Are you ready to transform your trading journey? As a seasoned Forex professional, I know the thrill and the challenge of the markets. We constantly seek strategies that offer both excitement and reliability. That’s where Olymptrade Fixed Time Trading (FTT) steps in, offering a unique opportunity to seize control of your financial destiny. This isn’t just about making predictions; it’s about mastering a powerful tool that allows you to target predictable profit potential with confidence and precision. Imagine executing trades with clear entry and exit points, knowing your potential returns upfront. That’s the power of FTT on Olymptrade, a platform designed for traders who value clarity and efficiency.

I’ve navigated countless market conditions, and I can tell you, the ability to define your risk and reward before you even open a trade is a game-changer. Fixed Time Trading empowers you to do exactly that. It simplifies the trading process without sacrificing the excitement or the lucrative opportunities. Whether you’re a forex veteran or just starting to explore online trading, understanding and mastering FTT on Olymptrade can unlock a new dimension in your profit generation strategy. Let’s dive in and discover how you can leverage this powerful approach to achieve consistent results and elevate your trading game.

- What is Fixed Time Trading (FTT)?

- How Fixed Time Trading Works: The Essentials

- Key Characteristics of FTT

- Is FTT for You? Considerations for Traders

- Understanding Olymptrade Fixed Time Trading

- How Fixed Time Trades Work on Olymptrade

- Advantages and Considerations for Fixed Time Trading

- Advantages:

- Considerations:

- Getting Started: How to Trade Fixed Time on Olymptrade

- What Exactly is Fixed Time Trading?

- Why Start Your Fixed Time Journey with Olymp Trade?

- Your First Steps: How to Trade Fixed Time on Olymp Trade

- Essential Tips for Successful Fixed Time Trading

- “The markets are constantly in a state of flux. Understanding the flow is key.”

- The Critical Role of Risk Management

- Key Features of the Olymptrade FTT Platform

- Unlocking Your Trading Potential: Core Features Explained

- What These Features Mean for You

- Choosing Optimal Assets for Olymptrade Fixed Time Trading

- Key Factors for Intelligent Asset Selection

- Popular Asset Categories for Fixed Time Trading

- Currency Pairs (Forex)

- Commodities

- Stock Indices

- Individual Stocks

- How to Choose Your Optimal Asset: A Practical Guide

- Final Thoughts on Asset Selection

- Effective Strategies for Olymptrade FTT

- Mastering the Fundamentals of FTT

- Key Components of a Winning FTT Strategy:

- Popular & Potent FTT Strategies

- 1. Price Action Trading

- 2. Indicator-Based Strategies

- Advantages of Indicator-Based Trading:

- Disadvantages of Indicator-Based Trading:

- Implementing Your Chosen Strategy

- Tips for Successful Trading:

- Final Thoughts for Your Trading Journey

- Trend Following Strategies

- Key Elements of Trend Following

- Advantages of Embracing Trend Following

- The Other Side of the Coin: Disadvantages

- Putting Trend Following into Practice

- Reversal and Price Action Tactics

- What is Price Action?

- Why Focus on Price Action for Reversals?

- Understanding Key Reversal Patterns

- Comparing Common Reversal Patterns

- Combining Price Action with Confluence

- Utilizing Indicators in FTT

- Types of Indicators Every FTT Trader Should Know

- The Ups and Downs: Pros and Cons of Indicators in FTT

- Top Indicators for FTT & Their Actionable Insights

- Essential Risk Management for Olymptrade Fixed Time Traders

- Understanding Your Capital at Risk

- Implementing a Fixed Percentage Rule

- The Power of Trade Size Control

- Advantages and Disadvantages of Consistent Trade Sizing:

- Emotional Discipline: Your Best Risk Tool

- Always Have a Trading Plan

- Benefits of Engaging in Olymptrade Fixed Time Trading

- Key Advantages of Olymp Trade Fixed Time Trading:

- Potential Challenges and Risks in Olymptrade FTT

- Mitigating FTT Risks: A Practical Approach

- Practicing with the Olymptrade Fixed Time Trading Demo Account

- Why Every Trader Should Master the Demo Account

- Putting Theory Into Practice

- Top Tips for Successful Olymptrade Fixed Time Trading

- Master Your Approach: From Demo to Discipline

- Technical vs. Fundamental Analysis

- Common Mistakes to Avoid in Olymptrade FTT

- Overtrading and Poor Money Management

- Ignoring Market Analysis and Trading Impulsively

- Emotional Trading: The Saboteur Within

- Lack of a Well-Defined Trading Plan

- Neglecting Continuous Education and Practice

- Olymptrade Regulation and Security for FTT Users

- The Regulatory Backbone: FinaCom Membership

- Safeguarding Your Capital: Fund Security

- Fortifying Your Digital Fortress: Platform Security

- Why This Matters for Fixed Time Traders

- Olymptrade Fixed Time Trading: Is It Right for You?

- How Fixed Time Trading Works on OlympTrade

- The Advantages of OlympTrade FTT

- Considerations Before You Dive In

- Is OlympTrade Fixed Time Trading for You?

- Frequently Asked Questions

What is Fixed Time Trading (FTT)?

As a seasoned trader, I’ve navigated many markets, and Fixed Time Trading (FTT) always sparks a lot of discussion. So, what exactly is it? At its core, FTT is a financial instrument where you predict the future direction of an asset’s price within a specific timeframe. Think of it as a sprint in the trading world, rather than a marathon.

Unlike traditional Forex where you buy or sell an asset and hold it until you decide to close the position, FTT operates on a simple premise: will the price go up or down by a specific expiration time? You don’t actually own the underlying asset. Instead, you’re speculating on its price movement, aiming for a predetermined payout if your prediction is correct.

How Fixed Time Trading Works: The Essentials

Understanding the mechanics is crucial. Here’s a breakdown of the typical FTT process:

- Choose an Asset: Select from a wide range of assets like currency pairs (EUR/USD, GBP/JPY), commodities (gold, oil), indices, or even cryptocurrencies.

- Set Expiration Time: This is a defining feature. You select how long your trade will last – it could be as short as 30 seconds, a few minutes, or as long as several hours, even days.

- Predict Direction: Based on your analysis, you decide if the asset’s price will rise (“CALL” or “UP”) or fall (“PUT” or “DOWN”) by the expiration time.

- Invest Amount: Specify how much capital you wish to allocate to this single trade.

- Execute Trade: Once you confirm, the trade is active. Your profit or loss is determined solely by whether the price meets your prediction at the exact moment of expiration.

Key Characteristics of FTT

FTT stands out with several distinct features that appeal to many traders, especially those looking for fast-paced opportunities:

- Fixed Payouts: Before you even place a trade, you know the exact percentage return you’ll get if your prediction is right (e.g., 70-90% of your investment). This transparency is a big draw for many.

- Fixed Risk: Your maximum loss is limited to the amount you invested in that particular trade. No nasty surprises from unexpected market swings beyond your initial stake. This makes risk management straightforward for each individual trade.

- Clear Timeframes: The predefined expiration times make FTT incredibly dynamic. You get quick results, which can be exhilarating but also demand rapid decision-making and precise entry points.

- Accessibility: Often, FTT platforms are user-friendly, allowing traders to start with relatively small capital. This lowers the barrier to entry for newcomers to the financial markets.

“In my years of trading, FTT has always been about precision and timing. It’s not just about knowing where the market will go, but exactly when it will get there. Discipline is your greatest asset here.”

— A Professional Trader’s Insight

Is FTT for You? Considerations for Traders

While appealing, FTT demands a specific mindset. It thrives on clear price action and disciplined execution. Due to its fast-paced nature, solid technical analysis skills are paramount. You need to identify patterns, understand indicators, and make quick, informed decisions. Successful FTT trading isn’t about guesswork; it’s about anticipating market moves within tight windows.

When approaching FTT, remember that while the potential for quick returns is high, so is the risk if you don’t have a robust strategy. It’s a game of probabilities and disciplined risk management. Many professional traders integrate FTT as part of a broader portfolio, using it for specific, short-term opportunities when market conditions align perfectly with their strategy.

Understanding Olymptrade Fixed Time Trading

Welcome, fellow traders! Let’s dive deep into Olymptrade Fixed Time Trading, a dynamic way to engage with the financial markets. It offers a unique approach to predicting asset price movements, providing a clear profit or loss outcome within a specific timeframe. Many traders find this method appealing for its defined parameters and quick results. As a content creator and Forex trader, I’ve seen firsthand how exciting and potentially profitable fixed time trades can be when approached with a solid strategy.

