focus on market analysis, not on figuring out the software.

- Excellent Educational Resources: Olymp Trade invests heavily in trader education. You get access to a free demo account with replenishable virtual funds, regular webinars, video tutorials, and market analysis. This ecosystem is perfect for building a solid trading foundation.

- Integrated Trading Modes: The platform seamlessly integrates both forex and Fixed Time Trades (FTT). This allows you to easily switch between different trading styles and instruments without needing separate accounts or platforms, offering flexibility in how you approach the markets.

Disadvantages to Consider

No platform is perfect. It’s crucial to be aware of the potential downsides before you commit your capital.

- Limited Asset Selection: While Olymp Trade covers the major and some minor currency pairs, its selection isn’t as vast as what you’d find at a specialized, large-scale forex broker. If your strategy involves trading exotic or rare pairs, you might find the options lacking.

- Spreads Can Be Wider: The spreads (the difference between the buy and sell price) on Olymp Trade may not always be the tightest in the industry. For high-frequency traders or scalpers, wider spreads can eat into profits over time. It’s a trade-off for the platform’s simplicity.

- Fewer Advanced Tools: The platform’s strength—its simplicity—can also be a weakness for advanced traders. It lacks support for things like Expert Advisors (EAs), complex custom indicators, or the in-depth analytical capabilities found on platforms like MetaTrader 4/5.

At a Glance: Olymp Trade Forex

Here’s a quick summary to help you weigh the options:

| Pros | Cons |

|---|---|

| Low minimum deposit makes it accessible. | Fewer currency pairs than specialized brokers. |

| Clean and intuitive platform for beginners. | Spreads may be wider, impacting some strategies. |

| Free demo account and rich educational content. | Lacks support for advanced tools like EAs. |

| Combines Forex and FTT in one account. | Not geared towards professional, high-volume traders. |

Ultimately, Olymp Trade excels as a launchpad. It provides a supportive and low-risk environment to learn the ropes of forex trading. If you are a beginner or intermediate trader who values simplicity and education, it’s a fantastic choice. However, if you’re an experienced trader demanding razor-thin spreads and advanced analytical software, you might eventually outgrow the platform.

Key Advantages for Beginners and Experienced Traders

Finding a home for your trading activities can be tough. You need a place that supports your growth from day one and continues to provide value as you become a market veteran. That’s exactly what we offer—a robust environment built for every stage of your journey in forex trading.

For the Newcomer to the Markets

Just starting? We’ve got your back. We know the learning curve can be steep, so we focus on giving you the tools to build a solid foundation. You don’t have to navigate the charts alone. Our goal is to make your entry into the financial world as smooth as possible.

- Simplified Learning: Access a wealth of easy-to-understand educational materials. Learn the fundamentals of market analysis and how to protect your capital.

- Practice Makes Perfect: Use a demo account with virtual funds to test your ideas without any financial pressure. It’s the best way to practice your risk management techniques before you go live.

- Intuitive Interface: Our platform is designed for clarity. You can execute trades, set stop-losses, and monitor your positions without getting lost in complicated menus.

For the Seasoned Professional

If you’re an experienced trader, you demand performance, precision, and power. You need a trading platform that can keep up with your sophisticated trading strategy. We deliver the high-level features you require to gain an edge. From advanced charting tools to a wide array of indicators, you have everything you need to perform deep market analysis and seize opportunities as they arise. You also get flexible leverage options to maximize your capital’s potential.

| Feature | Benefit for Beginners | Benefit for Experts |

|---|---|---|

| Educational Content | Builds foundational knowledge. | Refines advanced strategies. |

| Trading Tools | Basic charting and one-click trading. | Advanced indicators and API access. |

| Community Access | Mentorship and shared learning. | Networking and idea validation. |

Ultimately, whether you are placing your first trade or your thousandth, you’ll find the resources and technology here to support your goals. We bridge the gap, creating a single, powerful environment where all traders can thrive.

Potential Disadvantages and Risks to Consider

Alright, let’s have a frank discussion. Anyone who tells you that forex trading is a guaranteed path to riches is selling you a fantasy. As a professional trader, my first duty is to be realistic. Understanding the risks isn’t about scaring you away; it’s about equipping you for the real battle ahead. Ignoring these points is the fastest way to empty your trading account.

Before you fund an account or place a single trade, you must internalize these core challenges. Every successful trader has learned to navigate them, and you will need to as well.

- The Double-Edged Sword of Leverage: Brokers offer high leverage, which seems fantastic at first. It means you can control a large position with a small amount of capital. But this magnifies your losses just as much as your gains. A small market move against you can result in a significant loss, potentially even a margin call.

- Extreme Market Volatility: The forex market can be incredibly volatile. Economic news, political events, or even a central bank announcement can cause currency prices to swing wildly in seconds. This speed can be thrilling, but it can also lead to sudden and unexpected losses if you are on the wrong side of the move.

- The Psychological Gauntlet: Honestly, your biggest opponent is often the person in the mirror. Trading brings out powerful emotions like greed, fear, and impatience. Chasing losses after a bad trade (revenge trading) or jumping into a trade for fear of missing out (FOMO) are classic mental traps that have destroyed countless accounts.

A Trader’s Risk Management Checklist

Success isn’t about avoiding risk—it’s about managing it intelligently. Here’s a simple table outlining common risks and the professional approach to handling them.

| Risk Factor | What It Looks Like in Practice | How a Professional Manages It |

|---|---|---|

| Over-Leveraging | Using the maximum leverage available on every single trade to chase huge profits. | Using leverage strategically and risking only a small percentage (typically 1-2%) of their total capital on any single trade. |

| Emotional Decisions | Abandoning your trading plan because of a gut feeling or after a series of losses. | Sticking rigidly to a pre-defined and tested trading plan. Using stop-loss orders to automate risk control. |

| Information Overload | Trying to trade based on dozens of indicators, news feeds, and conflicting opinions. | Focusing on a clean, simple strategy that has a proven edge. Filtering out market noise. |

Your first job as a trader is not to make money. Your first job is to protect the capital you already have. Profit comes second.

Thinking about these disadvantages doesn’t make you a pessimistic trader; it makes you a professional one. Every flight a pilot takes begins with a pre-flight check of potential issues. Treat your trading with the same level of serious preparation. Acknowledge the risks, create a plan to manage them, and you’ll already be miles ahead of the crowd.

Comparing Olymp Trade with Other Popular Forex Brokers

Choosing your trading partner is one of the most critical decisions you’ll make. I’ve been in this game for years, and I’ve seen dozens of Forex brokers come and go. While many platforms look similar on the surface, the devil is always in the details. So, how does Olymp Trade really stack up against the competition? Let’s break it down from a trader’s perspective.

Instead of just another feature list, let’s look at the practical differences that impact your daily trading.

- Accessibility and Entry Barrier: Many popular Forex brokers require a significant initial investment, often starting at $200 or more. Olymp Trade lowers this barrier dramatically with a very low minimum deposit. This makes it an excellent choice for new traders wanting to test the waters with real money without risking a large sum of capital.

- The Trading Platform Itself: While giants like IG or Saxo Bank offer complex, feature-heavy platforms, they can be overwhelming. Many brokers simply offer a standard MetaTrader (MT4/MT5) integration. Olymp Trade developed its own proprietary platform. The focus here is on a clean user experience and intuitive design, which can significantly reduce the learning curve. You get everything you need without the clutter you don’t.

- Fixed Time Trades (FTT): This is a key differentiator. Traditional Forex brokers focus exclusively on CFD or spot Forex trading. Olymp Trade offers FTTs alongside its Forex mode, providing a different way to speculate on asset price movements within a predetermined timeframe. This offers a level of trading diversity not found on most standard Forex platforms.

To put things into a clearer context, let’s compare some core trading conditions. Here’s a table that contrasts Olymp Trade with what you might find at other typical brokers in the industry.

| Feature | Olymp Trade | Typical Industry Broker (e.g., ECN/STP) |

|---|---|---|

| Minimum Deposit | Low (e.g., $10) | Moderate to High (e.g., $100 – $500+) |

| Platform Type | Proprietary, Web & Mobile Focused | Often MetaTrader 4/5, cTrader, or complex proprietary software |

| Spreads & Commissions | Spreads with commission-style fees included | Variable spreads, often with separate commission charges per lot |

| Asset Variety | Curated selection of popular assets, indices, and commodities | Extensive list, sometimes numbering in the thousands of instruments |

| Trader Education | Integrated into the platform, focused on practical application | Often extensive but can be fragmented across different websites/portals |

It’s not just about the numbers, though. It’s about the feel of the platform and the support you receive. Some of the bigger Forex brokers can feel impersonal, with customer support that is slow or difficult to reach. My experience has shown that a responsive support team can be a lifesaver when a trade is on the line.