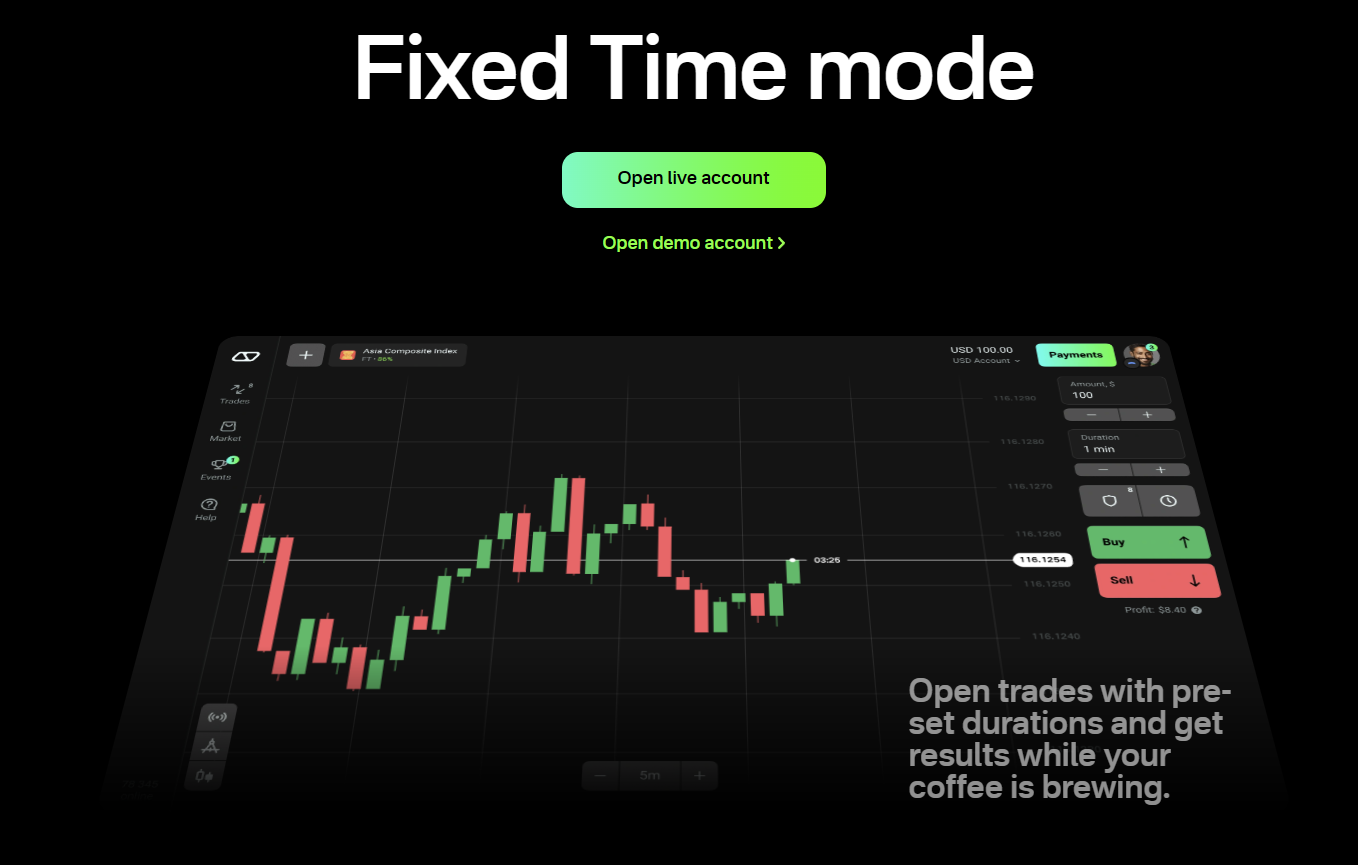

At its core, **Olymptrade Fixed Time Trading** involves making a prediction: will an asset’s price be higher or lower than its current level by a set expiration time? If your prediction proves correct, you secure a predetermined percentage of your invested amount as profit. If not, you lose your initial investment. This straightforward mechanism makes it highly popular among those looking for rapid opportunities in online trading.

How Fixed Time Trades Work on Olymptrade

Executing a fixed time trade is simpler than you might think. Here’s a quick breakdown of the steps you take:

- Select Your Asset: Choose from a wide range of assets, including currency pairs, commodities, indices, or cryptocurrencies. Your market analysis guides this choice.

- Set the Expiration Time: Decide how long your trade will last. Options typically range from as short as 1 minute to several hours. This timeframe is crucial for your price movement prediction.

- Determine Investment Amount: Specify how much capital you want to commit to the trade. This amount directly impacts your potential profit or loss.

- Predict the Direction: Based on your analysis, predict if the asset’s price will be “Up” (higher) or “Down” (lower) at the expiration time. This is where your trading skills come into play.

- Execute the Trade: Confirm your trade, and then simply wait for the outcome. The platform clearly shows your potential payout if your forecast is correct.

Advantages and Considerations for Fixed Time Trading

Just like any trading style, Olymptrade Fixed Time Trading comes with its own set of pros and cons. Understanding these helps you manage your risk and optimize your approach.

Advantages:

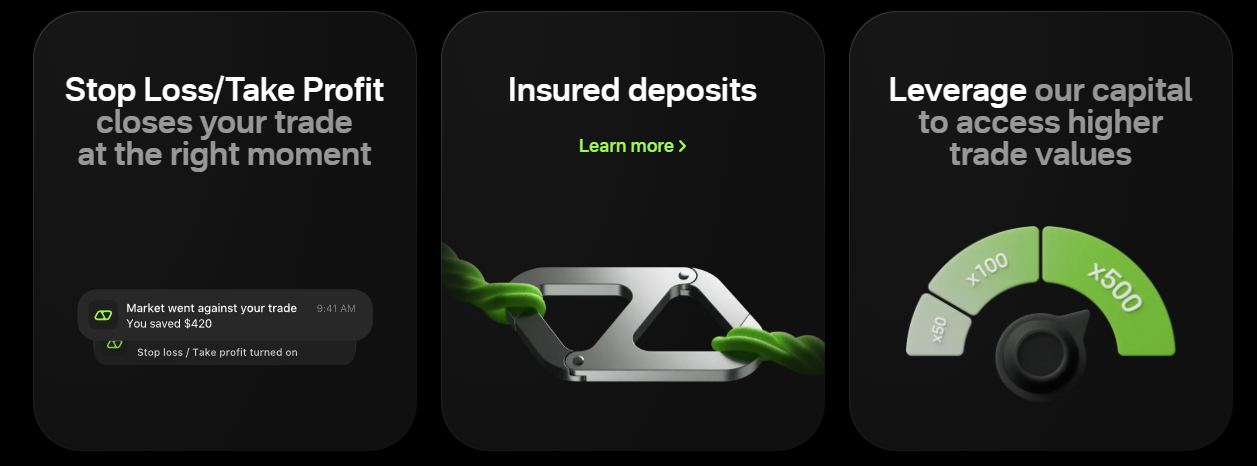

- Defined Risk and Reward: Before you even open a trade, you know exactly how much you stand to gain or lose. This clarity is a powerful tool for risk management.

- Quick Outcomes: With short expiration times, you get immediate feedback on your market predictions. This rapid turnover is attractive for traders seeking fast action.

- Simplicity: The concept is easy to grasp, making it accessible even for those new to the financial markets. Focus on predicting direction, not calculating spreads.

- High Profit Potential: Successful trades can yield significant percentage returns on your investment in a short period.

Considerations:

- High Risk: While profits can be high, so can the losses. An incorrect prediction means losing your full invested amount for that trade.

- Time Sensitive: Success heavily relies on precise timing and accurate short-term market analysis. Unexpected market shifts can quickly turn a winning trade into a losing one.

- Not for Long-Term Growth: This is not an investment strategy for long-term portfolio building. It’s more suited for speculative, short-term plays.

“In the world of Olymptrade Fixed Time Trading, success hinges on sharp market observation and disciplined execution. Treat every trade as a learning opportunity, and never stop refining your strategy.”

Navigating the world of fixed time trading requires discipline and continuous learning. Use robust market analysis tools, stay informed about global events, and always practice sound risk management. It’s a thrilling part of online trading, but remember, intelligent decision-making is your best asset.

Getting Started: How to Trade Fixed Time on Olymptrade

Ready to dive into the fast-paced world of trading? Fixed Time Trading on Olymp Trade offers an exciting way to potentially profit from market movements. It’s incredibly popular for its simplicity and the ability to make quick trades. If you’re an Olymp Trade beginner, this guide is your first step to understanding how to navigate this dynamic trading method.

What Exactly is Fixed Time Trading?

Imagine predicting whether an asset’s price will go up or down within a specific, short timeframe – that’s fixed time trading in a nutshell! You select an asset, choose an expiry time (from 1 minute to several hours), decide your investment amount, and then predict the price direction. If your prediction is correct when the time runs out, you earn a percentage of your investment. It’s straightforward, offering a clear “yes” or “no” outcome, making it an attractive option for many traders.

Why Start Your Fixed Time Journey with Olymp Trade?

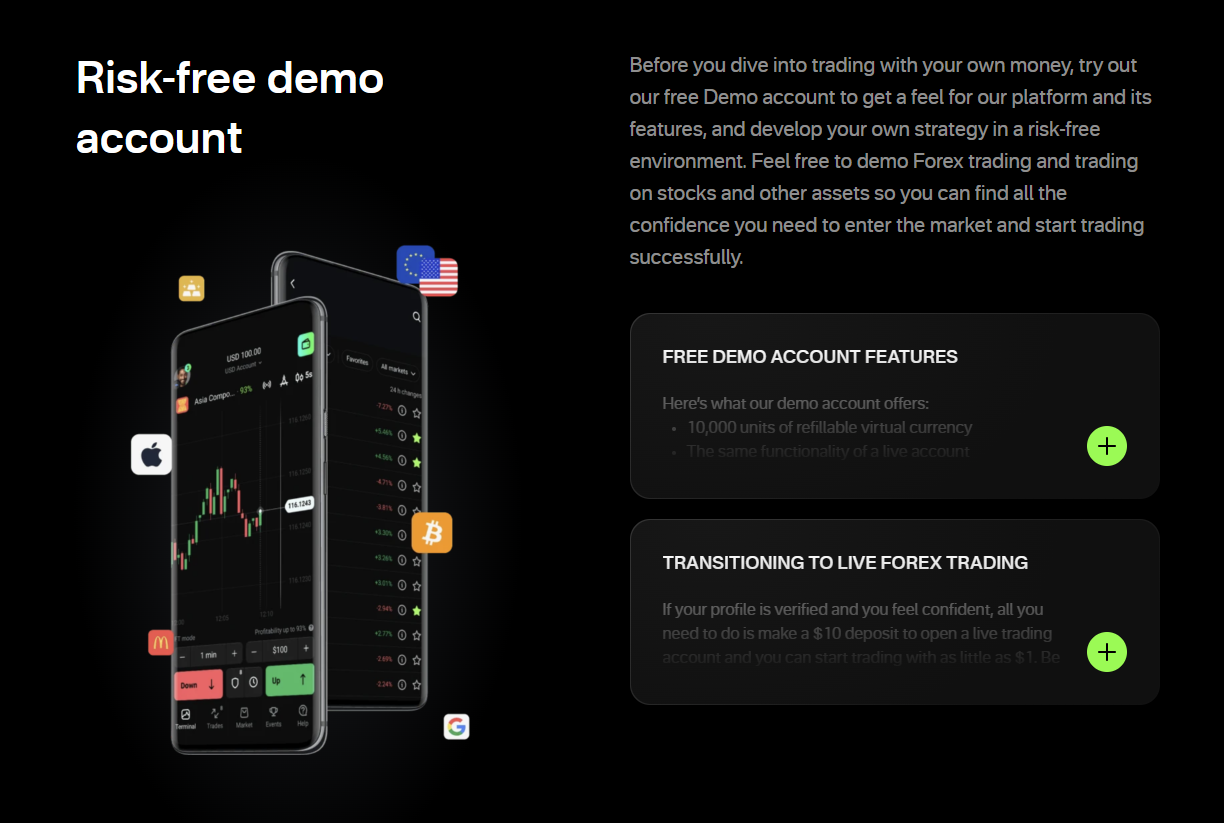

Olymp Trade provides a user-friendly platform perfect for those new to fixed time options. They offer a wide range of assets, from currencies to commodities, and excellent educational resources. Plus, their demo account lets you practice without risking real money, building confidence before you jump into live trading. For Olymp Trade beginners, it’s an ideal environment to learn the ropes.

Your First Steps: How to Trade Fixed Time on Olymp Trade

Getting started is simpler than you might think. Follow these essential steps:

- Create Your Account: Sign up on Olymp Trade. You’ll instantly get access to a free demo account loaded with virtual funds. This is where you practice your fixed time trading strategy without risk.

- Explore the Platform: Familiarize yourself with the interface. Identify the asset selection menu, the chart, the expiry time dropdown, your investment amount field, and the crucial “Up” and “Down” buttons.

- Choose Your Asset: Select an asset you want to trade. Popular choices include currency pairs like EUR/USD or commodities like Gold.

- Set Your Expiry Time: This is critical for fixed time options. For quick trades, you might select 1-5 minutes. Longer trades could be 15-30 minutes or more.

- Determine Your Investment: Decide how much you want to invest in this particular trade.

- Make Your Prediction: Based on your market analysis, click “Up” if you believe the price will rise or “Down” if you expect it to fall by the expiry time.

Essential Tips for Successful Fixed Time Trading

While fixed time trading on Olymp Trade is accessible, success requires more than just guessing. Here are key areas to focus on:

“The markets are constantly in a state of flux. Understanding the flow is key.”

Mastering Market Analysis: Before placing any quick trades, take time to understand basic market analysis. This involves:

- Trend Identification: Is the market generally moving up (uptrend), down (downtrend), or sideways (ranging)? Trade with the trend.

- Using Indicators: Olymp Trade offers various technical indicators. Start with simple ones like Moving Averages (MA) or Relative Strength Index (RSI) to help confirm your predictions. These tools provide visual cues on price momentum.

- Support and Resistance: Identify key price levels where the asset has historically struggled to go higher (resistance) or lower (support). These levels often act as turning points.

The Critical Role of Risk Management

This cannot be stressed enough. Fixed time trading can be highly profitable, but it also carries risk. Proper risk management is your best friend:

| Good Practice | Bad Practice |

|---|---|

| Invest a small percentage (e.g., 1-5%) of your total capital per trade. | Risk a large portion of your capital on a single trade. |

| Develop and stick to a consistent fixed time trading strategy. | Trade impulsively or based on emotion. |

| Utilize the demo account extensively to test new strategies. | Jump directly into live trading without practice. |

| Maintain a trading journal to track your performance. | Ignore past mistakes and learning opportunities. |

By understanding how to trade fixed time on Olymp Trade, focusing on solid market analysis, and implementing strict risk management, you set yourself up for a much better trading experience. Remember, consistency and discipline are vital.

Key Features of the Olymptrade FTT Platform

As a seasoned Forex trader, I know that choosing the right platform is half the battle. The Olymptrade Fixed Time Trades (FTT) platform stands out for several reasons, offering a robust environment suitable for both beginners and experienced traders. It simplifies complex trading concepts without sacrificing powerful tools. Let’s dive into the core features that make it a go-to choice for many in the trading community.

Unlocking Your Trading Potential: Core Features Explained

The Olymptrade FTT platform is designed with the user in mind, focusing on accessibility, functionality, and support. Here’s a breakdown of its most compelling features:

- Intuitive User Interface: Navigating the platform is incredibly straightforward. Its clean, uncluttered design means you can focus on market analysis rather than figuring out where everything is. Placing trades, monitoring charts, and accessing tools feels natural and efficient, which is crucial when every second counts.

- Diverse Asset Selection: You’re not limited to just a few options. The platform offers a wide range of assets, including popular currency pairs like EUR/USD, commodities such as gold and oil, major stock indices, and even cryptocurrencies. This variety allows you to diversify your portfolio and explore different market opportunities.

- Flexible Expiration Times: One of the hallmarks of FTT trading is the ability to choose your trade duration. Olymptrade provides a broad spectrum of expiration times, from ultra-short 60-second trades for high-frequency strategies to longer-term options that cater to more patient analysis. This flexibility lets you align trades with your specific market insights and risk tolerance.

- Comprehensive Trading Tools: Success in trading often relies on good analysis. The platform comes equipped with a suite of technical indicators (like Moving Averages, RSI, MACD) and advanced charting tools. These resources empower you to conduct thorough market analysis and make informed trading decisions.

- Free Demo Account: This is a game-changer, especially for new traders. Olymptrade provides a demo account pre-loaded with virtual funds, allowing you to practice your strategies, familiarize yourself with the platform, and test market theories without risking real capital. It’s an invaluable learning tool.

- Extensive Educational Resources: Beyond the demo, Olymptrade offers a wealth of educational materials, including tutorials, webinars, and strategy guides. These resources are designed to help you improve your trading skills, understand market dynamics, and stay updated with new techniques.

- Reliable Customer Support: Facing an issue or having a question? Olymptrade provides 24/7 customer support via live chat, email, and phone. Quick and efficient support is vital in the fast-paced world of trading.

- Mobile Trading Accessibility: Never miss a trading opportunity, even on the go. The Olymptrade mobile app, available for both iOS and Android devices, offers full functionality, allowing you to execute trades, monitor your portfolio, and analyze charts directly from your smartphone or tablet.

Pro Trader Tip: Always start with the demo account, even if you’re an experienced trader. It’s the perfect environment to test new strategies or simply get comfortable with the Olymptrade interface before putting your real money on the line. It’s about smart practice, not just blind luck.

What These Features Mean for You

When you combine an easy-to-use interface with a wide array of assets, powerful tools, and strong support, you get a trading platform that genuinely supports your journey. The Olymptrade FTT platform doesn’t just offer features; it offers solutions designed to enhance your trading experience and potentially improve your outcomes. Whether you are aiming for quick profits with short-term trades or building a long-term strategy, this platform provides the necessary environment to achieve your goals.