A trader’s final choice often comes down to this: Do you want a platform that gives you every possible tool, even if you’ll never use 90% of them? Or do you want a streamlined, efficient platform that helps you focus on your trading strategy? There’s no right answer, but Olymp Trade clearly caters to the second group, prioritizing clarity and ease of use. It’s built for traders who want to trade, not get bogged down in overly complex software.

Final Verdict: Is Olymp Trade the Right Forex Broker for You?

We’ve walked through the platform, analyzed the features, and discussed the trading conditions. Now, it’s time for the million-dollar question: should you trade with Olymp Trade? The honest answer depends entirely on who you are as a trader. A forex broker is not a one-size-fits-all solution; it’s a personal tool for your trading journey.

To help you make a clear decision, let’s break down who will likely thrive on this trading platform and who might need to consider other options.

You’ll likely enjoy Olymp Trade if…

- You’re just starting out: If the world of forex trading is new to you, this platform is a fantastic entry point. Its interface is clean and intuitive, removing the intimidation factor that comes with more complex software. The educational resources and free demo account provide a safe space to learn and practice.

- You value a low barrier to entry: You don’t need a massive bankroll to start. With a low minimum deposit, you can get your feet wet with real money without taking a significant risk. This makes it accessible for almost everyone.

- You trade on the go: The mobile app is robust and fully functional. If you like to check your positions, analyze charts, and open trades from your phone or tablet, you will appreciate the seamless mobile experience.

- You want more than just Forex: The platform offers Fixed Time Trades (FTTs) alongside its forex offerings. If you enjoy the simplicity and fast-paced nature of FTTs, having both in one place is a major convenience.

You might want to look elsewhere if…

- You’re a seasoned professional: If you rely on sophisticated analytical tools, custom indicators, or automated trading with Expert Advisors (EAs), you’ll find the platform lacking. Professional traders often require the advanced capabilities of platforms like MetaTrader 4 or 5.

- You are a scalper or high-frequency trader: While the spreads are reasonable, they may not be tight enough for strategies that depend on capturing a few pips per trade. ECN brokers are typically a better fit for this style of trading.

- You require top-tier regulatory oversight: While Olymp Trade is regulated, it’s not by a top-tier authority like the FCA (UK) or ASIC (Australia). For traders whose primary concern is the highest level of regulatory protection, this could be a deciding factor.

A Quick Look: Pros & Cons

Sometimes a simple table says it all. Here is a summary of our Olymp Trade review.

| Advantages | Disadvantages |

|---|---|

| User-friendly and intuitive platform | Lacks advanced trading tools (e.g., MT4/MT5) |

| Low minimum deposit and trade size | Spreads may not be the tightest for scalping |

| Excellent, free, and unlimited demo account | Regulatory status may not satisfy all traders |

| Strong educational resources for beginners | Limited selection of complex analytical instruments |

| Reliable and highly-rated mobile application | Asset selection is good but not as vast as some competitors |

Ultimately, the best way to know if a broker is right for you is to try it yourself. My advice? Open a free demo account. Spend a week trading with virtual money. Test the platform, check the spreads on your favorite pairs, and get a feel for the execution speed. Your own experience is the most valuable review you will ever get. Happy trading!

Frequently Asked Questions

Is Olymp Trade a good platform for beginners?

Yes, Olymp Trade is excellent for beginners due to its low minimum deposit, user-friendly interface, and extensive educational resources, including a free and replenishable demo account to practice risk-free.

What are the main costs when trading Forex on Olymp Trade?

The main costs include dynamic spreads (the difference between buy and sell prices), a small fixed fee on trades that is shown upfront, and fixed overnight fees (swaps) for positions held overnight. Olymp Trade does not charge for deposits or withdrawals.

How much leverage does Olymp Trade offer?

Olymp Trade offers leverage, which it calls a “multiplier,” of up to 1:500. This allows traders to control larger positions with smaller capital but also significantly increases risk, so it should be used wisely.

Can I trade with Olymp Trade on my mobile phone?

Yes, Olymp Trade provides a full-featured and highly-rated mobile trading app for both Android and iOS devices. The app allows you to manage your account, analyze charts with various tools, and execute trades from anywhere.

Is Olymp Trade a safe and legit broker?

Olymp Trade is considered a legitimate broker. It is a member of the Financial Commission (FinaCom), which offers third-party dispute resolution and a compensation fund up to €20,000 per case. The platform also uses security measures like segregated client accounts and SSL encryption.