Here’s a quick overview of why traders appreciate specific functionalities:

| Feature | Trader Benefit | Impact on Trading |

|---|---|---|

| User-Friendly Interface | Faster execution, less confusion. | Reduced errors, increased confidence. |

| Diverse Assets | More trading opportunities across markets. | Portfolio diversification, risk spread. |

| Flexible Expiration Times | Adapt strategies to market volatility. | Tailored risk management, varied strategy application. |

| Free Demo Account | Risk-free learning and strategy testing. | Improved skills, reduced real money losses. |

The array of features on the Olymptrade FTT platform is clearly tailored to meet the demands of a dynamic market. It’s a platform built to empower traders, providing the tools and knowledge necessary to navigate the world of Fixed Time Trades successfully.

Choosing Optimal Assets for Olymptrade Fixed Time Trading

As a seasoned Forex trader and content creator, I’ve seen countless traders jump into Olymptrade Fixed Time Trading without a solid plan. One of the biggest mistakes? Neglecting proper asset selection. Your choice of asset profoundly impacts your trading success. It’s not just about finding a good entry point; it’s about finding the right market to apply your strategy.

Key Factors for Intelligent Asset Selection

Before you even think about opening a trade, consider these vital factors. They form the bedrock of smart asset selection in any market, especially in the fast-paced world of Fixed Time Trading.

- Volatility: This is the degree of variation of a trading price over time. High volatility means bigger price swings, potentially offering more frequent entry and exit points for your Fixed Time trades. But beware! High volatility also means higher risk. Conversely, low volatility offers stability but fewer clear trading opportunities. Match your risk tolerance to the asset’s volatility.

- Liquidity: Always aim for liquid assets. High liquidity ensures you can enter and exit trades smoothly without significant price discrepancies. Illiquid assets, on the other hand, can lead to wider spreads and frustrating slippage, eating into your potential profits.

- Market Analysis Preference: Do you lean towards technical analysis, focusing on charts, patterns, and indicators? Or do you prefer fundamental analysis, tracking economic news, geopolitical events, and company earnings? Some assets respond better to one type of analysis over the other. Choose assets where your preferred analysis method shines.

Popular Asset Categories for Fixed Time Trading

Olymptrade offers a diverse range of assets. Let’s break down some of the most popular categories and their typical characteristics:

Currency Pairs (Forex)

The bread and butter for many traders. Major pairs like EUR/USD, GBP/USD, and USD/JPY offer high liquidity and often display predictable technical patterns.

- Advantages:

- Exceptional liquidity and tight spreads.

- Available 24/5, offering constant trading opportunities.

- Often follow clear trends and chart patterns.

- Disadvantages:

- Highly sensitive to economic news and central bank decisions.

- Can experience choppy, unpredictable periods during low volume hours.

Commodities

Think Gold, Silver, Crude Oil. These can be fantastic, especially when geopolitical tensions rise or supply-demand dynamics shift.

- Advantages:

- Strong, sustained trends driven by global events.

- Excellent for traders who incorporate fundamental analysis.

- Disadvantages:

- Can experience extreme volatility on breaking news.

- Often influenced by specific supply and demand shocks.

Stock Indices

Indices like the S&P 500, Dow Jones, or DAX reflect the broader market sentiment of an economy or sector.

- Advantages:

- Offer a diversified view, less prone to individual company news.

- Can provide good insights into overall economic health.

- Disadvantages:

- Can be slower-moving compared to Forex pairs or commodities.

- Heavily influenced by global economic events and major announcements.

Individual Stocks

Trading individual company stocks (e.g., Apple, Google) allows you to capitalize on specific company news or sector trends.

- Advantages:

- Potential for explosive moves on positive earnings reports or product launches.

- Can be great for traders who follow specific industries.

- Disadvantages:

- Require in-depth knowledge of specific companies.

- Generally less liquid than major currency pairs.

How to Choose Your Optimal Asset: A Practical Guide

Picking the right asset for you is not a universal truth. It’s highly personal. Consider this table when making your decisions:

| Asset Type | Best For… | Key Considerations |

|---|---|---|

| Major Currency Pairs | Beginners, Trend Followers, Scalpers | High Liquidity, News Impact, 24/5 availability |

| Gold/Silver | Event-Driven Traders, Safe-Haven Seekers | High Volatility, Geopolitical Influence, Strong Trends |

| Stock Indices | Macro Traders, Diversified Exposure | Broad Market View, Global Economic Impact, Slower Pace |

| Individual Stocks | Sector-Specific Traders, News Traders | Company-Specific News, Earnings Reports, Market Hours |

Always remember what legendary trader Jesse Livermore once said:

“The game taught me that the money to be made in the market was always there, but you had to be patient enough to wait for the right opportunities.”This perfectly applies to asset selection. Don’t rush into trading every asset. Pick a few you understand well.

Final Thoughts on Asset Selection

Choosing the optimal assets for your Olymptrade Fixed Time Trading isn’t a one-time decision. It’s an ongoing process of learning, adapting, and refining your approach. Start with assets that align with your current knowledge and risk appetite. As you gain experience, you can explore other markets. Test different assets on a demo account, understand their unique behavior, and align them with your trading style. Informed asset selection is a cornerstone of consistent profitability. Happy trading!

Effective Strategies for Olymptrade FTT

Hey fellow traders! Navigating the financial markets requires sharp skills, especially when you’re delving into fixed time trades (FTT) on platforms like Olymp Trade. It’s an exciting challenge, isn’t it? As a professional trader, I know the thrill and the pressure. Success in Olymp Trade FTT isn’t just about luck; it’s about employing robust trading strategies and discipline. Let’s explore some effective approaches that can help you sharpen your edge and boost your profitability.

Mastering the Fundamentals of FTT

Before diving into specific tactics, understand that Olymp Trade FTT involves predicting price movement direction within a set timeframe. Your goal is to accurately forecast if an asset’s price will go up or down. This calls for more than just guesswork; it demands solid market analysis and careful decision-making.

Key Components of a Winning FTT Strategy:

- Thorough Market Analysis: This includes both technical and fundamental analysis. You need to understand what drives asset prices.

- Sound Risk Management: Protecting your capital is paramount. Never risk more than you can afford to lose on a single trade.

- Disciplined Trading Psychology: Emotional control separates successful traders from those who struggle. Stick to your plan.

- Continuous Learning: Markets evolve, and so should your strategies. Always seek new knowledge and adapt.

Popular & Potent FTT Strategies

Let’s talk about some actionable strategies you can implement. Remember, the best approach often involves combining elements from different methods.

1. Price Action Trading

Price action trading focuses on analyzing historical price movements, primarily through candlestick patterns, to predict future direction. It’s about reading the market’s story directly from the charts.

Common Candlestick Patterns to Watch:

- Doji: Indicates indecision; often signals a potential reversal.

- Engulfing Patterns: Strong reversal signals where one candle completely covers the previous one.

- Hammer/Hanging Man: Reversal patterns, typically found at the bottom or top of trends.

- Pin Bar: Shows rejection of a certain price level, suggesting a strong move in the opposite direction.

\”The market is always speaking; you just need to learn its language.\” – A seasoned trader’s mantra.

2. Indicator-Based Strategies

Technical indicators are mathematical calculations based on an asset’s price and/or volume. They help confirm trends, identify potential reversals, and provide entry/exit signals. Using them effectively in fixed time trades can give you significant advantages.

| Indicator | How it Helps in FTT | Best Use Cases |

|---|---|---|

| Relative Strength Index (RSI) | Identifies overbought (>70) or oversold (<30) conditions, signaling potential reversals. | Ranging markets, confirming trend reversals. |

| Moving Averages (MA) | Shows trend direction and potential support/resistance levels. Crossovers indicate trend changes. | Trend following, identifying dynamic support/resistance. |

| MACD (Moving Average Convergence Divergence) | Generates buy/sell signals through crossovers and divergence from price. | Identifying momentum and trend changes. |

Advantages of Indicator-Based Trading:

- Provides objective signals, reducing emotional bias.

- Can be combined to create robust confirmation strategies.

- Useful for identifying trends and potential reversals quickly.

Disadvantages of Indicator-Based Trading:

- Indicators can lag behind price action.

- May generate false signals in volatile or choppy markets.

- Over-reliance can lead to analysis paralysis.

Implementing Your Chosen Strategy

Once you choose a strategy, or a combination, practice is key. Start with a demo account on Olymp Trade. This allows you to test your strategy without risking real capital. Document your trades in a trading journal. This isn’t optional; it’s a critical tool for learning and improvement.

Tips for Successful Trading:

- Start Small: Begin with small trade sizes as you gain experience.

- Set Stop-Loss Levels (Mentally for FTT): Though not direct stop-losses in FTT, define your acceptable loss per trade or per day.

- Stay Updated: Keep an eye on economic news and major events that could impact the assets you trade. Fundamental analysis can complement your technical approach.

- Patience is a Virtue: Wait for your setups. Don’t force trades.

- Review and Adapt: Regularly assess your performance and adjust your strategy as market conditions change.

Final Thoughts for Your Trading Journey

Developing effective strategies for Olymp Trade FTT is an ongoing process. It requires dedication, continuous learning, and strict adherence to your risk management rules. Remember, consistency beats intensity in the long run. Embrace the learning curve, refine your approach, and you’ll find greater success in the dynamic world of fixed time trades. See you on the charts!

Trend Following Strategies

As traders, we constantly seek methods to navigate the unpredictable currents of the financial markets. Among the myriad approaches, trend following stands out as a timeless and often highly effective strategy. It’s not about predicting future price movements; rather, it’s about identifying and riding existing momentum until it exhausts itself. Think of it like surfing – you don’t create the wave, you just catch it and ride it as long as it carries you.

The core philosophy is elegantly simple: prices move in trends. By aligning your trades with these trends, you position yourself to capture substantial gains while minimizing the need for constant, stressful market forecasting. This approach appeals to many traders because it emphasizes patience, discipline, and the ability to let profits run.

Key Elements of Trend Following

Successful trend followers rely on a suite of technical tools to identify and confirm trends. Here are some of the most common:

- Moving Averages (MA): These smooth out price data, making it easier to spot the direction of the trend. Crossovers of different period MAs often signal entry or exit points.

- Moving Average Convergence Divergence (MACD): A momentum indicator that shows the relationship between two moving averages of prices. It helps identify changes in the strength, direction, momentum, and duration of a trend.

- Average Directional Index (ADX): This indicator quantifies the strength of a trend. A high ADX value suggests a strong trend, while a low value indicates a weak or range-bound market.

- Donchian Channels: These channels plot the highest high and lowest low over a specific period, defining the boundaries of a trend. Breakouts from these channels often signal new trend formations.

Advantages of Embracing Trend Following

Why Ride the Trend?

- Simplicity: The rules are often straightforward, reducing complexity and analysis paralysis.

- Potential for Large Gains: Catching a significant trend can lead to substantial profits, as you allow your winners to run.

- Reduced Emotional Trading: By focusing on objective trend signals, you minimize the impact of fear and greed on your decisions.

- Scalability: You can apply trend following across various timeframes and asset classes, from forex to stocks and commodities.

The Other Side of the Coin: Disadvantages

Challenges to Consider

- Whipsaws: In choppy or range-bound markets, trend following strategies can suffer from multiple small losses as trends fail to establish.

- Late Entry/Exit: By definition, you enter a trend after it has started and exit after it has shown signs of weakening. This means you don’t capture the absolute bottom or top.

- Requires Patience: Big trends don’t appear every day. You’ll spend significant time waiting for clear signals and enduring periods of flat performance.

- Lagging Nature: Indicators used in trend following are inherently lagging, meaning they confirm a trend rather than predict it.

Putting Trend Following into Practice

Successful trend following is more than just applying indicators; it’s about adopting a disciplined mindset. Here are some practical tips:

- Define Your Rules: Clearly outline your entry, exit, and risk management parameters before you trade.

- Risk Management is Key: Always use stop-loss orders. Protect your capital first and foremost. Never risk more than 1-2% of your account on a single trade.

- Patience, Patience, Patience: Not every day offers a clear trend. Learn to sit on your hands and wait for high-probability setups.

- Diversify: Don’t put all your eggs in one basket. Apply trend following across different markets or pairs to smooth out equity curves.

- Backtest and Forward-Test: Understand how your chosen strategy performs historically and then monitor its performance in live market conditions (even with small stakes or demo accounts).

A Simple Moving Average Crossover Example

Here’s a simplified look at a common trend-following strategy:

| Indicator Setup | Buy Signal | Sell Signal | Market Type Suited |

|---|---|---|---|

| 50-period SMA & 200-period SMA | 50-period SMA crosses above 200-period SMA | 50-period SMA crosses below 200-period SMA | Strongly trending markets |

“The trend is your friend until the end when it bends.”

Embracing trend following can be a powerful addition to your trading arsenal. It offers a structured, less emotional path to potentially significant returns. While it comes with its challenges, a disciplined approach and robust risk management can help you navigate the ebb and flow of the markets with greater confidence. Are you ready to catch the next big wave?

Reversal and Price Action Tactics

As a seasoned Forex trader, I know the market constantly shifts. Understanding these shifts, especially when a trend is about to reverse, is vital for profitable trading. That’s where reversal and price action tactics become your best friends. These aren’t just fancy terms; they are powerful tools that help you read the market like an open book, often giving you an edge before others catch on.

What is Price Action?

Simply put, price action trading involves analyzing the movement of prices over time to make trading decisions. You focus on the raw price charts, candle by candle, without relying on lagging indicators. It’s about interpreting market psychology directly from the charts – what buyers and sellers are doing in real-time. This pure approach cuts through the noise and helps you spot genuine opportunities.

Why Focus on Price Action for Reversals?

Price action offers a unique perspective when anticipating reversals. It provides clear, actionable signals that often appear before traditional indicators confirm a turn. Here are some compelling reasons to integrate price action into your reversal strategy:

- Early Signals: You often spot potential reversals at their earliest stages, maximizing your profit potential.

- Reduced Lag: Unlike indicators that use historical data, price action is immediate, showing you what’s happening now.

- Simplicity: While it takes practice, once mastered, it simplifies your chart analysis. You don’t need dozens of indicators cluttering your screen.

- Universal Application: Price action principles apply across all markets and timeframes, making them incredibly versatile.

Understanding Key Reversal Patterns

Reversal patterns are specific formations on a price chart that signal a high probability of a trend change. Mastering these patterns is crucial for any trader looking to profit from market turns. Here are some of the most common and reliable ones:

- Head and Shoulders: A classic pattern indicating a potential bearish reversal after an uptrend.

- Inverse Head and Shoulders: The bullish counterpart, signaling a potential bullish reversal after a downtrend.

- Double Top/Bottom: Two attempts to break a level of resistance (top) or support (bottom) that ultimately fail, leading to a reversal.

- Triple Top/Bottom: Similar to double tops/bottoms, but with three failed attempts.

- Engulfing Patterns: Powerful two-candle patterns where the second candle completely engulfs the first, signaling a strong shift in momentum.

- Pin Bars: Single candlesticks with small bodies and long wicks, indicating rejection of a certain price level.

Comparing Common Reversal Patterns

Each pattern offers unique insights into market sentiment. Let’s look at two popular ones:

| Pattern | Description | Typical Outcome | Key Signal |

|---|---|---|---|

| Head and Shoulders | Three peaks with the middle one (head) higher than the other two (shoulders). | Bearish reversal. Price breaks neckline. | Break of the neckline support. |

| Double Bottom | Two distinct lows at roughly the same price level, forming a “W” shape. | Bullish reversal. Price breaks resistance between lows. | Break of the resistance line between the two lows. |

Combining Price Action with Confluence

While price action is powerful on its own, its effectiveness soars when you combine it with other confirmation tools. This concept is called “confluence.” Imagine spotting a double bottom reversal pattern exactly at a strong support level that has held multiple times before. This confluence significantly increases the probability of a successful trade. Always look for multiple reasons to take a trade, not just one.

"The market whispers before it shouts. Price action teaches you to hear those whispers, giving you a crucial head start."

– A Professional Trader’s Insight

Mastering reversal and price action tactics requires dedication and practice. Start by backtesting these patterns on historical charts, then move to demo trading. Build confidence in your ability to spot and execute these setups. It’s a journey worth taking, leading you to more informed, higher-probability trades. Join our community to share your insights and learn from others who navigate the exciting world of Forex with precision!

Utilizing Indicators in FTT

As a seasoned Forex trader, I know firsthand that Fixed Time Trading (FTT) demands precision. Every second counts, and your ability to read the market quickly and accurately directly impacts your success. This is where technical indicators become your most valuable allies. They aren’t crystal balls, but powerful tools that distill complex market data into clear signals, helping you make informed decisions in the fast-paced world of FTT.

Think of indicators as your market radar. They help you identify trends, spot potential reversals, measure market strength, and gauge volatility. For FTT, where trade durations can be as short as 60 seconds, these insights are crucial for pinpointing ideal entry and exit points. Relying solely on intuition is a recipe for disaster; combining your market understanding with indicator signals gives you a significant edge.

Types of Indicators Every FTT Trader Should Know

- Trend Indicators: These help you confirm the direction of the market. Examples include Moving Averages (MAs) and Bollinger Bands. An MA crossover, for instance, can signal a potential trend shift perfect for your next FTT trade.

- Momentum Indicators: They measure the speed and strength of price changes. The Relative Strength Index (RSI) and Stochastic Oscillator are popular choices. An RSI reading above 70 might suggest an asset is overbought, potentially signaling a downward reversal.

- Volatility Indicators: These tell you how much the price is fluctuating. Average True Range (ATR) is a prime example. High ATR can mean bigger price swings, offering more opportunities but also higher risk for short-term FTT.

- Volume Indicators: While less common in all FTT platforms, indicators like On-Balance Volume (OBV) show the buying and selling pressure behind price movements. Increasing volume on a trend confirmation strengthens your FTT conviction.

The Ups and Downs: Pros and Cons of Indicators in FTT

Just like any trading tool, indicators have their strengths and weaknesses in the FTT environment.

Advantages:

- Confirmation: They provide objective confirmation for your trading ideas, reducing reliance on gut feelings.

- Signal Generation: Many indicators generate clear buy or sell signals, simplifying decision-making.

- Trend Identification: They help you spot new trends or confirm existing ones, vital for trend-following FTT strategies.

- Risk Management: By highlighting overbought/oversold conditions, they can help you avoid entering trades at extreme price points.

Disadvantages:

- Lagging Nature: Most indicators are derived from past price data, meaning they reflect what has already happened, not what will happen next.

- False Signals: In choppy or consolidating markets, indicators can generate numerous false signals, leading to losing trades.

- Over-reliance: Relying solely on one indicator without considering overall market context or price action can be detrimental.

- Overwhelm: Using too many indicators simultaneously can create confusion and analysis paralysis.

Top Indicators for FTT & Their Actionable Insights

| Indicator | What it tells you | FTT Application |

|---|---|---|

| Relative Strength Index (RSI) | Overbought or oversold conditions | Identify potential reversals for “Put” (overbought) or “Call” (oversold) trades. |

| Moving Average (MA) | Trend direction and potential support/resistance | Look for price crossing the MA for trend continuation or reversal signals. |

| Bollinger Bands | Volatility and price extremes | Trade reversals when price touches or moves outside the bands; look for breakouts when bands contract. |

| Stochastic Oscillator | Momentum and potential reversals | Similar to RSI, used for identifying overbought/oversold levels and crossovers for entry signals. |

“Indicators don’t predict the future; they interpret the past to illuminate present probabilities. Combine them with solid price action analysis for true power in FTT.”

Mastering the use of indicators in FTT takes practice. Don’t just pick one and stick with it. Experiment, backtest different combinations, and learn how various indicators interact. The goal isn’t to find a perfect indicator, but to build a robust trading strategy that integrates indicator signals with your overall understanding of market dynamics. This thoughtful, disciplined approach is what will ultimately set you apart and drive your success in Fixed Time Trading.

Essential Risk Management for Olymptrade Fixed Time Traders

As a seasoned Forex trader and a content creator, I know one thing for sure: trading is exhilarating, especially on platforms like Olymptrade with its dynamic fixed time trading options. The potential for quick profits is tempting, but without a rock-solid approach to risk management, you’re essentially gambling. Successful trading isn’t just about winning trades; it’s about protecting your capital and ensuring longevity in the market. Every profitable trader understands that proper money management is the bedrock of consistent success.

Understanding Your Capital at Risk

Before you even place your first trade, you must know your total trading capital. Your account balance is your lifeline. Treat it with the utmost respect. Never risk capital you cannot afford to lose. This foundational principle prevents emotional decisions and protects your financial well-being. Think of your trading account as a business. Would you invest your entire business capital in a single, high-risk venture?

- Capital Protection: Always prioritize safeguarding your trading funds.

- Defined Risk: Know the maximum amount you are willing to lose per trade.

- Long-Term Vision: Focus on sustainable growth, not quick riches.

Implementing a Fixed Percentage Rule

One of the most effective risk management strategies for Olymptrade fixed time traders is to adhere to a strict fixed percentage rule. This means you only risk a small, predetermined percentage of your total account balance on any single trade. I personally recommend risking no more than 1-2% per trade, especially when you are starting out or dealing with high-frequency trading. This rule significantly reduces the impact of a losing streak on your overall capital.

| Account Balance | 1% Risk per Trade | 2% Risk per Trade |

|---|---|---|

| $100 | $1 | $2 |

| $500 | $5 | $10 |

| $1000 | $10 | $20 |

The Power of Trade Size Control

Directly linked to the fixed percentage rule is managing your trade size. If you decide to risk 2% of a $1000 account, your maximum risk per trade is $20. This means each of your individual positions should not exceed this amount. Consistently controlling your trade size, regardless of your confidence in a setup, is a crucial discipline. It keeps you from making impulsive, oversized bets that can wipe out your gains.

Advantages and Disadvantages of Consistent Trade Sizing:

- Advantages:

- Protects your capital from large drawdowns.

- Promotes emotional stability during losing streaks.

- Allows for statistical probabilities to play out over many trades.

- Simplifies your trading strategy and execution.

- Disadvantages:

- Limits potential profits on any single, highly successful trade.

- Requires discipline to stick to the rule even with strong convictions.

Emotional Discipline: Your Best Risk Tool

No matter how perfect your strategy or how strict your money management rules, emotions can derail everything. Fear of missing out (FOMO), greed, and frustration often lead traders to abandon their plans. Maintaining emotional control is arguably the most challenging, yet most important, aspect of fixed time trading. Recognize when emotions influence your decisions and step away.

“The single most important attribute for success in trading is patience. Patience to wait for the right setup, patience to let your profits run, and patience to cut your losses.” – Mark Douglas

Here are a few tips to keep your emotions in check:

- Stick to Your Plan: Execute your strategy without hesitation or deviation.

- Avoid Revenge Trading: Never try to win back losses immediately after a losing trade.

- Take Breaks: Step away from the charts if you feel overwhelmed or frustrated.

- Trade Small: If you’re feeling emotional, reduce your trade size until you regain composure.

Always Have a Trading Plan

A comprehensive trading plan is your roadmap. It defines your entry and exit criteria, your preferred markets, your session times, and crucially, your risk management parameters. Before you click that trade button on Olymptrade, you should know exactly why you are entering, what your potential profit target is, and what your maximum tolerable loss is. While fixed time trading doesn’t always allow for traditional stop loss or take profit orders, your plan should define your maximum risk per trade and overall daily/weekly loss limits. This foresight prevents impulsive trades and keeps your strategy aligned with your long-term goals.

Mastering risk management on Olymptrade is a journey, not a destination. It requires constant discipline, self-awareness, and a commitment to protecting your capital. By implementing these essential strategies, you’ll transform from a hopeful gambler into a methodical trader, steadily growing your account balance and navigating the exciting world of fixed time trading with confidence.

Benefits of Engaging in Olymptrade Fixed Time Trading

As a seasoned trader, I’ve seen many approaches to navigating the financial markets. Among them, Olymptrade Fixed Time Trading stands out for its unique blend of simplicity and high-octane potential. It’s an accessible entry point for new traders and a compelling option for veterans looking for a dynamic trading experience.

One of the immediate benefits you’ll discover with Olymp Trade is its straightforward nature. You set a specific time frame for your trade and predict the asset’s price movement. This clarity on duration and potential payout makes risk management incredibly transparent. You know your maximum exposure from the start, a huge advantage in volatile markets.

The speed of fixed time trading is another major draw. Unlike traditional investing where you might wait weeks or months for returns, here, outcomes materialize in minutes, sometimes even seconds. This rapid turnover means you can seize multiple opportunities throughout the trading day, capitalizing on short-term market fluctuations.

Furthermore, Olymp Trade offers a diverse range of assets. Whether you’re interested in currencies, commodities, indices, or cryptocurrencies, you’ll find plenty of choices to diversify your portfolio. This variety allows you to adapt your trading strategy to different market conditions and explore new avenues for profit.

Key Advantages of Olymp Trade Fixed Time Trading:

- Simplicity: Easy to understand and execute, making it ideal for beginners.

- Defined Risk & Reward: Clearly know your potential profit or loss before entering a trade.

- Rapid Outcomes: Experience quick results, allowing for frequent trading opportunities.

- Accessibility: Low entry barriers, making it affordable to start trading.

- Diverse Assets: Trade on a wide selection of financial instruments.

- User-Friendly Platform: Intuitive interface and powerful analytical tools.

- Educational Resources: Access tutorials and guides to sharpen your trading skills.

Ultimately, engaging in Olymptrade Fixed Time Trading empowers you to take control of your financial journey with a platform designed for efficiency and clarity. It’s about making informed decisions quickly and seeing the results unfold right before your eyes. Join the community and experience the excitement for yourself!

Potential Challenges and Risks in Olymptrade FTT

Trading Fixed Time Trades (FTT) on platforms like Olymptrade offers an exciting, fast-paced way to engage with financial markets. The allure of quick returns is undeniable, yet like all trading endeavors, FTT comes with its own set of significant challenges and risks. As a seasoned trader, I’ve seen countless individuals stumble by overlooking these crucial aspects. Understanding these pitfalls isn’t just about caution; it’s about building a sustainable trading strategy and protecting your capital. Let’s dig into what you truly need to watch out for.

Here are the key risks and challenges every FTT trader faces:

- High Volatility and Market Noise: Short timeframes, often a minute or less, mean market movements can be incredibly erratic. Small price fluctuations, or \”noise,\” become amplified, making accurate predictions incredibly difficult even with solid analysis. You’re essentially trying to capture tiny, unpredictable price swings.

- The Time Constraint: With FTTs, your prediction must be correct not just in direction, but also within a specific, very short expiry time. Missing your target by even a fraction of a second means a loss. This adds immense pressure and removes the flexibility of traditional trading where you can wait for a position to recover.

- Emotional Trading and Overtrading: The rapid win/loss cycle of FTTs can trigger strong emotions. Chasing losses or getting overly confident after wins often leads to impulsive decisions and overtrading. This quickly depletes accounts, regardless of initial strategy.

- Analytical Limitations: Deep fundamental or complex technical analysis is largely impractical for trades lasting mere minutes. You often rely on simpler indicators or price action, which have limited predictive power in extremely short timeframes, increasing the guesswork.

- Risk of Over-Sizing Positions: The quick turnaround can tempt traders to increase their stake rapidly after a few wins, hoping to compound profits faster. However, this same rapid compounding works in reverse during a losing streak, leading to swift and significant capital depletion.

Mitigating FTT Risks: A Practical Approach

While risks are inherent, you can manage them effectively with discipline and a robust strategy. Here’s a quick guide:

| Challenge/Risk | Mitigation Strategy |

|---|---|

| High Volatility | Trade during stable market hours; use higher timeframes for analysis before placing short FTTs. |

| Time Constraint | Focus on strong, clear signals; avoid marginal trades. Set strict expiry times. |

| Emotional Trading | Develop a strict trading plan; define daily loss limits. Walk away after hitting limits. |

| Analytical Limitations | Combine simple indicators with strong price action patterns; do not chase every signal. |

| Over-Sizing Positions | Implement a consistent risk management rule (e.g., risk 1-2% of capital per trade). |

“In trading, the most dangerous risk is the one you don’t even know you’re taking. FTT trading demands an acute awareness of its unique challenges.”

Ultimately, success in Olymptrade FTT doesn’t come from avoiding risks entirely – that’s impossible. It comes from understanding them deeply, respecting their power, and employing proactive strategies to manage them. Approach every trade with a clear head, a defined plan, and a commitment to protecting your capital. That’s the real secret to staying in the game and finding consistency.

Practicing with the Olymptrade Fixed Time Trading Demo Account

Stepping into the world of fixed time trading can feel like diving into the deep end, especially when real money is on the line. Every successful trader knows that preparation is key. That’s precisely why the Olymptrade Fixed Time Trading Demo Account isn’t just a feature; it’s an essential tool in your trading arsenal. Think of it as your personal training ground, a place where you can sharpen your skills without any financial risk.

This demo account mirrors the real Olymptrade platform in every way that matters. You get access to the same assets, the same indicators, and the same chart types. The only difference? You’re trading with virtual funds, not your hard-earned capital. This setup allows you to truly experiment, learn from your mistakes, and build confidence before you ever commit a single dollar.

Why Every Trader Should Master the Demo Account

Whether you’re a complete beginner or an experienced trader looking to test new strategies, the Olymptrade demo account offers invaluable benefits. It’s more than just a place to practice; it’s where you build the foundational habits for consistent success.

- Risk-Free Exploration: Experiment with different fixed time trading strategies. Test out various timeframes, asset pairs, and investment amounts without the fear of losing money. This freedom empowers you to be bold and innovative.

- Platform Familiarity: Get comfortable with the Olymptrade interface. Learn where everything is, how to execute trades quickly, and how to customize your charts for optimal analysis. Smooth navigation is crucial when every second counts.

- Strategy Development: Do you have a new trading idea? The demo account is the perfect place to backtest and forward-test your hypotheses. Refine your entry and exit points, understand market reactions, and optimize your trading plan.

- Emotional Discipline: Trading involves emotions, and the demo account helps you understand how you react to wins and losses, even virtual ones. Practice sticking to your plan, managing impulses, and maintaining a disciplined approach.

- Indicator Mastery: There are countless technical indicators available. Use the demo environment to understand how each indicator works, when it’s most effective, and how to combine them for stronger signals.

Many new traders rush directly into live trading, often with disappointing results. They skip the crucial learning phase. Don’t make that mistake. The Olymptrade demo account provides an identical trading environment, giving you a true feel for market dynamics and the platform’s functionality. You can switch between your demo and live accounts instantly, making it convenient to apply what you’ve learned.

Putting Theory Into Practice

To truly maximize your demo account experience, treat it as if it were real. Set realistic goals, manage your virtual capital wisely, and record your trades in a journal. Analyze your performance, identify patterns, and adapt your approach. This diligent practice transforms your theoretical knowledge into practical trading skill.

So, before you place your first live fixed time trade on Olymptrade, dedicate ample time to practicing with the demo account. It’s the smart move, the strategic move, and the move that sets you up for long-term success in the exciting world of trading.

Top Tips for Successful Olymptrade Fixed Time Trading

Navigating the world of fixed time trading on Olymptrade can be incredibly rewarding, but it demands more than just luck. As a fellow trader with years on the charts, I’ve seen what separates consistent winners from those who just spin their wheels. Success in Olymptrade fixed time trading hinges on smart preparation, disciplined execution, and a deep understanding of the market. Let’s dive into some practical advice to sharpen your edge and boost your profits.

Master Your Approach: From Demo to Discipline

Before you commit real capital, treat your Olymptrade demo account like it’s live. This is your training ground to test strategies, understand asset movements, and get comfortable with the platform’s interface. It’s the perfect place to make mistakes without financial consequences. Only transition to live trading once you consistently achieve profitability in the demo environment.

- Develop a Robust Trading Strategy: Don’t just trade randomly. A successful trading strategy is your roadmap. It defines your entry and exit points, the assets you trade, and the timeframes you prefer. Backtest your strategy extensively. Does it have a positive expectancy over a large number of trades? Consider using indicators like MACD, RSI, or moving averages as part of your system.

- Implement Strict Risk Management: This is non-negotiable for long-term survival in fixed time trading. Never risk more than 1-5% of your total capital on a single trade. If you have a $1000 account, a $10 trade is the max you should consider. This approach protects your capital during losing streaks, which are inevitable. Your capital is your tool; protect it fiercely.

- Understand Market Analysis: Successful Olymptrade trading relies on informed decisions. You need to grasp both technical analysis and fundamental analysis.

Technical vs. Fundamental Analysis

| Aspect | Technical Analysis | Fundamental Analysis |

|---|---|---|

| Focus | Price charts, patterns, indicators | Economic news, company reports, political events |

| Goal | Predict future price movements based on historical data | Assess intrinsic value and future economic impact |

| Usage | Identifying trends, support/resistance levels, entry/exit points | Understanding long-term market sentiment, major shifts |

- Maintain Trading Discipline: Emotions are the biggest enemy of a trader. Fear of missing out (FOMO) and revenge trading after a loss can quickly wipe out your account. Stick to your plan, even when it feels difficult. If your strategy indicates a trade, take it. If it doesn’t, stay out. Discipline separates professional traders from gamblers.

- Keep a Trading Journal: Document every trade you make. Note the asset, entry and exit points, the reason for the trade, and the outcome. Crucially, write down your emotional state during the trade. This practice helps you identify patterns in your behavior, refine your strategy, and learn from both your successes and failures. It’s an invaluable tool for continuous improvement.

- Continuous Learning: The financial markets are dynamic. What worked yesterday might not work tomorrow. Stay updated with global news, economic calendars, and new trading strategies. Read books, watch webinars, and follow experienced traders. The more you learn, the better equipped you are to adapt and find profitable opportunities in Olymptrade fixed time trading.

By integrating these tips into your trading routine, you’ll build a solid foundation for consistent profitability. Remember, successful trading is a marathon, not a sprint. Be patient, be disciplined, and always prioritize protecting your capital.

Common Mistakes to Avoid in Olymptrade FTT

As a seasoned Forex trader and content creator, I’ve seen countless hopefuls step into the fast-paced world of Fixed Time Trades (FTT) on platforms like Olymptrade. It’s an exhilarating environment, offering quick potential gains, but it’s also a minefield for the unprepared. Many traders, especially newcomers, fall into predictable traps that can quickly deplete their capital and spirits. Let’s explore these common pitfalls so you can avoid them and trade smarter, not harder.

Overtrading and Poor Money Management

One of the most destructive habits in FTT is overtrading. You see an opportunity, you take it, then another, and another, sometimes without a clear strategy. This often leads to poor decision-making and significant losses. Compounding this issue is the lack of proper money management – risking too much capital on a single trade or not setting clear limits on daily losses.

To sidestep this trap, always remember:

- Define Your Risk Per Trade: Never risk more than 1-2% of your total trading capital on any single FTT. This protects your account from a string of bad trades.

- Set Daily Limits: Decide on a maximum number of trades you’ll execute in a day, or a maximum loss you’re willing to accept. Once you hit that limit, step away. The market will always be there tomorrow.

- Avoid Martingale: Doubling your trade size after a loss to recover is a high-risk strategy that often leads to account blowouts. It’s a gamble, not a trade.

Ignoring Market Analysis and Trading Impulsively

Many traders jump into FTTs based on a gut feeling or simply watching a few candlesticks move. They neglect fundamental and technical analysis, which are crucial for informed trading decisions. Impulse trading, without understanding the underlying market dynamics, is essentially gambling.

“Successful trading isn’t about predicting the future; it’s about being prepared for what the market might do.”

— A seasoned trader’s mantra

Before placing an FTT, take a moment to analyze:

- Technical Analysis: Look at chart patterns, support and resistance levels, and indicators like RSI or Moving Averages. These tools help you identify potential entry and exit points.

- Fundamental Analysis: Be aware of major economic news releases or geopolitical events that could impact currency pairs or assets. High-impact news can cause extreme volatility.

- Price Action: Understand how price moves and reacts to key levels. This often gives clues about short-term direction.

Emotional Trading: The Saboteur Within

Fear, greed, and the urge for revenge trading are powerful emotions that can cloud your judgment and derail your trading success. You chase losses, take overly risky positions, or exit profitable trades too early due to panic. Emotions are perhaps the biggest enemy of a disciplined trader.

| Emotional Trading | Disciplined Trading |

|---|---|

| Revenge trading after a loss. | Accepting losses as part of the game. |

| Overleveraging due to greed. | Sticking to strict risk management. |

| Panicking and closing winning trades early. | Following your plan for take-profit levels. |

| Ignoring signals because of fear of loss. | Executing trades based on objective analysis. |

Mastering your emotions takes time, but it starts with self-awareness and strict adherence to your trading plan.

Lack of a Well-Defined Trading Plan

Approaching Olymptrade FTT without a clear trading plan is like sailing without a map. You might get lucky for a bit, but eventually, you’ll get lost. A trading plan outlines your strategy, risk parameters, and psychological approach, providing a roadmap for every trade you make.

Your trading plan should cover:

- Entry Criteria: What specific conditions must be met before you enter a trade?

- Exit Criteria: When will you close a trade, whether profitable or losing?

- Money Management Rules: How much will you risk per trade? What are your daily/weekly loss limits?

- Asset Focus: Which currency pairs or assets will you trade?

- Timeframe: What timeframes will you analyze and trade on?

- Trading Journal: How will you record and review your trades?

Develop your plan, backtest it on a demo account, and stick to it religiously. Consistency is key.

Neglecting Continuous Education and Practice

The market is constantly evolving, and so should your trading knowledge. Many traders make the mistake of thinking they’ve learned everything after a few successful trades. This complacency can be costly. Continuous learning and diligent practice are indispensable for long-term success in Olymptrade FTT.

Regularly:

- Study new strategies and indicators.

- Review your past trades to identify patterns and areas for improvement.

- Practice extensively on a demo account before risking real capital, especially when testing new approaches.

- Stay updated on global economic news and how it influences market behavior.

By consciously avoiding these common pitfalls, you equip yourself with a stronger foundation for consistent and profitable trading in Olymptrade FTT. Trade smart, trade safe, and always prioritize learning and discipline over impulse.

Olymptrade Regulation and Security for FTT Users

As experienced traders, we all know success isn’t just about sharp market analysis or killer strategies. It’s equally about choosing a broker you can trust implicitly. The safety of your hard-earned capital and personal data is non-negotiable. Olymp Trade understands this critical need, especially for those engaging in Fixed Time Trades (FTT), and they’ve put robust measures in place to ensure a secure and fair trading environment.

The Regulatory Backbone: FinaCom Membership

Olymp Trade isn’t just another platform operating in a vacuum. They hold an esteemed membership with the Financial Commission (FinaCom), an independent international organization specializing in dispute resolution for financial services. This isn’t just a badge; it provides an invaluable extra layer of protection for traders. FinaCom’s oversight ensures a truly fair trading environment, mediating disputes transparently and effectively. This commitment to legitimate financial services regulation offers significant peace of mind, knowing an external body champions your rights.

Safeguarding Your Capital: Fund Security

So, how does Olymp Trade actively protect your money? A cornerstone of their security framework involves the use of segregated accounts. This crucial practice means your trading funds are kept entirely separate from the company’s operational capital. It’s a vital measure for client fund protection, ensuring your money remains accessible and secure, even in unforeseen circumstances related to the company’s operations. They prioritize your financial safety above all else.

Fortifying Your Digital Fortress: Platform Security

Beyond securing your funds, your personal data and trading activity demand robust protection. Olymp Trade employs advanced encryption protocols, such as SSL, to secure all communication and transactions on their platform. This comprehensive data security measure prevents unauthorized access to your sensitive information. Furthermore, they implement strong authentication procedures, like two-factor authentication (2FA), to keep your account safe from login breaches, providing a truly secure trading platform. Here are some key ways they protect you:

- Advanced SSL Encryption: Secures all data transfers between your device and the platform.

- Two-Factor Authentication (2FA): Adds an extra layer of security to your account logins.

- Segregated Client Funds: Keeps your money separate from company capital for maximum safety.

- Regular Security Audits: Ongoing checks to identify and mitigate potential vulnerabilities.

Why This Matters for Fixed Time Traders

For FTT users, these robust regulatory and security frameworks translate directly into significant peace of mind. You can focus on analyzing markets and executing your trades, knowing a recognized, independent body oversees the platform’s operations. The comprehensive Olymp Trade security features safeguard your deposits, withdrawals, and personal data, ensuring smooth and worry-free transactions. This robust framework, built on strong broker compliance and dedication to trader protection, builds immense confidence. When you choose a platform committed to regulatory oversight and your safety, you’re setting yourself up for a far more focused and successful Fixed Time Trading experience.

Olymptrade Fixed Time Trading: Is It Right for You?

As a seasoned trader, I know the thrill and the challenge of navigating financial markets. You’re constantly searching for opportunities, for platforms that align with your style and goals. OlympTrade’s Fixed Time Trading (FTT) is one option that frequently pops up in discussions among traders. But the big question remains: Is it genuinely the right fit for your trading journey?

Let’s cut through the noise and explore what OlympTrade FTT offers. It’s a popular form of online trading where you predict price movements of assets – like currencies, commodities, or stocks – over a very specific, short period. If your prediction is correct, you earn a predetermined percentage of your investment. If it’s wrong, you lose the invested amount.

How Fixed Time Trading Works on OlympTrade

The mechanics of OlympTrade FTT are straightforward, making it accessible even for those new to the game. Here’s a quick breakdown:

- Choose Your Asset: Select from a wide range of assets available on the platform.

- Set Your Expiry Time: Decide how long your trade will last, from as little as 1 minute up to several hours.

- Predict the Direction: Will the asset’s price go UP or DOWN by the time your trade expires? Make your call.

- Enter Your Investment: Specify the amount of money you want to put into this particular trade.

- Confirm and Wait: Execute the trade and watch the market. Your result is determined automatically at expiry.

The Advantages of OlympTrade FTT

Many traders gravitate towards Fixed Time Trading for compelling reasons. Here are some of the key benefits:

- Simplicity: You only need to predict price direction, not the magnitude of the move. This simplicity appeals to many.

- Defined Risk and Reward: Before you even enter a trade, you know exactly how much you stand to gain or lose. This clarity helps with initial risk management.

- Quick Returns: With expiry times often measured in minutes, you can potentially see returns much faster than with traditional long-term investments.

- Low Entry Barrier: OlympTrade often allows you to start trading with a small minimum deposit, making it accessible for beginner traders.

- User-Friendly Platform: The OlympTrade interface is generally intuitive, making it easy to navigate and execute trades.

Considerations Before You Dive In

While the advantages are clear, it’s crucial to look at the other side of the coin. Every form of trading carries its own set of challenges.

| Aspect | Potential Challenge |

|---|---|

| High Volatility Impact | Sudden price swings can quickly turn a winning trade into a losing one, especially in short timeframes. |

| Emotional Trading | The fast pace can lead to impulsive decisions, making disciplined trading strategy difficult to maintain. |

| All-or-Nothing Outcome | Unlike traditional trading where you can cut losses early, in FTT you either win or lose the entire investment for that trade. |

| Overtrading Risk | The speed and frequency of trades can encourage excessive trading, leading to faster capital depletion. |

\”Success in Fixed Time Trading isn’t about making a single correct prediction. It’s about consistent strategic thinking, stringent risk management, and the discipline to stick to your plan, even when the market tests you.\”

Is OlympTrade Fixed Time Trading for You?

Ultimately, your trading style and personality will dictate whether OlympTrade FTT is a good fit. Consider these points:

- Are you comfortable with rapid decision-making? FTT demands quick analysis and execution.

- Do you have a strong grasp of risk management? Without it, the “all or nothing” nature can quickly deplete your capital.

- Can you control your emotions? The fast pace and immediate results can trigger impulsive trading, which is a common pitfall.

- Are you willing to learn and adapt? Developing a reliable trading strategy takes time and continuous refinement.

For some, OlympTrade’s Fixed Time Trading offers an exciting, fast-paced way to engage with financial markets and potentially generate quick returns. For others, its inherent risks and speed might not align with their preference for slower, more analytical trading. Explore the platform’s demo account, test various trading strategy approaches, and understand the platform’s features thoroughly before you commit real capital. Your trading journey is unique, and finding the right tools for it is key.

Frequently Asked Questions

What is Olymptrade Fixed Time Trading (FTT)?

Olymptrade FTT is a trading method where you predict if an asset’s price will go up or down within a specific, predetermined timeframe. If your prediction is correct when the trade expires, you earn a fixed percentage of your investment as profit.

Is trading FTT on Olymptrade suitable for beginners?

Yes, FTT can be suitable for beginners due to its simple “up or down” concept and the availability of a free demo account for practice. However, consistent success requires a strong understanding of market analysis, risk management, and emotional discipline.

What are the main risks associated with Olymptrade FTT?